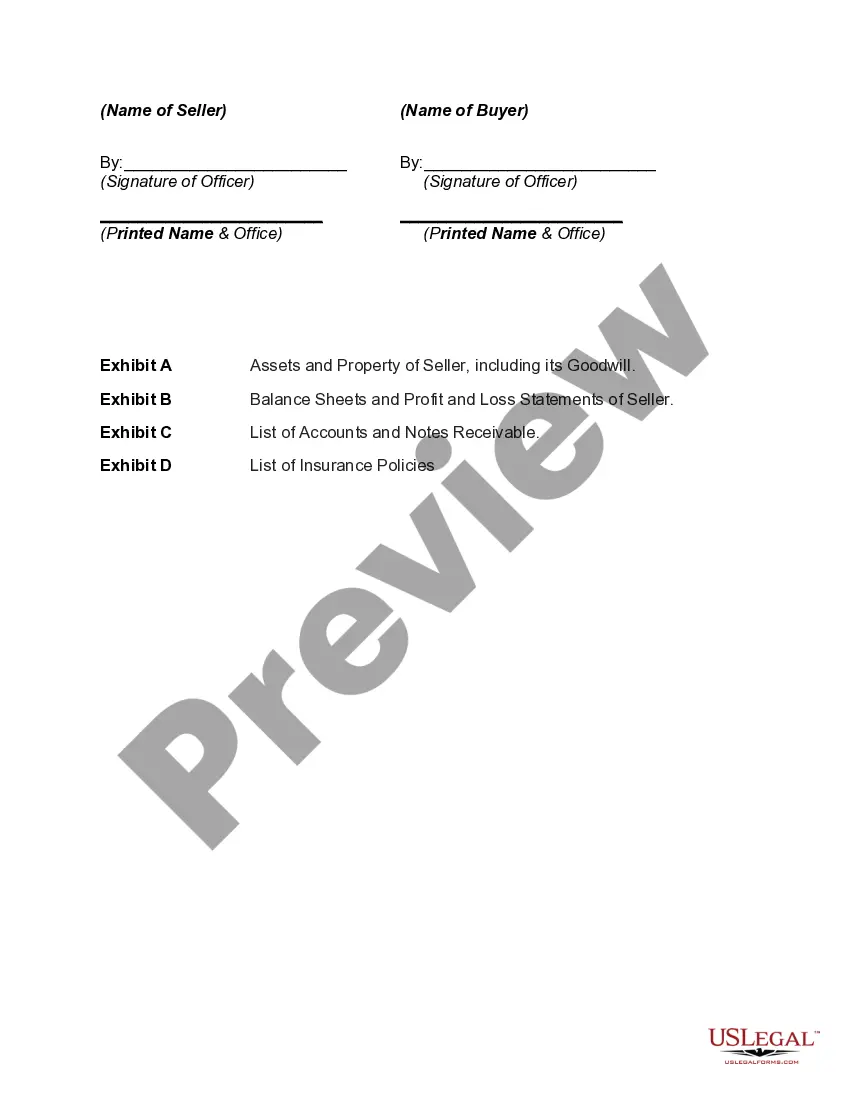

The Suffolk New York Agreement for Sale of Assets of Corporation is a legally binding contract that outlines the sale and transfer of assets from one corporation to another in Suffolk County, New York. This agreement covers the purchase of tangible and intangible assets, such as real estate, vehicles, equipment, proprietary technology, trademarks, patents, customer contracts, and intellectual property. In the Suffolk New York Agreement for Sale of Assets of Corporation, both the buyer and the seller agree to the terms and conditions of the asset sale. These terms include the purchase price, payment terms, responsibilities of each party, representations and warranties, covenants, confidentiality, and any other specific provisions related to the transaction. There are several types of Suffolk New York Agreements for Sale of Assets of Corporation, depending on the nature of the assets being sold and the specific needs of the parties involved. Some common types include: 1. Real Estate Asset Purchase Agreement: This type of agreement focuses on the sale of real property assets, such as land, buildings, or warehouses. It includes details about the property's location, size, condition, zoning, and any restrictions. Additionally, it covers the transfer of titles and the allocation of property taxes and liabilities. 2. Intellectual Property Asset Purchase Agreement: This agreement pertains to the sale of intangible assets such as patents, trademarks, copyrights, and trade secrets. It outlines the scope of the intellectual property rights being transferred, any existing licenses or agreements, and any restrictions on the use or transfer of the assets. 3. Business Asset Purchase Agreement: This type of agreement encompasses the sale of a corporation's entire business, including tangible and intangible assets, customer contracts, inventory, accounts receivable, and goodwill. It outlines the specific assets being sold, any liabilities assumed by the buyer, and the transfer of employees or contracts associated with the business. 4. Equipment Asset Purchase Agreement: This agreement focuses on the sale of machinery, vehicles, or equipment owned by a corporation. It includes details about the condition, specifications, warranties, and responsibilities for maintenance or repairs. Additionally, it outlines the payment terms and any restrictions on the use or transfer of the equipment. The Suffolk New York Agreement for Sale of Assets of Corporation is a crucial document that protects the interests of both the buyer and the seller during asset transactions. It ensures that the transfer is conducted smoothly, and all parties involved adhere to their agreed-upon obligations.

Suffolk New York Agreement for Sale of Assets of Corporation

Description

How to fill out Suffolk New York Agreement For Sale Of Assets Of Corporation?

Whether you intend to start your company, enter into a deal, apply for your ID update, or resolve family-related legal concerns, you must prepare specific documentation corresponding to your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and verified legal templates for any personal or business occasion. All files are grouped by state and area of use, so picking a copy like Suffolk Agreement for Sale of Assets of Corporation is fast and easy.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you several more steps to obtain the Suffolk Agreement for Sale of Assets of Corporation. Follow the guide below:

- Make sure the sample meets your personal needs and state law regulations.

- Look through the form description and check the Preview if available on the page.

- Make use of the search tab providing your state above to locate another template.

- Click Buy Now to obtain the sample when you find the right one.

- Opt for the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Suffolk Agreement for Sale of Assets of Corporation in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our website are reusable. Having an active subscription, you can access all of your previously purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!