Harris Texas Conflict of Interest Disclosure of Director of Corporation refers to the legal requirement and process where directors of corporations established in Harris County, Texas must disclose any potential conflicts of interest they may have. This policy ensures transparency and prevents directors from making decisions that could personally benefit them at the expense of the corporation. The Conflict of Interest Disclosure document serves as a means to identify and address conflicts that could arise between a director's personal interests and their fiduciary duty towards the corporation. It is an important tool in maintaining the integrity and reputation of the corporation, as well as protecting the interests of shareholders, stakeholders, and the public. The Harris Texas Conflict of Interest Disclosure of Director of Corporation document typically requires directors to provide a detailed description of any relationships, financial interests, or associations they have that could potentially compromise their ability to act in the best interest of the corporation. This may include ownership or employment in competing businesses, financial investments, relationships with suppliers or customers, or any other situation that could create a conflict. By disclosing these potential conflicts, directors allow the corporation and its stakeholders to evaluate and address any potential risks or biases that may arise. Moreover, it enables the board of directors to make informed decisions and take appropriate actions to mitigate or avoid any conflicts of interest. Different types of Harris Texas Conflict of Interest Disclosure of Director of Corporation may include: 1. Financial Conflicts: This relates to situations where a director has a financial interest, such as investments, loans, or ownership in a competing business, supplier, or customer of the corporation. 2. Personal Relationships: This refers to situations where a director has personal relationships, such as family ties or close friendships, with individuals or entities that could influence their decision-making within the corporation. 3. Outside Employment: Directors may hold positions in other companies as directors, advisors, or employees. This can create conflicts of interest if the other companies are competitors or have conflicting interests with the corporation. 4. Non-Financial Benefits: Directors may receive non-financial benefits, such as gifts, discounts, or perks from individuals or entities that have a business relationship with the corporation. These benefits can potentially compromise the director's objectivity and create conflicts. It is crucial for directors in Harris County, Texas to fully disclose any potential conflicts of interest they might have. This requirement ensures that the decision-making process remains impartial and in the best interest of the corporation, its shareholders, and stakeholders.

Harris Texas Conflict of Interest Disclosure of Director of Corporation

Description

How to fill out Harris Texas Conflict Of Interest Disclosure Of Director Of Corporation?

Laws and regulations in every area vary throughout the country. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid high priced legal assistance when preparing the Harris Conflict of Interest Disclosure of Director of Corporation, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal templates. It's an excellent solution for professionals and individuals looking for do-it-yourself templates for various life and business scenarios. All the documents can be used many times: once you obtain a sample, it remains accessible in your profile for further use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Harris Conflict of Interest Disclosure of Director of Corporation from the My Forms tab.

For new users, it's necessary to make several more steps to get the Harris Conflict of Interest Disclosure of Director of Corporation:

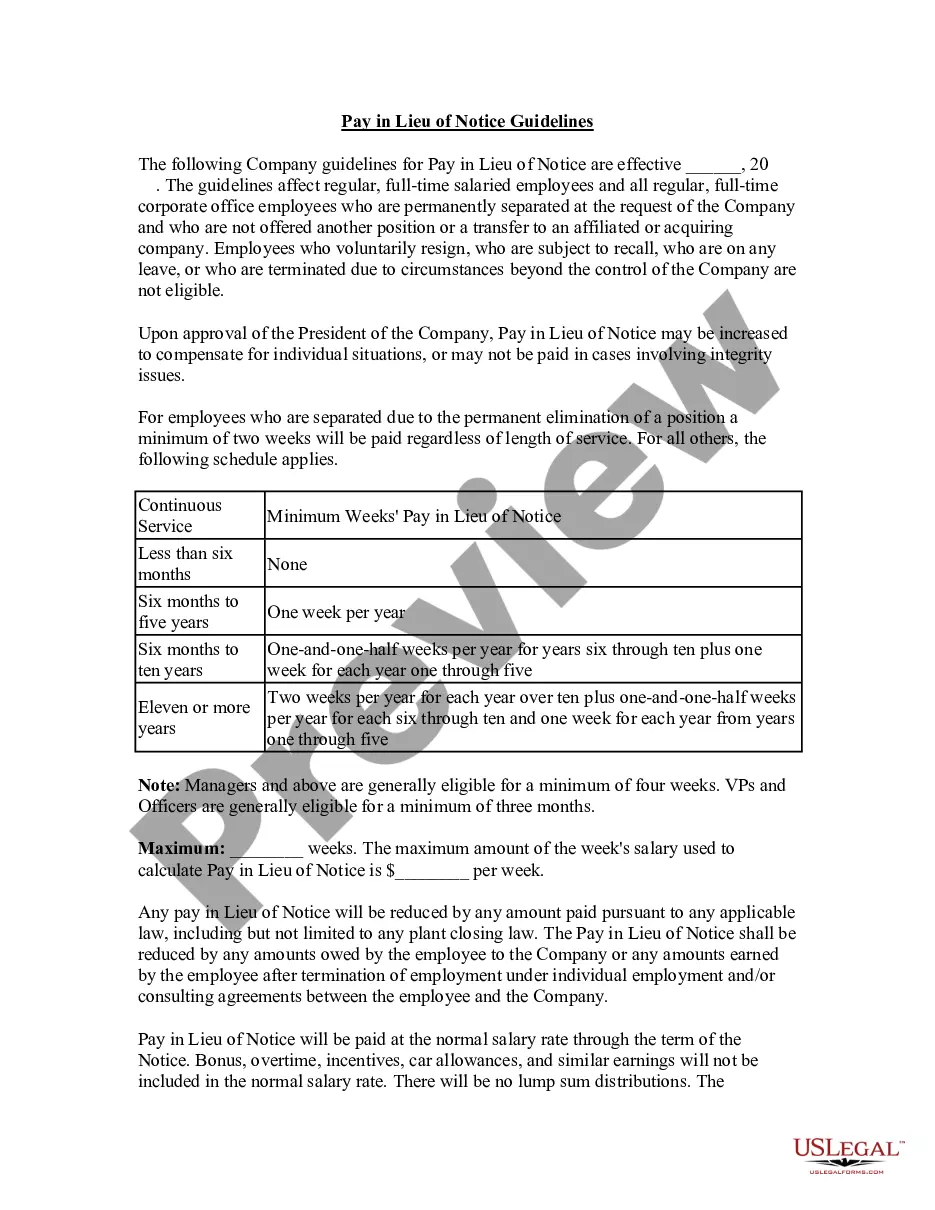

- Take a look at the page content to ensure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to get the document when you find the right one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your paperwork in order with the US Legal Forms!