Orange, California is a vibrant city located in Orange County, known for its rich history, diverse community, and beautiful landscapes. When it comes to financial planning, one option that many individuals consider is a Gift of Stock to Spouse for Life with Remainder to Children. This type of gift involves transferring stock ownership to a spouse, ensuring financial security during their lifetime, and ultimately passing the remaining stock to the children upon their passing. Gifts of stock provide a unique opportunity to transfer assets while potentially minimizing tax liabilities. By gifting stock to a spouse, the owners can ensure that their partner continues to benefit from the investments during their lifetime. In Orange, California, this type of gift can be particularly beneficial due to the city's robust economy and potential for continued growth. There are different variations of the Gift of Stock to Spouse for Life with Remainder to Children, each offering distinct benefits and considerations. Some notable types include: 1. Charitable Remainder Trust (CRT): This type of gift allows individuals to place stocks into a trust, providing income to the spouse for life, and afterward, the remaining assets are distributed to chosen charities or the children. 2. Qualified Personnel Residence Trust (PRT): While not specific to stocks, this trust allows individuals to transfer their primary residence or vacation property to a spouse while retaining the right to live in the home for a specified period. Afterward, the property passes to the children. 3. Charitable Lead Trust (CLT): Although not directly related to the spouse and children, a CLT involves gifting stock to a charitable organization for a specific period. Once the period ends, the remaining stock or assets are transferred to the donor's children. The Gift of Stock to Spouse for Life with Remainder to Children is an excellent option for individuals in Orange, California, who wish to provide financial security for their loved ones while also considering charitable giving. With the city's growing economy and thriving community, this type of gift can be a smart financial decision for families looking to secure their future. Seeking professional advice from financial or estate planning experts is always recommended ensuring that this strategy aligns with individual goals and circumstances.

Orange California Gift of Stock to Spouse for Life with Remainder to Children

Description

How to fill out Orange California Gift Of Stock To Spouse For Life With Remainder To Children?

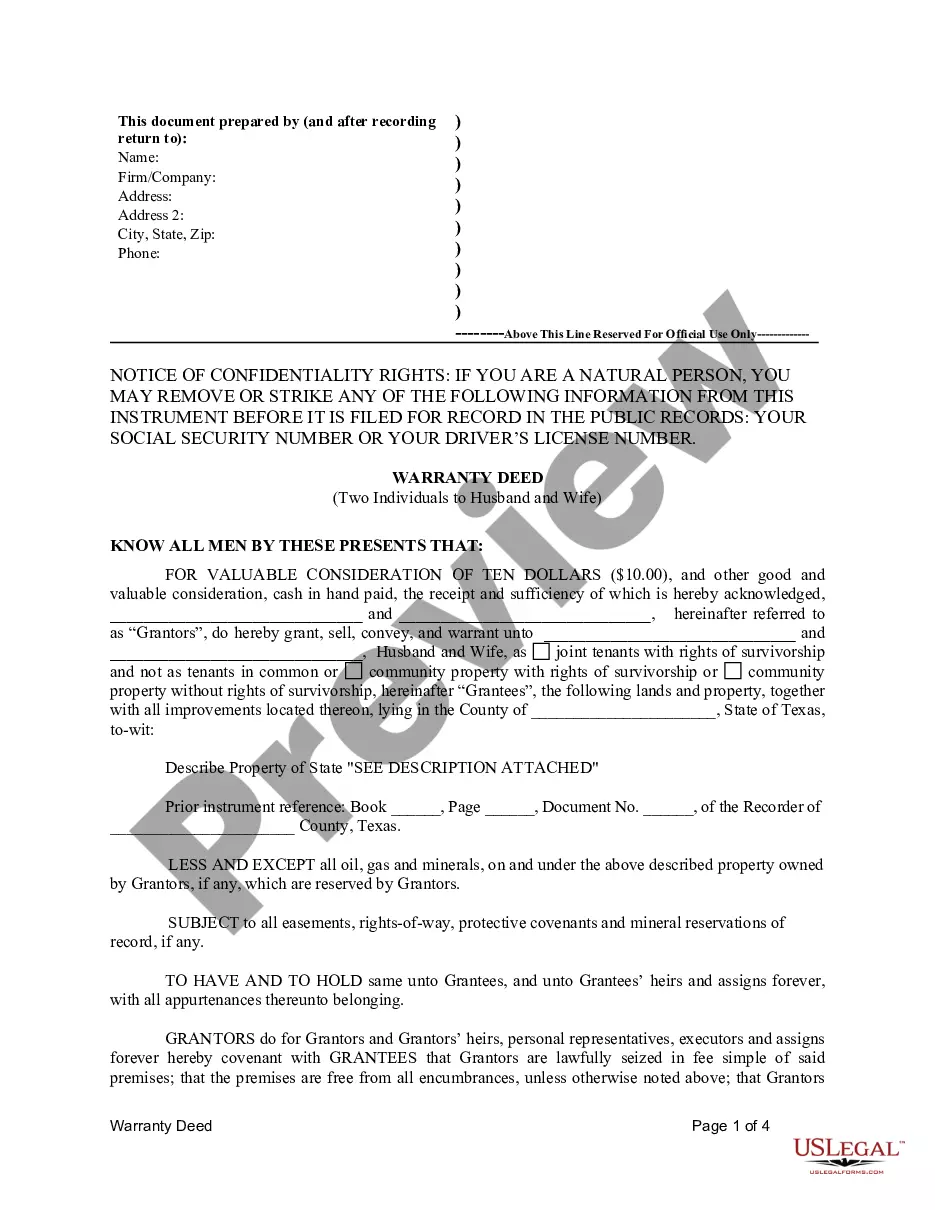

Laws and regulations in every area vary from state to state. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documents. To avoid pricey legal assistance when preparing the Orange Gift of Stock to Spouse for Life with Remainder to Children, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal templates. It's a perfect solution for specialists and individuals looking for do-it-yourself templates for various life and business occasions. All the forms can be used many times: once you pick a sample, it remains accessible in your profile for subsequent use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the Orange Gift of Stock to Spouse for Life with Remainder to Children from the My Forms tab.

For new users, it's necessary to make some more steps to get the Orange Gift of Stock to Spouse for Life with Remainder to Children:

- Take a look at the page content to make sure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to get the template once you find the right one.

- Choose one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your paperwork in order with the US Legal Forms!