Maricopa, Arizona is a vibrant city located in the heart of the Sonoran Desert. Known for its stunning natural beauty, rich history, and thriving economy, Maricopa offers a plethora of opportunities for independent contractors looking to work as consultants in various fields. A Maricopa Arizona contract with an independent contractor to work as a consultant is a legally binding agreement that outlines the terms and conditions of the professional relationship between the contractor and the client. This type of contract provides clarity and protection for both parties involved, ensuring a seamless collaboration and successful project completion. In Maricopa, there are different types of contracts with independent contractors to work as consultants, tailored to meet specific industry requirements and project scopes. Here are a few notable ones: 1. IT Consulting Contract: This type of contract is designed for independent contractors specializing in information technology. It encompasses services such as software development, network administration, cybersecurity, and database management. The contract outlines the project scope, deliverables, payment terms, intellectual property rights, and any applicable non-disclosure agreements. 2. Marketing Consulting Contract: Maricopa businesses often seek the expertise of marketing consultants to develop effective strategies, conduct market research, and enhance their branding efforts. This type of contract defines the services to be rendered, marketing deliverables, timeline, compensation structure, and may also include provisions for social media management or content creation. 3. Financial Consulting Contract: Independent contractors specializing in finance and accounting can enter into contracts to provide consulting services to Maricopa-based businesses. These contracts typically specify the scope of financial analysis, budgeting assistance, tax planning, and other relevant services. Terms related to client information confidentiality and conflict of interest may be addressed as well. 4. HR Consulting Contract: Human resource consultants play a crucial role in supporting businesses with their talent acquisition, employee training, and compliance related concerns. A Maricopa HR consulting contract would encompass the specific scope of services, expectations for employee performance evaluations, policy development, employee dispute resolution, and confidentiality provisions. No matter the type of Maricopa Arizona contract with an independent contractor to work as a consultant, it is essential for both parties to carefully review, negotiate, and fully understand the terms outlined within the agreement. Engaging in transparent communication and ensuring legal compliance will set the framework for a successful and mutually beneficial professional relationship.

Maricopa Arizona Contract with Independent Contractor to Work as a Consultant

Description

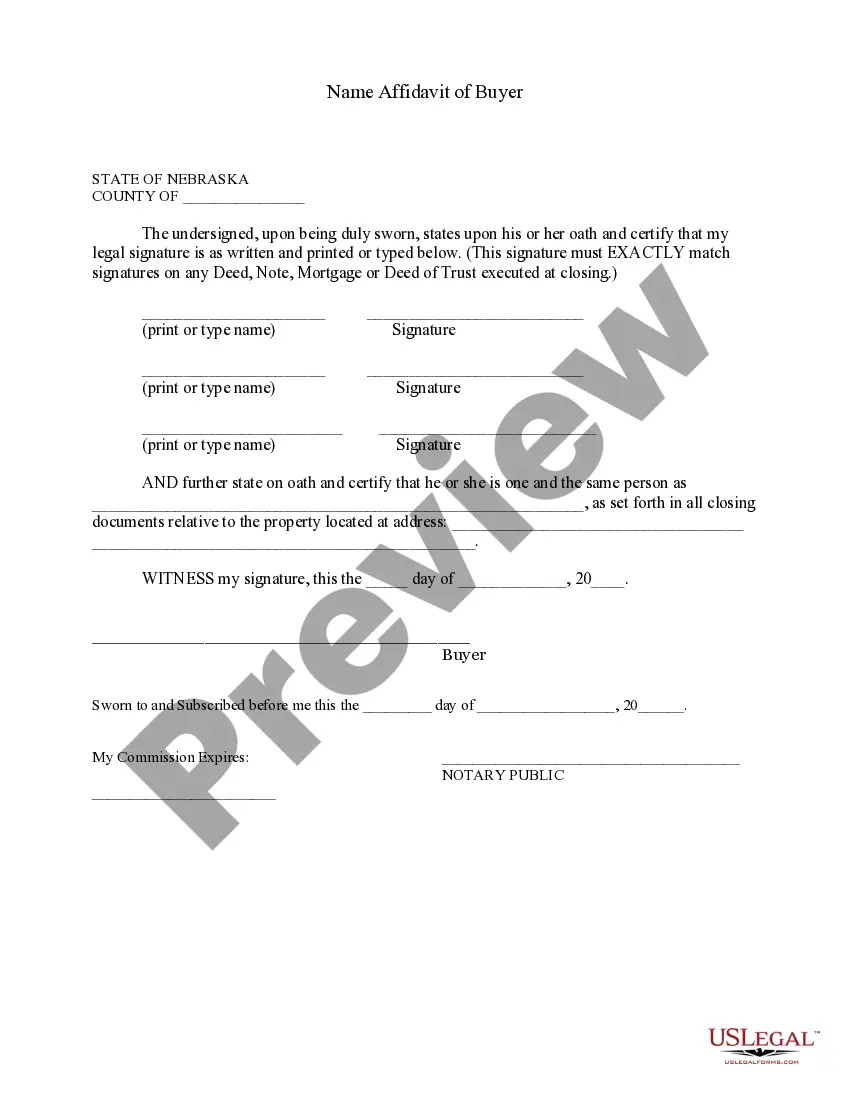

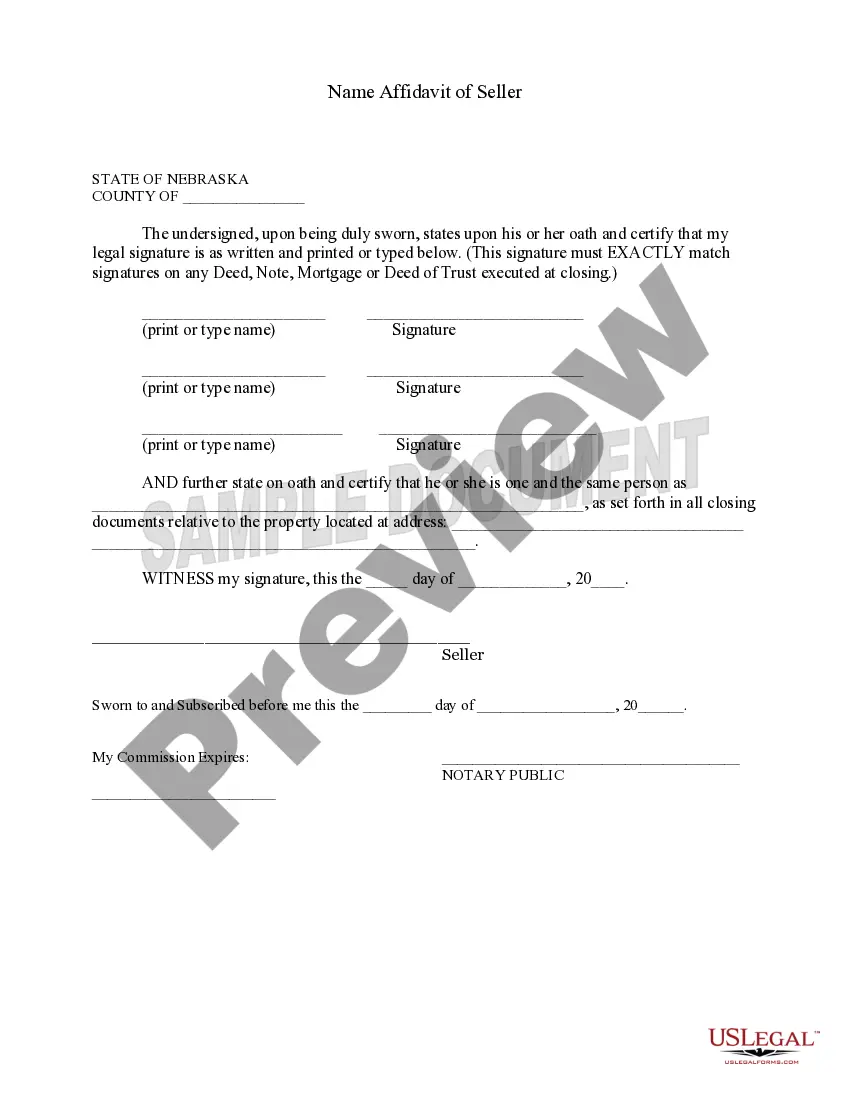

How to fill out Maricopa Arizona Contract With Independent Contractor To Work As A Consultant?

How much time does it normally take you to create a legal document? Since every state has its laws and regulations for every life situation, locating a Maricopa Contract with Independent Contractor to Work as a Consultant meeting all regional requirements can be stressful, and ordering it from a professional attorney is often expensive. Numerous web services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive web catalog of templates, grouped by states and areas of use. In addition to the Maricopa Contract with Independent Contractor to Work as a Consultant, here you can find any specific form to run your business or individual deeds, complying with your county requirements. Experts check all samples for their actuality, so you can be certain to prepare your documentation properly.

Using the service is fairly simple. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required sample, and download it. You can retain the file in your profile at any time later on. Otherwise, if you are new to the platform, there will be a few more actions to complete before you obtain your Maricopa Contract with Independent Contractor to Work as a Consultant:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another form using the related option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Choose the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Maricopa Contract with Independent Contractor to Work as a Consultant.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!

Form popularity

FAQ

1099 employees don't have to paid overtime. Since they aren't on payroll, you can keep payroll and other taxes, including the unemployment tax, under control. They can't collect workers' compensation so you get a break on premiums as well.

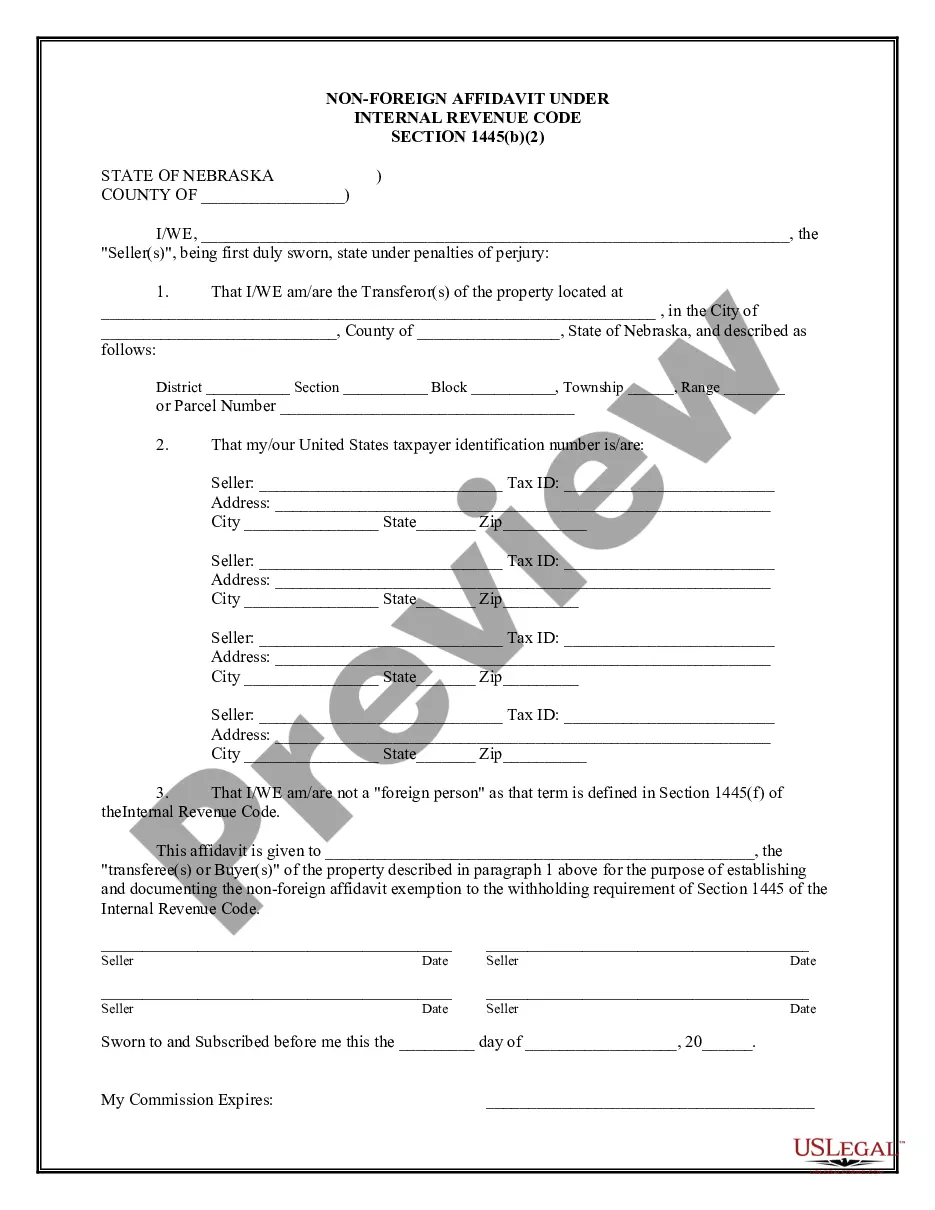

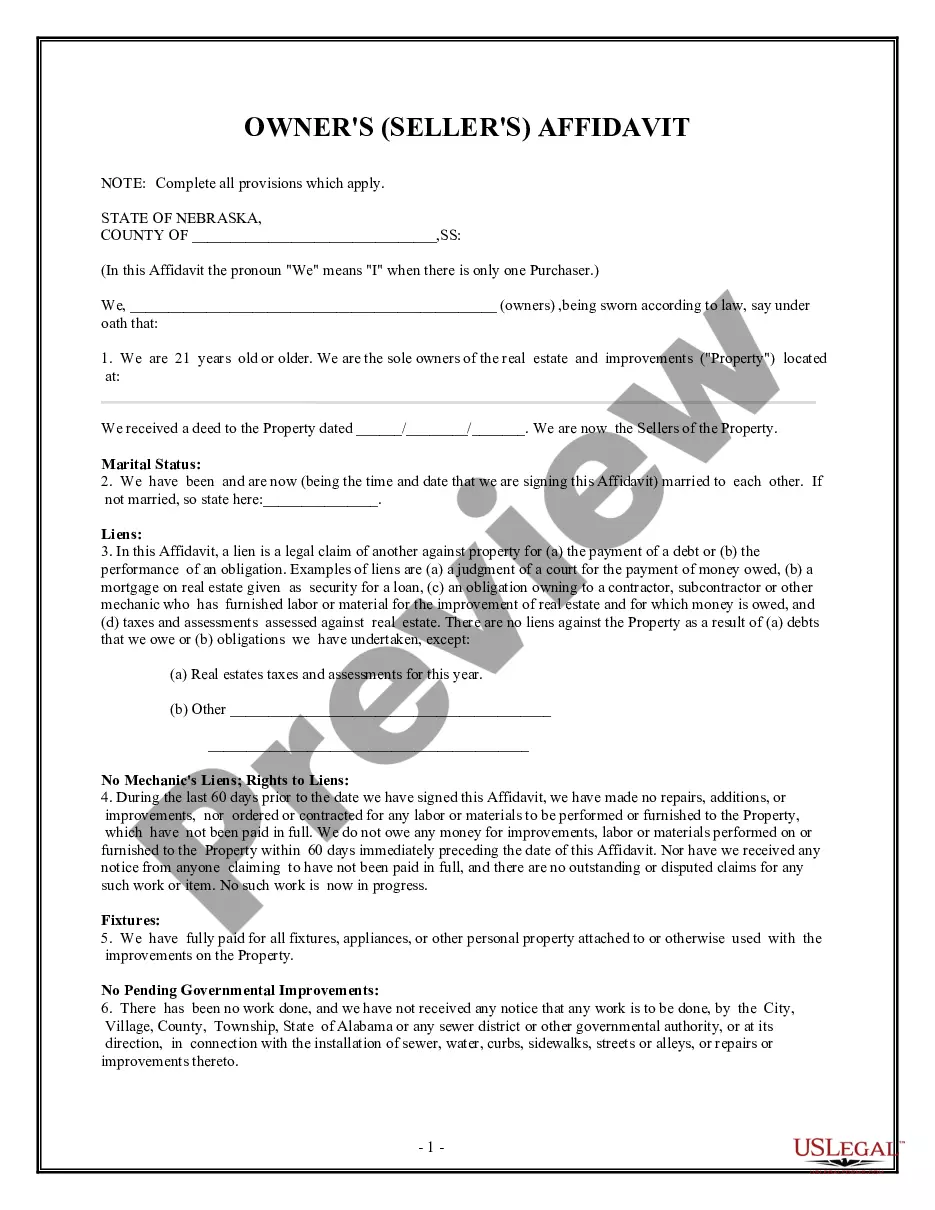

Arizona allows employers to request that individuals classified as independent contractors sign a Declaration of Independent Business Status (DIBS). The execution of a DIBS is not mandatory in order to establish the existence of an independent contractor relationship between a business and an independent contractor.

Independent contractors provide goods or services according to the terms of a contract they have negotiated with an employer. Independent contractors are not employees, and therefore they are not covered under most federal employment statutes.

The only problem is that it is often illegal. There is no such thing as a 1099 employee. The 1099 part of the name refers to the fact that independent contractors receive a form 1099 at the end of the year, which reports to the IRS how much money was paid to the contractor.

An independent contractor is defined as an individual who contracts to work for others without having the legal status of an employee. By engaging independent contractors, employers can avoid many of the costs associated with hiring employees.

Make sure you really qualify as an independent contractor. Choose a business name (and register it, if necessary). Get a tax registration certificate (and a vocational license, if required for your profession). Pay estimated taxes (advance payments of your income and self-employment taxes).

The new law allows Arizona employing units and independent contractors to establish their shared intent for the status of their relationship from its inception by permitting employing units to require their independent contractors to execute declarations affirming that their relationship with the business is as an

What Is an Independent Contractor? An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

Interesting Questions

More info

I also handle complaints and reviews. Send me your public records requests. 9. I can assist clients with legal needs. In order to find the best way to fulfill your legal requirements, I will offer you the necessary legal services to assist you in filing a lawsuit. Legal documents, I provide free of charge, free of charge for the first six months. After this time, you must pay a 19.50 additional service fee. I am willing to assist you in every legal procedure. If you have questions or concerns call my office at 916.923.7780 or email my office to learn about my free legal services. 9. I will be able to assist you with tax preparation and tax credits for home improvement. 1. My services can be completed within 10 hours. 2. All documents must be provided to me. 3. The tax preparation and tax credits have a 19.50 additional charge. 4. I need a return within 10 days. 5. You must provide a photocopy of your most recent W-2 and 1099. 6. Return or copy receipt is required.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.