Travis Texas Indemnification of Corporate Director refers to the legal provisions or policies that protect corporate directors from liabilities arising from their actions or decisions while serving on the board. This form of indemnification is designed to safeguard directors against potential financial risks and provide them with financial support in case they face legal disputes, claims, or lawsuits due to their corporate duties. Travis Texas, being a state in the United States, has its specific legislation governing the indemnification of corporate directors. Under these laws, directors may be entitled to indemnification for expenses incurred during legal proceedings, such as attorney fees, court costs, settlement payments, or judgments. The indemnification can apply both during their tenure on the board and even after they have left their position as a director. There are primarily two main types of Travis Texas Indemnification of Corporate Director: 1. Mandatory Indemnification: The mandatory indemnification provision is usually included in a company's bylaws or articles of incorporation. It ensures that directors are entitled to indemnification as long as they meet certain criteria, such as acting in good faith, diligently fulfilling their duties, and avoiding actions that are knowingly unlawful. This provision provides a sense of assurance to directors, encouraging them to make decisions in the best interest of the company without fear of personal financial consequences. 2. Permissive Indemnification: The permissive indemnification provision allows a company, at its discretion, to indemnify directors for liabilities incurred while performing their corporate duties. Unlike mandatory indemnification, this provision grants more flexibility to the company's board or shareholders to decide whether indemnification is appropriate in a particular situation. The decision is typically made based on factors such as the director's conduct, the merits of the case, and whether the actions were taken in good faith and believed to be in the best interest of the company. The Travis Texas Indemnification of Corporate Director aims to attract competent individuals to serve on corporate boards by mitigating the potential risks associated with directorial roles. It ensures that directors are protected from personal financial losses, allowing them to make informed and independent decisions without undue pressure. It is crucial for companies to clearly outline their indemnification policies and procedures to provide directors with a comprehensive understanding of their rights, liabilities, and the steps they can take to seek indemnification when necessary. Keywords: Travis Texas, indemnification, corporate director, liabilities, legal provisions, policies, financial risks, legal disputes, claims, lawsuits, tenure, mandatory indemnification, permissive indemnification, bylaws, articles of incorporation, good faith, personal financial consequences, assurance, company board, shareholders, competent individuals, mitigating risks, informed decisions, independent decisions, indemnification policies, procedures, seek indemnification.

Travis Texas Indemnification of Corporate Director

Description

How to fill out Travis Texas Indemnification Of Corporate Director?

Whether you plan to start your company, enter into an agreement, apply for your ID renewal, or resolve family-related legal issues, you need to prepare specific documentation corresponding to your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and checked legal documents for any personal or business case. All files are collected by state and area of use, so picking a copy like Travis Indemnification of Corporate Director is fast and simple.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a few more steps to get the Travis Indemnification of Corporate Director. Follow the guide below:

- Make certain the sample meets your individual needs and state law regulations.

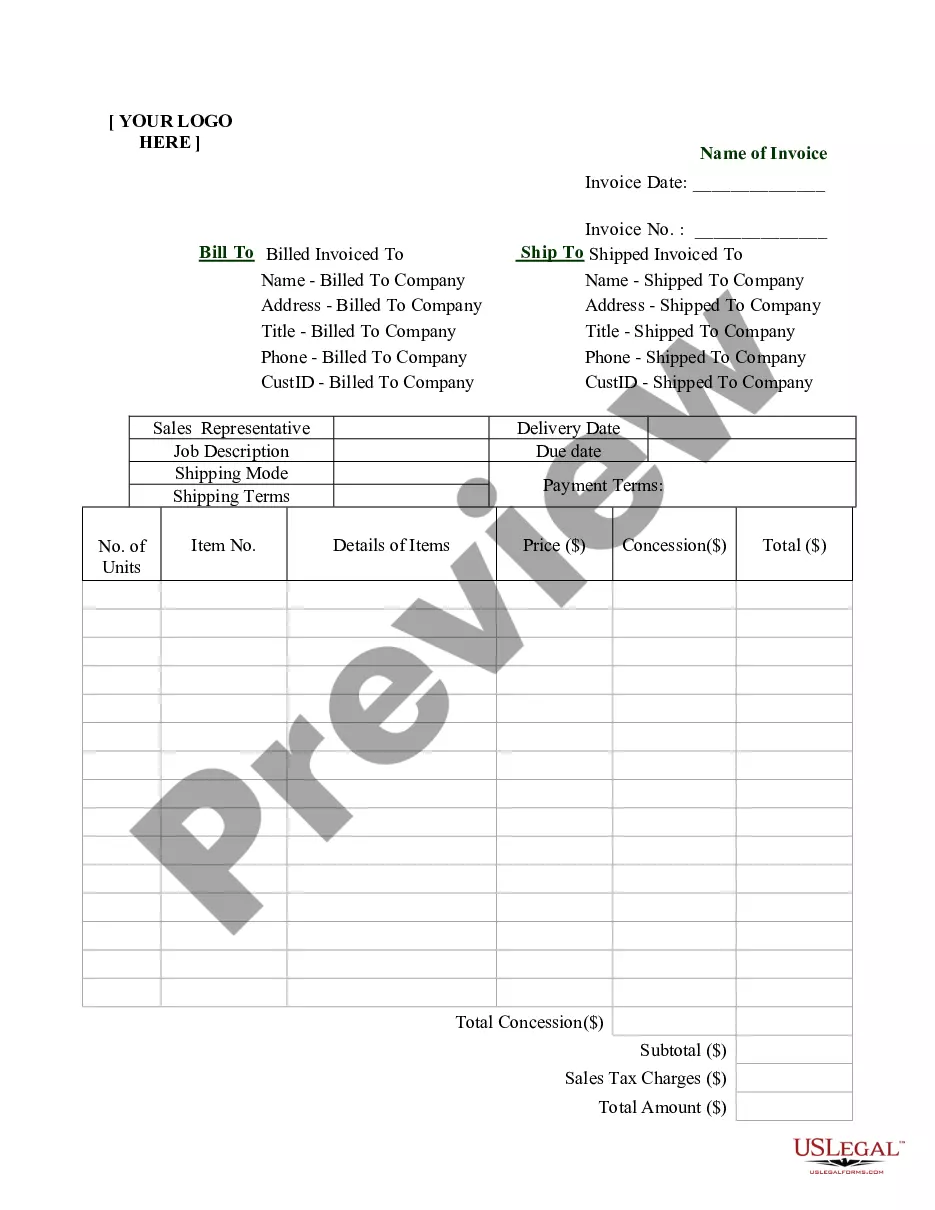

- Look through the form description and check the Preview if available on the page.

- Use the search tab specifying your state above to locate another template.

- Click Buy Now to get the sample when you find the proper one.

- Select the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Travis Indemnification of Corporate Director in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you are able to access all of your earlier acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!