Clark Nevada Credit Information Request is a process that allows individuals or businesses in Clark County, Nevada, to access their credit information through specific channels. It enables them to obtain insights into their credit history, including payment history, open credit accounts, debts, bankruptcies, and any other relevant financial information. The Clark Nevada Credit Information Request aims to provide individuals with a comprehensive understanding of their creditworthiness, which plays a crucial role in various financial transactions. By accessing their credit information, individuals can assess their eligibility for loans, mortgages, credit cards, and other forms of credit-based services. It also serves as a tool for monitoring any suspicious activities or errors in credit reports that may negatively impact one's financial standing. To fulfill a Clark Nevada Credit Information Request, individuals can approach different entities authorized to provide credit reports, such as credit bureaus or credit reporting agencies. These entities gather information from various sources, including lenders, financial institutions, and public records, to compile comprehensive credit reports. There are different types of Clark Nevada Credit Information Requests, such as: 1. Personal Credit Information Request: Individuals can request their personal credit information to gain insights into their individual creditworthiness. This report helps them understand their current financial standing and make informed decisions regarding their credit-related activities. 2. Business Credit Information Request: Businesses operating in Clark County, Nevada, can request their business credit information to evaluate their creditworthiness from a commercial perspective. This report allows them to assess the financial health of their business, potential risk factors, and eligibility for commercial credit options. 3. Credit Report Dispute Request: In case individuals or businesses find any errors, inaccuracies, or fraudulent activities in their credit reports, they can submit a credit report dispute request. This type of request initiates an investigation process, during which the credit reporting agency examines the disputed information and makes necessary corrections, if required. 4. Credit Monitoring Request: Individuals or businesses can subscribe to credit monitoring services, which involve continuous monitoring of credit reports for any changes or suspicious activities. This request ensures timely detection of potential identity theft, fraud, or errors in credit reports. 5. Credit Freeze/Security Freeze Request: Individuals concerned about identity theft or fraudulent credit activities can request a credit freeze. This request restricts access to their credit information, preventing unauthorized individuals from opening new credit accounts in their name. A credit freeze request provides an additional layer of security to safeguard personal and financial information. In summary, Clark Nevada Credit Information Request is a process designed to provide individuals and businesses in Clark County, Nevada, with access to their credit information. By obtaining credit reports through authorized entities, individuals can assess their creditworthiness, detect errors or suspicious activities, and make informed financial decisions based on accurate information.

Clark Nevada Credit Information Request

Description

How to fill out Clark Nevada Credit Information Request?

How much time does it normally take you to draw up a legal document? Given that every state has its laws and regulations for every life scenario, locating a Clark Credit Information Request meeting all local requirements can be tiring, and ordering it from a professional lawyer is often expensive. Numerous online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online collection of templates, grouped by states and areas of use. Apart from the Clark Credit Information Request, here you can find any specific form to run your business or personal deeds, complying with your county requirements. Specialists check all samples for their validity, so you can be certain to prepare your documentation properly.

Using the service is fairly easy. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed sample, and download it. You can get the file in your profile at any time in the future. Otherwise, if you are new to the website, there will be a few more actions to complete before you get your Clark Credit Information Request:

- Check the content of the page you’re on.

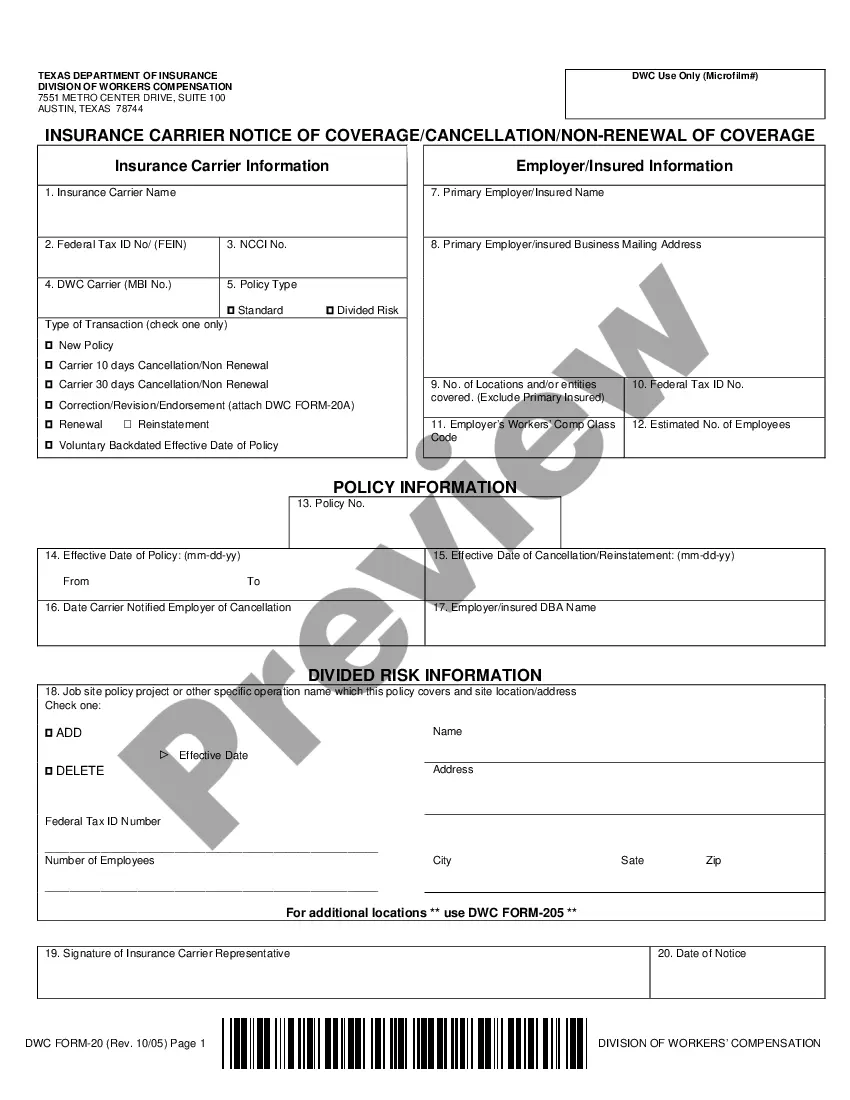

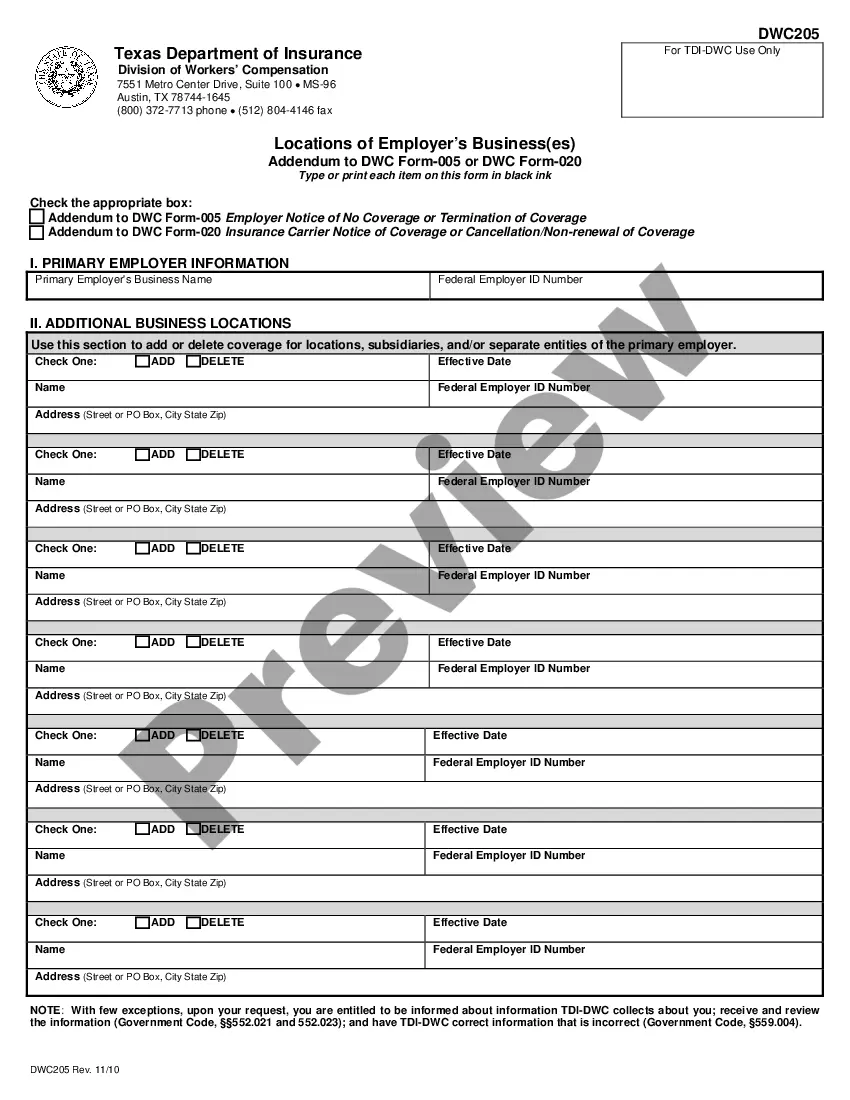

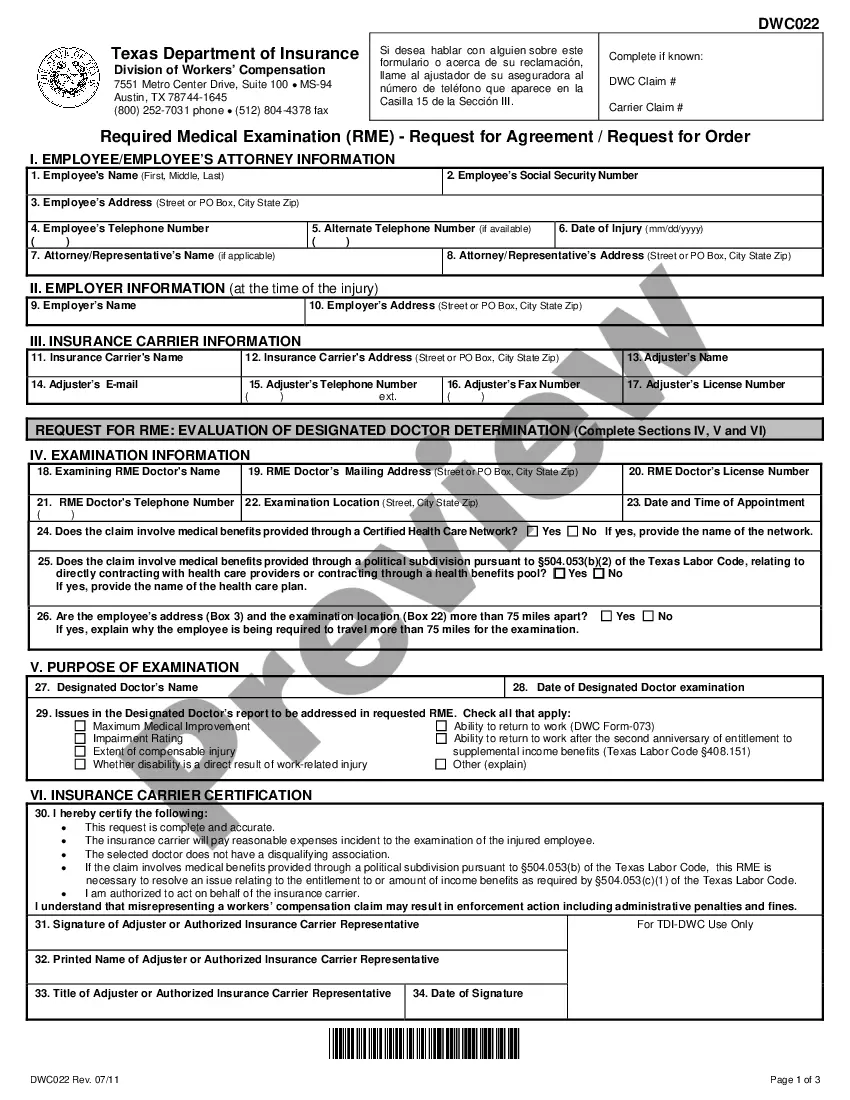

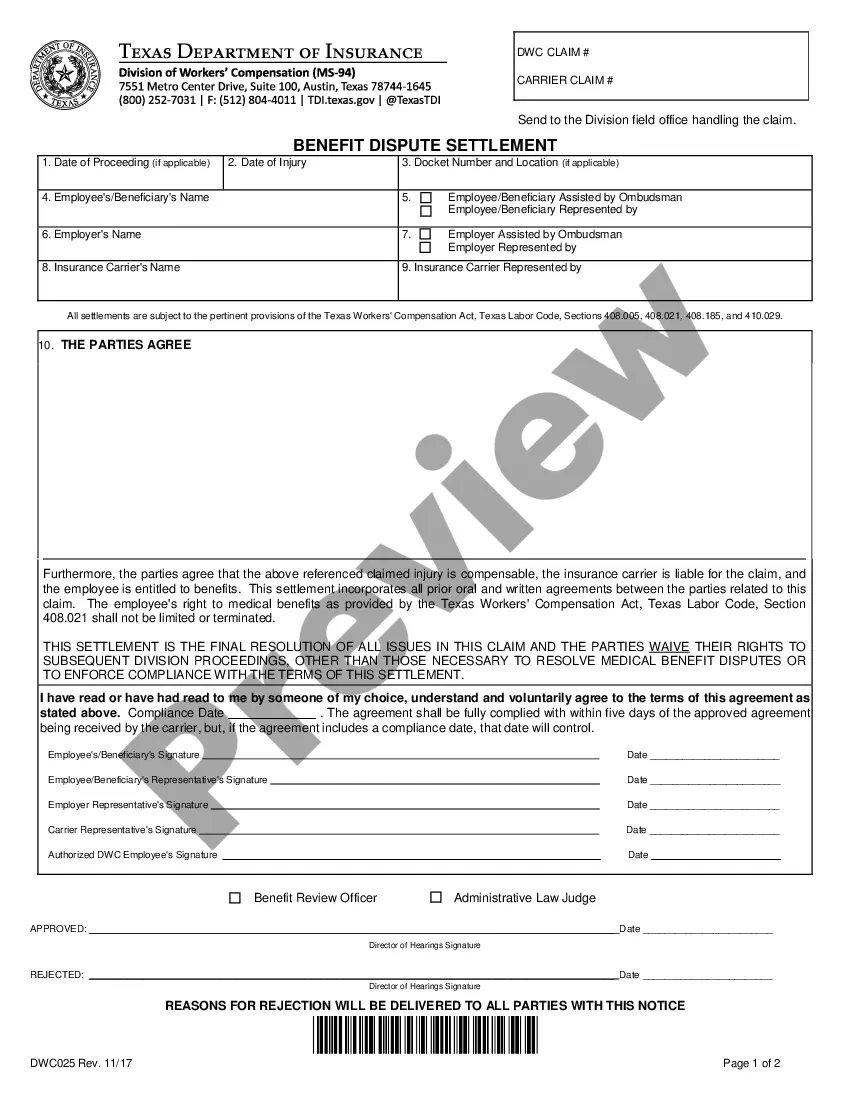

- Read the description of the sample or Preview it (if available).

- Search for another form utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the selected file.

- Select the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Clark Credit Information Request.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!