San Bernardino California Gift of Stock to Spouse for Life with Remainder to Children is a type of estate planning strategy that allows individuals to transfer ownership of their stock or other investments to their spouse for their lifetime, while ensuring that the remainder of the assets will pass on to their children or other beneficiaries. This estate planning option is popular among individuals in San Bernardino California who want to provide for both their spouse's lifelong financial security and the efficient transfer of assets to their children upon the spouse's death. By gifting the stock to the spouse, the donor can ensure that their spouse receives regular income from the stock's dividends and potential growth throughout their lifetime. When setting up a San Bernardino California Gift of Stock to Spouse for Life with Remainder to Children plan, individuals can establish the terms and conditions under which the stock will be managed and distributed. These arrangements can include guidelines for the management of the stock, including the reinvestment of dividends or the ability to sell a portion of the stock to cover living expenses. While there are no specific types of San Bernardino California Gift of Stock to Spouse for Life with Remainder to Children plans, this estate planning strategy can be customized to suit the unique needs and goals of each individual or couple. Some individuals may choose to set up a Charitable Remainder Trust, which allows them to donate a portion of the stock's value to a charity while still providing for the spouse and children. Others may opt for a Qualified Personnel Residence Trust, which allows them to transfer their primary residence to their spouse for their lifetime, with the remainder interest passing to the children upon the spouse's death. This can be a beneficial option for individuals wanting to ensure their spouse's access to the family home while planning for the future inheritance of their children. Overall, a San Bernardino California Gift of Stock to Spouse for Life with Remainder to Children provides individuals with the ability to maintain financial security for their spouse while efficiently passing on assets to their children or other beneficiaries. Seeking the guidance of an experienced estate planning attorney in San Bernardino California is crucial to ensure that the plan aligns with individual goals, meets legal requirements, and optimizes tax benefits.

San Bernardino California Gift of Stock to Spouse for Life with Remainder to Children

Description

How to fill out San Bernardino California Gift Of Stock To Spouse For Life With Remainder To Children?

A document routine always goes along with any legal activity you make. Creating a business, applying or accepting a job offer, transferring property, and many other life scenarios demand you prepare formal documentation that varies throughout the country. That's why having it all collected in one place is so valuable.

US Legal Forms is the biggest online library of up-to-date federal and state-specific legal templates. On this platform, you can easily find and download a document for any individual or business purpose utilized in your region, including the San Bernardino Gift of Stock to Spouse for Life with Remainder to Children.

Locating templates on the platform is amazingly simple. If you already have a subscription to our service, log in to your account, find the sample through the search bar, and click Download to save it on your device. Following that, the San Bernardino Gift of Stock to Spouse for Life with Remainder to Children will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this simple guide to obtain the San Bernardino Gift of Stock to Spouse for Life with Remainder to Children:

- Make sure you have opened the right page with your regional form.

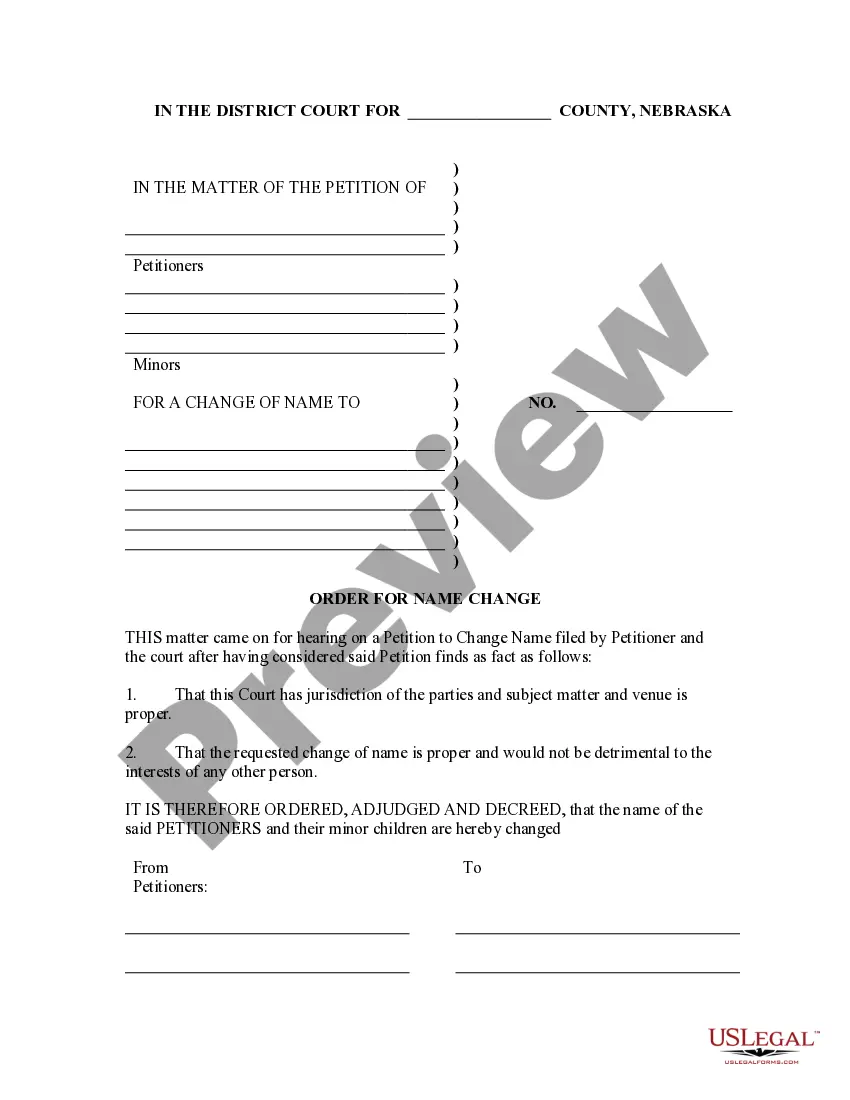

- Use the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the template corresponds to your needs.

- Search for another document via the search option if the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Select the appropriate subscription plan, then log in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and download the San Bernardino Gift of Stock to Spouse for Life with Remainder to Children on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most reliable way to obtain legal paperwork. All the templates provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs efficiently with the US Legal Forms!