The Salt Lake Utah Declaration of Gift with Signed Acceptance by Done is a legal document that outlines the transfer of a gift from the donor to the recipient, specifically in the Salt Lake City, Utah area. This document acts as a formal agreement between the parties involved, ensuring that the gift is properly conveyed and accepted. Keywords: Salt Lake Utah, Declaration of Gift, Signed Acceptance by Done, legal document, transfer, recipient, donor, formal agreement Types of Salt Lake Utah Declaration of Gift with Signed Acceptance by Done: 1. Personal Property Declaration of Gift with Signed Acceptance by Done: This type of declaration is used when the gift being transferred is a personal property, such as artwork, jewelry, or vehicles. It specifies the details of the property being gifted and ensures that the recipient acknowledges and accepts it. 2. Real Estate Declaration of Gift with Signed Acceptance by Done: When the gift involves the transfer of real estate property, including land or buildings, this type of declaration is used. It outlines the property's specific location, legal description, and any relevant terms and conditions of the gift, ensuring that both parties understand the implications of the transfer. 3. Financial Asset Declaration of Gift with Signed Acceptance by Done: In cases where the gift involves financial assets like stocks, bonds, or cash, this type of declaration is used. It includes details about the assets being gifted, any specific instructions or restrictions regarding their use or transfer, and the done's acceptance of the gift. 4. Charitable Donation Declaration of Gift with Signed Acceptance by Done: If the gift is intended for a charitable or nonprofit organization in Salt Lake Utah, this type of declaration is utilized. It outlines the purpose of the gift, the recipient organization's details, and any relevant tax information or legal requirements for charitable donations. Overall, the Salt Lake Utah Declaration of Gift with Signed Acceptance by Done serves as a crucial legal document to ensure a smooth and transparent transfer of gifts in various contexts, covering personal property, real estate, financial assets, and charitable donations.

Salt Lake Utah Declaration of Gift with Signed Acceptance by Donee

Description

How to fill out Salt Lake Utah Declaration Of Gift With Signed Acceptance By Donee?

Preparing papers for the business or individual demands is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's essential to take into account all federal and state regulations of the specific area. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it stressful and time-consuming to draft Salt Lake Declaration of Gift with Signed Acceptance by Donee without professional assistance.

It's easy to avoid spending money on lawyers drafting your documentation and create a legally valid Salt Lake Declaration of Gift with Signed Acceptance by Donee by yourself, using the US Legal Forms online library. It is the biggest online collection of state-specific legal documents that are professionally verified, so you can be sure of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to save the needed form.

In case you still don't have a subscription, adhere to the step-by-step guide below to get the Salt Lake Declaration of Gift with Signed Acceptance by Donee:

- Examine the page you've opened and verify if it has the document you need.

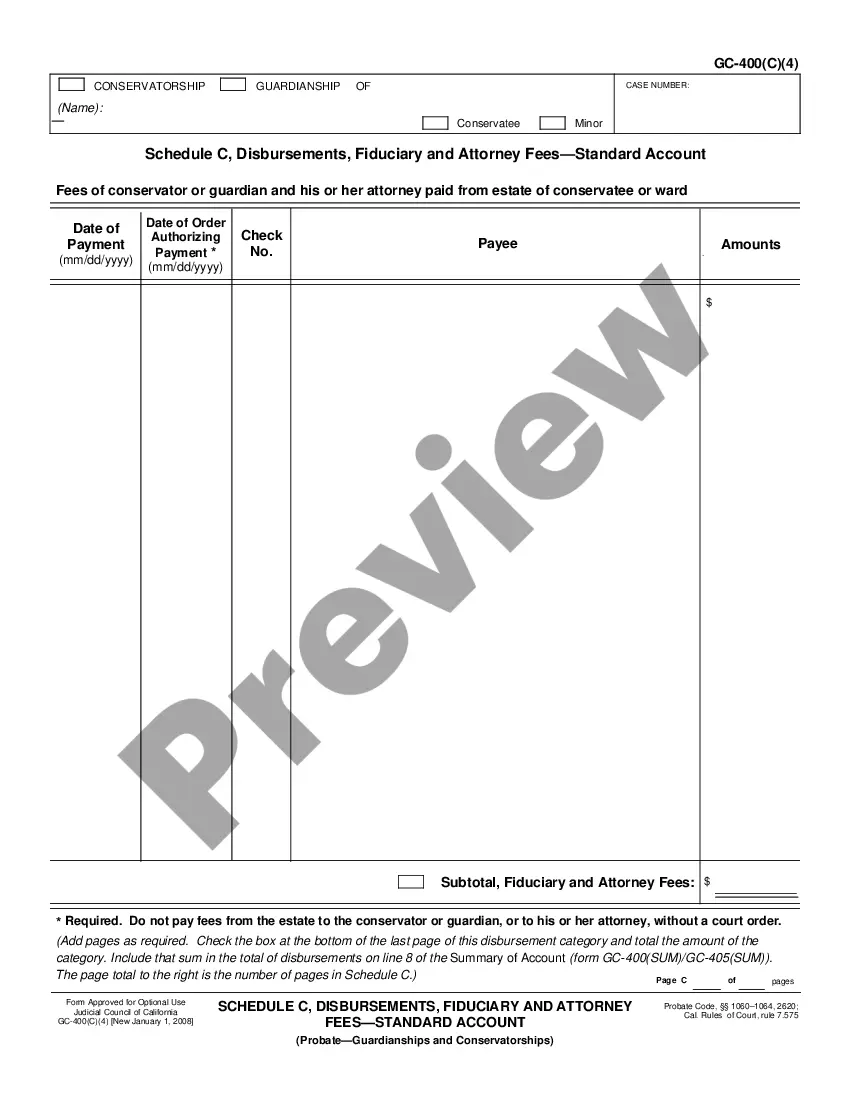

- To do so, use the form description and preview if these options are presented.

- To locate the one that fits your requirements, utilize the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Select the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal templates for any situation with just a few clicks!

Form popularity

FAQ

A donee is a person who receives an asset or assets to another person or legal entity.

A donee may also be a person who is unable to express acceptance. A gift can be made to a child and could be accepted on the child's behalf. The donee must be an ascertainable person. A gift involves the process of giving and taking which are two simultaneous and reciprocal acts.

In legal terms the person giving the gift is called the Donor and the person receiving it is called the Donee. Importantly, as the agreement does not involve a payment the signing of the contract must be witnessed and the witnesses must have no interest in the arrangement.

It is not a legally required document for the exchange of a gift, but rather is used to protect the interests of both parties when a Donor decides to gift something high in value to a Donee.

Registration of Gift Deed The donor and donee should sign on all pages of the gift deed and must be attested by at least two witnesses. The donee must accept the gift in the lifetime of the donor and when the donor is of sound mind for it to be valid.

The person who makes a gift is known as the donor. The person who receives a gift is known as the donee. There are three basic time periods during which a person can make a gift.

Photographic documentation is a good way to prove that a gift was delivered to you. If there is no evidence to prove acceptance, then a claim is much harder to prove. Write up a statement describing what occurred between you, the donee, and the person who gave you the property, the donor.

According to The Transfer of Property Act, 1882, acceptance of gift must be made by the donee during the lifetime of the donor and while the donor is still capable of giving the gift. If the donee dies before accepting the gift, then it is void.

Acceptance of a gift by the donee can be done anytime during the lifetime of the donor. . Section 123 provides that for a gift of immovable property to be valid, the transfer must be effectuated by means of a registered instrument bearing the signature of the donor and attested by at least two witnesses."