A San Diego California Buy-Sell Agreement with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership is a legal contract that outlines the terms and conditions for the transfer of a deceased partner's ownership interest in a professional partnership. This agreement helps ensure a smooth transition of ownership and protects the remaining partners from potential disputes or financial strains. Keywords: San Diego California, Buy-Sell Agreement, Life Insurance, Fund Purchase, Deceased Partner's Interest, Professional Partnership There are several types of San Diego California Buy-Sell Agreements with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership that can be tailored to meet the unique requirements of different partnerships. These types include: 1. Cross-Purchase Agreement: In this type of agreement, each partner agrees to purchase the deceased partner's interest using life insurance proceeds. Each partner will own a policy on the life of the other partners, and the death benefit will be used to fund the purchase of the deceased partner's share. 2. Entity Redemption Agreement: In this arrangement, the partnership itself agrees to purchase the deceased partner's interest. The partnership obtains life insurance policies on the lives of each partner, and the death benefit is used to buy the deceased partner's share from their estate. 3. Wait-and-See Agreement: This type of agreement allows the surviving partners to choose between a cross-purchase or entity redemption agreement after the death of a partner. They can evaluate the financial and tax implications before making a final decision. 4. Hybrid Agreement: This agreement combines elements of both cross-purchase and entity redemption agreements. It allows some partners to buy the deceased partner's interest while the partnership buys the remaining shares. San Diego California Buy-Sell Agreements with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership provide several benefits, including: — Ensures business continuity: The agreement enables the surviving partners to maintain control and ownership of the partnership without disruption in the event of a partner's death. — Facilitates a fair valuation: The agreement specifies the valuation method for the buyout, ensuring that the deceased partner's interest is assessed at a fair market value. — Provides liquidity: Life insurance provides immediate cash flow to fund the purchase, avoiding the need for partners to dip into personal savings or seek external financing. — Protects against disputes: The agreement sets clear guidelines for the buyout process, ensuring a smooth transition and preventing conflicts or disagreements among the remaining partners or the deceased partner's estate. In conclusion, a San Diego California Buy-Sell Agreement with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership is a crucial legal document that protects the interests of the partners and ensures a seamless transfer of ownership in the event of a partner's death. By utilizing the appropriate type of agreement, the partnership can safeguard its future and protect the financial well-being of all involved parties.

San Diego California Buy-Sell Agreement with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership

Description

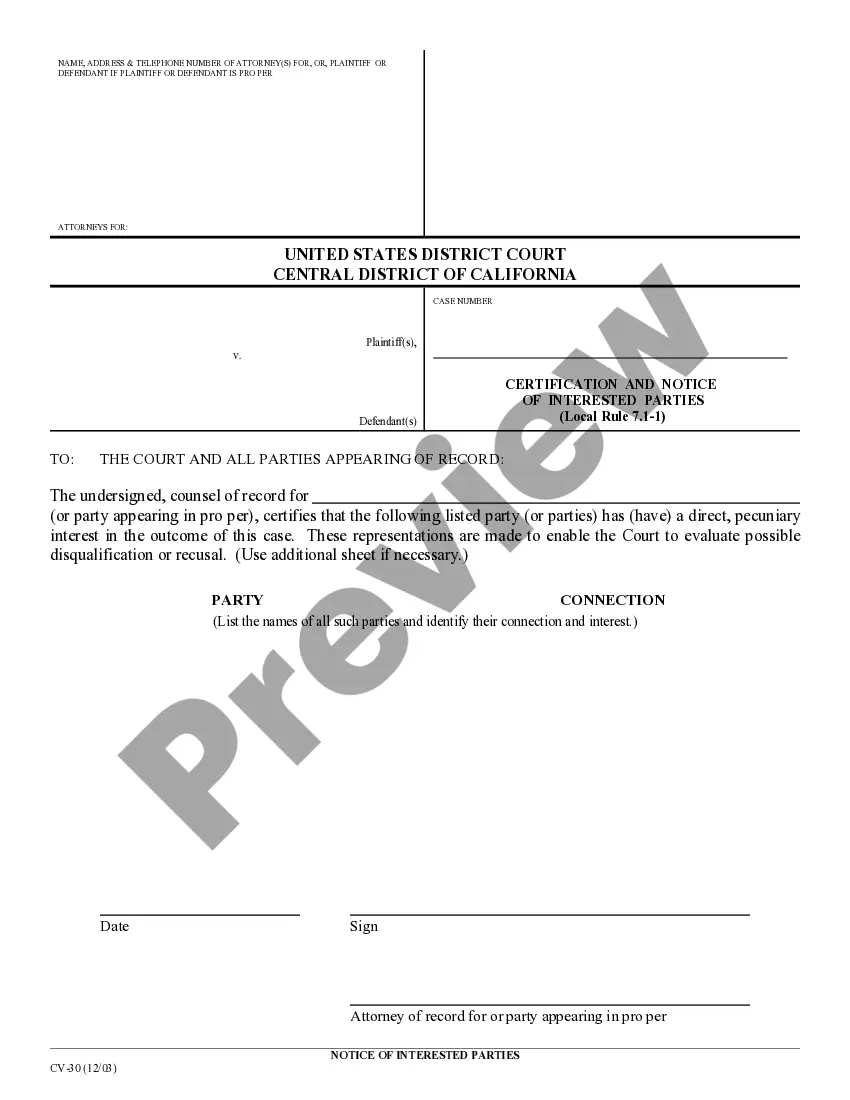

How to fill out San Diego California Buy-Sell Agreement With Life Insurance To Fund Purchase Of Deceased Partner's Interest In A Professional Partnership?

Preparing legal documentation can be cumbersome. Besides, if you decide to ask an attorney to draft a commercial contract, papers for ownership transfer, pre-marital agreement, divorce papers, or the San Diego Buy-Sell Agreement with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership, it may cost you a fortune. So what is the best way to save time and money and draw up legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a great solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any use case accumulated all in one place. Therefore, if you need the recent version of the San Diego Buy-Sell Agreement with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the San Diego Buy-Sell Agreement with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership:

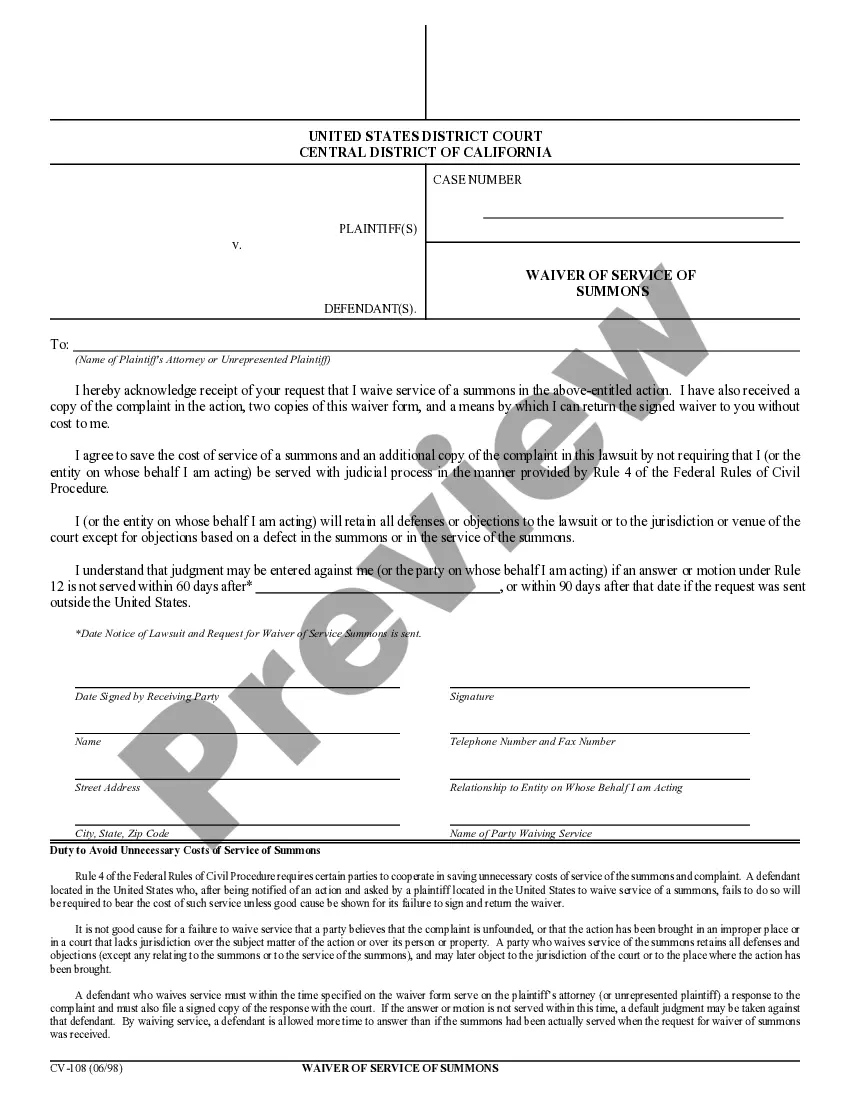

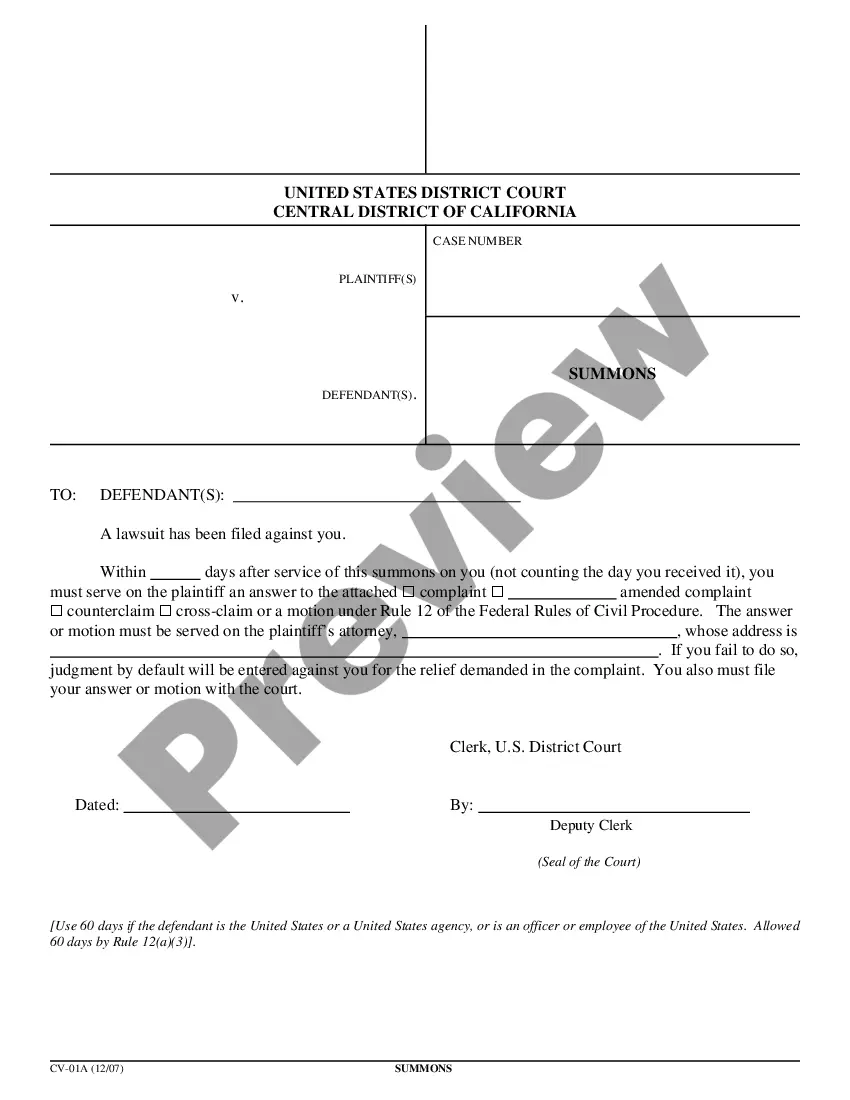

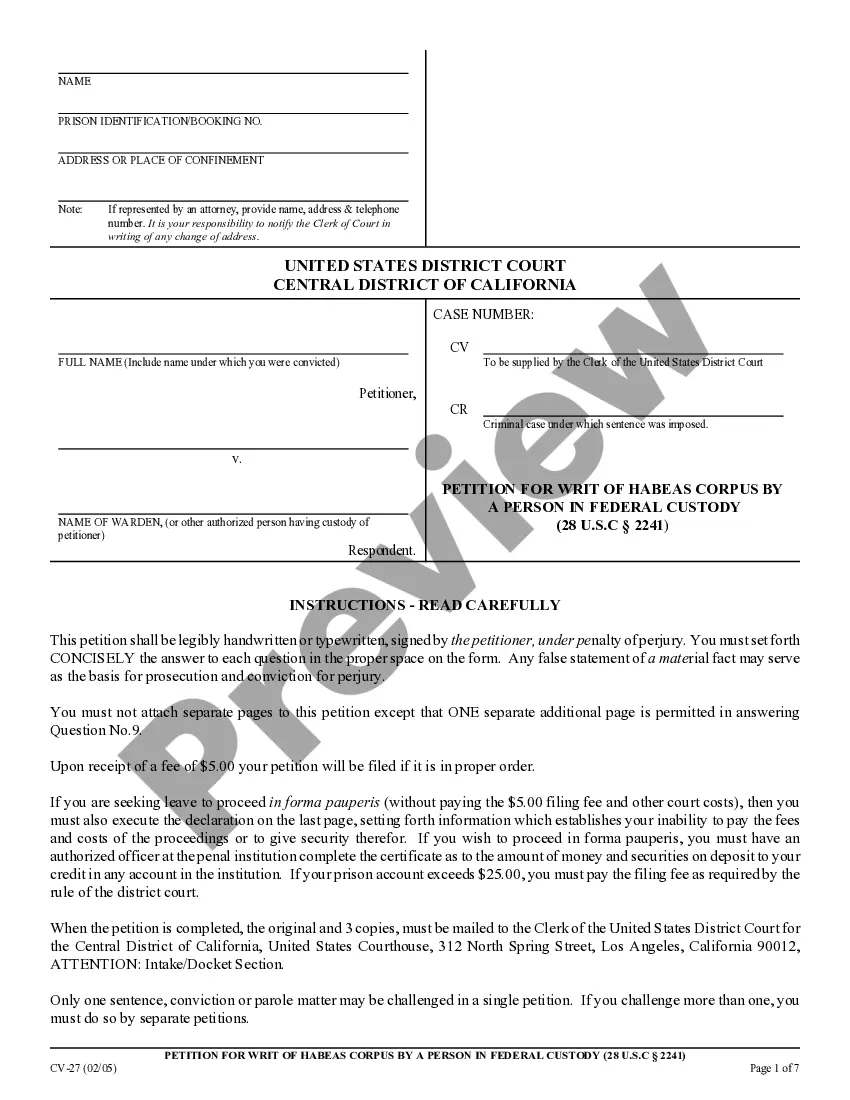

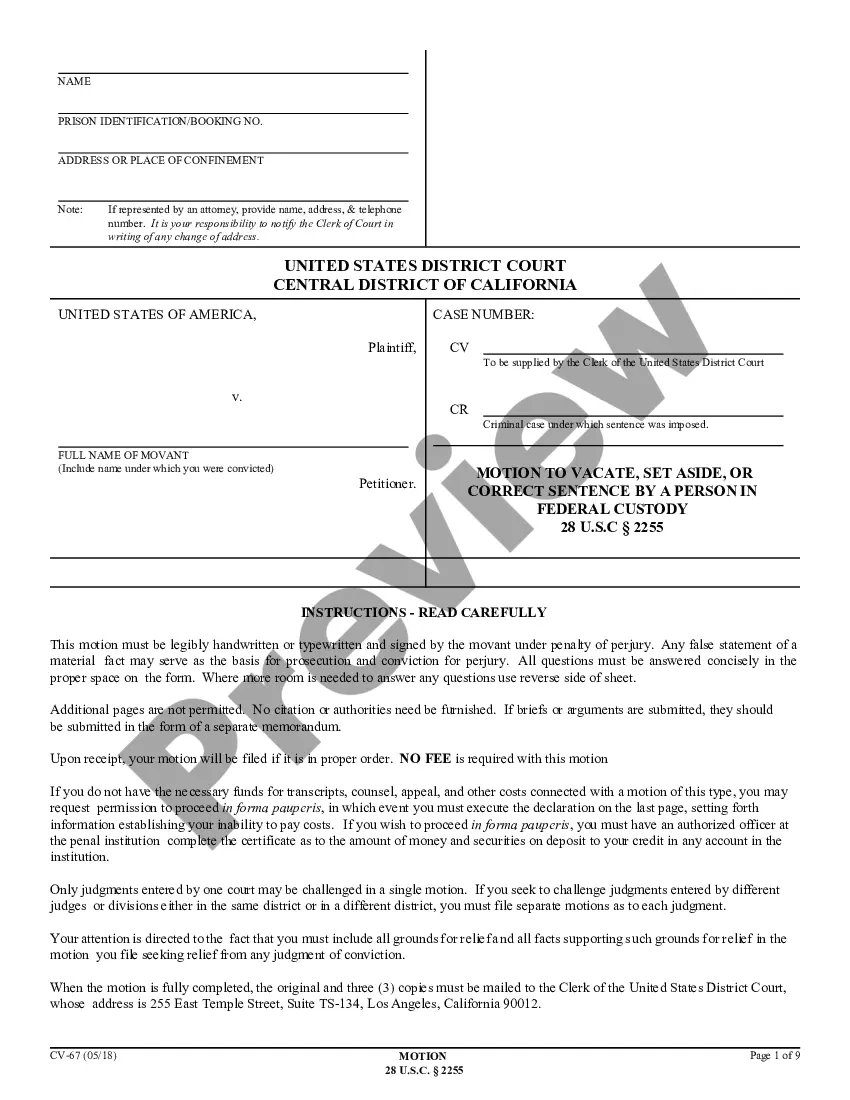

- Glance through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - look for the right one in the header.

- Click Buy Now once you find the required sample and select the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a transaction with a credit card or through PayPal.

- Choose the file format for your San Diego Buy-Sell Agreement with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership and download it.

When finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever obtained many times - you can find your templates in the My Forms tab in your profile. Give it a try now!