Tarrant Texas Account Stated Between Partners and Termination of Partnership: A Comprehensive Overview In Tarrant County, Texas, Account Stated Between Partners refers to a legal arrangement where partners in a business have a mutually agreed account of the financial transactions and balances between them. This type of account enables the partners to keep track of their respective contributions, profits, losses, and distributions within the partnership. Moreover, it allows for transparency, accountability, and accurate record-keeping as partners navigate their joint business ventures. Termination of Partnership holds significant importance when it comes to dissolving a business partnership in Tarrant County, Texas. Partnerships may be terminated due to various reasons such as completion of a specific project, expiration of a partnership agreement, retirement, bankruptcy, or when one or more partners wish to exit the partnership. It is essential to understand the termination process and the legal implications surrounding it, to ensure a smooth and lawful dissolution of the partnership. Different Types of Tarrant Texas Account Stated Between Partners and Termination of Partnership: 1. General Partnerships: A general partnership is the most common type of business partnership in Tarrant County, Texas. Partners in a general partnership share equal responsibility, liability, and decision-making power within the business. When it comes to Account Stated Between Partners and Termination of Partnership in a general partnership, the partners must agree on how the partnership's financial matters will be settled upon dissolution. 2. Limited Partnerships: Unlike general partnerships, limited partnerships consist of at least one general partner who has unlimited liability, and one or more limited partners who have limited liability and usually contribute capital rather than actively participating in management. The Account Stated Between Partners and Termination of Partnership in limited partnerships may involve additional considerations due to the different roles, responsibilities, and liabilities of general and limited partners. 3. Limited Liability Partnerships (Laps): Laps offer partners limited personal liability for the partnership's debts or lawsuits. Such partnerships are common in professional fields like law, accounting, and architecture. The Account Stated Between Partners and Termination of Partnership in Laps require careful attention to the partnership agreement, which may dictate the allocation of profits, losses, and the process of winding down the partnership. In conclusion, Tarrant Texas Account Stated Between Partners and Termination of Partnership encompasses an array of legal procedures and considerations that partners must navigate when dissolving their business partnership. Understanding the specific type of partnership, whether it be a general partnership, limited partnership, or limited liability partnership, is crucial for executing the termination process smoothly. By adhering to the legal requirements and maintaining a transparent account stated between partners, individuals can ensure a proper conclusion to their partnership while safeguarding their interests.

Tarrant Texas Account Stated Between Partners and Termination of Partnership

Description

How to fill out Tarrant Texas Account Stated Between Partners And Termination Of Partnership?

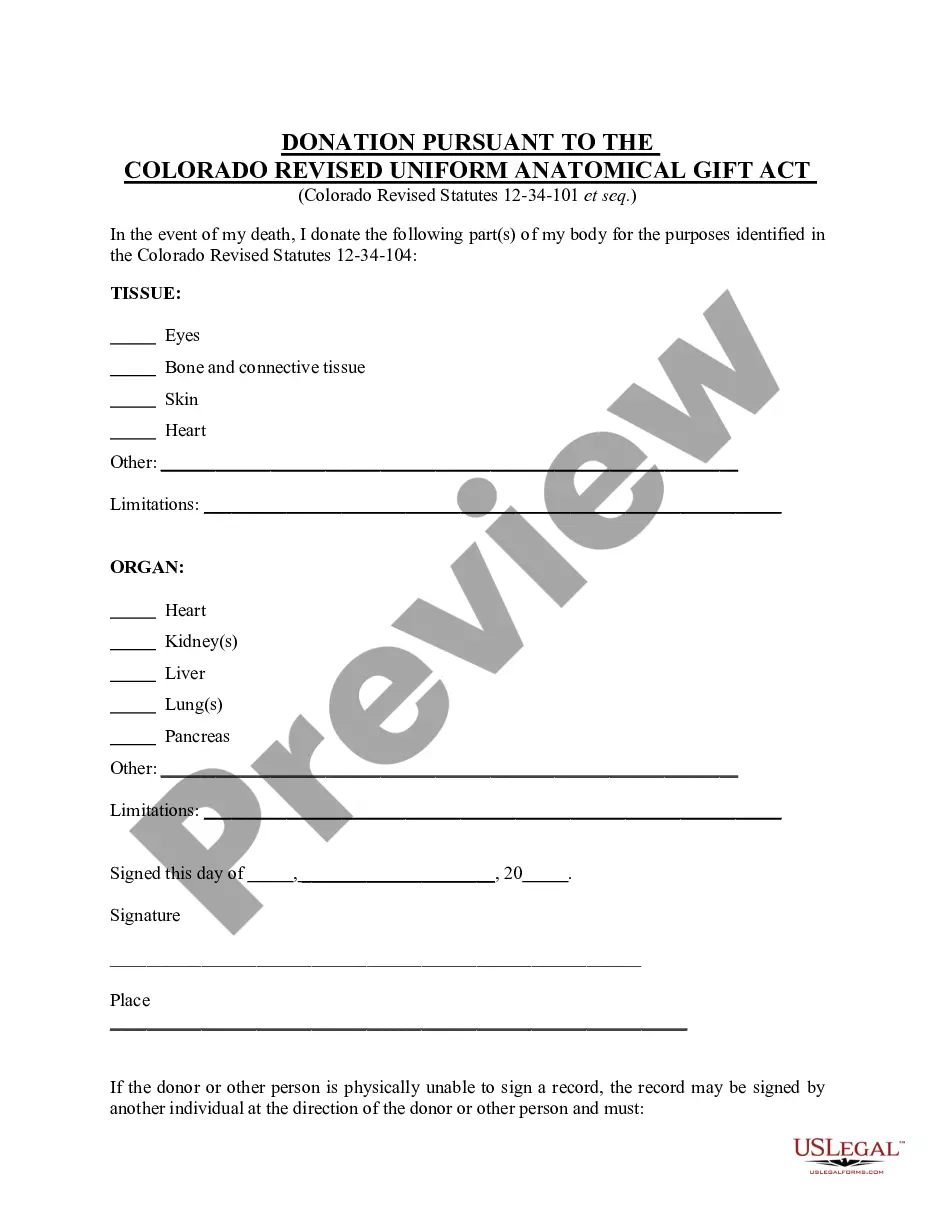

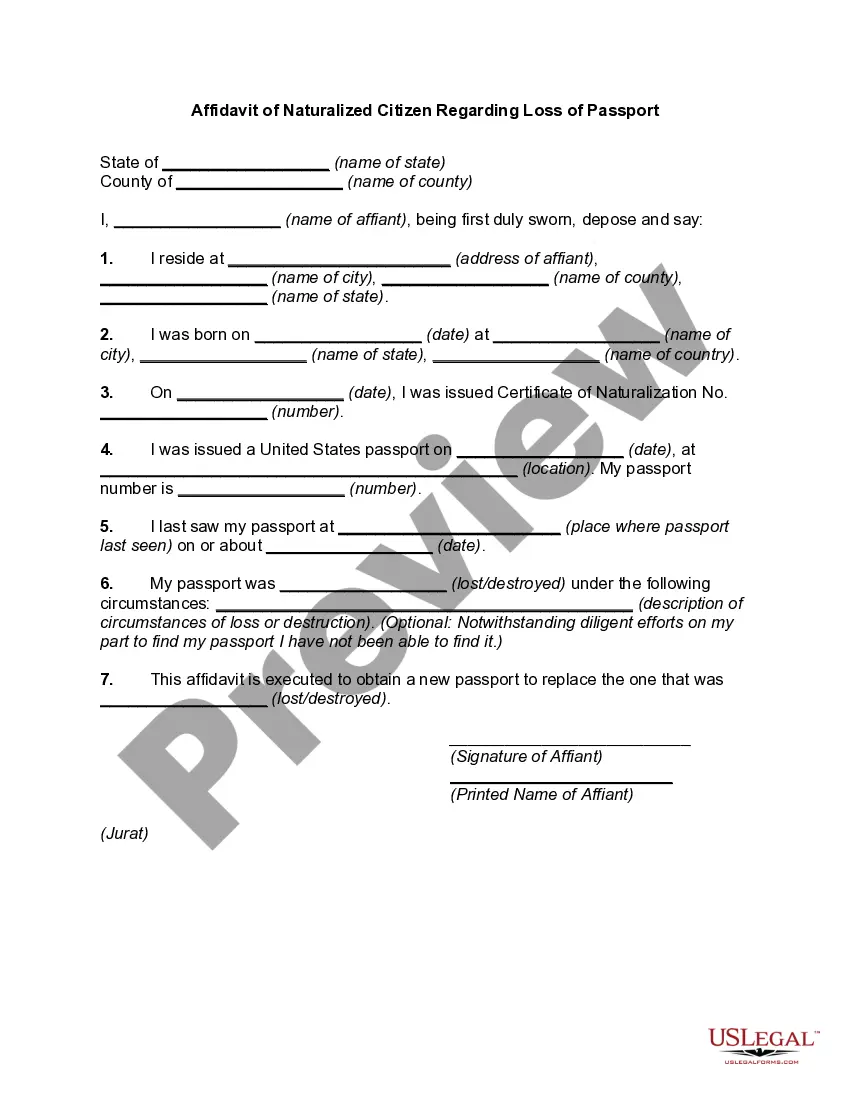

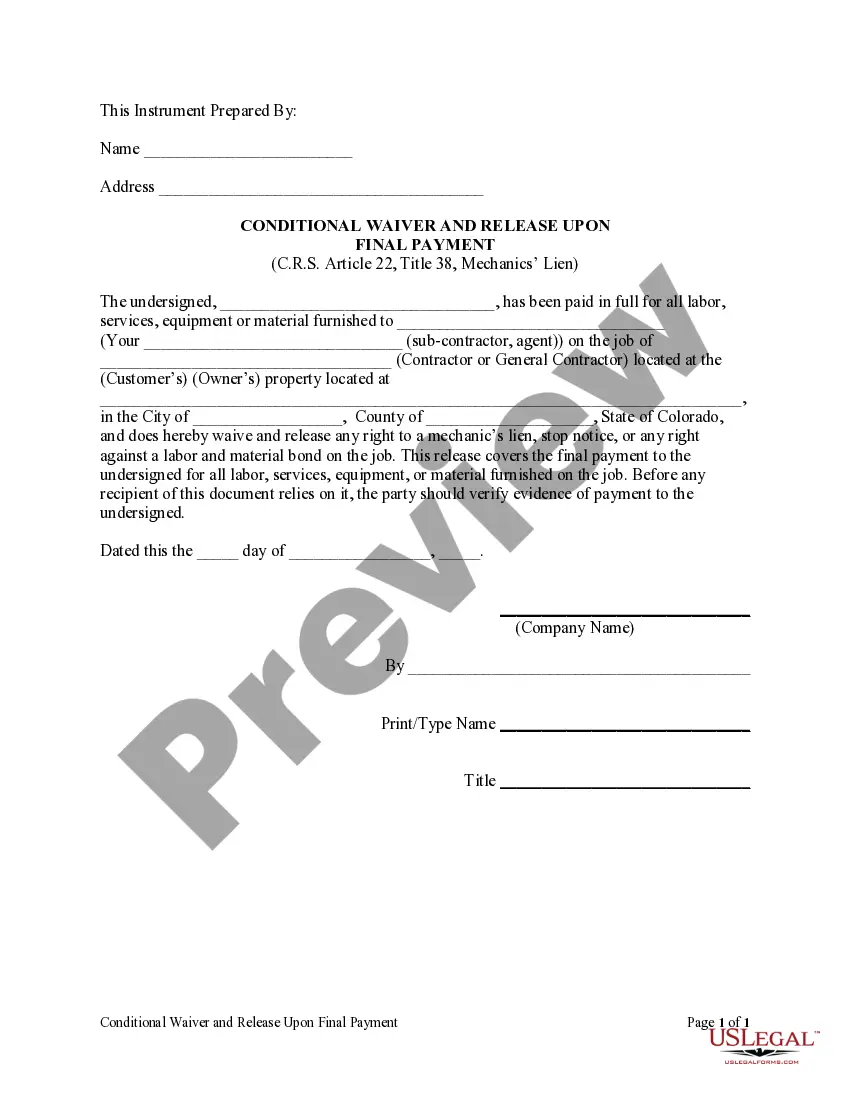

Laws and regulations in every sphere vary throughout the country. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid costly legal assistance when preparing the Tarrant Account Stated Between Partners and Termination of Partnership, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal templates. It's a great solution for professionals and individuals searching for do-it-yourself templates for various life and business situations. All the documents can be used many times: once you obtain a sample, it remains available in your profile for subsequent use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Tarrant Account Stated Between Partners and Termination of Partnership from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Tarrant Account Stated Between Partners and Termination of Partnership:

- Analyze the page content to ensure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to obtain the template when you find the correct one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

3 Ways Your Business Partnership Can Expel a Partner Simple Expulsions. The simplest way of removing one business partner from an ongoing business is to consult the partnership agreement.Changing the Business.Involuntary Expulsions.

How to Dissolve a Partnership Review and Follow Your Partnership Agreement.Vote on Dissolution and Document Your Decision.Send Notifications and Cancel Business Registrations.Pay Outstanding Debts, Liquidate, and Distribute Assets.File Final Tax Return and Cancel Tax Accounts.Limiting Your Future Liability.

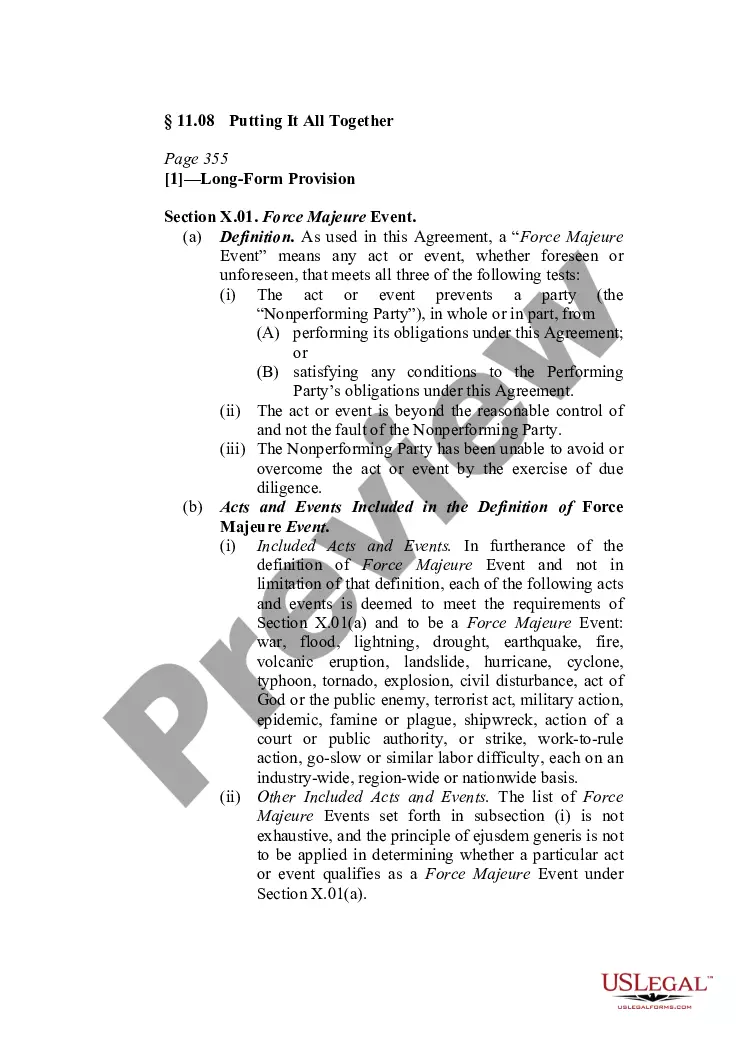

If a partnership is terminated by a sale or exchange of more than 50% of the capital and profits interests within a 12-month period, the following is deemed to occur: The terminating partnership contributes all of its assets and liabilities to a new partnership in exchange for an interest in the new partnership, and.

Therefore, you should consider consulting with a local business attorney before ending your partnership. Review Your Partnership Agreement.Take a Vote or Action to Dissolve.Pay Debts and Distribute Assets (Wind Up)No State Filing Required.Notify Creditors, Customers, Clients, and Suppliers.Final Tax Issues.

Termination when only one partner remains The partnership form also ceases to exist if a transfer of partnership interests occurs and only one partner remains. For example, a partnership terminates when a 60% partner acquires the interests of two other partners who each have a 20% interest in the partnership (Regs.

These, according to , are the five steps to take when dissolving your partnership: Review Your Partnership Agreement.Discuss the Decision to Dissolve With Your Partner(s).File a Dissolution Form.Notify Others.Settle and close out all accounts.

If you don't have an operating agreement, and your partner won't come to terms, your only recourse is to file a lawsuit and ask the court to do what your operating agreement would have done: Kick her out and determine how much she's owed. However you look at it, isn't an attractive option.

Termination ensures that partners can no longer be held responsible for other partner's debts, and partners can no longer obligate the partnership in any way. The original partnership agreement is now void.

How to Dissolve a Partnership Review and Follow Your Partnership Agreement.Vote on Dissolution and Document Your Decision.Send Notifications and Cancel Business Registrations.Pay Outstanding Debts, Liquidate, and Distribute Assets.File Final Tax Return and Cancel Tax Accounts.Limiting Your Future Liability.

When one partner wants to leave the partnership, the partnership generally dissolves. Dissolution means the partners must fulfill any remaining business obligations, pay off all debts, and divide any assets and profits among themselves.