Cuyahoga Ohio Credit Information Request is a formal process utilized by individuals, businesses, and organizations to obtain financial information about an individual's credit history and standing within Cuyahoga County, Ohio. This request allows access to an individual's credit report, which includes details such as credit accounts, payment history, outstanding debts, bankruptcies, and other relevant information. By examining this report, lenders, employers, landlords, and other entities can evaluate an individual's creditworthiness and make informed decisions about extending credit, offering employment, or granting housing. There are several types of Cuyahoga Ohio Credit Information Requests that can be made depending on the nature of the inquiry. Here are a few commonly known types: 1. Personal Credit Information Request: This type of request allows individuals to access their own credit reports from credit reporting agencies within Cuyahoga County, Ohio. It enables individuals to monitor their creditworthiness, identify any errors or discrepancies, and take appropriate actions to rectify them. 2. Lender Credit Information Request: When financial institutions, such as banks or credit unions, consider granting a loan or credit facility to an individual or business, they may initiate a credit information request. This enables them to assess the applicant's creditworthiness and determine the level of risk associated with extending credit. 3. Employment Credit Information Request: Some employers require potential job candidates to undergo a credit check as part of the hiring process, primarily for positions that involve handling finances, sensitive information, or positions of trust. This request assists employers in evaluating an applicant's financial responsibility and reliability. 4. Rental Credit Information Request: Property owners and landlords often request credit information from prospective tenants to assess their ability to pay rent consistently and on time. This helps landlords in making informed decisions about the suitability of applicants for a tenancy. 5. Credit Information Request for Identity Verification: In certain situations, individuals may request credit information as a means of verifying identities or combating identity theft. By obtaining their credit report, individuals can identify any unauthorized accounts or suspicious activities that may indicate fraudulent use of their personal information. The Cuyahoga Ohio Credit Information Request plays a crucial role in enabling transparent and informed financial decisions regarding credit extensions, employability, and housing opportunities. It helps ensure fair and responsible lending practices while safeguarding individuals' personal and financial information in accordance with the relevant laws and regulations.

Cuyahoga Ohio Credit Information Request

Description

How to fill out Cuyahoga Ohio Credit Information Request?

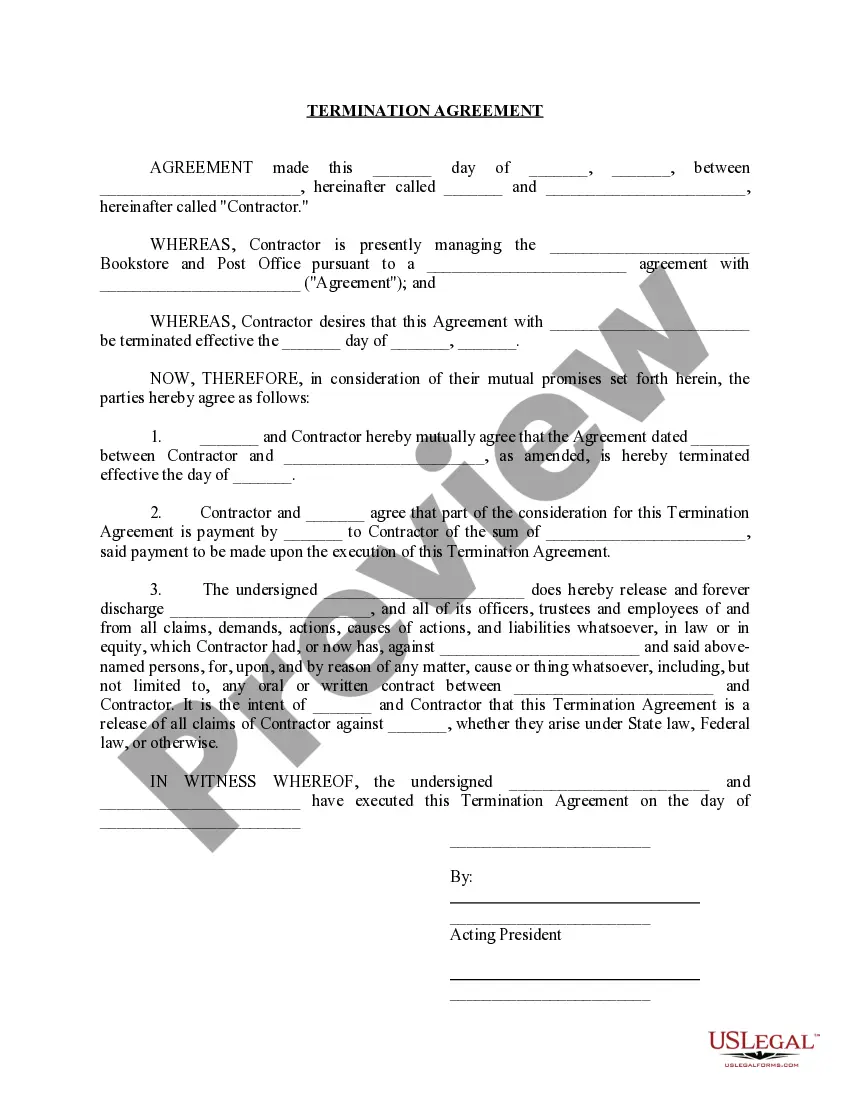

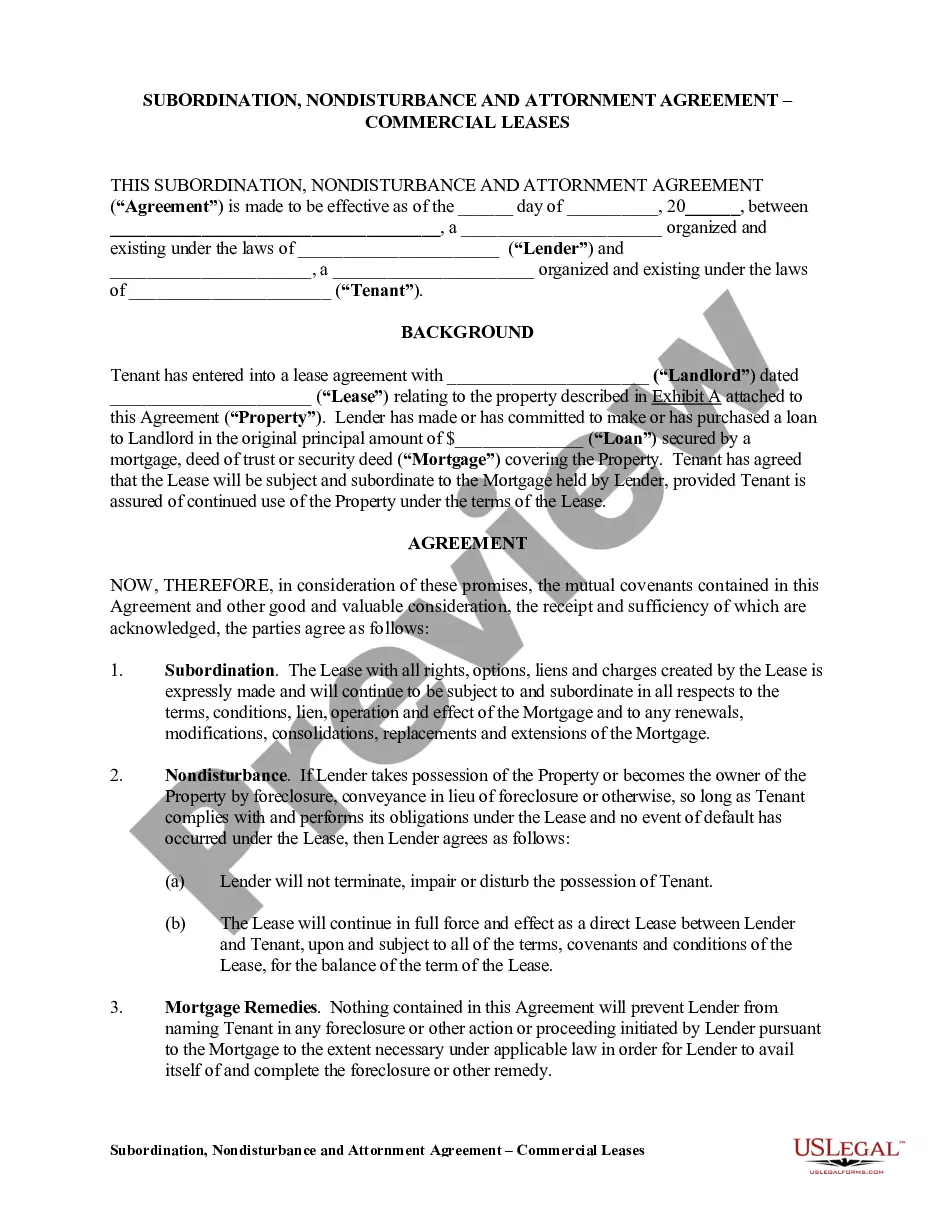

If you need to get a reliable legal form supplier to find the Cuyahoga Credit Information Request, consider US Legal Forms. Whether you need to launch your LLC business or manage your asset distribution, we got you covered. You don't need to be well-versed in in law to locate and download the appropriate form.

- You can search from more than 85,000 forms categorized by state/county and case.

- The self-explanatory interface, number of supporting resources, and dedicated support team make it easy to locate and execute various paperwork.

- US Legal Forms is a trusted service offering legal forms to millions of customers since 1997.

Simply select to look for or browse Cuyahoga Credit Information Request, either by a keyword or by the state/county the document is created for. After finding the required form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply find the Cuyahoga Credit Information Request template and take a look at the form's preview and description (if available). If you're comfortable with the template’s terminology, go ahead and click Buy now. Create an account and choose a subscription plan. The template will be instantly ready for download as soon as the payment is processed. Now you can execute the form.

Handling your legal affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our rich variety of legal forms makes this experience less pricey and more affordable. Create your first company, arrange your advance care planning, draft a real estate contract, or complete the Cuyahoga Credit Information Request - all from the comfort of your home.

Join US Legal Forms now!