The Allegheny Pennsylvania Employee Lending Agreement is a legal contract that sets out the terms and conditions surrounding the borrowing of funds by employees in the Allegheny region of Pennsylvania. This agreement outlines the rights and responsibilities of both the employee and the lending institution, ensuring that all parties are aware of their obligations. The Allegheny Pennsylvania Employee Lending Agreement is designed to address the specific needs and requirements of employees in the area, providing a framework for borrowing funds while safeguarding the interests of both parties. It lays out the various aspects of the lending process, including eligibility criteria, interest rates, repayment terms, and any additional charges or fees. Within the Allegheny Pennsylvania Employee Lending Agreement, different types of lending agreements can be included depending on the specific requirements of the employees and employers involved. Some common types of lending agreements that may fall under this umbrella include: 1. Personal Loans: These agreements enable employees to borrow funds for personal expenses, such as home renovations, medical bills, or education expenses. These loans typically have a fixed interest rate and are repaid in monthly installments over a specified period. 2. Payroll Advances: This type of agreement allows employees to access a portion of their upcoming salary in advance. It is often used to address immediate financial needs and is typically repaid through deductions from future paychecks. 3. Emergency Loans: These agreements cater to unforeseen circumstances and offer employees quick access to funds during emergencies, such as accidents, natural disasters, or unexpected medical expenses. Emergency loans are usually repaid within a shorter timeframe compared to other loan types. 4. Travel Loans: Designed for employees who frequently travel for work-related purposes, this agreement allows them to borrow funds to cover travel expenses such as accommodation, transportation, and meals. Repayment terms are often structured to coincide with the employee's expense report submission. 5. Relocation Assistance Loans: These agreements are offered to employees who are relocating for work, helping them cover expenses related to moving, housing deposits, and other relocation costs. Repayment terms can vary depending on the agreement between the employee and the employer. By having an Allegheny Pennsylvania Employee Lending Agreement in place, employers can support their employees during times of financial need while ensuring responsible lending practices. These agreements also provide clarity and transparency, reducing the risk of disputes and promoting a positive employer-employee relationship. In conclusion, the Allegheny Pennsylvania Employee Lending Agreement is a comprehensive legal document that governs the borrowing of funds by employees in the Allegheny region. It outlines the terms, conditions, and various types of lending agreements available to employees, ensuring responsible lending practices while providing assistance and financial support where required.

Allegheny Pennsylvania Employee Lending Agreement

Description

How to fill out Allegheny Pennsylvania Employee Lending Agreement?

Laws and regulations in every sphere differ around the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid expensive legal assistance when preparing the Allegheny Employee Lending Agreement, you need a verified template valid for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal templates. It's an excellent solution for specialists and individuals searching for do-it-yourself templates for different life and business scenarios. All the documents can be used many times: once you obtain a sample, it remains accessible in your profile for subsequent use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Allegheny Employee Lending Agreement from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Allegheny Employee Lending Agreement:

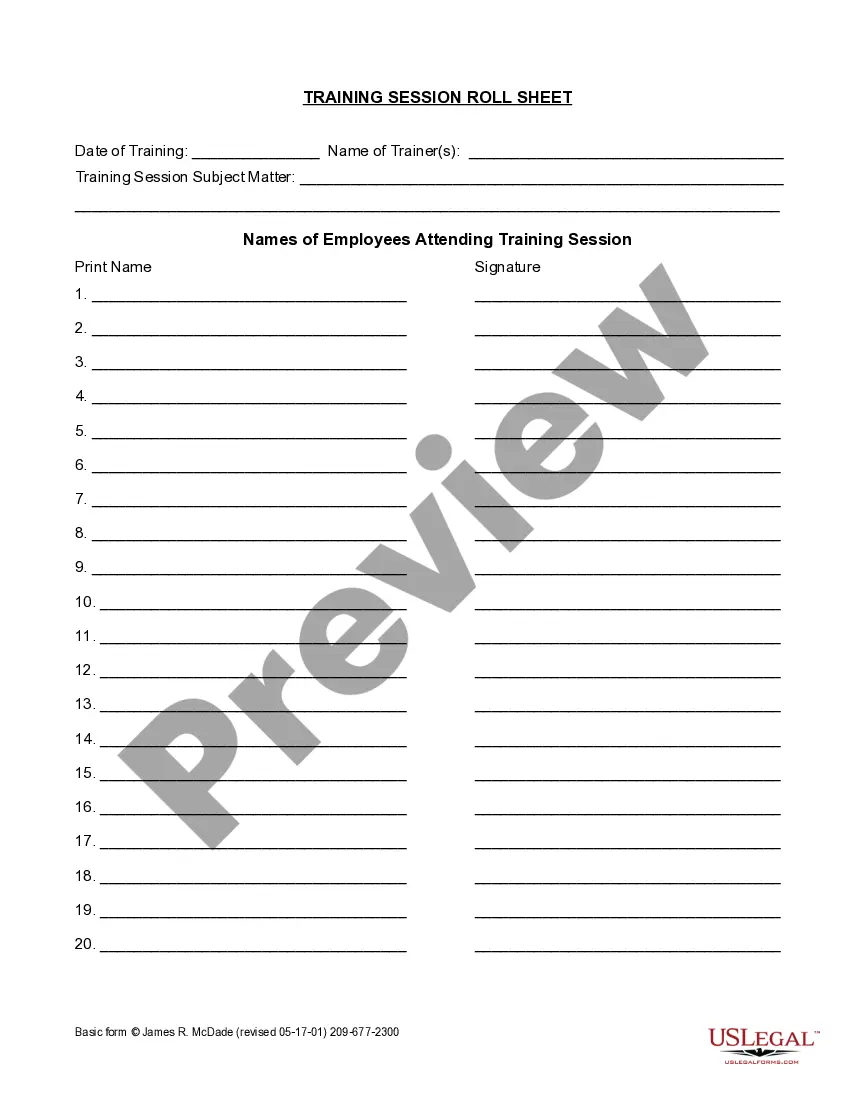

- Examine the page content to ensure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to get the document when you find the right one.

- Choose one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your documentation in order with the US Legal Forms!