Dallas Texas Conflict of Interest Disclosure for a Member of the Board of Directors of a Corporation is a formal document that outlines the requirements and expectations for board members to disclose any potential conflicts of interest that may arise while serving on the board. It ensures transparency, fairness, and ethical decision-making within the corporation. The Conflict of Interest Disclosure for a Member of the Board of Directors in Dallas, Texas, is a critical part of corporate governance. It safeguards the corporation's reputation and integrity by preventing any conflicts of interest that may compromise the board's ability to act in the best interest of the company and its stakeholders. Types of Dallas Texas Conflict of Interest Disclosure include: 1. Financial Conflicts of Interest: This type of disclosure involves the board member revealing any financial interests, relationships, or investments that may influence their decision-making, such as ownership of stock in a competitor or a financial relationship with a supplier or customer of the corporation. 2. Business Conflicts of Interest: Board members must disclose any personal business interests that may conflict with the corporation's operations, partnerships, or contracts. This may include involvement in a competing business or a position in a company doing business with or in direct competition with the corporation. 3. Personal Conflicts of Interest: This type of disclosure entails revealing personal relationships or interests that may interfere with the board member's objective decision-making. For example, disclosing a family member who is employed by a potential supplier or disclosing any affiliations with organizations that may influence the corporation's interests. 4. Employment Conflicts of Interest: Board members should disclose any current or anticipated employment or consulting engagements that may affect their ability to act impartially. This includes disclosing directorships, executive positions, or advisory roles with organizations that have a business relationship with the corporation or may compete directly with it. 5. Non-Financial Conflicts of Interest: Some conflicts of interest may not be financial in nature but can still present challenges. These can include personal biases, political affiliations, or involvement in nonprofit organizations that may impact the board member's decision-making. It is crucial for board members to complete the Conflict of Interest Disclosure accurately and in a timely manner, typically annually or whenever a potential conflict arises. Failure to disclose conflicts of interest may result in legal repercussions or damage to the corporation's reputation. Transparency and full disclosure are key elements in maintaining the corporation's ethical standards and promoting trust among shareholders, employees, and other stakeholders.

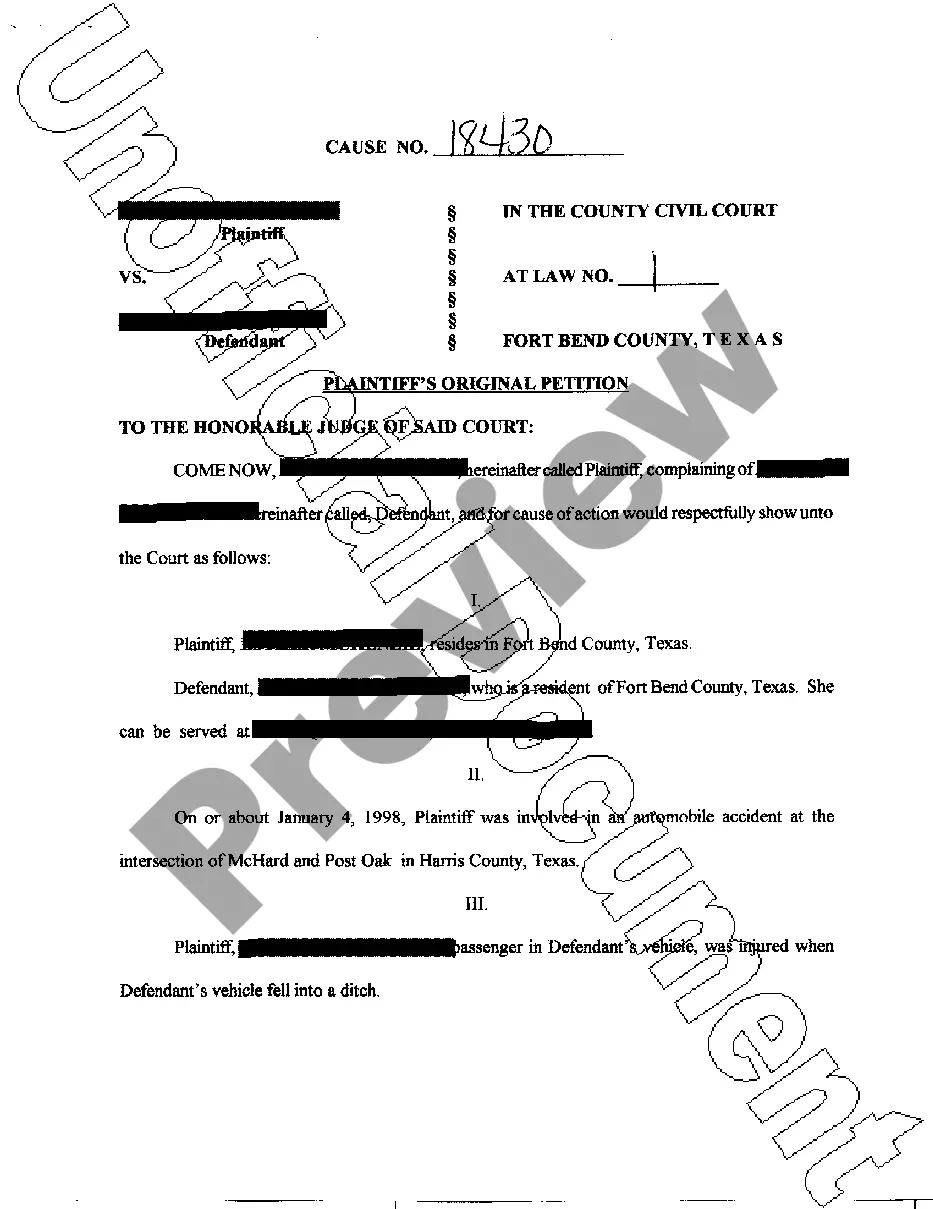

Dallas Texas Conflict of Interest Disclosure for Member of Board of Directors of Corporation

Description

How to fill out Dallas Texas Conflict Of Interest Disclosure For Member Of Board Of Directors Of Corporation?

Do you need to quickly draft a legally-binding Dallas Conflict of Interest Disclosure for Member of Board of Directors of Corporation or probably any other document to manage your personal or corporate affairs? You can select one of the two options: hire a professional to draft a valid paper for you or create it entirely on your own. Thankfully, there's an alternative solution - US Legal Forms. It will help you receive neatly written legal paperwork without having to pay sky-high fees for legal services.

US Legal Forms offers a rich collection of over 85,000 state-specific document templates, including Dallas Conflict of Interest Disclosure for Member of Board of Directors of Corporation and form packages. We offer documents for a myriad of life circumstances: from divorce paperwork to real estate documents. We've been on the market for over 25 years and gained a rock-solid reputation among our clients. Here's how you can become one of them and obtain the necessary document without extra troubles.

- First and foremost, carefully verify if the Dallas Conflict of Interest Disclosure for Member of Board of Directors of Corporation is tailored to your state's or county's regulations.

- If the document has a desciption, make sure to check what it's intended for.

- Start the searching process over if the document isn’t what you were seeking by utilizing the search bar in the header.

- Choose the plan that best fits your needs and proceed to the payment.

- Select the format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, locate the Dallas Conflict of Interest Disclosure for Member of Board of Directors of Corporation template, and download it. To re-download the form, simply head to the My Forms tab.

It's easy to buy and download legal forms if you use our catalog. Moreover, the templates we provide are updated by law professionals, which gives you greater peace of mind when writing legal matters. Try US Legal Forms now and see for yourself!