The Maricopa, Arizona Declaration of Gift with Signed Acceptance by Done is a legally-binding document used in Maricopa County, Arizona, to transfer ownership of a gift from the donor to the done. Gifts can encompass various types of assets, including money, property, or valuable possessions. This declaration is an essential legal instrument required when making a gift, ensuring that the transfer of ownership is formalized and recognized by the relevant authorities. There are several types of Maricopa Arizona Declaration of Gift with Signed Acceptance by Done, depending on the nature of the gift being made: 1. Monetary Gift Declaration: This type of declaration is used when the donor wishes to gift a sum of money to the done. It outlines the amount being gifted, the purpose (if any), and includes the signatures of both the donor and the done, acknowledging the transfer and acceptance of the gift. 2. Real Estate Gift Declaration: In cases where the gift is a property, land, or real estate, this type of declaration is utilized. It includes detailed information about the property being transferred, such as the address, legal description, and any specific terms or conditions associated with the gift. The declaration is completed and signed by both the donor and the done, along with any required witnesses or notary. 3. Personal Property Gift Declaration: This type of declaration is used when the gift involves movable objects such as vehicles, artwork, jewelry, or other valuable personal possessions. The declaration provides a comprehensive description of the item(s) being gifted, including any identifying features or unique characteristics. Both donor and done sign the document to authenticate the transfer. 4. Gift Declaration for Intangible Assets: In cases where the gift involves intangible assets such as stocks, bonds, intellectual property rights, or other non-physical assets, this type of declaration is used. It outlines the specific details of the intangible asset being gifted and may include supporting documentation or references to relevant legal agreements. Both parties sign the declaration to finalize the transfer. Regardless of the type of gift being made, the Maricopa Arizona Declaration of Gift with Signed Acceptance by Done serves as a crucial legal document that ensures transparency, validity, and enforceability of the gift transfer process in Maricopa County, Arizona. It provides a clear record of the donor's intent to gift, the done's acceptance, and any specific terms or conditions associated with the gift.

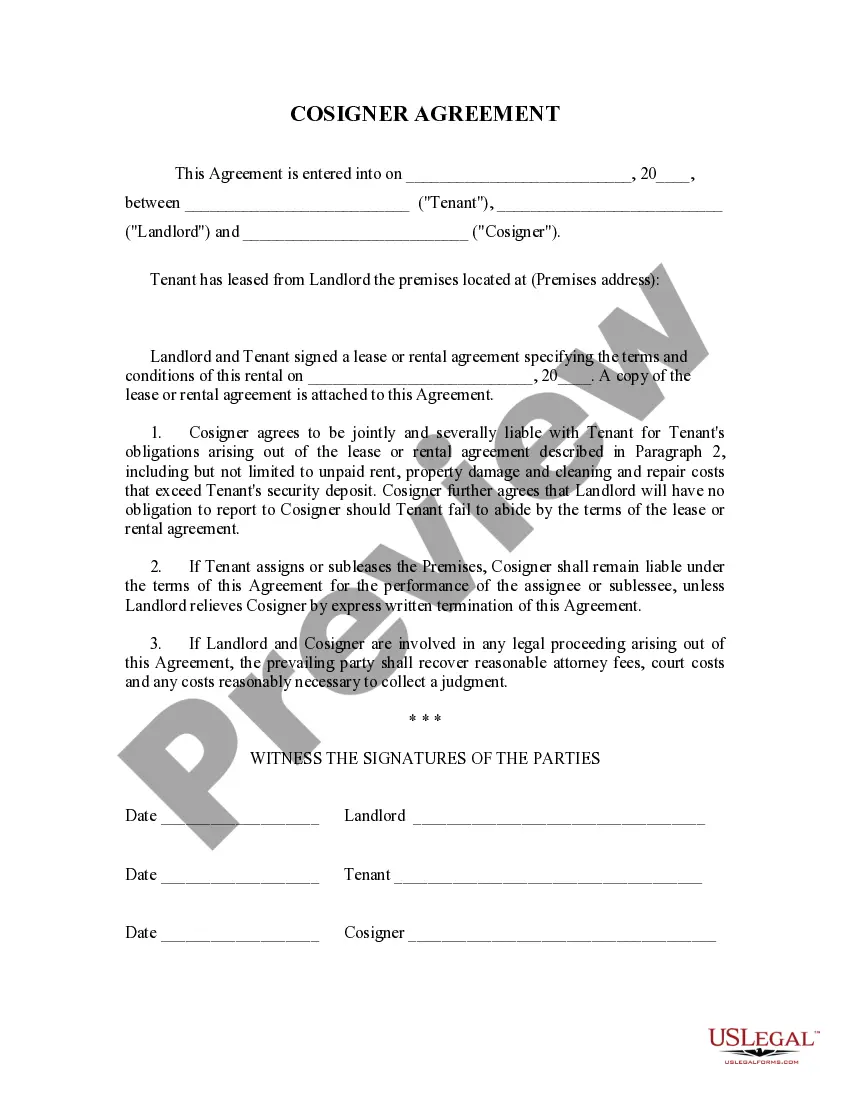

Maricopa Arizona Declaration of Gift with Signed Acceptance by Donee

Description

How to fill out Maricopa Arizona Declaration Of Gift With Signed Acceptance By Donee?

Draftwing paperwork, like Maricopa Declaration of Gift with Signed Acceptance by Donee, to manage your legal affairs is a tough and time-consumming process. A lot of situations require an attorney’s participation, which also makes this task expensive. Nevertheless, you can acquire your legal matters into your own hands and manage them yourself. US Legal Forms is here to the rescue. Our website features over 85,000 legal documents crafted for different cases and life circumstances. We make sure each document is compliant with the laws of each state, so you don’t have to be concerned about potential legal pitfalls compliance-wise.

If you're already familiar with our services and have a subscription with US, you know how easy it is to get the Maricopa Declaration of Gift with Signed Acceptance by Donee form. Go ahead and log in to your account, download the form, and customize it to your requirements. Have you lost your document? Don’t worry. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new users is just as straightforward! Here’s what you need to do before downloading Maricopa Declaration of Gift with Signed Acceptance by Donee:

- Ensure that your template is compliant with your state/county since the rules for creating legal papers may vary from one state another.

- Find out more about the form by previewing it or going through a brief description. If the Maricopa Declaration of Gift with Signed Acceptance by Donee isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Sign in or create an account to start using our service and download the document.

- Everything looks great on your side? Hit the Buy now button and choose the subscription plan.

- Select the payment gateway and type in your payment details.

- Your template is good to go. You can go ahead and download it.

It’s easy to find and purchase the needed template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our extensive collection. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!