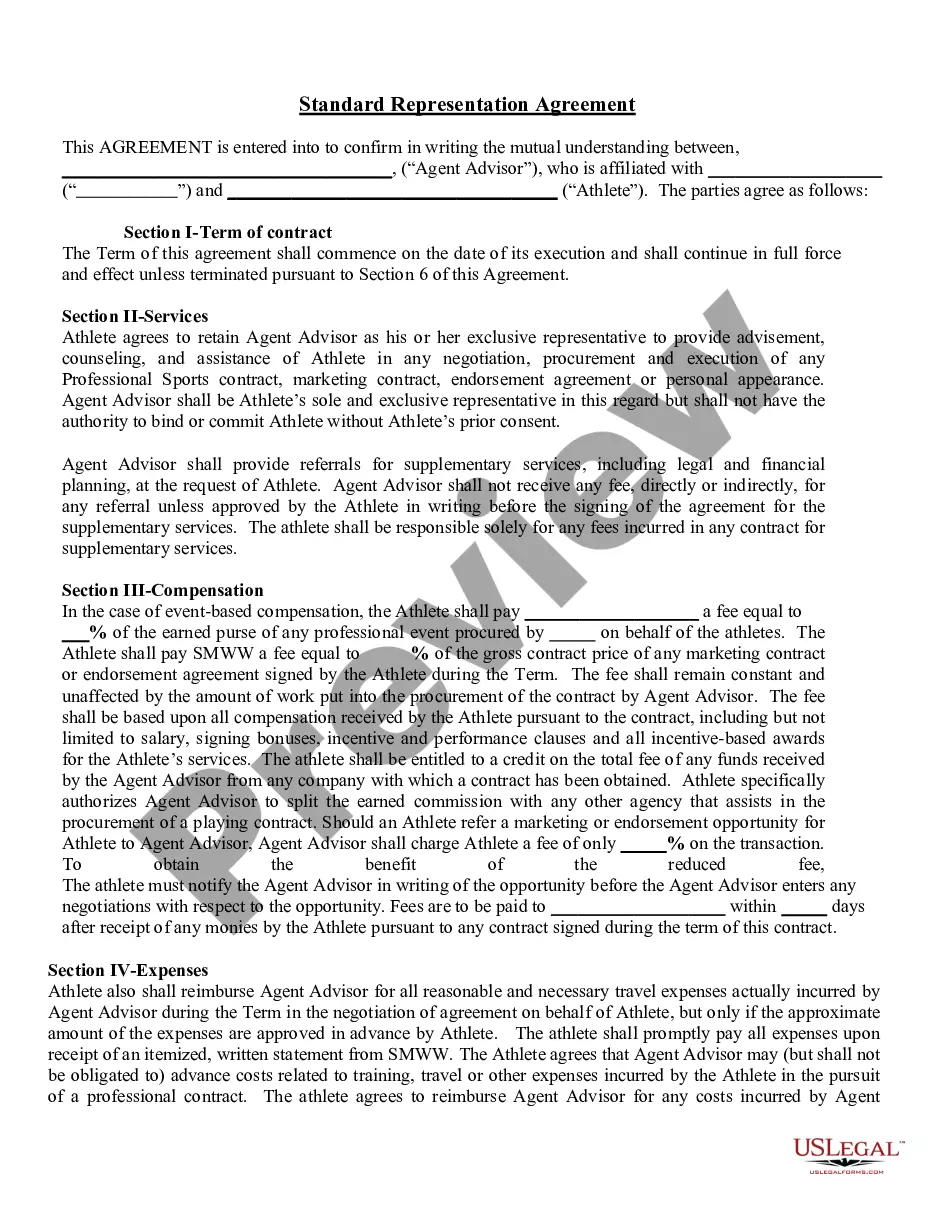

San Antonio Texas Employee Lending Agreement is a legal contract designed to outline the terms and conditions under which an employer offers financial assistance to its employees. This agreement specifies the borrowing limit, repayment terms, interest rates, and any applicable fees or penalties. It aims to regulate the employer-employee relationship in terms of lending and borrowing funds. The San Antonio Texas Employee Lending Agreement enables employees to access financial assistance from their employer, providing them with convenient and potentially cheaper loan options. This agreement helps employees manage their unforeseen financial emergencies or personal needs without resorting to high-interest loans from external sources. There are various types of San Antonio Texas Employee Lending Agreements that may exist based on the specific needs and policies of individual companies. Some common types include: 1. Emergency Loan Agreement: This type of agreement is designed to address urgent financial situations that employees may encounter. It provides employees with quick access to funds to cover unforeseen expenses, such as medical bills, vehicle repairs, or home emergencies. 2. Educational Loan Agreement: Some companies offer educational loans to support their employees' professional growth and development. This agreement outlines the terms for borrowing funds to finance educational expenses, such as tuition fees, books, or certifications. 3. Travel Expense Loan Agreement: When employees are required to travel for work-related purposes, this agreement allows them to borrow funds from their employer to cover travel-related expenses, including transportation, accommodation, and meals. 4. Relocation Loan Agreement: In case an employee needs to relocate due to work-related reasons, companies may offer relocation loans to assist with costs involved in moving, such as packing, transportation, temporary accommodation, and deposits for rental properties. 5. Home Improvement Loan Agreement: To facilitate home improvement projects, some employers may offer loans to employees for renovating or enhancing their properties. The agreement outlines the terms and conditions for borrowing funds to cover expenses related to home improvements. San Antonio Texas Employee Lending Agreements are essential for both parties involved, as they set clear expectations and obligations for borrowing and repayment. It is crucial for employees to carefully review the agreement, understanding all the terms, interest rates, repayment schedules, and any potential penalties before signing. These agreements promote responsible borrowing practices and provide financial support that can positively impact employees' lives while maintaining a mutually beneficial relationship between employers and their workforce.

San Antonio Texas Employee Lending Agreement

Description

How to fill out San Antonio Texas Employee Lending Agreement?

Preparing documents for the business or individual demands is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's essential to consider all federal and state laws and regulations of the specific area. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it tense and time-consuming to create San Antonio Employee Lending Agreement without professional help.

It's possible to avoid spending money on attorneys drafting your paperwork and create a legally valid San Antonio Employee Lending Agreement by yourself, using the US Legal Forms web library. It is the greatest online collection of state-specific legal templates that are professionally cheched, so you can be certain of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to download the needed form.

If you still don't have a subscription, follow the step-by-step instruction below to obtain the San Antonio Employee Lending Agreement:

- Look through the page you've opened and verify if it has the document you require.

- To accomplish this, use the form description and preview if these options are available.

- To find the one that satisfies your needs, utilize the search tab in the page header.

- Recheck that the template complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal forms for any scenario with just a few clicks!