San Bernardino California Employment Agreement between General Agent as Employer and Salesperson — Sale of Insurance is a legally binding document that outlines the responsibilities, rights, and obligations of the general agent and salesperson in the insurance industry. This agreement sets the terms and conditions of employment, including compensation, benefits, termination, and non-compete provisions. The primary objective of this Employment Agreement is to establish a mutually beneficial relationship between the general agent and salesperson, ensuring the smooth operation of insurance sales in San Bernardino, California. This agreement will typically have several types based on various factors, such as the nature of the salesperson's employment, tenure, and specific insurance products being sold. 1. Full-Time Employment Agreement: This type of agreement applies to salespersons who work for the general agent on a full-time basis. It outlines their working hours, responsibilities, and the compensation structure, which may include a base salary, commissions, bonuses, and incentives. 2. Part-Time Employment Agreement: For salespersons working on a part-time basis, this agreement establishes the terms of their employment, including flexible working hours, pro-rated compensation, and specific sales targets. 3. Independent Contractor Agreement: Some salespersons may work as independent contractors rather than employees. This agreement defines the terms of their engagement with the general agent, including their status as an independent business entity, compensation structure, and scope of responsibilities. 4. Exclusive Sales Agreement: Under this agreement, the salesperson agrees to exclusively represent the general agent and sell their insurance products within a defined geographic area. This type of agreement often includes non-compete provisions and may offer additional benefits or commission rates to ensure loyalty. 5. Non-Exclusive Sales Agreement: This type of agreement allows the salesperson to work with multiple general agents or insurance companies simultaneously. It specifies the salesperson's obligations towards the general agent, including reporting requirements, marketing guidelines, and any territorial restrictions. Key clauses commonly found in San Bernardino California Employment Agreement between General Agent as Employer and Salesperson — Sale of Insurance may include: a) Compensation and Commission Structure: Outlines how the salesperson will be compensated, including base salary, commission rates, bonus structure, and expense reimbursements. b) Roles and Responsibilities: Defines the salesperson's duties, sales targets, performance expectations, and any additional responsibilities, such as client retention and cross-selling. c) Termination and Renewal: Specifies the conditions under which the agreement may be terminated, including notice periods, grounds for termination, and any renewal provisions. d) Confidentiality and Non-Disclosure: Ensures the protection of confidential information, trade secrets, and client data, prohibiting the salesperson from disclosing or using such information for personal gain. e) Non-Compete and Non-Solicitation: Restricts the salesperson from engaging in similar insurance sales activities or soliciting clients for a specified period after termination, protecting the general agent's market share. f) Governing Law and Dispute Resolution: Specifies the jurisdiction and the methods for resolving any disputes arising from the agreement, often opting for arbitration or mediation. In conclusion, the San Bernardino California Employment Agreement between General Agent as Employer and Salesperson — Sale of Insurance is a comprehensive legal document that outlines the terms, conditions, roles, and responsibilities of the general agent and salesperson in the insurance industry.

San Bernardino California Employment Agreement between General Agent as Employer and Salesperson - Sale of Insurance

Description

How to fill out San Bernardino California Employment Agreement Between General Agent As Employer And Salesperson - Sale Of Insurance?

A document routine always goes along with any legal activity you make. Staring a company, applying or accepting a job offer, transferring property, and many other life scenarios require you prepare formal paperwork that varies from state to state. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal forms. On this platform, you can easily locate and get a document for any personal or business objective utilized in your region, including the San Bernardino Employment Agreement between General Agent as Employer and Salesperson – Sale of Insurance.

Locating forms on the platform is amazingly simple. If you already have a subscription to our service, log in to your account, find the sample using the search field, and click Download to save it on your device. After that, the San Bernardino Employment Agreement between General Agent as Employer and Salesperson – Sale of Insurance will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this simple guideline to get the San Bernardino Employment Agreement between General Agent as Employer and Salesperson – Sale of Insurance:

- Ensure you have opened the proper page with your localised form.

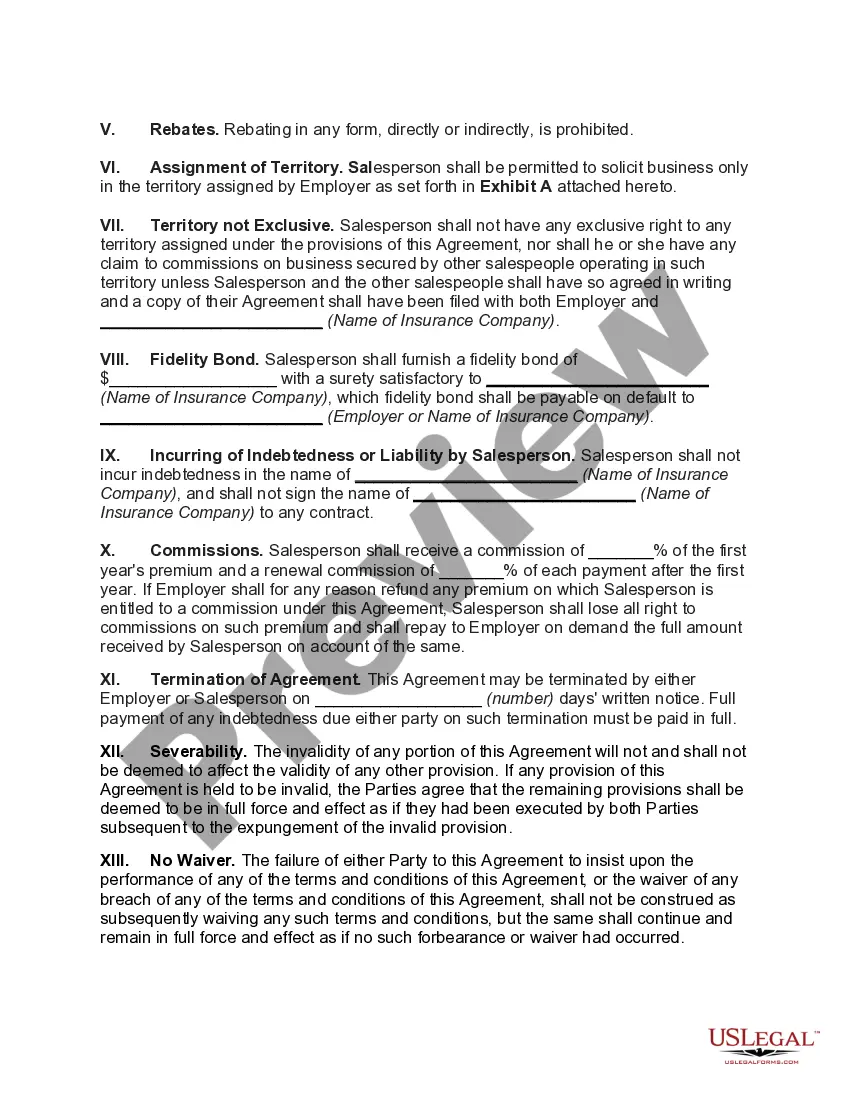

- Use the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the form corresponds to your needs.

- Search for another document via the search tab if the sample doesn't fit you.

- Click Buy Now when you locate the required template.

- Select the appropriate subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the San Bernardino Employment Agreement between General Agent as Employer and Salesperson – Sale of Insurance on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most reliable way to obtain legal documents. All the samples available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!