The Collin Texas Conflict of Interest Disclosure of Director of Corporation is an important document that aims to maintain transparency and uphold ethical standards within the corporate sector. This disclosure form is specifically designed for directors of corporations operating in Collin County, Texas, and is an essential tool for identifying and managing potential conflicts of interest. A conflict of interest may arise when a director's personal or financial interests could potentially influence their decision-making or actions on behalf of the corporation. This disclosure form acts as a preventive measure, ensuring that directors acknowledge and address any conflicts in a timely and transparent manner. By doing so, the corporation can maintain its integrity, protect the interests of its stakeholders, and demonstrate a commitment to good governance. The Collin Texas Conflict of Interest Disclosure of Director of Corporation encompasses various key elements. First and foremost, it requires directors to disclose any relationships, financial interests, or affiliations that may present a potential conflict. This includes partnerships, investments, or employment with organizations that have business dealings, competition, or a relationship with the corporation. Moreover, the disclosure form requires directors to provide detailed information about the nature and extent of the conflict. It allows directors to explain the specific circumstances of the conflict of interest, ensuring that all relevant details are brought to light. This transparency fosters an environment wherein conflicts can be effectively evaluated and addressed. Different types of conflicts of interest that directors may encounter can include: 1. Financial Interests: This occurs when a director has a personal investment or financial stake in a company or organization (such as being a shareholder), which may influence their decision-making. 2. Employment: If a director is simultaneously employed by another company or organization, which may pose a conflict due to potential competing interests or divided loyalties. 3. Board of Directors Membership: If a director simultaneously serves on the board of another organization that has business dealings with the corporation, creating potential conflicts between the two entities. 4. Family Relationships: A director may have a family member who is employed by a company that is involved in business transactions with the corporation, leading to a conflict of interest. It is crucial for directors in Collin County, Texas, to diligently complete the Conflict of Interest Disclosure form to ensure transparency and accountability. By providing this detailed information, directors enable the corporation's board and stakeholders to assess and manage potential conflicts appropriately, supporting a strong corporate governance framework.

Collin Texas Conflict of Interest Disclosure of Director of Corporation

Description

How to fill out Collin Texas Conflict Of Interest Disclosure Of Director Of Corporation?

Laws and regulations in every area differ around the country. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid expensive legal assistance when preparing the Collin Conflict of Interest Disclosure of Director of Corporation, you need a verified template valid for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal forms. It's a great solution for professionals and individuals searching for do-it-yourself templates for various life and business situations. All the forms can be used multiple times: once you pick a sample, it remains available in your profile for further use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the Collin Conflict of Interest Disclosure of Director of Corporation from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Collin Conflict of Interest Disclosure of Director of Corporation:

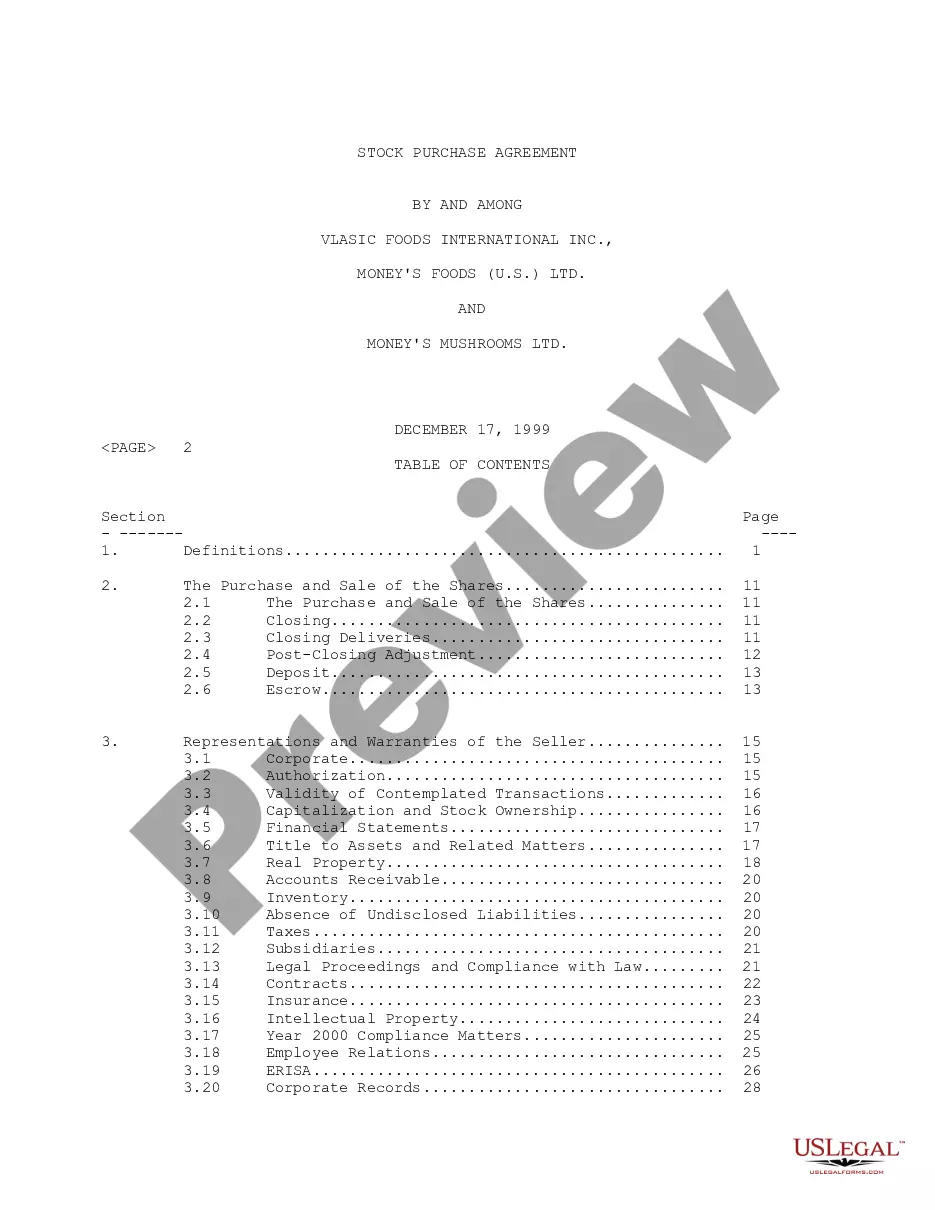

- Take a look at the page content to make sure you found the right sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to obtain the document when you find the appropriate one.

- Choose one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!