Chicago, Illinois Conflict of Interest Disclosure of Director of Corporation In Chicago, Illinois, the Conflict of Interest Disclosure of Directors of Corporations is an essential legal requirement aimed at fostering transparency and accountability within corporate governance. Directors are entrusted with significant decision-making powers and are expected to act in the best interest of the corporation and its stakeholders. The Conflict of Interest Disclosure serves as a framework to ensure that directors fulfill their duties responsibly and avoid situations that could compromise their objectivity or potentially benefit from personal interests or relationships. By disclosing any potential conflicts of interest, directors uphold the reputation and integrity of the corporation while safeguarding shareholders' interests. Different types of Chicago, Illinois Conflict of Interest Disclosures applicable to Directors of Corporations may include: 1. Financial Conflicts of Interest: Financial conflicts arise when a director has a personal financial interest that may influence their decision-making. This could include an ownership stake in a competitor company, a financial relationship with a supplier or customer, or any other situation that could impair their ability to act solely in the corporation's best interest. 2. Relationship Conflicts of Interest: Relationship conflicts occur when a director's personal relationships or connections could lead to biased decision-making. For instance, if a director has a close family member employed by a potential vendor, it could create a conflict that needs to be disclosed. 3. Corporate Opportunities Conflicts of Interest: Directors must disclose any situation where they may personally benefit from a business opportunity that should have been presented to the corporation. This includes situations where a director takes advantage of a potential investment or venture without the corporation's knowledge or consent. 4. Compensation Conflicts of Interest: Directors must disclose any financial arrangements or incentives that may compromise their independence or judgment. For example, undisclosed bonuses or undisclosed business relationships with individuals seeking contracts or partnerships with the corporation. To fulfill their obligations, directors must file a Conflict of Interest Disclosure form, detailing all potential conflicts periodically or as they arise during their tenure. This disclosure form must be submitted to the corporation's board of directors and maintained in the corporate records. Additionally, it is crucial for corporations to establish clear policies and procedures to manage conflicts of interest effectively. These policies should outline the process for identifying, addressing, and resolving conflicts, along with mechanisms to prevent future conflicts from arising. By adhering to the Conflict of Interest Disclosure requirements in Chicago, Illinois, Directors of Corporations play a pivotal role in maintaining ethical corporate practices, preserving the corporation's reputation, and ensuring accountability to all stakeholders.

Chicago Illinois Conflict of Interest Disclosure of Director of Corporation

Description

How to fill out Chicago Illinois Conflict Of Interest Disclosure Of Director Of Corporation?

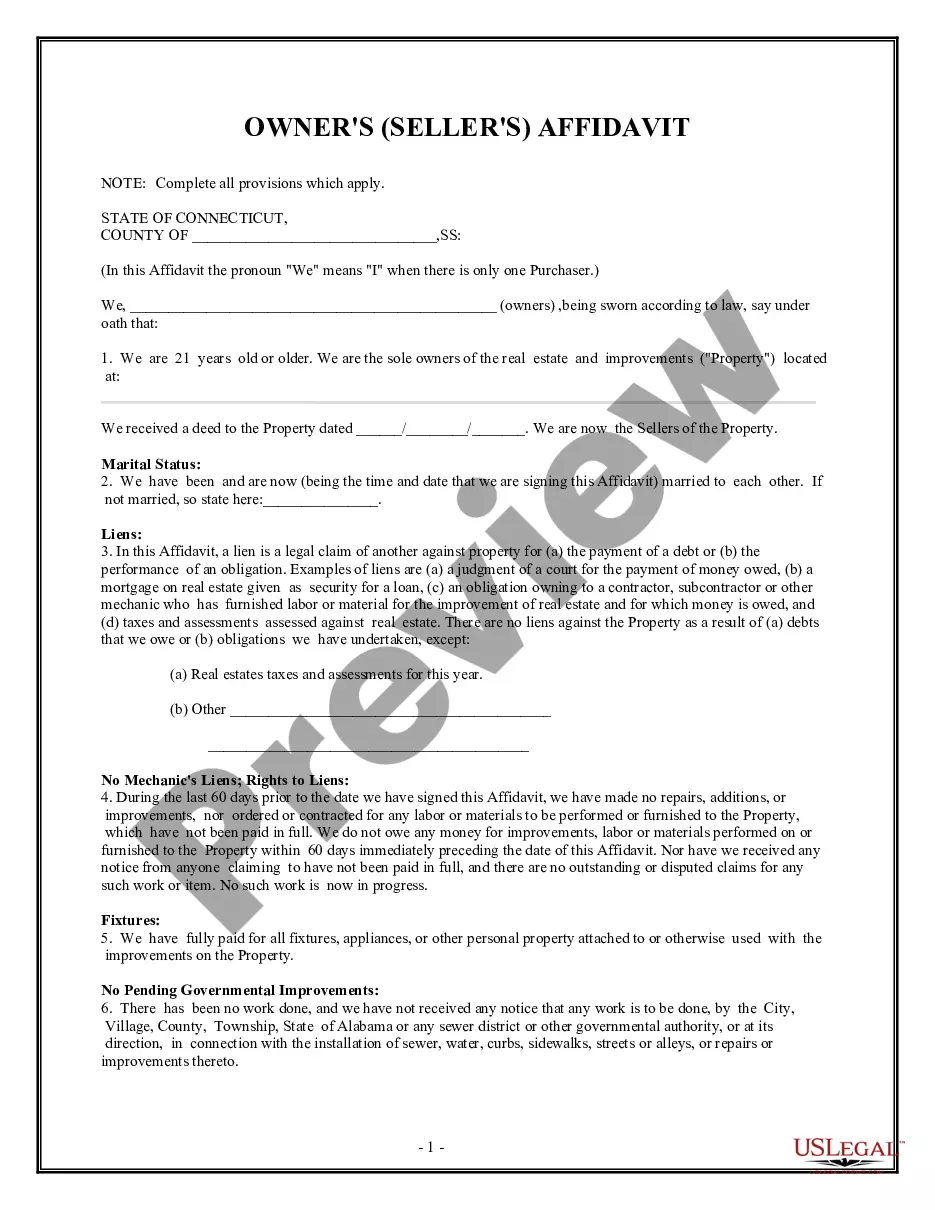

Do you need to quickly draft a legally-binding Chicago Conflict of Interest Disclosure of Director of Corporation or maybe any other form to handle your personal or corporate affairs? You can select one of the two options: contact a professional to write a valid document for you or create it entirely on your own. Thankfully, there's a third option - US Legal Forms. It will help you receive neatly written legal paperwork without paying sky-high prices for legal services.

US Legal Forms provides a rich catalog of more than 85,000 state-compliant form templates, including Chicago Conflict of Interest Disclosure of Director of Corporation and form packages. We offer templates for an array of use cases: from divorce paperwork to real estate documents. We've been on the market for more than 25 years and got a rock-solid reputation among our customers. Here's how you can become one of them and obtain the necessary template without extra troubles.

- To start with, carefully verify if the Chicago Conflict of Interest Disclosure of Director of Corporation is adapted to your state's or county's laws.

- In case the document has a desciption, make sure to check what it's suitable for.

- Start the search again if the document isn’t what you were seeking by using the search box in the header.

- Choose the plan that is best suited for your needs and move forward to the payment.

- Select the format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, locate the Chicago Conflict of Interest Disclosure of Director of Corporation template, and download it. To re-download the form, just head to the My Forms tab.

It's easy to buy and download legal forms if you use our services. Additionally, the paperwork we offer are updated by industry experts, which gives you greater peace of mind when dealing with legal affairs. Try US Legal Forms now and see for yourself!