Santa Clara, California is a vibrant city located in the heart of Silicon Valley. Known for its thriving technology industry, cultural diversity, and beautiful natural surroundings, Santa Clara offers a unique and desirable lifestyle. Within this context, a Santa Clara California Gift of Stock to Spouse for Life with Remainder to Children is a type of financial arrangement that allows individuals to transfer ownership of stocks to their spouse for their lifetime, with the remaining shares going to their children upon their spouse's death. The primary purpose of a Santa Clara California Gift of Stock to Spouse for Life with Remainder to Children is to ensure the financial security of both the spouse and the children. By gifting stocks, the individual can provide their spouse with a continuous income stream derived from dividends and any potential capital gains generated by the stock portfolio. This arrangement allows the surviving spouse to benefit from the stocks while maintaining control of the invested assets. The Santa Clara California Gift of Stock to Spouse for Life with Remainder to Children also serves as an estate planning tool. By designating the children as the ultimate beneficiaries upon the spouse's passing, the individual can ensure the transfer of wealth within the family and minimize potential estate taxes. This strategy provides an efficient way to pass on assets, enabling the next generation to benefit from the financial stability and potential growth of the gifted stocks. It is important to note that there are variations of the Santa Clara California Gift of Stock to Spouse for Life with Remainder to Children, which include specific conditions and provisions. For example, some arrangements may only transfer a portion of the stock portfolio to the surviving spouse, while others may stipulate that the children only receive the stocks after reaching a certain age or achieving certain milestones. Overall, a Santa Clara California Gift of Stock to Spouse for Life with Remainder to Children is an effective means of ensuring financial security and wealth transfer within a family. This arrangement leverages the potential growth of stocks while balancing the immediate needs of the surviving spouse. With proper estate planning, this gift can provide peace of mind for individuals looking to secure the financial future of their loved ones in Santa Clara, California.

Santa Clara California Gift of Stock to Spouse for Life with Remainder to Children

Description

How to fill out Santa Clara California Gift Of Stock To Spouse For Life With Remainder To Children?

Creating legal forms is a must in today's world. Nevertheless, you don't always need to look for professional help to create some of them from scratch, including Santa Clara Gift of Stock to Spouse for Life with Remainder to Children, with a service like US Legal Forms.

US Legal Forms has over 85,000 templates to pick from in different categories ranging from living wills to real estate papers to divorce documents. All forms are arranged based on their valid state, making the searching process less frustrating. You can also find information resources and guides on the website to make any activities associated with paperwork execution simple.

Here's how you can purchase and download Santa Clara Gift of Stock to Spouse for Life with Remainder to Children.

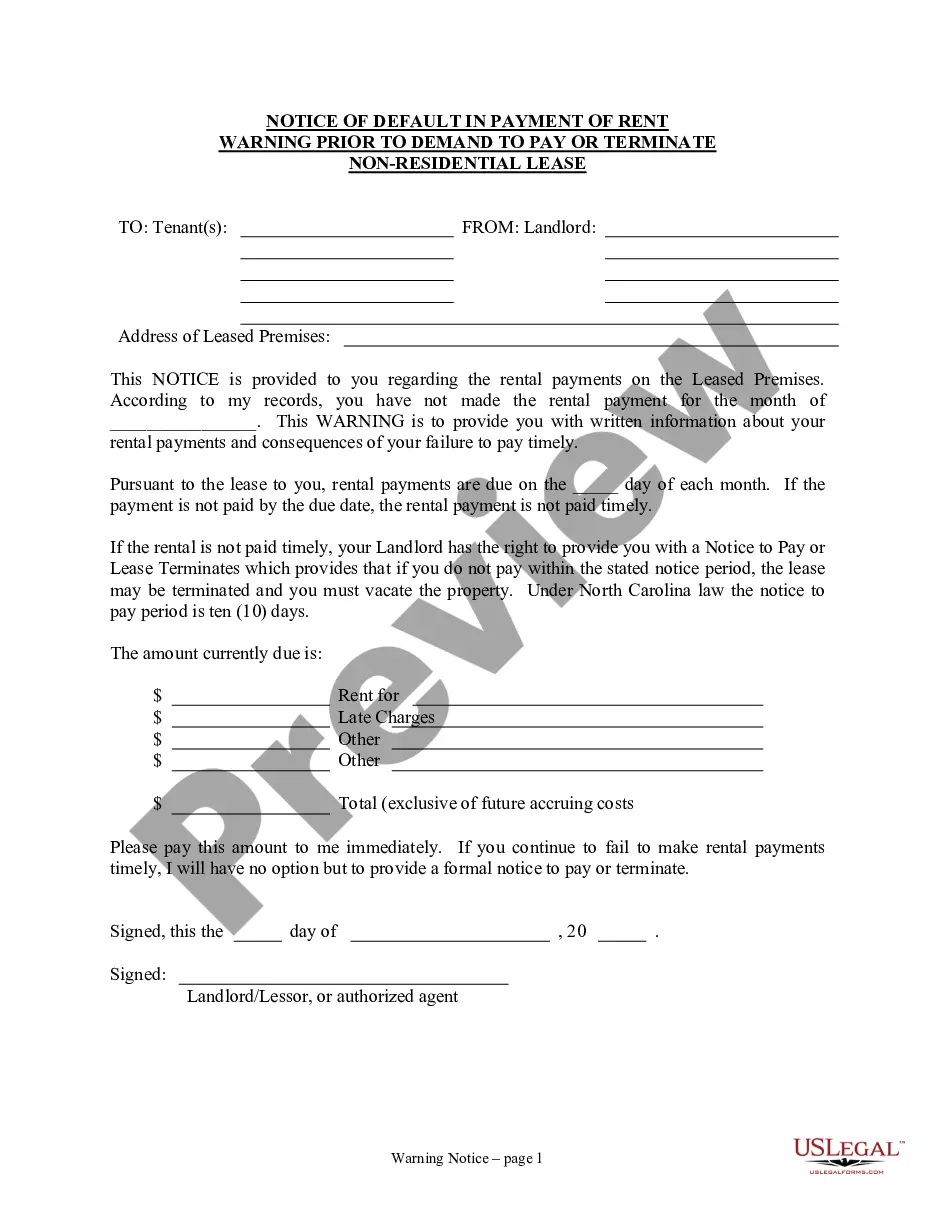

- Go over the document's preview and outline (if available) to get a basic idea of what you’ll get after downloading the document.

- Ensure that the document of your choice is specific to your state/county/area since state regulations can impact the legality of some documents.

- Check the similar forms or start the search over to find the right file.

- Click Buy now and create your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a suitable payment gateway, and buy Santa Clara Gift of Stock to Spouse for Life with Remainder to Children.

- Select to save the form template in any available format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Santa Clara Gift of Stock to Spouse for Life with Remainder to Children, log in to your account, and download it. Of course, our platform can’t take the place of a legal professional completely. If you have to cope with an extremely difficult situation, we recommend getting an attorney to review your document before executing and filing it.

With over 25 years on the market, US Legal Forms proved to be a go-to platform for many different legal forms for millions of customers. Join them today and purchase your state-specific documents with ease!