Dallas, Texas is a vibrant city known for its rich history, diverse culture, and strong business opportunities. When it comes to construction projects in Dallas, the role of subcontractors and the necessity of surety bonds cannot be overlooked. In the case of indemnification of surety on the contractor's bond by a subcontractor, it holds immense importance in ensuring project success and financial security for all parties involved. Surety bonds are contractual agreements between three parties: the principal (contractor), the obliged (project owner), and the surety (bonding company). These bonds provide a guarantee that the contractor will fulfill their contractual obligations and meet all financial and performance requirements outlined in the construction contract. In the event of a contractor's default or failure to fulfill their obligations, the surety steps in to compensate the obliged for potential losses. Subcontractors, who are hired by the main contractor to perform specific tasks or provide specialized services for a construction project, also play a critical role in the indemnification process. When a subcontractor agrees to indemnify the surety on the contractor's bond, they essentially take responsibility for certain risks and potential losses associated with their work. The indemnification of surety on a contractor's bond by a subcontractor serves multiple purposes. Firstly, it provides an additional layer of financial protection for the obliged, ensuring that they can recover losses if the subcontractor fails to complete their work or breaches their contractual obligations. Secondly, it enables the surety to seek reimbursement and compensation for any expenses incurred due to the subcontractor's failure. In Dallas, Texas, there are various types of indemnification scenarios involving subcontractors and surety bonds. These include: 1. Payment Bond Indemnification: This type of indemnification ensures that subcontractors are responsible for reimbursing the surety for any payments made to suppliers, laborers, or other subcontractors who have not been paid by the defaulting contractor. 2. Performance Bond Indemnification: In this scenario, subcontractors indemnify the surety for any losses incurred due to the contractor's failure to complete the project or fulfill their contractual obligations. This may involve costs associated with hiring alternative subcontractors or rectifying defects. 3. Material & Labor Bond Indemnification: Here, subcontractors indemnify the surety for any claims, losses, or expenses resulting from failure to supply materials, equipment, or labor as specified in the construction contract. It is crucial for subcontractors in Dallas, Texas, to fully understand the terms and implications of indemnification of surety on the contractor's bond. Clear communication, proper risk assessment, and adherence to contractual obligations are essential to mitigate potential liabilities and maintain a successful working relationship with both the contractor and the surety. By doing so, subcontractors can contribute to the overall success of construction projects in Dallas while safeguarding their own interests.

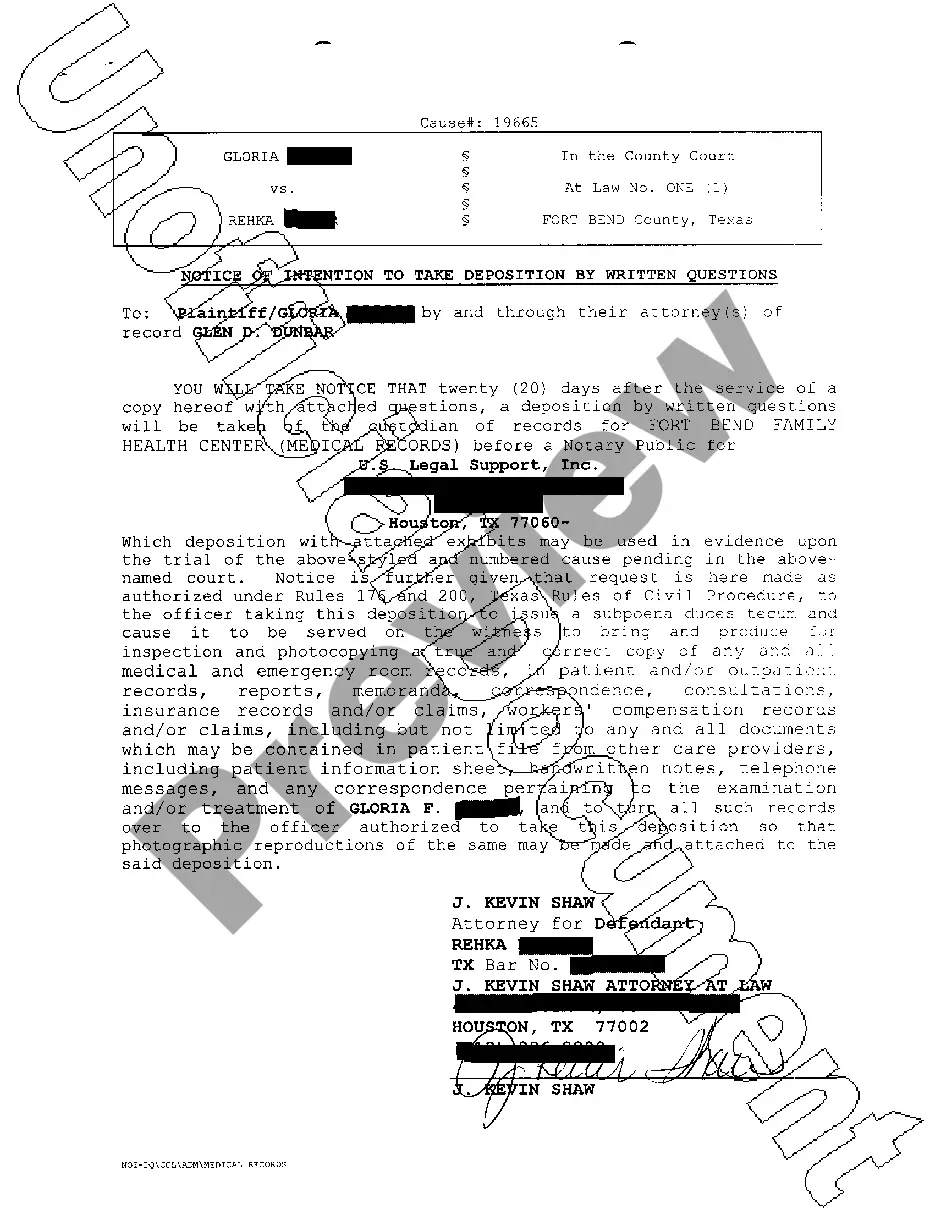

Dallas Texas Indemnification of Surety on Contractor's Bond by Subcontractor

Description

How to fill out Dallas Texas Indemnification Of Surety On Contractor's Bond By Subcontractor?

Laws and regulations in every sphere vary throughout the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documentation. To avoid costly legal assistance when preparing the Dallas Indemnification of Surety on Contractor's Bond by Subcontractor, you need a verified template valid for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal forms. It's an excellent solution for specialists and individuals searching for do-it-yourself templates for different life and business scenarios. All the forms can be used many times: once you pick a sample, it remains accessible in your profile for further use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Dallas Indemnification of Surety on Contractor's Bond by Subcontractor from the My Forms tab.

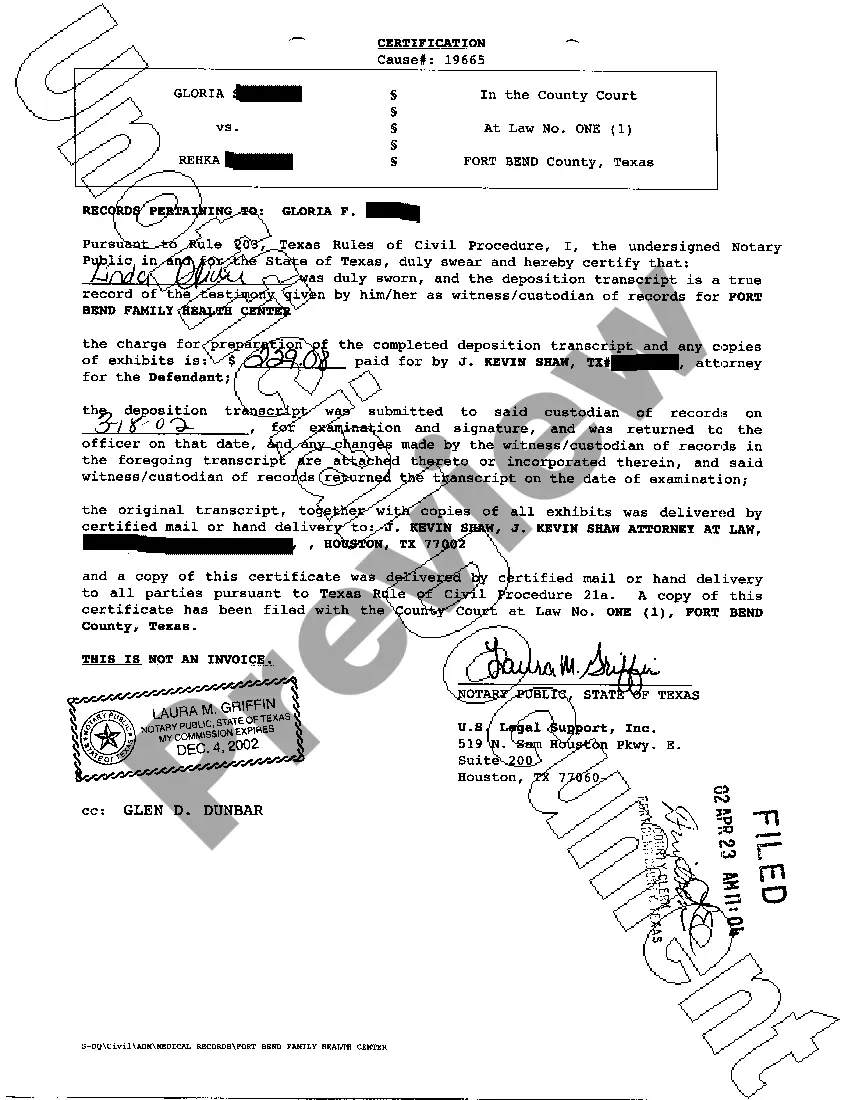

For new users, it's necessary to make several more steps to obtain the Dallas Indemnification of Surety on Contractor's Bond by Subcontractor:

- Examine the page content to make sure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to obtain the template once you find the correct one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your documentation in order with the US Legal Forms!