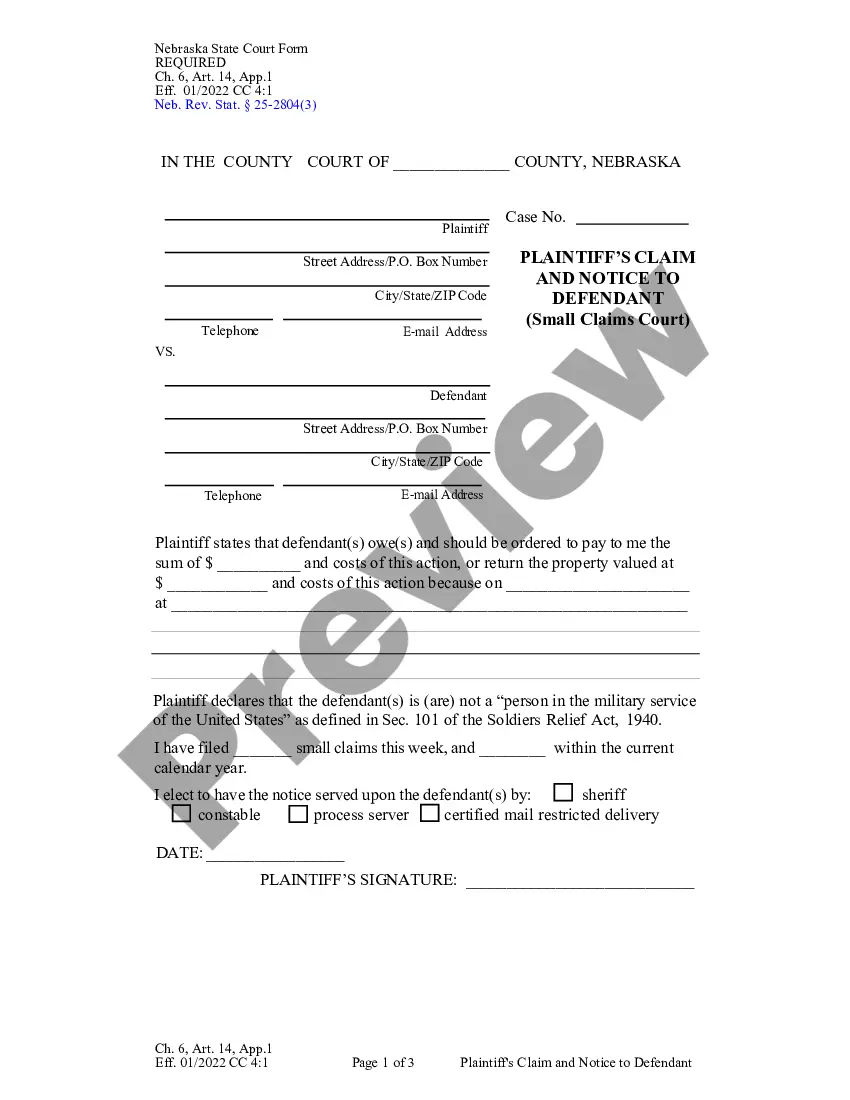

Maricopa, Arizona is a vibrant city located in the southern part of the state. Known for its warm climate, stunning landscapes, and rich cultural heritage, Maricopa offers a diverse range of attractions and amenities to its residents and visitors alike. When it comes to legal matters and drafting a verification of an account, it is crucial to adhere to a checklist of matters specific to Maricopa, Arizona. These considerations ensure that all necessary information and legal requirements are covered thoroughly. Here is a comprehensive Maricopa Arizona checklist of matters to be considered while drafting a verification of an account, with relevant keywords: 1. Identification of Parties: Begin by stating the names and addresses of the parties involved in the account verification process, including the individual or business seeking verification and the verifying party. 2. Account Details: Outline the specific account details to be verified, such as bank accounts, financial transactions, invoices, or any other relevant documentation. 3. Scope of Verification: Define the scope of the verification process, including the timeframe to be covered and any specific requirements or limitations. 4. Supporting Documentation: List the supporting documents that need to be submitted along with the verification, such as bank statements, invoices, or receipts. Ensure that all documents are up-to-date and properly organized. 5. Legal Compliance: Ensure that the verification process adheres to all relevant laws, regulations, and local ordinances in Maricopa, Arizona. 6. Notarization: Consider whether the verification document needs to be notarized for legal validity. If so, follow the appropriate procedures and guidelines in Maricopa. 7. Witness Statement: Determine if a witness statement is required to support the verification. If necessary, include the witness's details, affidavit, and signature. 8. Language and Format: Pay attention to the language and format of the verification document to ensure clarity and professionalism. Use appropriate legal terminology and formatting standards. 9. Submission and Filing: Provide instructions regarding the submission and filing of the verification document, including the designated recipient and any associated fees or deadlines. 10. Review and Revision: Emphasize the importance of reviewing and revising the verification document for accuracy, completeness, and compliance with Maricopa, Arizona's specific rules and regulations. Overall, this Maricopa Arizona checklist of matters to be considered in drafting a verification of an account is crucial for ensuring a thorough and legally compliant document. By diligently following these considerations, individuals and businesses can confidently navigate the verification process in Maricopa, Arizona, and protect their interests.

Maricopa Arizona Checklist of Matters to be Considered in Drafting a Verification of an Account

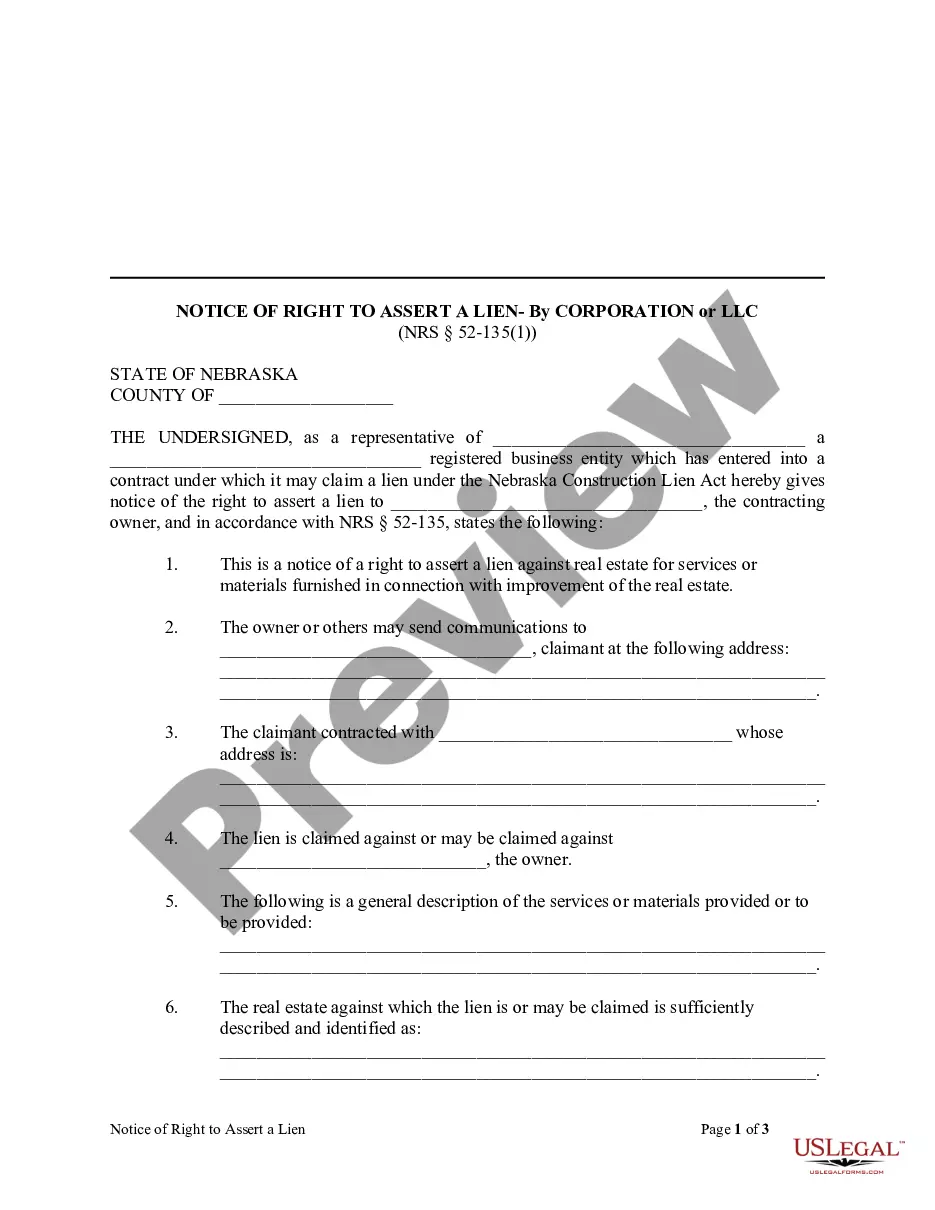

Description

How to fill out Maricopa Arizona Checklist Of Matters To Be Considered In Drafting A Verification Of An Account?

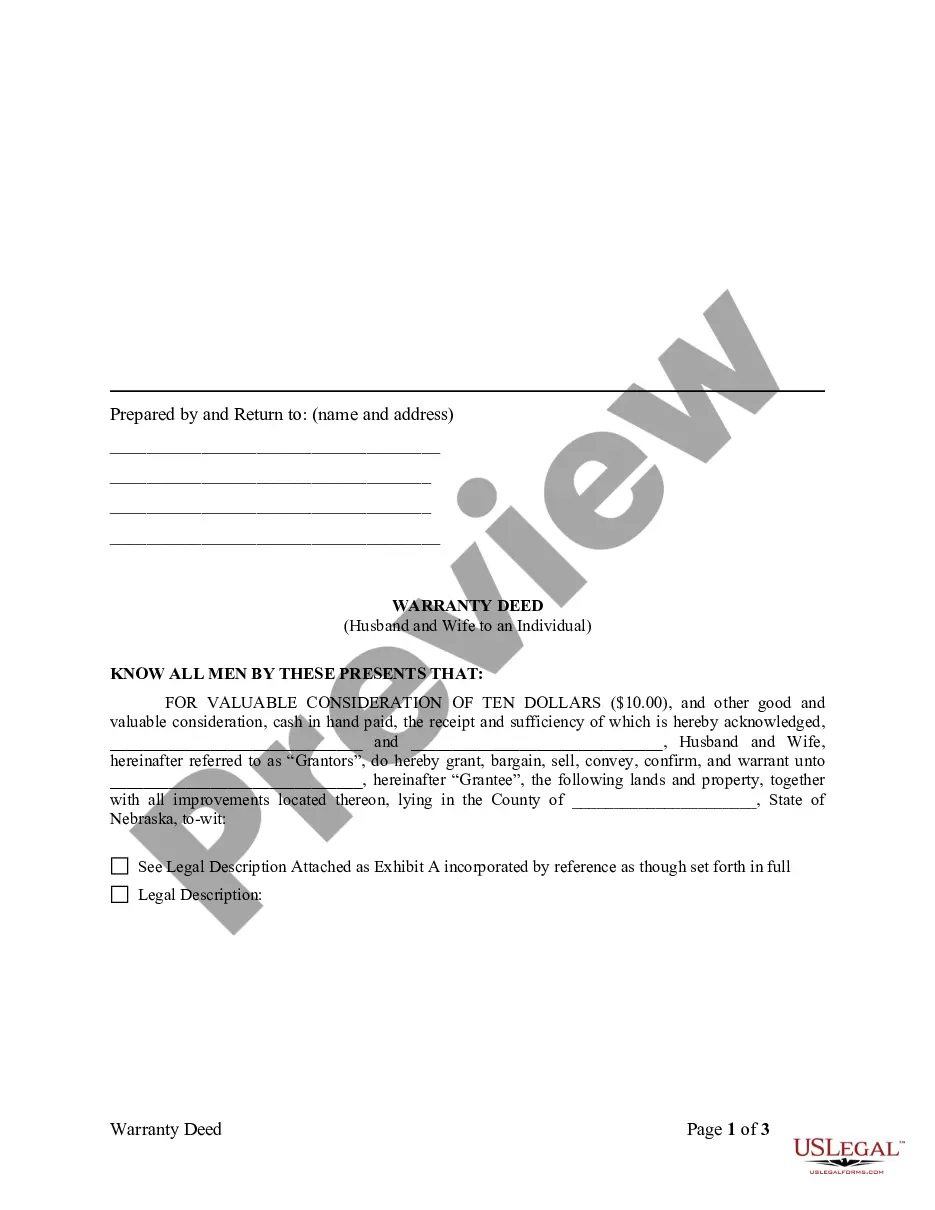

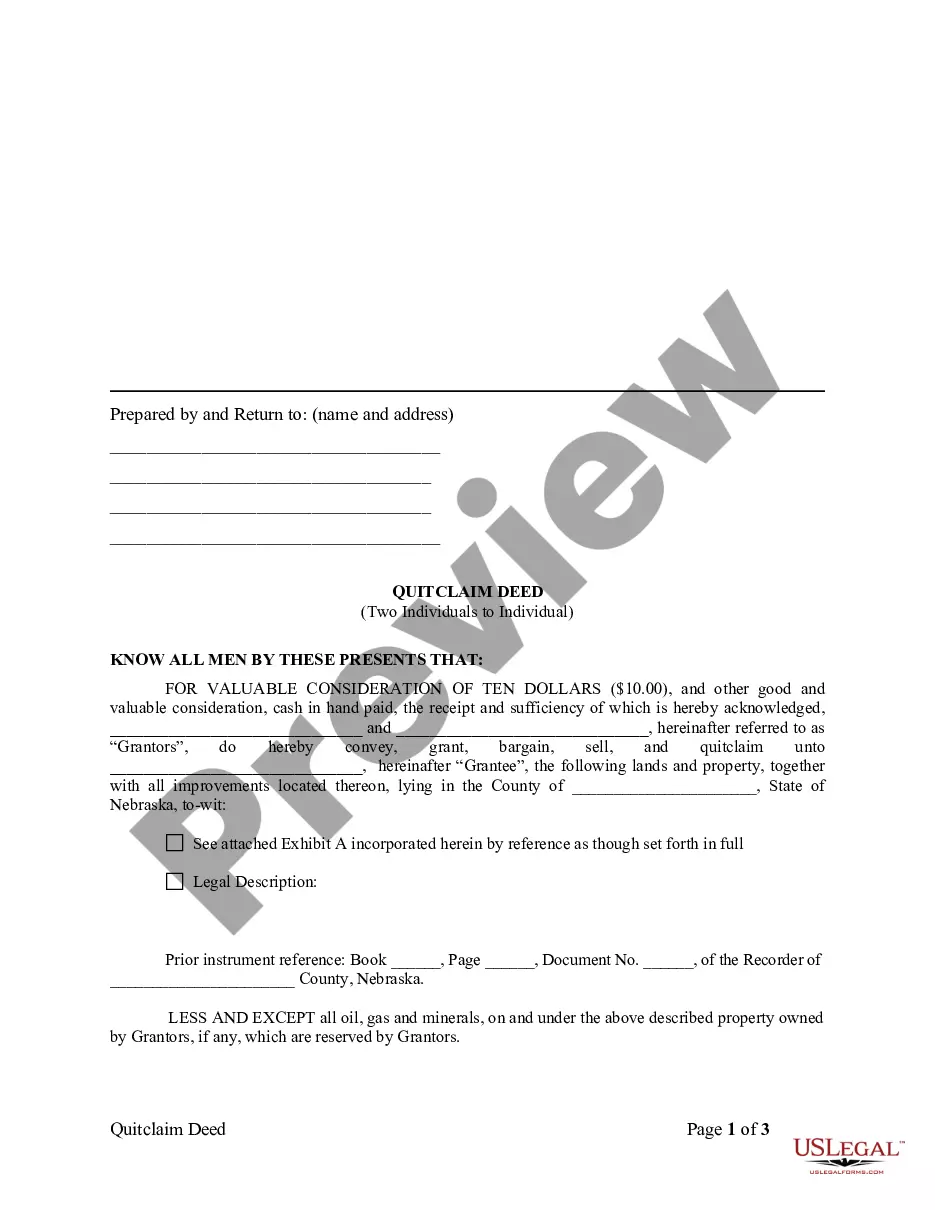

Draftwing documents, like Maricopa Checklist of Matters to be Considered in Drafting a Verification of an Account, to take care of your legal matters is a tough and time-consumming process. A lot of circumstances require an attorney’s involvement, which also makes this task not really affordable. Nevertheless, you can get your legal affairs into your own hands and manage them yourself. US Legal Forms is here to save the day. Our website comes with over 85,000 legal forms created for different cases and life situations. We make sure each form is compliant with the laws of each state, so you don’t have to be concerned about potential legal issues compliance-wise.

If you're already aware of our website and have a subscription with US, you know how straightforward it is to get the Maricopa Checklist of Matters to be Considered in Drafting a Verification of an Account template. Go ahead and log in to your account, download the form, and customize it to your requirements. Have you lost your form? Don’t worry. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is fairly easy! Here’s what you need to do before downloading Maricopa Checklist of Matters to be Considered in Drafting a Verification of an Account:

- Ensure that your document is specific to your state/county since the regulations for creating legal papers may differ from one state another.

- Find out more about the form by previewing it or going through a brief intro. If the Maricopa Checklist of Matters to be Considered in Drafting a Verification of an Account isn’t something you were hoping to find, then use the header to find another one.

- Log in or register an account to start utilizing our service and download the form.

- Everything looks great on your end? Click the Buy now button and select the subscription plan.

- Pick the payment gateway and enter your payment information.

- Your form is all set. You can try and download it.

It’s easy to find and buy the appropriate document with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our extensive collection. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!