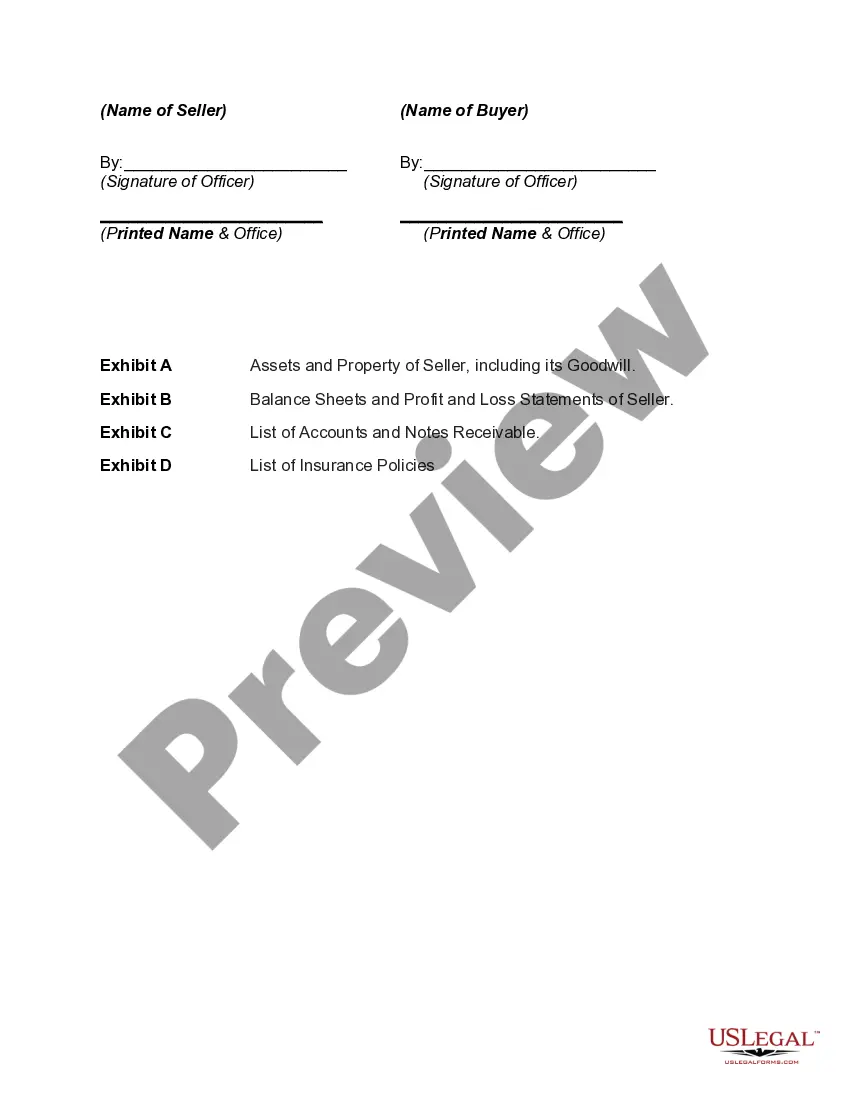

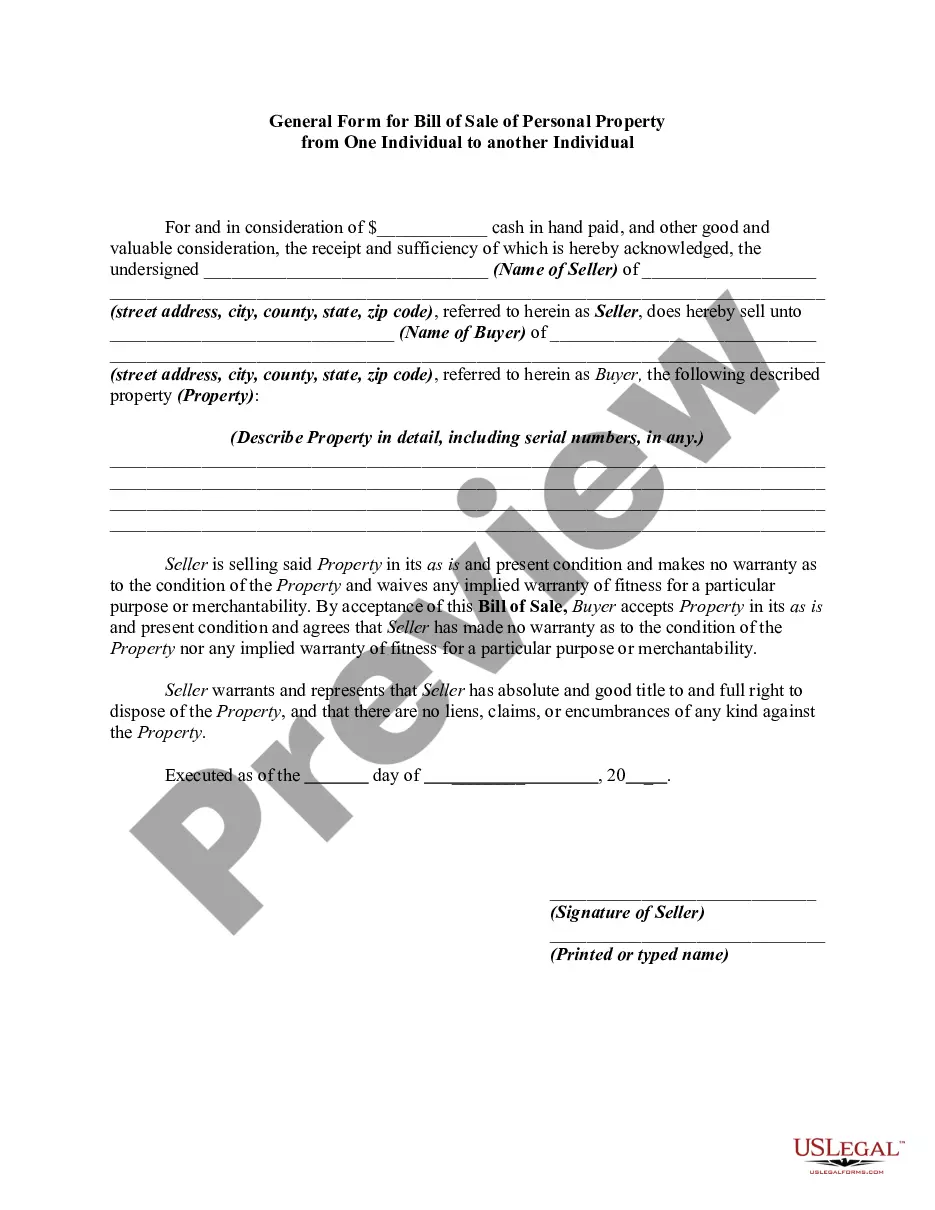

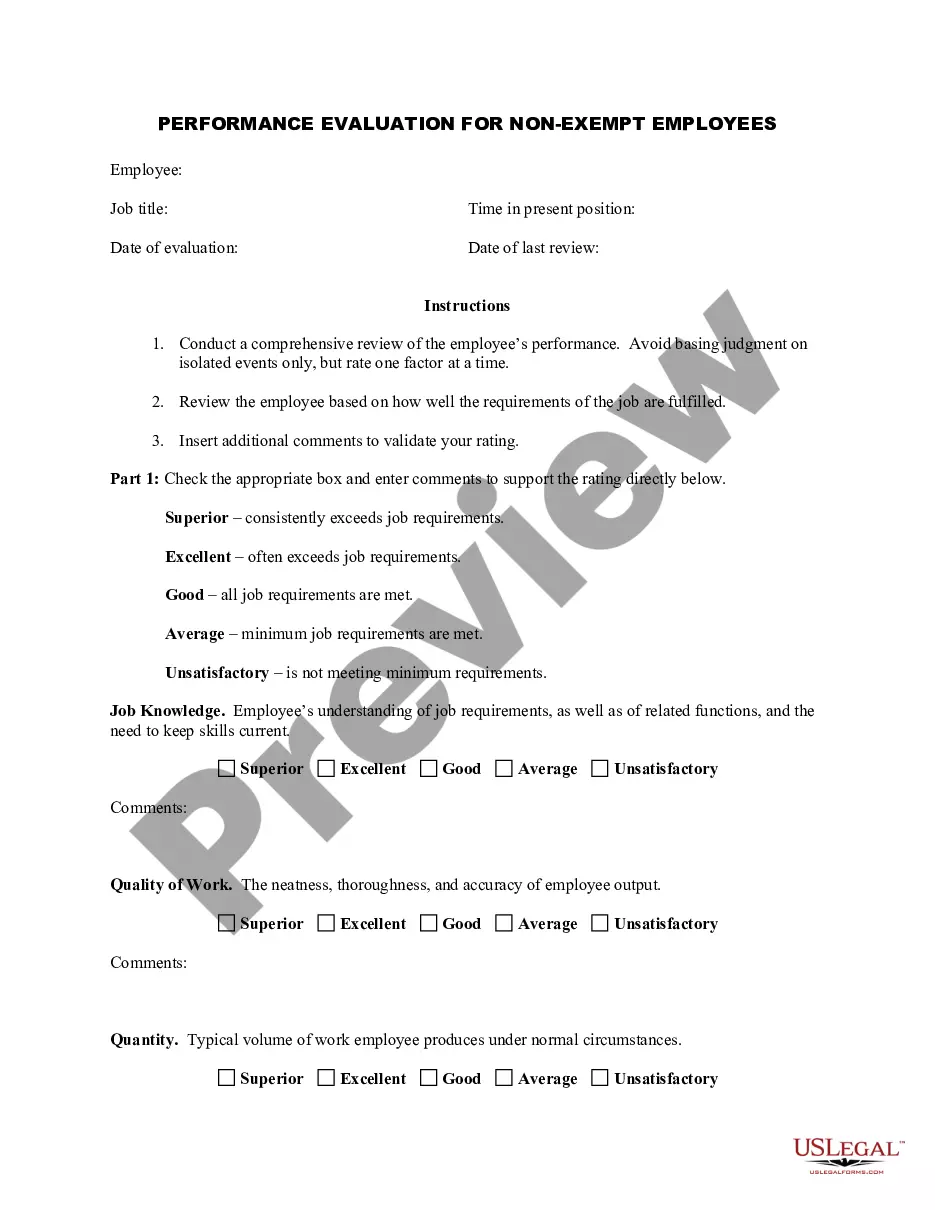

The Nassau New York Agreement for Sale of Assets of Corporation refers to a legally binding contract utilized when a corporation intends to sell its assets to another party within the jurisdiction of Nassau County, New York. This agreement outlines the terms and conditions associated with the sale, ensuring the smooth transfer of assets and protecting the rights of both the selling corporation and the purchasing party. The agreement typically contains several essential elements such as a detailed description of the assets being sold, including tangible properties, equipment, inventory, intellectual property rights, and any other relevant items involved in the transaction. It further specifies the agreed-upon purchase price or payment structure, which can include cash, stocks, or a combination of both. Moreover, the agreement comprehensively addresses any liabilities associated with the assets being sold, clearly defining whether the liabilities will be assumed by the buyer or retained by the seller. This mitigates any potential disputes or confusion during and after the sale process. There can be various types of Nassau New York Agreements for Sale of Assets of Corporation, based on the specific nature and purpose of the sale. Some of these types may include: 1. Asset Purchase Agreement: This type of agreement involves the sale of specific company assets, such as real estate, equipment, or intellectual property rights, rather than the entire corporation itself. 2. Stock Purchase Agreement: In this agreement, the buyer acquires the majority or complete ownership of the corporation by purchasing the outstanding shares of stock. 3. Merger and Acquisition Agreement: This type of agreement involves the complete merging or acquisition of one corporation by another, including the transfer of all assets, liabilities, and legal rights. 4. Cross-Border Asset Sale Agreement: This agreement applies when the sale of assets involves parties from different countries or jurisdictions, requiring adherence to additional legal requirements and international business regulations. In summary, the Nassau New York Agreement for Sale of Assets of Corporation is a vital legal document that facilitates the orderly transfer of assets from one corporation to another within the Nassau County jurisdiction. By addressing various elements such as asset descriptions, purchase price, liabilities, and the nature of the sale, this agreement ensures a transparent and protected transaction process for both parties involved.

Nassau New York Agreement for Sale of Assets of Corporation

Description

How to fill out Nassau New York Agreement For Sale Of Assets Of Corporation?

If you need to find a trustworthy legal form supplier to get the Nassau Agreement for Sale of Assets of Corporation, consider US Legal Forms. No matter if you need to launch your LLC business or manage your asset distribution, we got you covered. You don't need to be well-versed in in law to locate and download the needed template.

- You can browse from over 85,000 forms categorized by state/county and situation.

- The self-explanatory interface, number of learning resources, and dedicated support make it simple to get and execute different paperwork.

- US Legal Forms is a trusted service providing legal forms to millions of users since 1997.

Simply select to look for or browse Nassau Agreement for Sale of Assets of Corporation, either by a keyword or by the state/county the document is intended for. After locating necessary template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's effortless to start! Simply locate the Nassau Agreement for Sale of Assets of Corporation template and check the form's preview and description (if available). If you're confident about the template’s language, go ahead and click Buy now. Register an account and choose a subscription plan. The template will be instantly ready for download once the payment is completed. Now you can execute the form.

Taking care of your law-related affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our comprehensive variety of legal forms makes this experience less costly and more reasonably priced. Create your first business, arrange your advance care planning, draft a real estate agreement, or execute the Nassau Agreement for Sale of Assets of Corporation - all from the comfort of your sofa.

Sign up for US Legal Forms now!