Title: San Antonio Texas Account Stated Between Partners and Termination of Partnership: A Comprehensive Guide Introduction: In San Antonio, Texas, partnerships often play a significant role in various industries. Understanding the concept of account stated between partners and the termination of partnerships is crucial for business owners and individuals considering this business structure. This article provides an in-depth exploration of San Antonio Texas Account Stated Between Partners and Termination of Partnership, discussing its definition, types, relevant legal procedures, and considerations. 1. Definition of Account Stated Between Partners: An account stated between partners refers to a formal process where partners in a business venture agree upon the accuracy of their financial records and balances. It facilitates transparency, trust, and legal cooperation within a partnership. In San Antonio, Texas, account stated between partners is essential for ensuring a fair distribution of profits, liabilities, and assets between the involved parties. 2. Termination of Partnership: When a partnership in San Antonio, Texas, reaches its conclusion, proper procedures must be followed to ensure a smooth and legal dissolution. Termination of partnership encompasses the process of legally dissolving the business entity. Partners may choose to dissolve a partnership voluntarily, due to expiration of a specific term, or due to the occurrence of certain triggering events such as death, bankruptcy, or breach of contract. 3. Types of San Antonio Texas Account Stated Between Partners and Termination of Partnership: a. Voluntary Dissolution: Partners may mutually decide to dissolve their partnership when they no longer wish to continue the business venture. This type of dissolution usually involves drafting a written agreement that outlines the terms of the dissolution, including the distribution of assets, liabilities, and any remaining profits or losses. b. Dissolution by Expiration: Partnerships in San Antonio may operate for a specific term predetermined in their partnership agreement. Upon reaching the agreed-upon expiration date, the partnership is considered dissolved unless the partners choose to extend their agreement. c. Dissolution by Triggering Events: Certain events like the death, bankruptcy, or breach of contract by a partner may automatically trigger the dissolution of a partnership. In such cases, legal procedures must be followed to fairly distribute assets, settle any remaining obligations, and wind up the business affairs. 4. Legal Procedures: When terminating a partnership in San Antonio, Texas, partners must adhere to several legal procedures, which may include the following: a. Drafting a Dissolution Agreement: Partners should create a detailed dissolution agreement outlining the agreed-upon terms of the dissolution, including asset distribution, liability settlement, and any residual profits or losses. b. Asset and Liability Evaluation: Partners need to conduct a thorough assessment of all partnership assets, debts, and obligations to ensure a fair distribution. c. Filing Appropriate Documents: Partners must file necessary documents with the Texas Secretary of State and any relevant local agencies to officially dissolve their partnership. d. Tax and Legal Obligations: Partners must fulfill any remaining tax or legal obligations, such as settling outstanding debts, paying final taxes, and notifying creditors, employees, and other relevant entities. Conclusion: San Antonio, Texas, offers a dynamic business environment where partnerships play a crucial role in various industries. Understanding the concept of account stated between partners and the termination of partnerships is essential for successful collaborations. By comprehending the different types and legal procedures associated with these aspects, partners can navigate the dissolution process smoothly while ensuring a fair distribution of assets and liabilities.

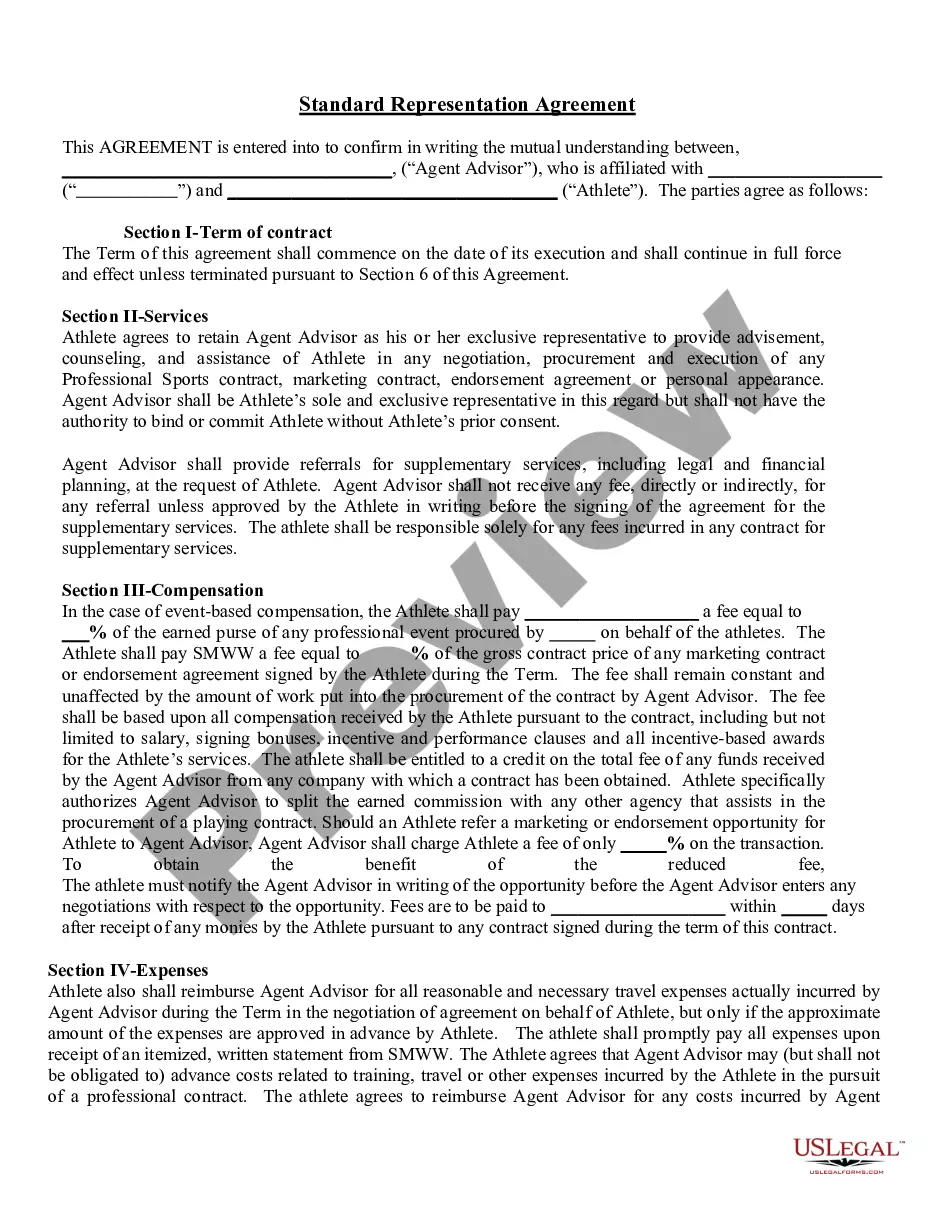

San Antonio Texas Account Stated Between Partners and Termination of Partnership

Description

How to fill out San Antonio Texas Account Stated Between Partners And Termination Of Partnership?

If you need to get a trustworthy legal paperwork supplier to obtain the San Antonio Account Stated Between Partners and Termination of Partnership, look no further than US Legal Forms. Whether you need to launch your LLC business or manage your asset distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the appropriate template.

- You can search from more than 85,000 forms categorized by state/county and case.

- The self-explanatory interface, variety of learning materials, and dedicated support make it simple to locate and execute different papers.

- US Legal Forms is a trusted service providing legal forms to millions of users since 1997.

You can simply type to look for or browse San Antonio Account Stated Between Partners and Termination of Partnership, either by a keyword or by the state/county the form is created for. After finding the required template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's easy to get started! Simply find the San Antonio Account Stated Between Partners and Termination of Partnership template and check the form's preview and description (if available). If you're confident about the template’s language, go ahead and hit Buy now. Register an account and select a subscription option. The template will be instantly ready for download as soon as the payment is completed. Now you can execute the form.

Handling your legal matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our extensive variety of legal forms makes this experience less pricey and more affordable. Set up your first business, organize your advance care planning, draft a real estate contract, or complete the San Antonio Account Stated Between Partners and Termination of Partnership - all from the comfort of your home.

Sign up for US Legal Forms now!