Phoenix Arizona Credit Information Request is a formal process that allows individuals or organizations to obtain specific details regarding their credit history, credit scores, and related financial information from credit reporting agencies. This information is crucial for individuals seeking personal loans, mortgages, and credit cards, as well as businesses looking for credit facilities and financial partnerships. Phoenix Arizona Credit Information Request is primarily used by individuals residing or conducting financial activities in Phoenix, Arizona. By utilizing this request, individuals can gain vital insights into their creditworthiness, allowing them to make informed decisions based on their financial standing. There are mainly two types of Phoenix Arizona Credit Information Request: 1. Personal Credit Information Request: This type of request allows individuals to acquire their personal credit information, including credit reports, credit scores from major credit bureaus (Experian, Equifax, TransUnion), and other relevant financial data. It provides a comprehensive overview of an individual's credit history, listing existing loans, outstanding debts, payment history, and any negative or delinquent accounts that may affect their creditworthiness. 2. Business Credit Information Request: This kind of request is specifically tailored for businesses operating in Phoenix, Arizona. It enables them to access important credit data such as business credit reports, scores, and other financial information. This information is essential for businesses to evaluate their creditworthiness, negotiate favorable terms with lenders or suppliers, and secure necessary financing or partnerships. By submitting a properly filled Phoenix Arizona Credit Information Request, individuals or businesses will receive a detailed credit report that outlines their credit performance, payment habits, and overall financial behavior. This report helps lenders, creditors, and other stakeholders evaluate an applicant's ability to manage credit responsibly and meet financial obligations. Applicants must provide accurate personal or business details along with the necessary identification documents when submitting a Phoenix Arizona Credit Information Request. The process generally requires individuals to complete an application and pay a nominal fee to cover the costs associated with retrieving and processing the requested credit information. Overall, Phoenix Arizona Credit Information Request empowers individuals and businesses with the knowledge required to understand their credit standing and make informed financial decisions. It serves as a critical tool for ensuring financial stability, obtaining favorable loan terms, and maintaining healthy credit profiles in the Phoenix, Arizona area.

Phoenix Arizona Credit Information Request

Description

How to fill out Phoenix Arizona Credit Information Request?

Laws and regulations in every area vary from state to state. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid high priced legal assistance when preparing the Phoenix Credit Information Request, you need a verified template valid for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal forms. It's an excellent solution for professionals and individuals looking for do-it-yourself templates for different life and business occasions. All the forms can be used many times: once you purchase a sample, it remains available in your profile for subsequent use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Phoenix Credit Information Request from the My Forms tab.

For new users, it's necessary to make a few more steps to get the Phoenix Credit Information Request:

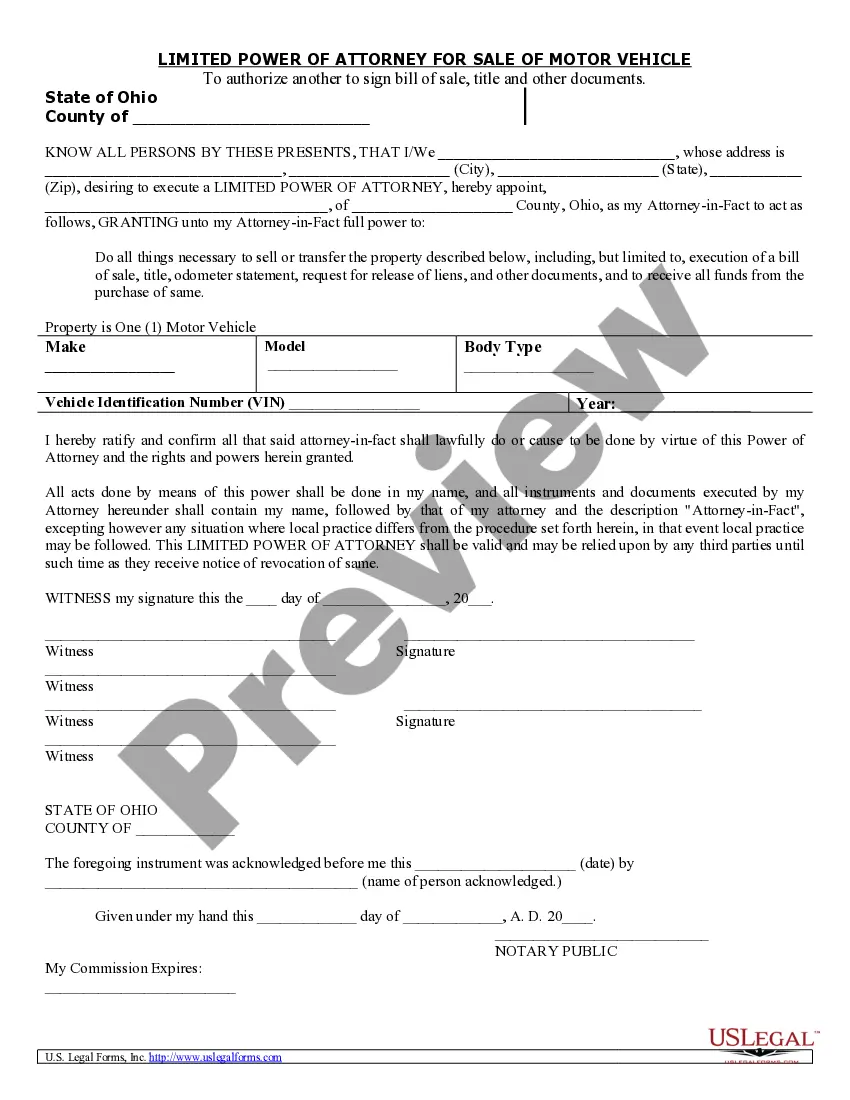

- Examine the page content to make sure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to get the template when you find the proper one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your paperwork in order with the US Legal Forms!