San Antonio, Texas is a vibrant city located in the southern part of the state, known for its rich history, diverse culture, and booming economy. From enchanting River Walk to historical missions, this metropolitan area offers a plethora of attractions and activities for tourists and residents alike. Now, let's delve into the checklist of matters to be considered when drafting a verification of an account specific to San Antonio, Texas. 1. Account Holder Details: Begin the verification by clearly stating the name and contact information of the account holder in San Antonio, Texas. Include their full name, residential address, phone number, and email address if available. 2. Account Information: Provide a detailed description of the account being verified. This includes the type of account (checking, savings, credit card, etc.), the account number, and the financial institution where the account is held, specifying if it is a local bank or a national one with branches in San Antonio. 3. Personal Identification: Request the account holder's identification documents, such as a photocopy of their valid driver's license or passport. This step is crucial to ensure the authenticity of the verification process. 4. Signer Details: Identify and provide the name, title, and contact information of the person signing the verification on behalf of the account holder. This could be the account holder themselves or an authorized representative acting on their behalf. 5. Notary Public: Consider including a section for notarization, where the verification can be notarized by a duly authorized Notary Public. This legalizes the verification and adds an extra layer of authenticity. 6. Date and Place: Specify the date when the verification is being prepared. Mention San Antonio, Texas, as the place where the verification is being drafted. 7. Attach Supporting Documents: If there are any supporting documents that need to be included with the verification, clearly outline which documents should be attached. For example, if bank statements or transaction records are required, mention them explicitly. Different types of San Antonio, Texas Checklists of Matters to be Considered in Drafting a Verification of an Account may vary based on the type of account being verified or the specific requirements of the requesting party. For example, if the verification is being made for a mortgage loan application, additional details related to income and financial history may be required. In conclusion, drafting a verification of an account in San Antonio, Texas requires attention to detail and the inclusion of specific information necessary to authenticate the account holder's identity and account details. By following this checklist, you can ensure that the verification meets the necessary requirements and provides accurate information, allowing for a smooth verification process.

San Antonio Texas Checklist of Matters to be Considered in Drafting a Verification of an Account

Description

How to fill out San Antonio Texas Checklist Of Matters To Be Considered In Drafting A Verification Of An Account?

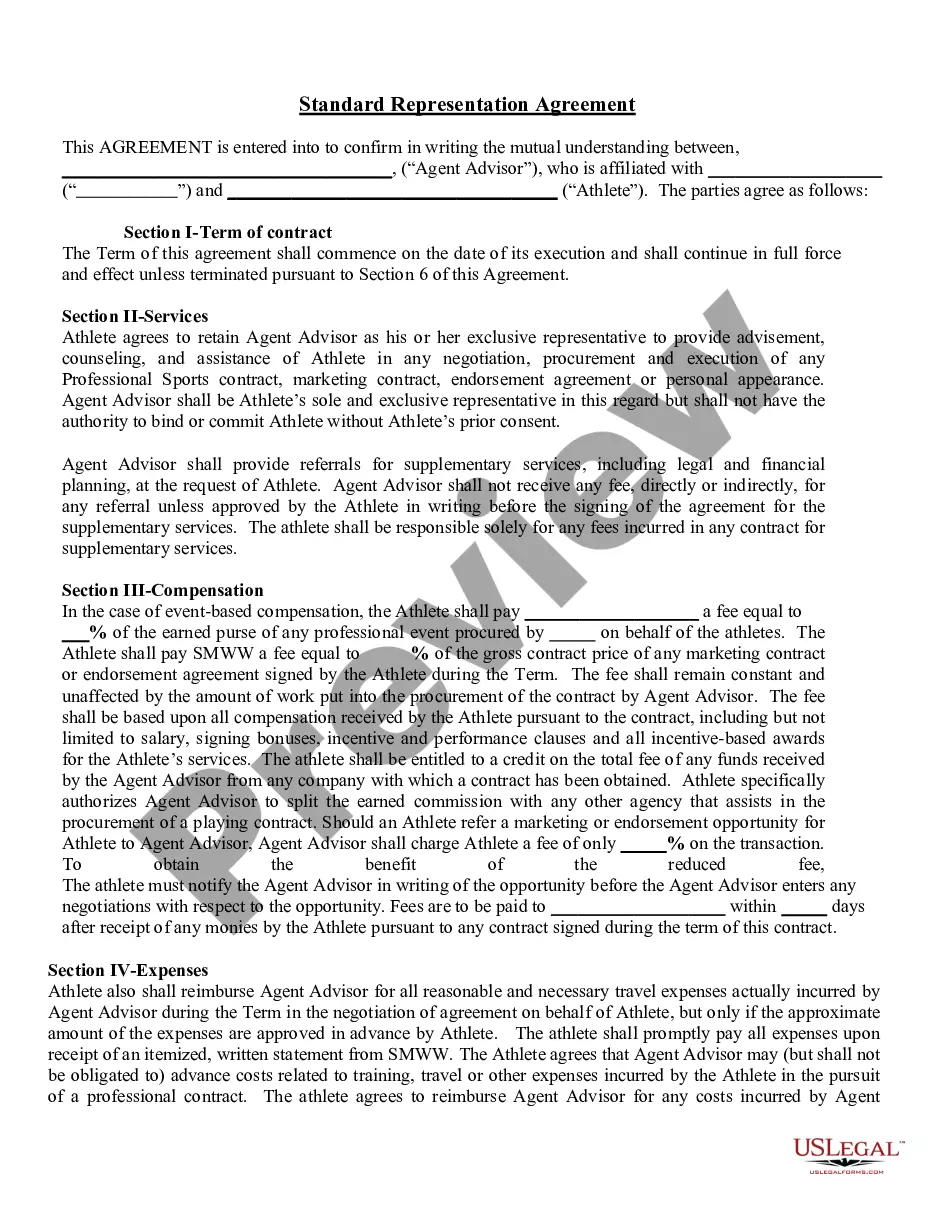

Are you looking to quickly draft a legally-binding San Antonio Checklist of Matters to be Considered in Drafting a Verification of an Account or maybe any other document to handle your personal or business matters? You can go with two options: contact a legal advisor to draft a valid document for you or create it completely on your own. Thankfully, there's a third option - US Legal Forms. It will help you get professionally written legal documents without having to pay unreasonable fees for legal services.

US Legal Forms provides a rich collection of over 85,000 state-specific document templates, including San Antonio Checklist of Matters to be Considered in Drafting a Verification of an Account and form packages. We offer templates for a myriad of life circumstances: from divorce paperwork to real estate document templates. We've been on the market for over 25 years and got a rock-solid reputation among our clients. Here's how you can become one of them and get the necessary document without extra hassles.

- To start with, carefully verify if the San Antonio Checklist of Matters to be Considered in Drafting a Verification of an Account is adapted to your state's or county's regulations.

- In case the document comes with a desciption, make sure to verify what it's suitable for.

- Start the search again if the form isn’t what you were seeking by using the search box in the header.

- Select the plan that best fits your needs and move forward to the payment.

- Select the format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, find the San Antonio Checklist of Matters to be Considered in Drafting a Verification of an Account template, and download it. To re-download the form, simply head to the My Forms tab.

It's easy to buy and download legal forms if you use our catalog. Moreover, the documents we offer are updated by law professionals, which gives you greater peace of mind when dealing with legal matters. Try US Legal Forms now and see for yourself!