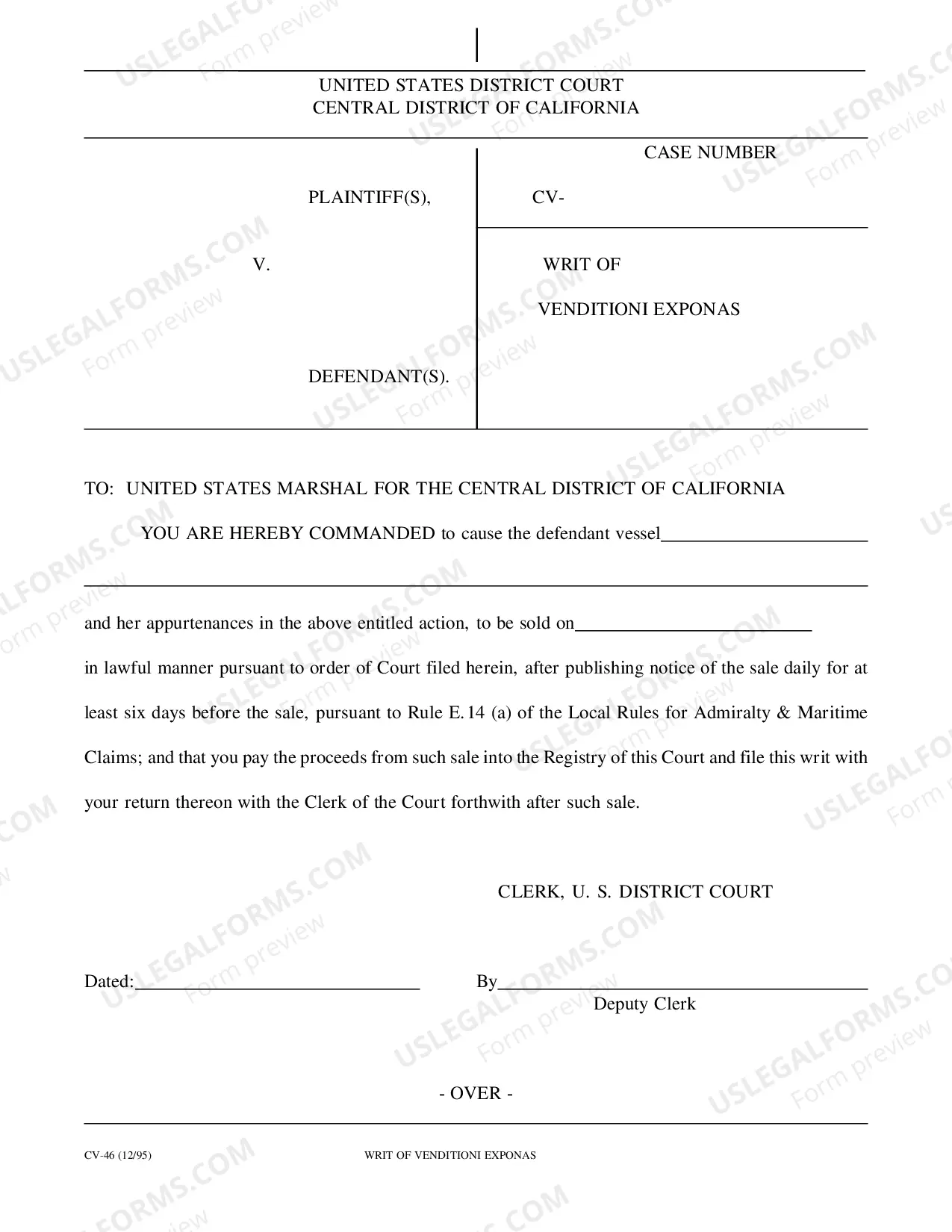

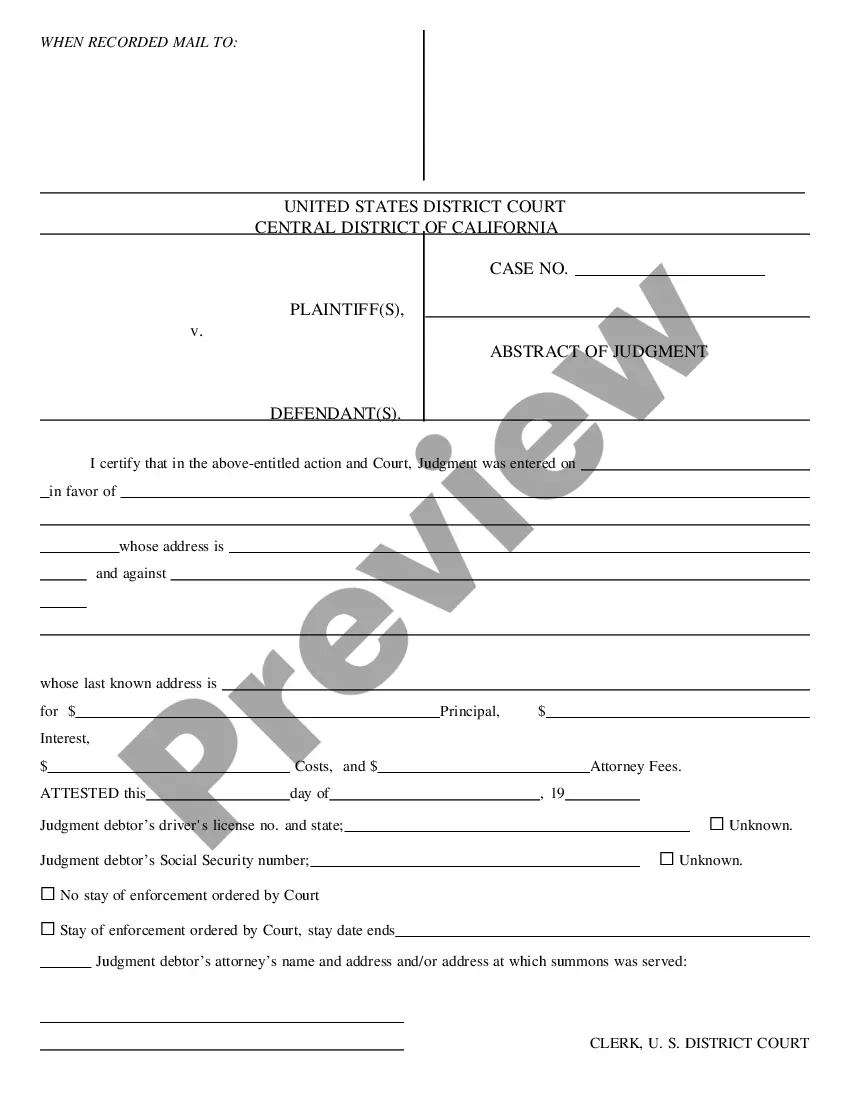

San Diego California Credit Information Request is a formal procedure through which individuals and businesses can obtain accurate credit information specific to San Diego, California. It allows them to assess their creditworthiness, monitor their financial health, and make informed decisions regarding loans, mortgages, and other financial transactions in the region. Conducting a credit information request is vital to understand and effectively manage one's financial standing in San Diego. The different types of San Diego California Credit Information Requests include: 1. Personal Credit Information Request: This type of request enables individuals to access their personal credit reports in San Diego, providing an overview of their credit history, outstanding debts, credit limits, payment history, and any derogatory remarks. 2. Business Credit Information Request: Designed for businesses, this request allows access to comprehensive credit reports to assess the creditworthiness of potential clients or partners in San Diego. It provides insights into the company's financial performance, trade credit history, outstanding liabilities, and other relevant financial factors. 3. Mortgage Credit Information Request: Those considering purchasing or refinancing a home in San Diego can request mortgage credit information. This type of request evaluates an individual's credit history, debt-to-income ratio, past mortgage payments, and other aspects to determine their eligibility for a mortgage loan in the region. 4. Auto Loan Credit Information Request: People in San Diego seeking auto financing can request their credit information to assess their eligibility for obtaining favorable terms and interest rates on auto loans. This request examines factors such as credit score, payment history, and outstanding debts related to auto loans. 5. Student Loan Credit Information Request: Students or recent graduates in San Diego can request credit information specifically related to their student loans. This enables them to evaluate their loan repayment status, ensure accuracy of reported information, and explore options for loan consolidation or refinancing. Regardless of the type of San Diego California Credit Information Request, it is crucial to provide accurate personal information, such as name, contact details, social security number, and any other required identification. The credit information obtained through these requests helps individuals and businesses make informed financial decisions and establish a solid foundation for future financial endeavors in the San Diego area.

San Diego California Credit Information Request

Description

How to fill out San Diego California Credit Information Request?

How much time does it typically take you to create a legal document? Given that every state has its laws and regulations for every life sphere, locating a San Diego Credit Information Request suiting all local requirements can be exhausting, and ordering it from a professional lawyer is often costly. Many online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive online collection of templates, collected by states and areas of use. Aside from the San Diego Credit Information Request, here you can get any specific form to run your business or individual affairs, complying with your county requirements. Experts check all samples for their actuality, so you can be sure to prepare your paperwork properly.

Using the service is pretty easy. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed sample, and download it. You can pick the document in your profile at any time later on. Otherwise, if you are new to the website, there will be some extra actions to complete before you get your San Diego Credit Information Request:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another form using the corresponding option in the header.

- Click Buy Now once you’re certain in the chosen document.

- Decide on the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the San Diego Credit Information Request.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!