In Fairfax, Virginia, a "Gift of Stock to Spouse for Life with Remainder to Children" is a type of estate planning strategy that allows individuals to transfer ownership of stock or designated securities to their spouse during their lifetime while ensuring their children receive the remaining assets after the spouse's passing. This gift arrangement provides both current financial benefits and a future inheritance for the children. Fairfax, Virginia, Gift of Stock to Spouse for Life with Remainder to Children strategies offer several variations to fit different estate planning goals. Some different types include: 1. Irrevocable Stock Gift: This type of gift involves transferring ownership of stock to the spouse as an irrevocable transfer, meaning the donors cannot reverse or alter the terms of the gift once it is made. The recipient spouse retains ownership and receives all financial benefits of the stock during their lifetime. 2. Charitable Remainder Trust (CRT) with Stock: In this arrangement, individuals can transfer stock ownership to a CRT, benefiting their spouse for life. Upon the spouse's passing, the remaining assets in the CRT are distributed to the specified children as beneficiaries. This type of gift offers potential tax advantages and allows individuals to support charitable causes while continuing to benefit their family. 3. Qualified Terminable Interest Property Trust (TIP): A TIP trust allows individuals to provide income and financial support to their surviving spouse while specifying that the remaining assets will pass to their children after the spouse's death. This ensures the spouse's financial security while keeping the assets within the family line. 4. Granter Retained Annuity Trust (GREAT) with Stock: A GREAT allows individuals to transfer stock to an irrevocable trust while retaining an annual income stream from the assets for a specific period. After the predetermined time, the remaining assets pass to the children. This strategy can help minimize estate taxes while providing a financial benefit to the spouse during their lifetime. 5. Testamentary Trust: A testamentary trust is established through an individual's will, and it becomes effective after their passing. This type of trust can be used to specify that certain stock assets be transferred to the surviving spouse for life, with the remainder distributed to the children upon the spouse's death. Overall, Fairfax, Virginia, Gift of Stock to Spouse for Life with Remainder to Children strategies provide individuals with a flexible and customizable approach to meet their estate planning objectives. These strategies enable them to ensure their surviving spouse's financial security while guaranteeing that their children will receive their intended inheritance in the form of stock or other securities.

Fairfax Virginia Gift of Stock to Spouse for Life with Remainder to Children

Description

How to fill out Fairfax Virginia Gift Of Stock To Spouse For Life With Remainder To Children?

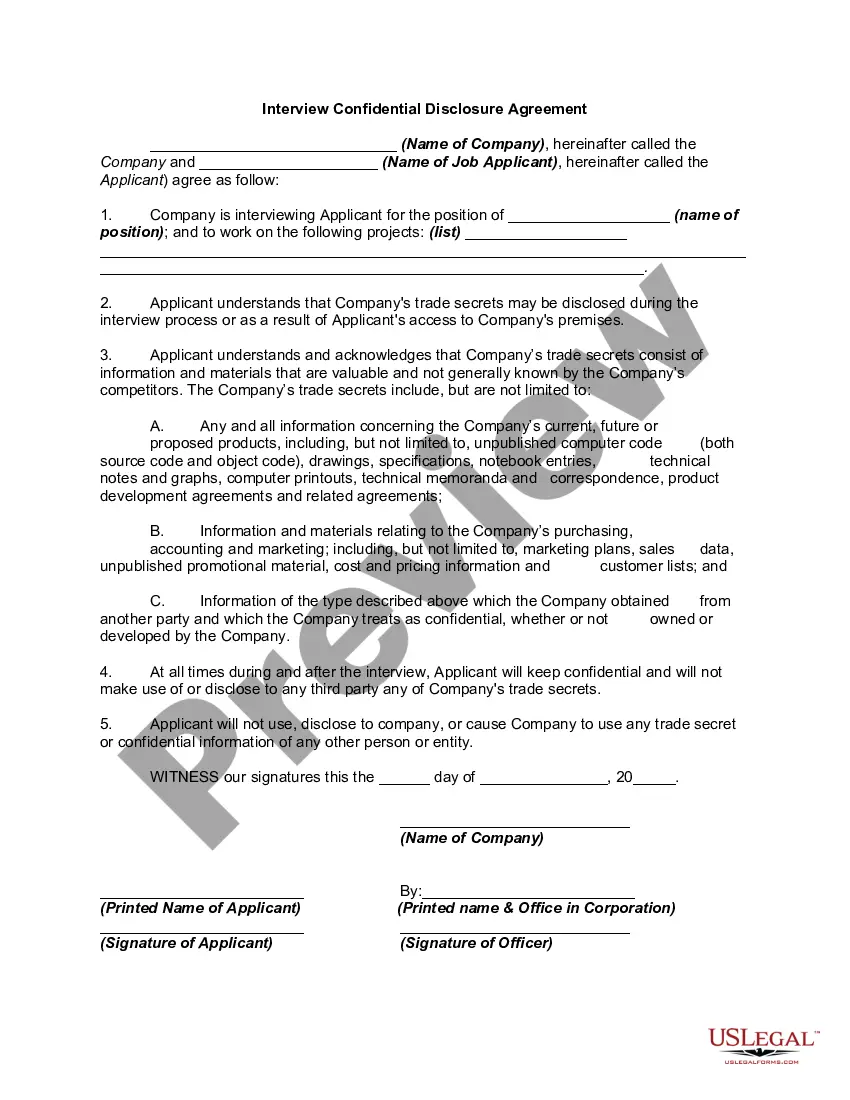

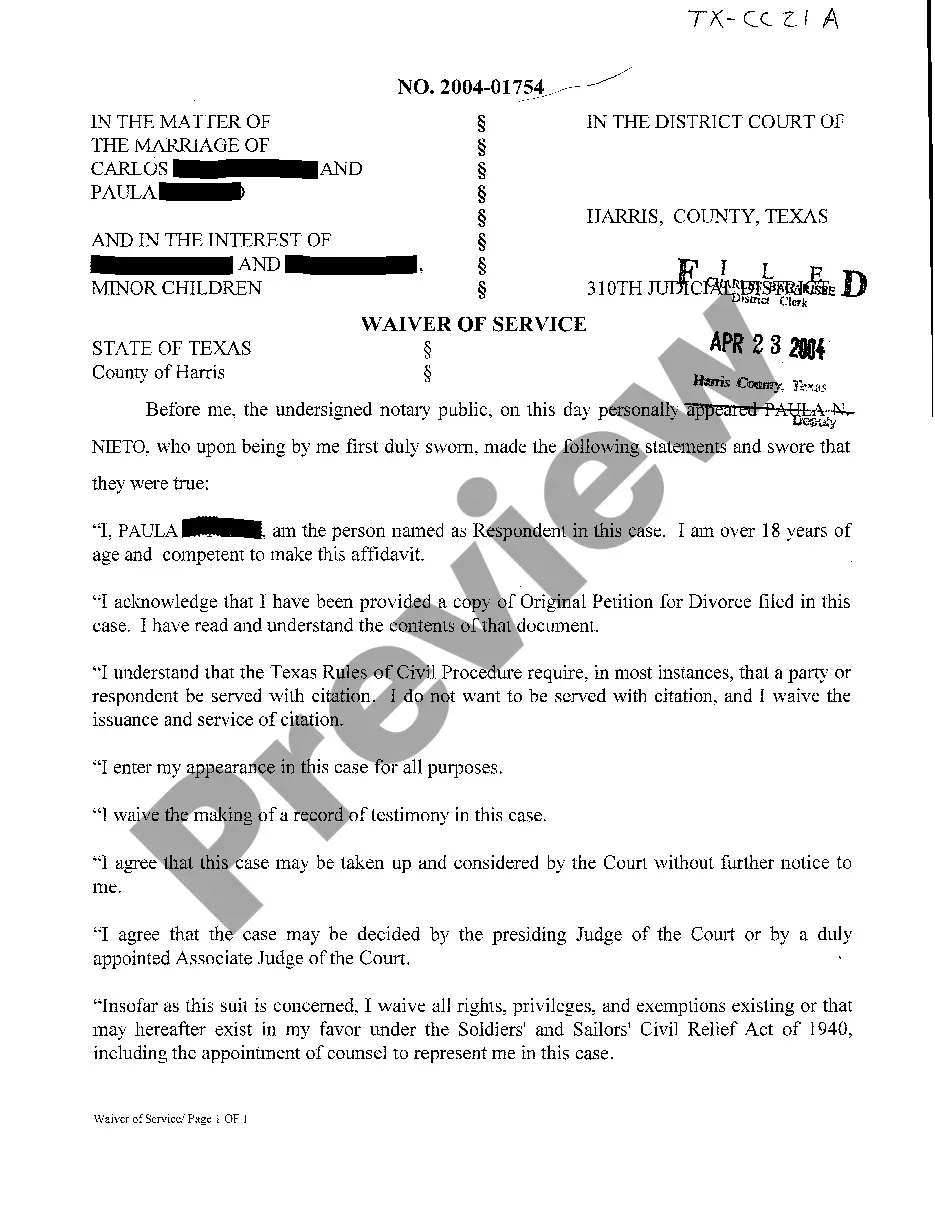

Whether you intend to open your company, enter into an agreement, apply for your ID update, or resolve family-related legal issues, you must prepare certain paperwork corresponding to your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal templates for any personal or business occurrence. All files are grouped by state and area of use, so opting for a copy like Fairfax Gift of Stock to Spouse for Life with Remainder to Children is quick and easy.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you several more steps to get the Fairfax Gift of Stock to Spouse for Life with Remainder to Children. Adhere to the guidelines below:

- Make sure the sample fulfills your personal needs and state law regulations.

- Read the form description and check the Preview if available on the page.

- Use the search tab providing your state above to locate another template.

- Click Buy Now to get the file when you find the right one.

- Opt for the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Fairfax Gift of Stock to Spouse for Life with Remainder to Children in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you can access all of your previously acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!