Title: San Antonio Texas Agreement for Sale of Assets of Corporation: Understanding the Key Aspects Introduction: The San Antonio Texas Agreement for Sale of Assets of Corporation is a legal document that governs the transfer of assets from one corporation to another. This agreement specifies the terms and conditions under which the assets are sold, ensuring a smooth and legally binding transaction. Let's delve deeper into the various types of San Antonio Texas Agreement for Sale of Assets of Corporation. 1. San Antonio Texas Agreement for Sale of Tangible Assets of Corporation: This type of agreement focuses on the transfer of physical assets such as machinery, equipment, inventory, or real estate properties. It outlines details regarding the condition, location, and valuation of these assets, as well as any warranties or liabilities associated with them. 2. San Antonio Texas Agreement for Sale of Intangible Assets of Corporation: In some cases, the assets being sold might include intangible assets like trademarks, copyrights, patents, trade secrets, or customer lists. This type of agreement addresses the identification, transfer, and protection of these intangible assets, ensuring that all necessary rights and permissions are properly assigned. 3. San Antonio Texas Agreement for Sale of Intellectual Property Assets of Corporation: Focusing specifically on intellectual property assets, this agreement covers the transfer of copyrights, patents, or trademarks held by a corporation. It includes provisions for royalty payments, non-disclosure agreements, restrictions on future use, and indemnification in case of any litigation related to the intellectual property. 4. San Antonio Texas Agreement for Sale of Financial Assets of Corporation: In instances where a corporation wants to sell financial assets like stocks, bonds, or derivatives, this agreement comes into play. It encompasses the transfer process, the valuation of these assets, and any necessary regulatory compliance requirements. Key Components of a San Antonio Texas Agreement for Sale of Assets of Corporation: — Parties involved: Identification of the buyer and seller corporations, their legal addresses, and contact details. — Asset list: Detailed descriptions of the assets being sold, including quantity, location, condition, and valuation. — Purchase price and payment terms: Clear indication of the agreed-upon purchase price, along with payment terms, such as lump sum, installments, or contingent payments. — Representations and warranties: Assurance made by the seller regarding the ownership, condition, and validity of the assets being sold, protecting the buyer's interests. — Due diligence: Provision for the buyer to conduct a thorough examination of the assets and related documents before closing the sale. — Closing conditions: Conditions to be met before the transaction can be completed, such as obtaining necessary approvals, consents, or waivers. — Confidentiality and non-compete agreements: Clauses restricting the seller from disclosing confidential information or engaging in competing businesses. — Indemnification: Provision allocating responsibility and liability for any potential claims, debts, or undisclosed liabilities related to the sold assets. — Governing law and jurisdiction: Clearly defining the laws and legal jurisdiction under which any disputes will be resolved. Conclusion: The San Antonio Texas Agreement for Sale of Assets of Corporation plays a critical role in facilitating the transfer of assets between corporations. By understanding the specific type of assets being sold and incorporating the essential components mentioned above, this agreement ensures a transparent, legally sound, and successful transaction.

San Antonio Texas Agreement for Sale of Assets of Corporation

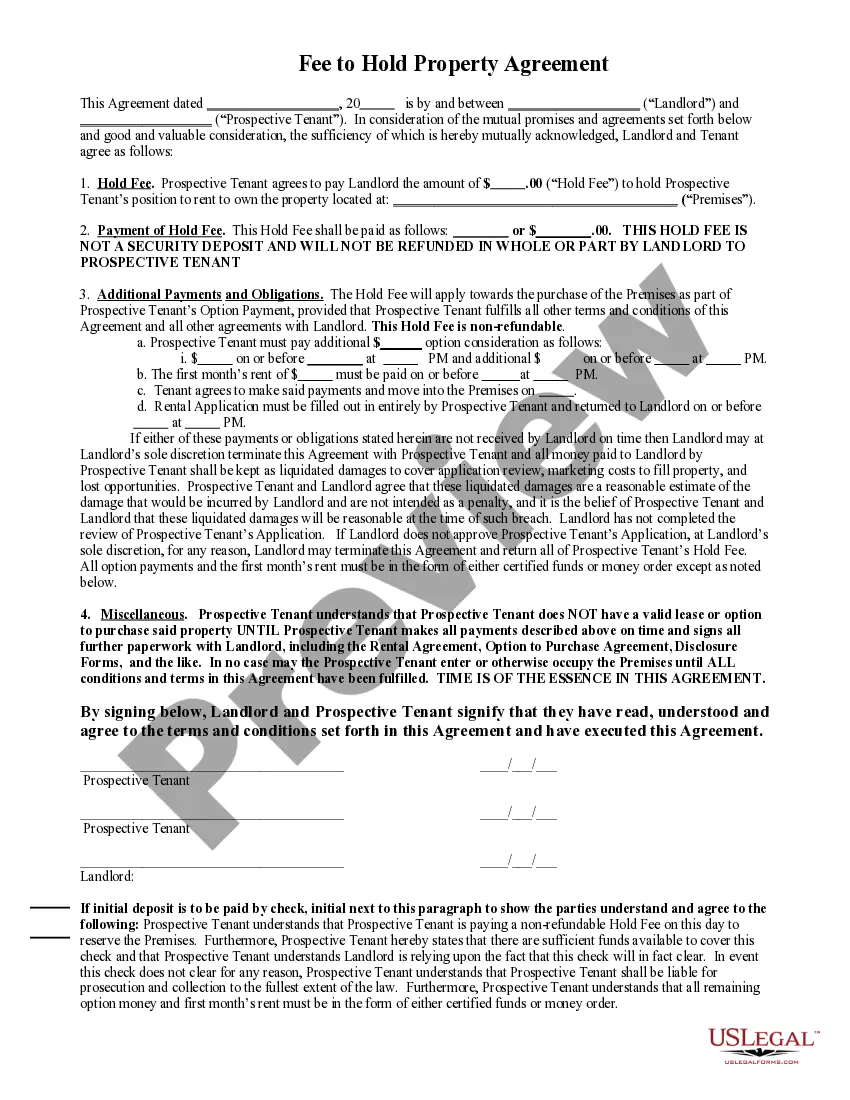

Description

How to fill out San Antonio Texas Agreement For Sale Of Assets Of Corporation?

Preparing documents for the business or individual demands is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's important to take into account all federal and state regulations of the particular region. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it stressful and time-consuming to draft San Antonio Agreement for Sale of Assets of Corporation without professional help.

It's possible to avoid wasting money on lawyers drafting your documentation and create a legally valid San Antonio Agreement for Sale of Assets of Corporation by yourself, using the US Legal Forms online library. It is the most extensive online collection of state-specific legal documents that are professionally cheched, so you can be certain of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to download the required document.

In case you still don't have a subscription, follow the step-by-step guideline below to get the San Antonio Agreement for Sale of Assets of Corporation:

- Look through the page you've opened and verify if it has the document you require.

- To do so, use the form description and preview if these options are available.

- To find the one that fits your needs, utilize the search tab in the page header.

- Double-check that the template complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal forms for any use case with just a few clicks!