Kings New York Notice of Disputed Account is a legal document used to contest or dispute a particular account or charge that appears on an individual's credit report. It is a formal way to inform the creditor or the credit reporting agency that there is a discrepancy or error regarding a specific account. The Kings New York Notice of Disputed Account serves as a means for consumers to exercise their consumer rights and protect their creditworthiness. This document follows the guidelines and provisions of the Fair Credit Reporting Act (FCRA), which ensures fair, accurate, and private credit reporting. In general, there are two main types of Kings New York Notice of Disputed Account: 1. General Dispute: This type of notice is utilized when an individual notices inaccurate or misleading information on their credit report. It can include incorrect balances, erroneous late payment records, duplicate accounts, or identity theft-related issues. By submitting a General Dispute, the consumer aims to correct any inaccuracies and restore their credit integrity. 2. Fraudulent Activity Dispute: This type of notice is employed when an individual identifies fraudulent activity or unauthorized charges on their credit report. It is crucial for individuals to act swiftly by submitting a Fraudulent Activity Dispute to protect themselves from further financial harm. The notice provides detailed information about the disputed charges, any associated supporting documentation, and requests an immediate investigation and removal of the fraudulent account. Submitting a Kings New York Notice of Disputed Account requires individuals to include essential information such as their name, contact details, the account details being disputed, a clear description of the dispute, and any supporting documents as evidence. Moreover, it is crucial to provide a concise and accurate statement explaining the reasons behind the dispute. Once the Kings New York Notice of Disputed Account is submitted, the credit reporting agency or creditor is obligated to initiate an investigation into the dispute within a specific timeframe, usually 30 days. During this investigation process, the agency or creditor must examine the evidence provided and verify the accuracy of the disputed account. Upon completing the investigation, the credit reporting agency is required to inform the individual about the outcome and any changes made to their credit report. It is important to remember that individuals have the right to dispute any inaccurate or fraudulent information that appears on their credit report. By utilizing the Kings New York Notice of Disputed Account, individuals can take control of their creditworthiness and rectify any errors or misrepresentations to safeguard their financial well-being.

Kings New York Notice of Disputed Account

Description

How to fill out Kings New York Notice Of Disputed Account?

A document routine always goes along with any legal activity you make. Opening a company, applying or accepting a job offer, transferring property, and lots of other life situations require you prepare official documentation that varies from state to state. That's why having it all accumulated in one place is so valuable.

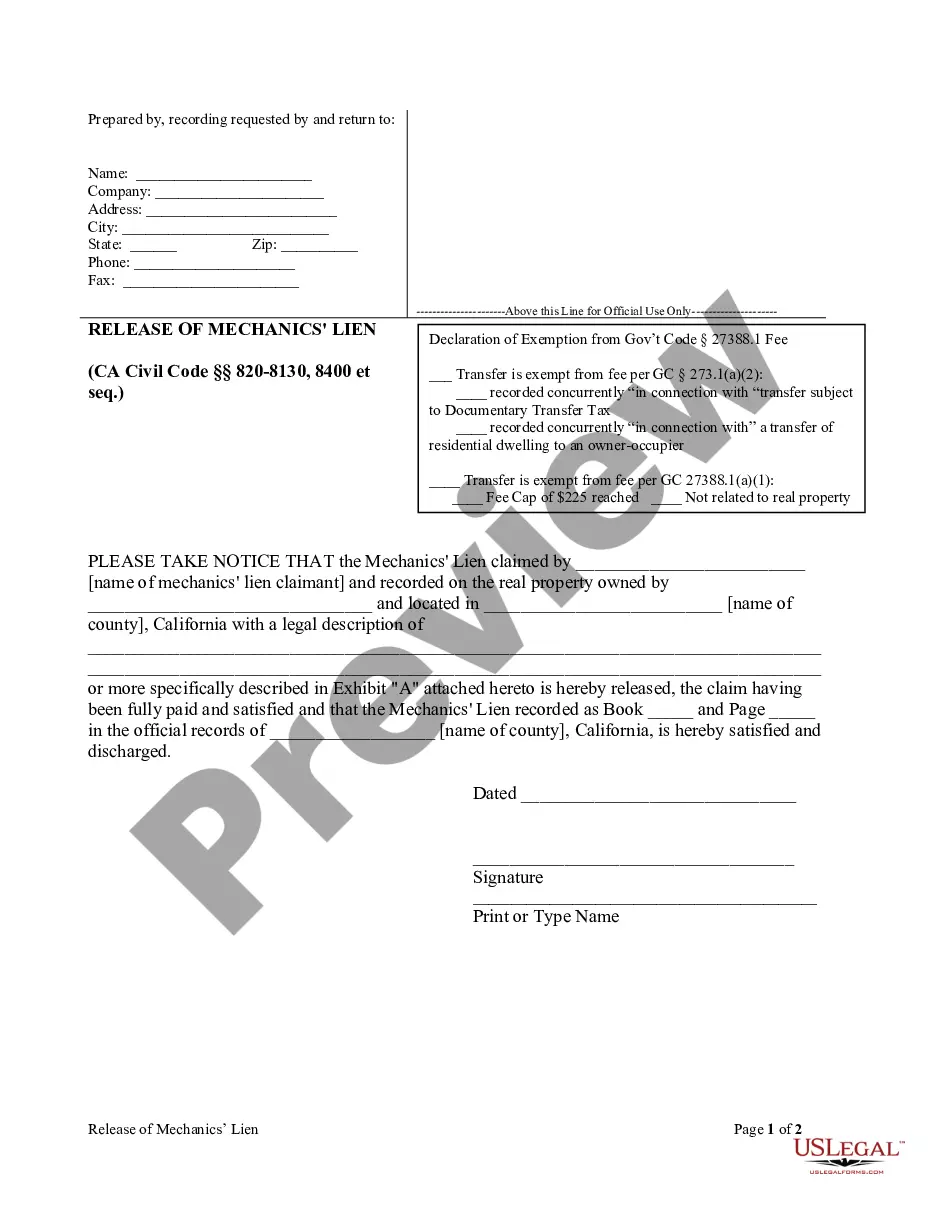

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal templates. Here, you can easily find and download a document for any individual or business purpose utilized in your region, including the Kings Notice of Disputed Account.

Locating forms on the platform is amazingly simple. If you already have a subscription to our library, log in to your account, find the sample using the search bar, and click Download to save it on your device. Afterward, the Kings Notice of Disputed Account will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this simple guideline to obtain the Kings Notice of Disputed Account:

- Make sure you have opened the correct page with your localised form.

- Use the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the template corresponds to your needs.

- Look for another document using the search option if the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Decide on the suitable subscription plan, then log in or create an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and download the Kings Notice of Disputed Account on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most reliable way to obtain legal paperwork. All the samples available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!