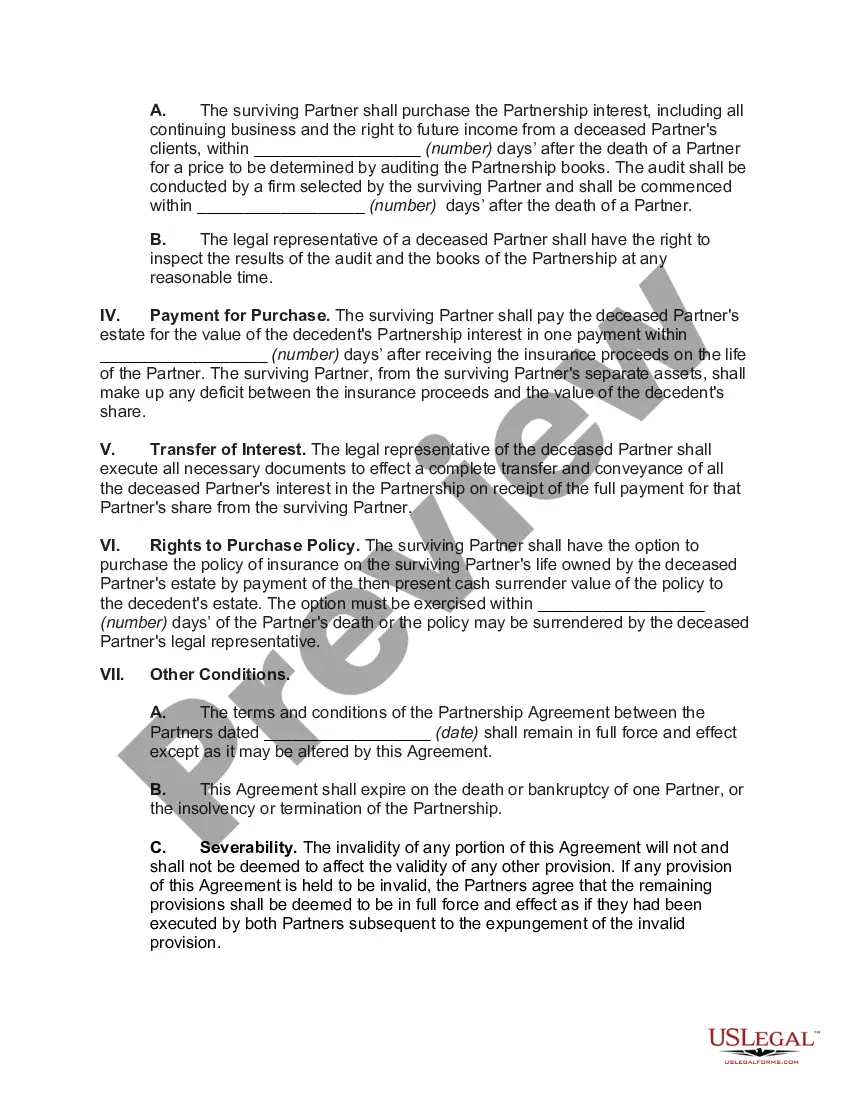

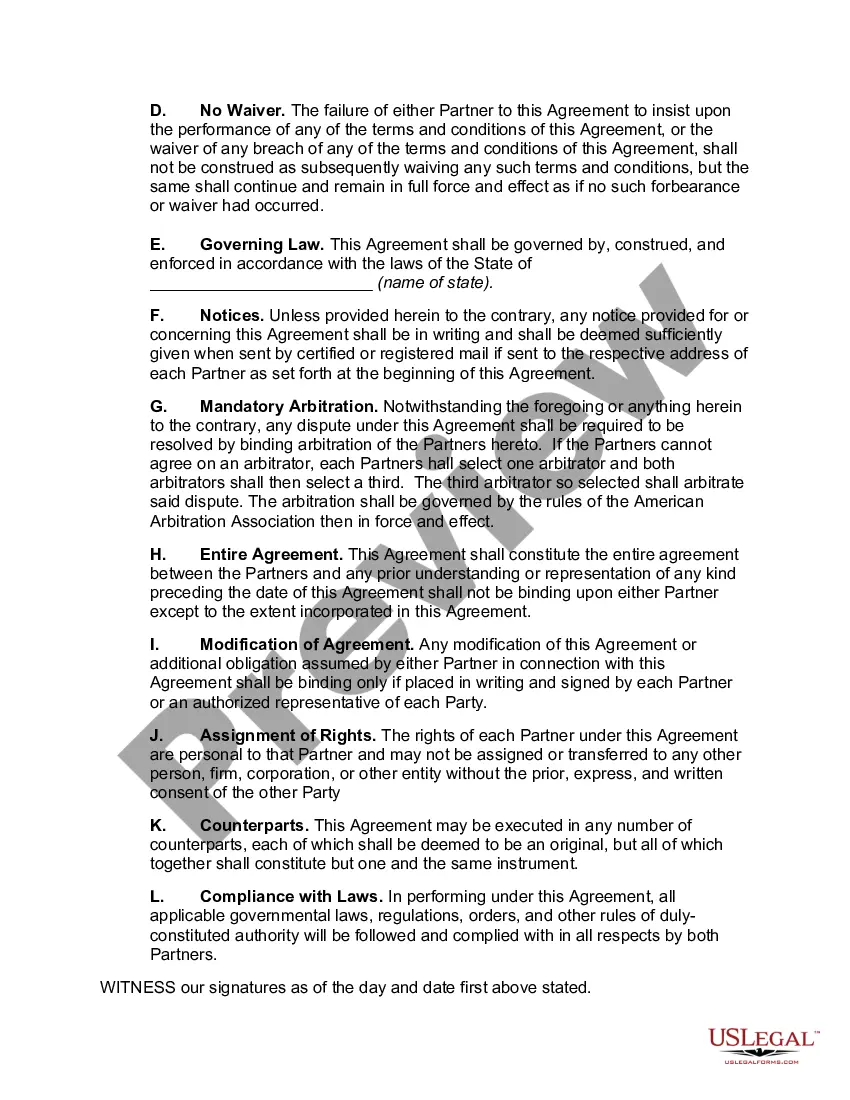

A Wake North Carolina Buy-Sell Agreement with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership is a legally binding document that outlines the terms and conditions for the buying and selling of a deceased partner's interest in a professional partnership. This agreement is crucial in ensuring the smooth transition of ownership and the continuation of the business after the unfortunate demise of a partner. In Wake North Carolina, there are several types of Buy-Sell Agreements available, each catering to the specific needs and goals of the partners involved. Some of these types include: 1. Cross-Purchase Agreement: This type of agreement allows the remaining partners to individually purchase the deceased partner's interest in the professional partnership. The life insurance policy is structured in a way that each partner holds a policy on the life of the other partners. In the event of a partner's death, the surviving partners use the insurance proceeds to buy the deceased partner's share. 2. Entity Redemption Agreement: In an Entity Redemption Agreement, the professional partnership itself agrees to purchase the deceased partner's interest. The partnership holds the life insurance policies on the lives of the partners, and upon the death of a partner, the partnership uses the insurance proceeds to buy the deceased partner's share. 3. Wait-and-See Agreement: This agreement provides flexibility in choosing between a Cross-Purchase Agreement and an Entity Redemption Agreement. The decision is made once a partner passes away, considering factors such as tax implications, financial capabilities, and other relevant circumstances. 4. Hybrid Agreement: A Hybrid Agreement combines elements of both Cross-Purchase and Entity Redemption Agreements. It allows certain partners to individually purchase the deceased partner's interest, while the remaining partners opt for the partnership to redeem the interest. The choice typically depends on the ownership interests and dynamics of the professional partnership. The primary objective of a Wake North Carolina Buy-Sell Agreement with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership is to ensure the smooth transition of ownership, provide financial security to the deceased partner's family, and maintain the continuity of the business. By utilizing life insurance proceeds, the surviving partners can fund the purchase of the deceased partner's interest without excessive financial strain or relying on external sources of funding. This agreement also offers protection to the surviving partners by preventing the interest from being sold to a third party who may not align with the partnership's goals and values. Overall, a Wake North Carolina Buy-Sell Agreement with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership provides a practical and comprehensive solution to address the potential challenges and uncertainties associated with the loss of a partner in a professional partnership. It ensures a fair and orderly transition, promotes stability within the partnership, and protects the financial well-being of all parties involved.

Wake North Carolina Buy-Sell Agreement with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership

Description

How to fill out Wake North Carolina Buy-Sell Agreement With Life Insurance To Fund Purchase Of Deceased Partner's Interest In A Professional Partnership?

Preparing documents for the business or individual needs is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's crucial to take into account all federal and state regulations of the specific region. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these details make it tense and time-consuming to draft Wake Buy-Sell Agreement with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership without professional assistance.

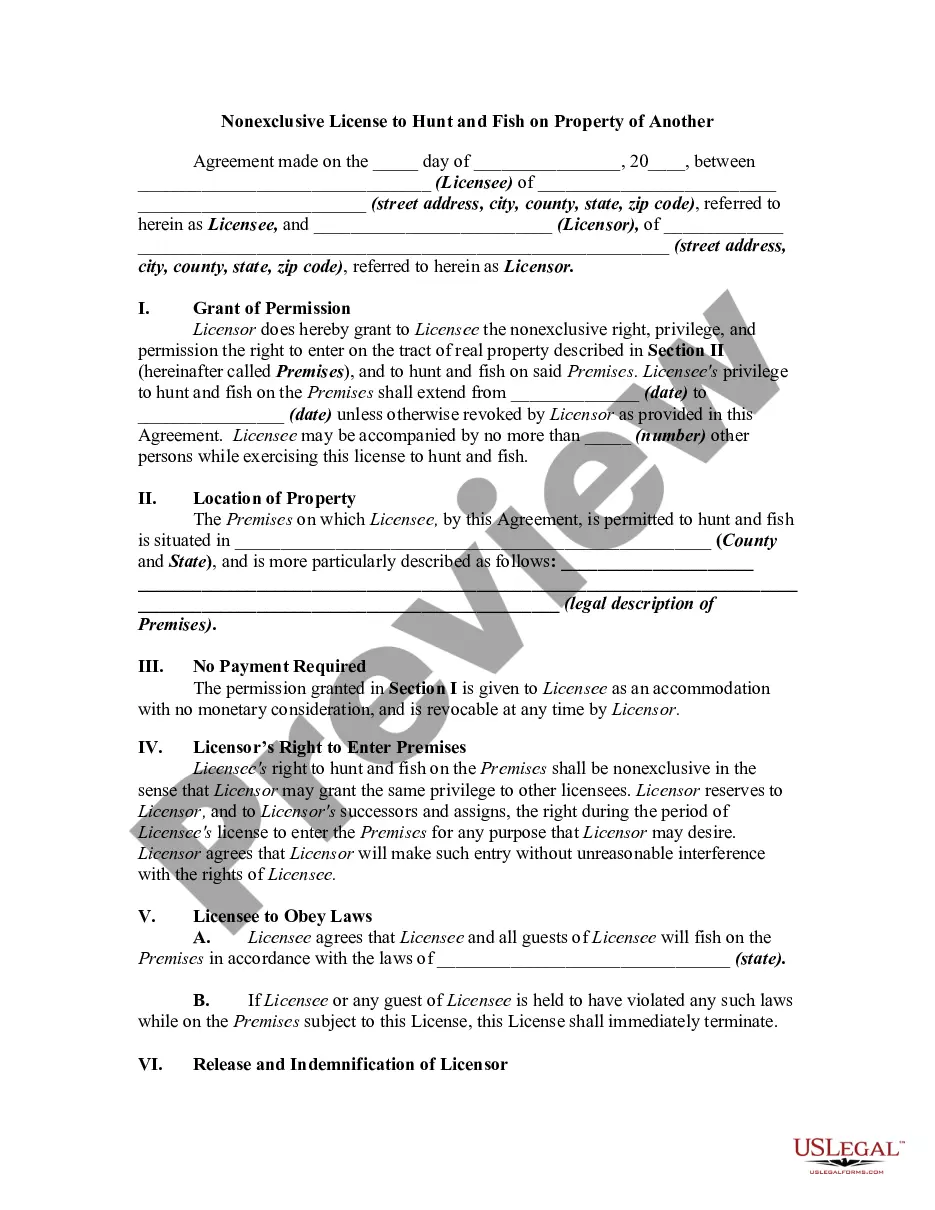

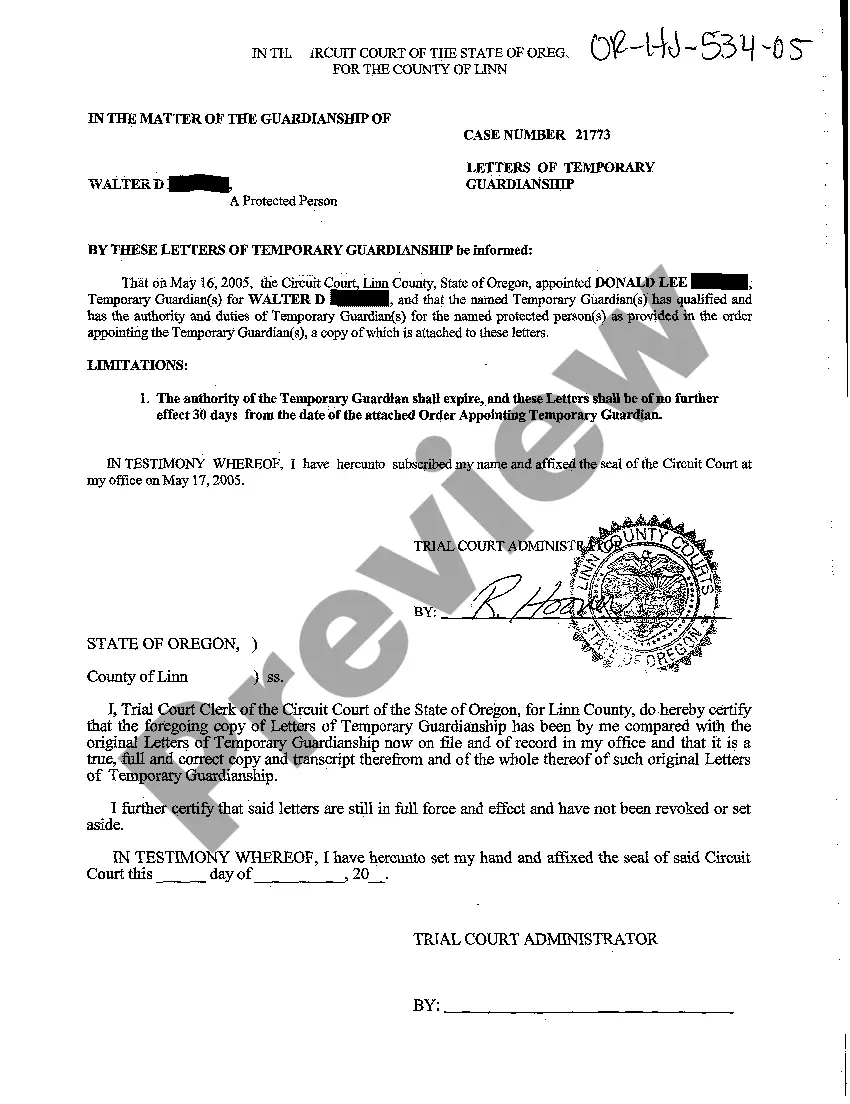

It's easy to avoid spending money on attorneys drafting your paperwork and create a legally valid Wake Buy-Sell Agreement with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership on your own, using the US Legal Forms online library. It is the largest online collection of state-specific legal templates that are professionally verified, so you can be sure of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to download the needed document.

In case you still don't have a subscription, follow the step-by-step guideline below to get the Wake Buy-Sell Agreement with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership:

- Look through the page you've opened and check if it has the sample you require.

- To do so, use the form description and preview if these options are available.

- To locate the one that satisfies your requirements, use the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal forms for any use case with just a few clicks!