Wake North Carolina Credit Information Request is a process through which individuals or businesses can obtain their credit information from credit bureaus operating in Wake County, North Carolina. This information is crucial for individuals wanting to assess their creditworthiness or businesses seeking to make informed decisions about potential clients or partners. One type of Wake North Carolina Credit Information Request is the personal credit information request. Individuals can submit this request to access their personal credit history, which includes details about their credit accounts, payment history, outstanding loans, credit utilization, and any negative information like delinquencies or bankruptcies. Obtaining this information allows individuals to ensure its accuracy, identify any discrepancies, and take appropriate steps to improve their credit score. Another type is the business credit information request. Small businesses, financial institutions, or potential lenders use this request to evaluate the creditworthiness and financial status of a business entity. It includes information about the company's credit accounts, payment history, public records, industry risk factors, and other relevant data. Businesses can leverage this information to make informed decisions regarding credit extensions, partnerships, or to negotiate better terms for their financial arrangements. Furthermore, Wake North Carolina Credit Information Request may also encompass specialized reports like credit inquiries reports. These reports provide a comprehensive list of entities or individuals who have recently accessed an individual's credit information. It helps individuals monitor any credit checks performed during loan applications or other credit-related activities, thereby enabling them to identify potential instances of unauthorized access or fraud. Lastly, the Credit Information Request process may differ based on the specific credit bureau or agency involved. Depending on the bureau's policies, individuals or businesses may need to follow specific procedures, provide necessary documents, and pay associated fees to obtain their credit information. Some common credit bureaus operating in Wake County, North Carolina, include Equifax, Experian, and TransUnion. In summary, Wake North Carolina Credit Information Request is a vital process that allows individuals and businesses in Wake County to obtain their credit information from credit bureaus. By assessing personal or business credit histories, individuals can monitor their financial status, check for inaccuracies, and work towards improving their creditworthiness. Businesses can evaluate clients or partners based on their credit information, assisting in making informed decisions about extending credit or forming partnerships.

Wake North Carolina Credit Information Request

Description

How to fill out Wake North Carolina Credit Information Request?

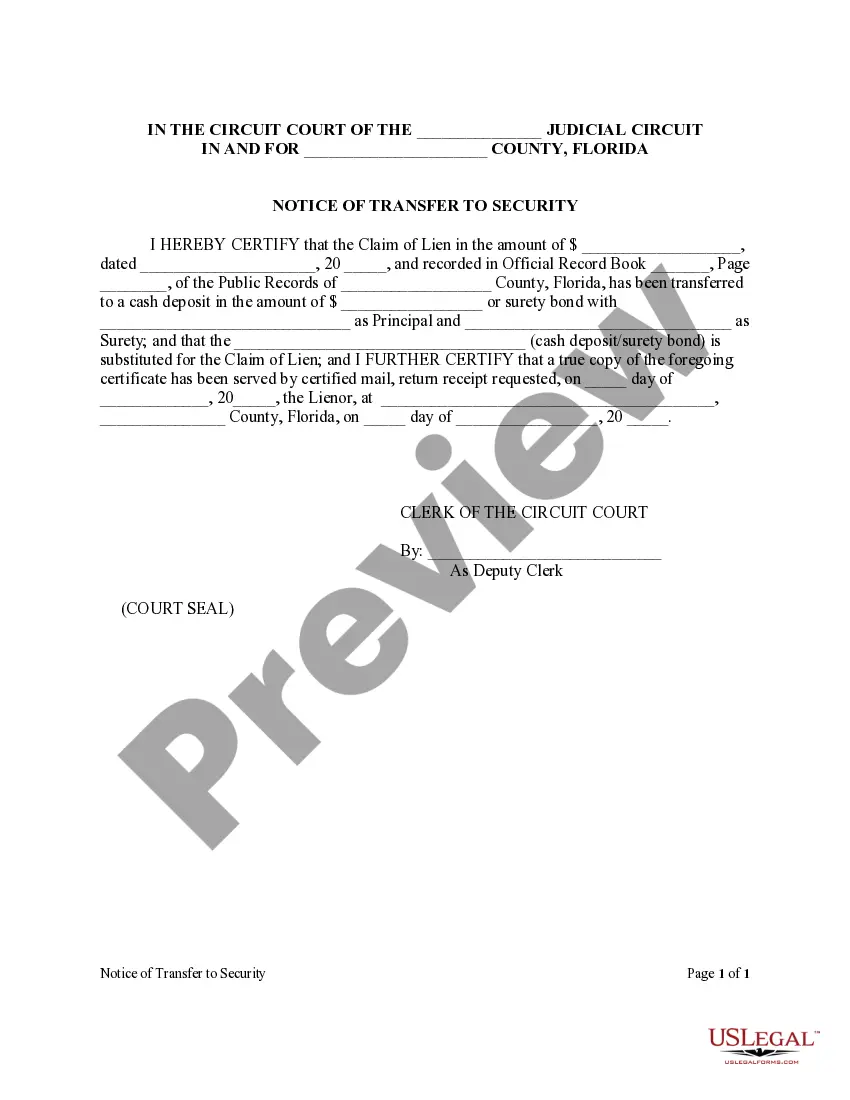

Creating legal forms is a necessity in today's world. Nevertheless, you don't always need to seek professional help to draft some of them from the ground up, including Wake Credit Information Request, with a service like US Legal Forms.

US Legal Forms has more than 85,000 forms to pick from in various types varying from living wills to real estate paperwork to divorce documents. All forms are organized based on their valid state, making the searching experience less overwhelming. You can also find information materials and tutorials on the website to make any tasks associated with paperwork execution simple.

Here's how to purchase and download Wake Credit Information Request.

- Take a look at the document's preview and description (if available) to get a general idea of what you’ll get after getting the form.

- Ensure that the template of your choosing is specific to your state/county/area since state regulations can impact the legality of some records.

- Examine the related document templates or start the search over to locate the appropriate document.

- Click Buy now and register your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a suitable payment gateway, and buy Wake Credit Information Request.

- Choose to save the form template in any available file format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the appropriate Wake Credit Information Request, log in to your account, and download it. Of course, our website can’t take the place of an attorney entirely. If you need to deal with an extremely difficult situation, we advise using the services of an attorney to check your form before executing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of customers. Join them today and purchase your state-specific documents effortlessly!

Form popularity

FAQ

Transcript Request your transcript. Email to: admissions@waketech.edu. - OR - Mail to: Wake Tech Admissions. 9101 Fayetteville Road. Raleigh, NC 27603.

Registration and Records Contact Information Mailing address: Registration and Student Records. Wake Technical Community College.Campus location: Building L, Room 243. Campus location:Hours: Monday - Thursday 8 a.m. - 5 p.m. Friday 8 a.m. - 5 p.m.Phone: 919-866-5700. Phone:Fax: 919-662-3564.Email: registrar@waketech.edu.

Student Services will provide enrollment, advising and other functions on a five-day/eight-hour work week on all campuses. Eastern Wake Education Center closes during the day Fridays but is open Friday evenings and all day Saturday.

Transcript requests Transcripts may also be obtained by mail from Registration and Student Records, Wake Tech Community College, 9101 Fayetteville Road, Raleigh, NC 27603.

Dropping a course Courses dropped after the last day to drop for the term and on or before the 60% date of the semester or term are considered withdrawals. Courses dropped during this period will result in a grade of "W." Student who drop a class are advised that doing so may affect their financial aid.

Your User ID is the ID you will use to log in. It is made up of your first initial, middle initial and last name. Occasionally, there will be a sequence number at the end. To find out your User ID, use WebAdvisor.

For the best response, call 919-866-5000.

Transcript requests Transcripts may also be obtained by mail from Registration and Student Records, Wake Tech Community College, 9101 Fayetteville Road, Raleigh, NC 27603.

YOUR WAKE TECH EMAIL ACCOUNT Twenty-four hours after activating your Wake Tech Key Account, go to Office 365 and type in your Key Account username followed by @my.waketech.edu (example: zzsmith@my.waketech.edu).