Nassau, New York Conflict of Interest Disclosure of Director of Corporation In Nassau, New York, it is of utmost importance for directors of corporations to abide by ethical standards and maintain transparency in their actions. To ensure this, a Conflict of Interest Disclosure is required by law. This disclosure is a formal statement made by the director of a corporation, revealing any personal or financial interests that could potentially influence their decision-making processes or compromise the best interests of the corporation. The purpose of the Nassau, New York Conflict of Interest Disclosure is to promote a high level of corporate governance and prevent any conflicts that may negatively impact the corporation. This disclosure allows the board of directors and shareholders to be aware of any potential conflicts, thus enabling them to make informed decisions and take appropriate actions to mitigate any conflicts or bias. The disclosure process involves the director identifying any relationships, financial investments, or affiliations that could create a conflict of interest. These could include business partnerships, family connections, investments in competitors, or financial interests in suppliers or contractors with whom the corporation does business. Directors are obliged to disclose these relationships promptly and accurately to the corporation's board. By providing this disclosure, directors demonstrate their commitment to transparency and accountability while upholding their fiduciary duty to act in the corporation's best interests. It also helps maintain public trust and confidence in the corporation and its leadership. Different types of Conflict of Interest Disclosure that may exist in Nassau, New York can include: 1. Financial Conflict of Interest Disclosure: This type of disclosure revolves around any personal financial interests or investments that the director may have that could potentially conflict with the corporation's interests. 2. Personal Conflict of Interest Disclosure: This disclosure pertains to any personal relationships, such as family or close friendships, that the director may have, which could influence their decision-making process and potentially compromise the corporation's best interests. 3. Professional Conflict of Interest Disclosure: In this case, the director discloses any professional affiliations, partnerships, or consulting engagements that could create conflicts of interest and compromise their objectivity and independence as a director. Nassau, New York takes Conflict of Interest Disclosure of directors very seriously in order to maintain the integrity and ethical standards of corporate governance. Failure to disclose conflicts of interest can have severe consequences, including legal and reputational damage, as well as potential legal actions against directors who breach their fiduciary duties.

Nassau New York Conflict of Interest Disclosure of Director of Corporation

Description

How to fill out Nassau New York Conflict Of Interest Disclosure Of Director Of Corporation?

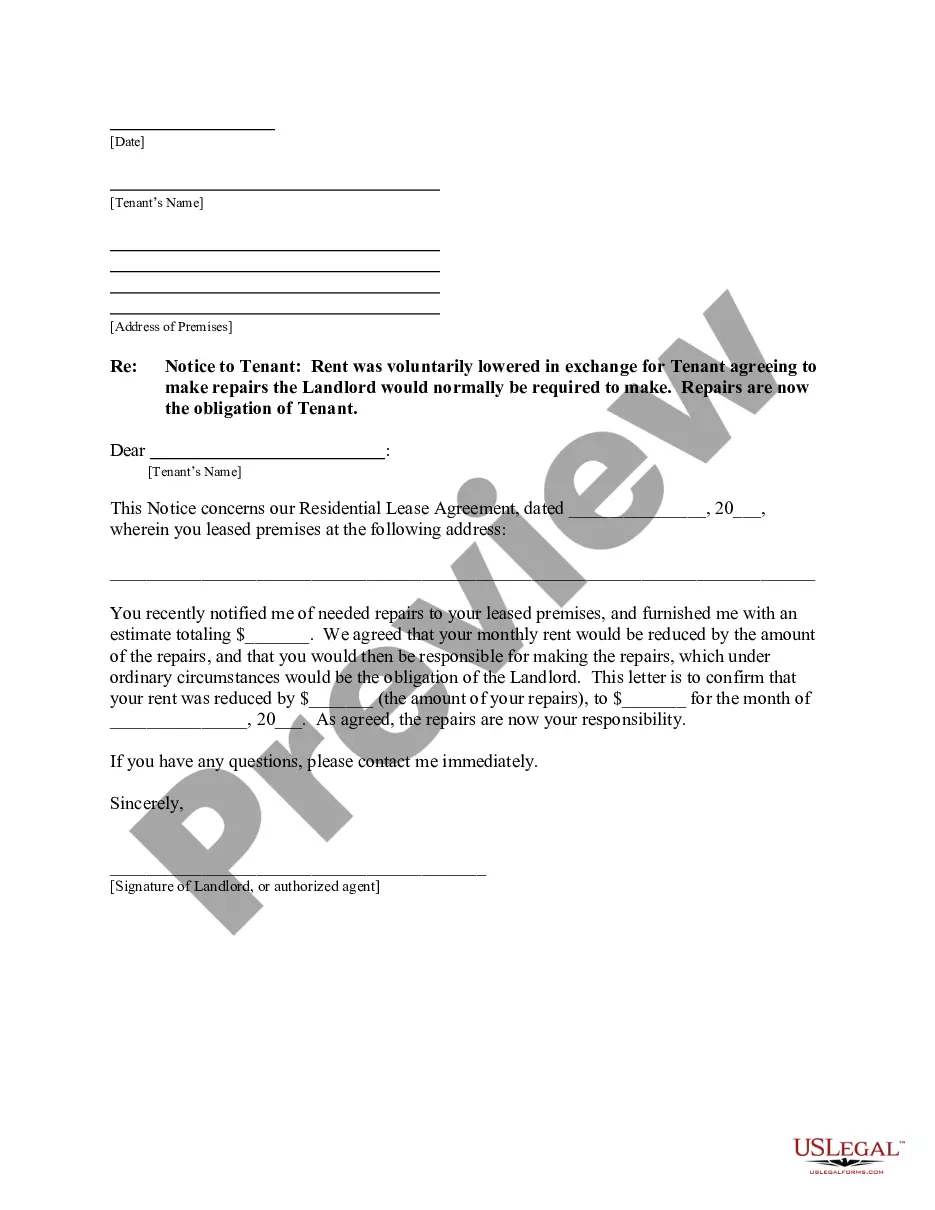

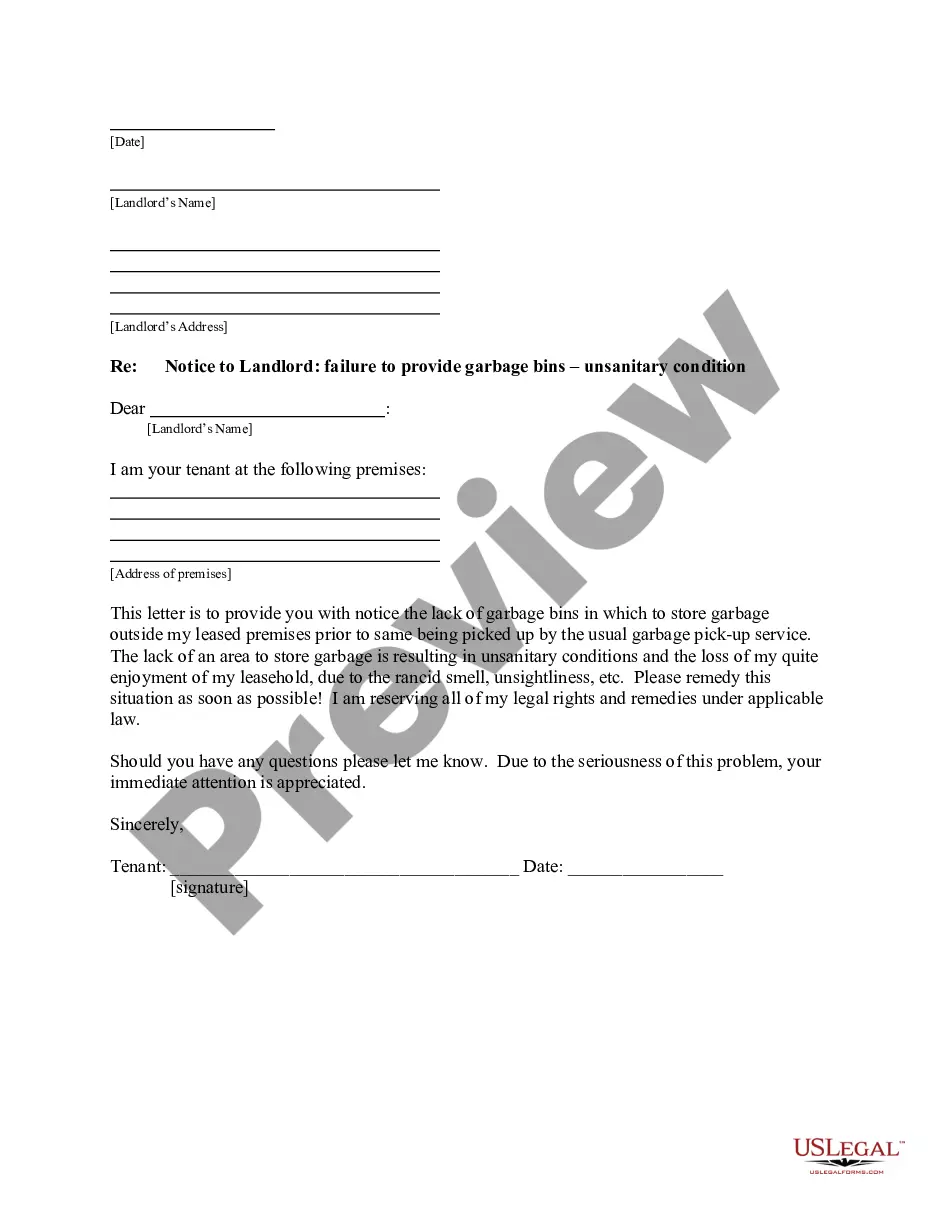

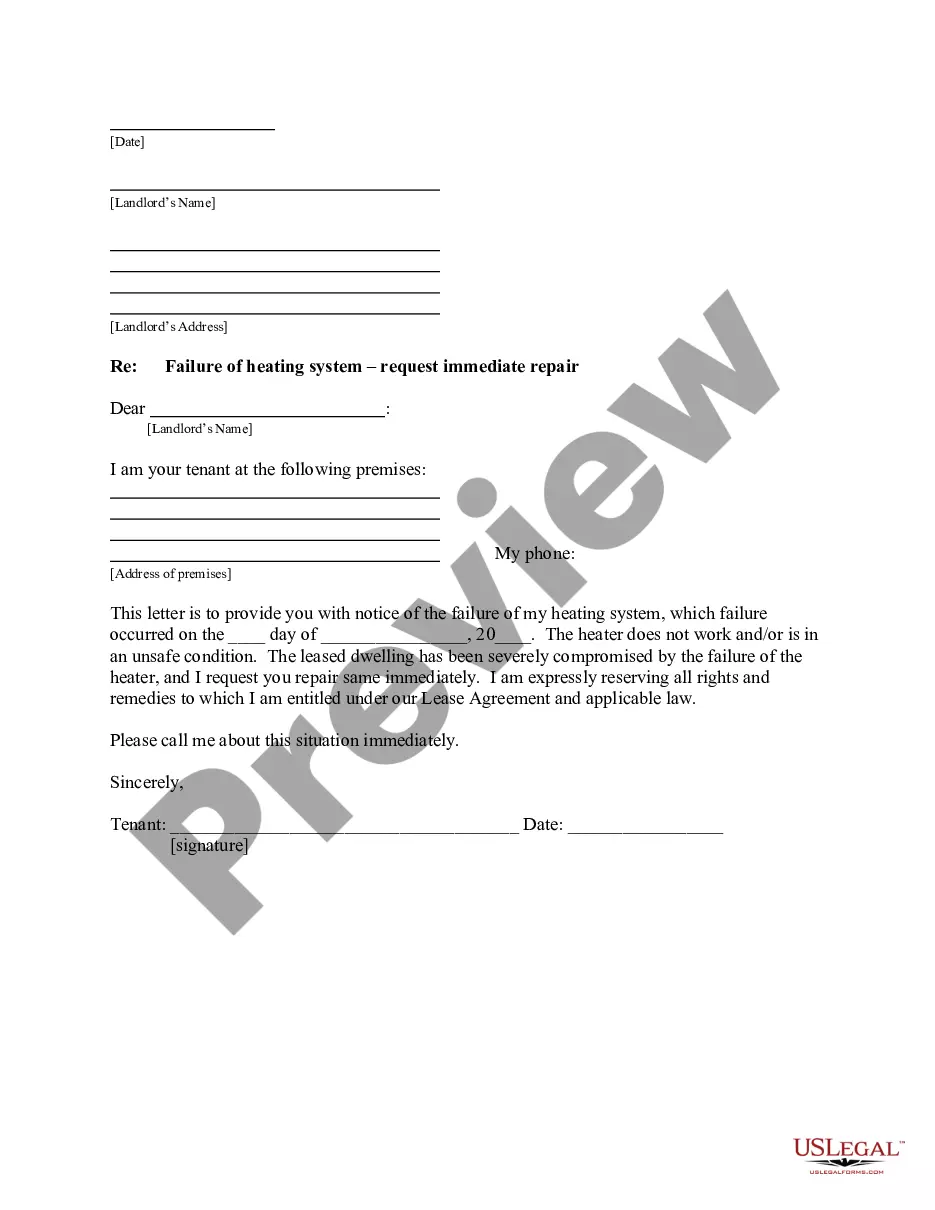

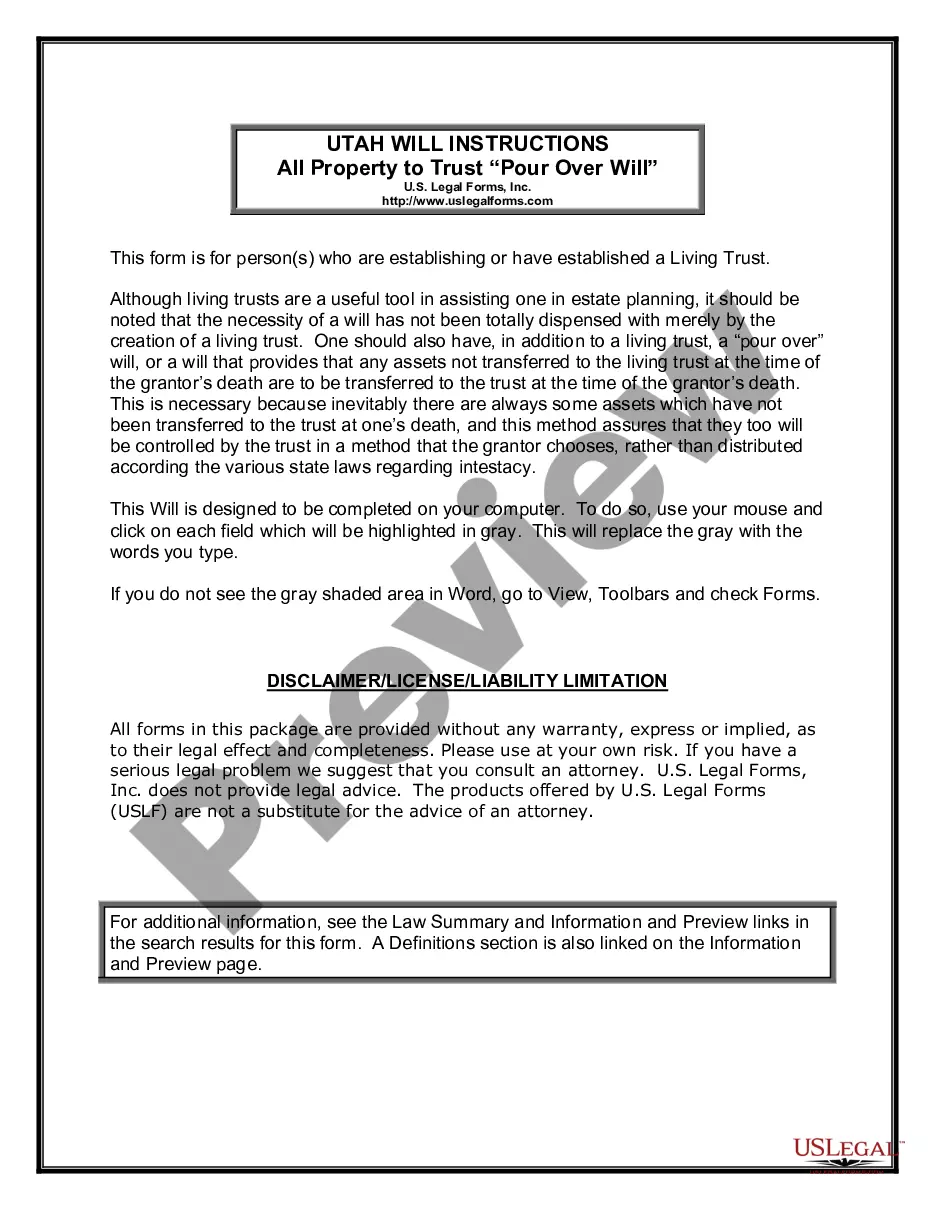

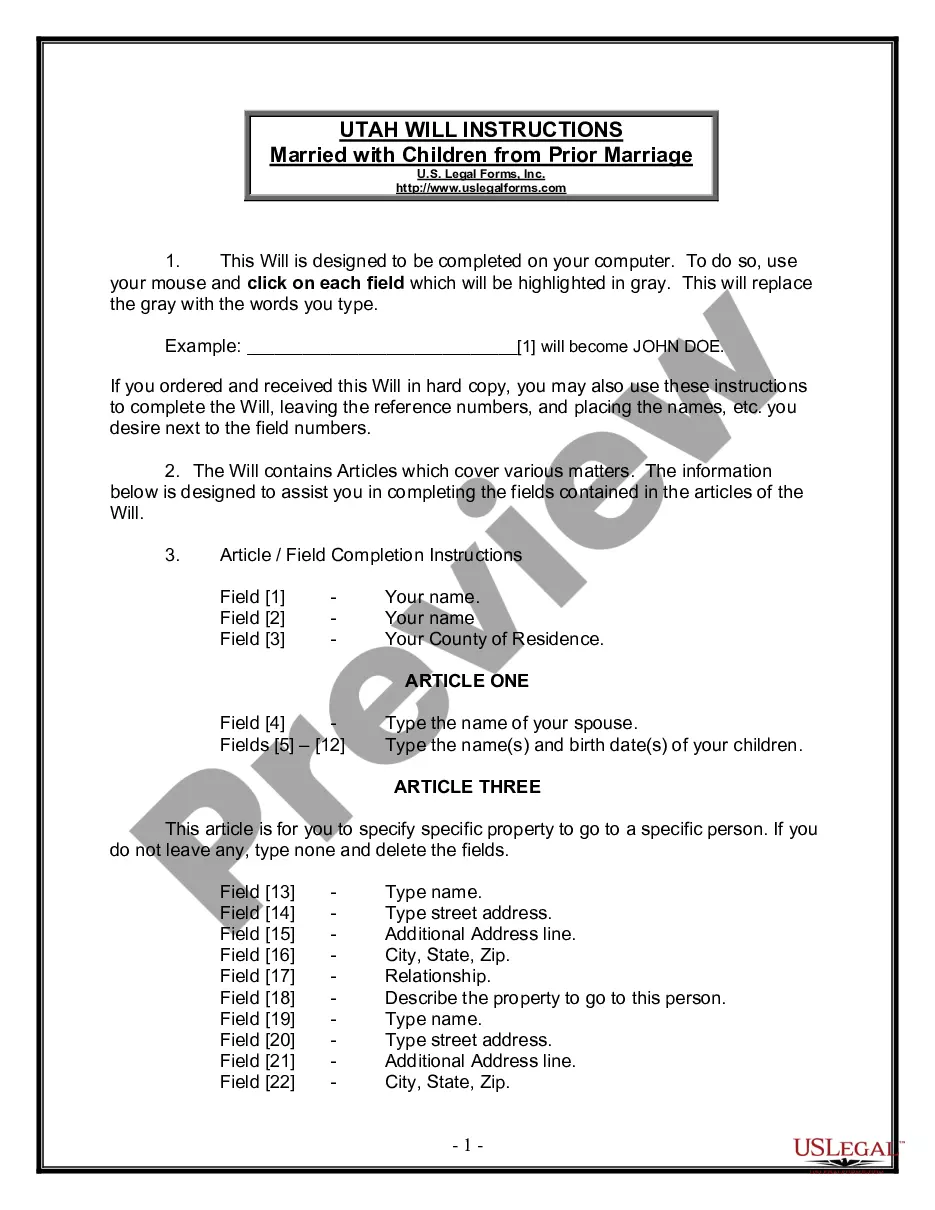

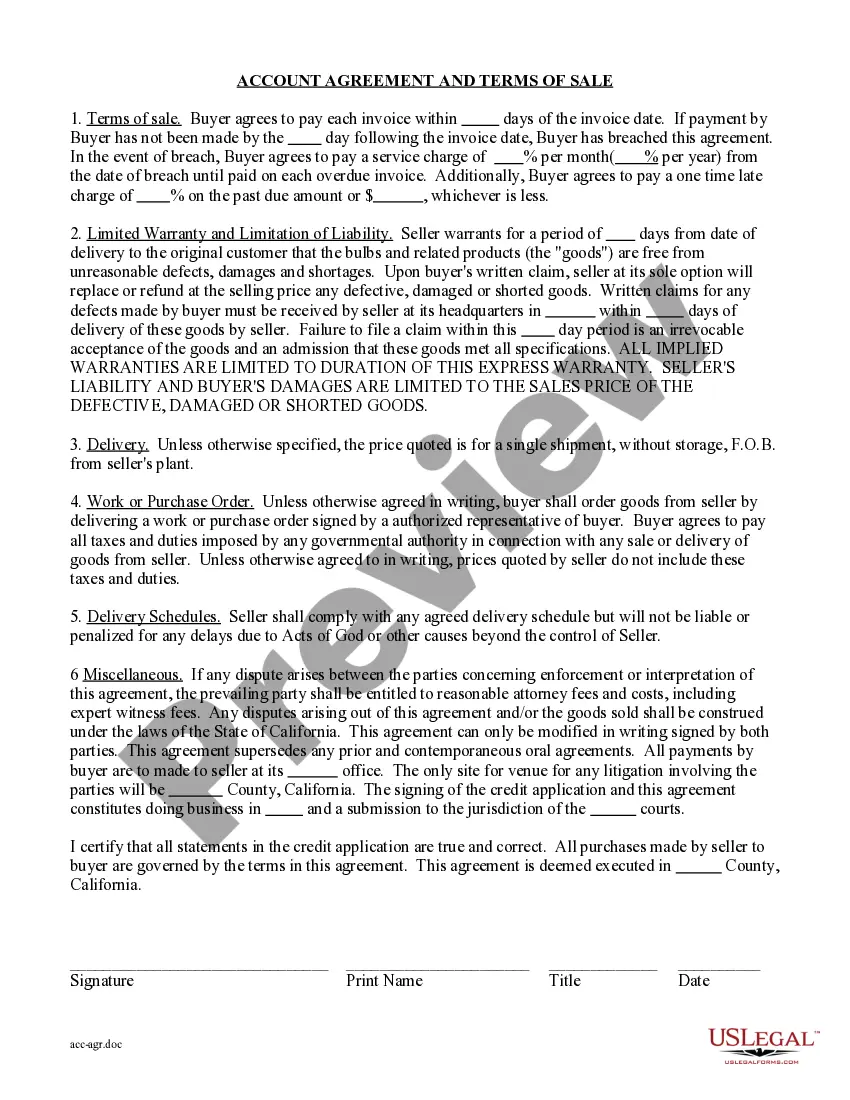

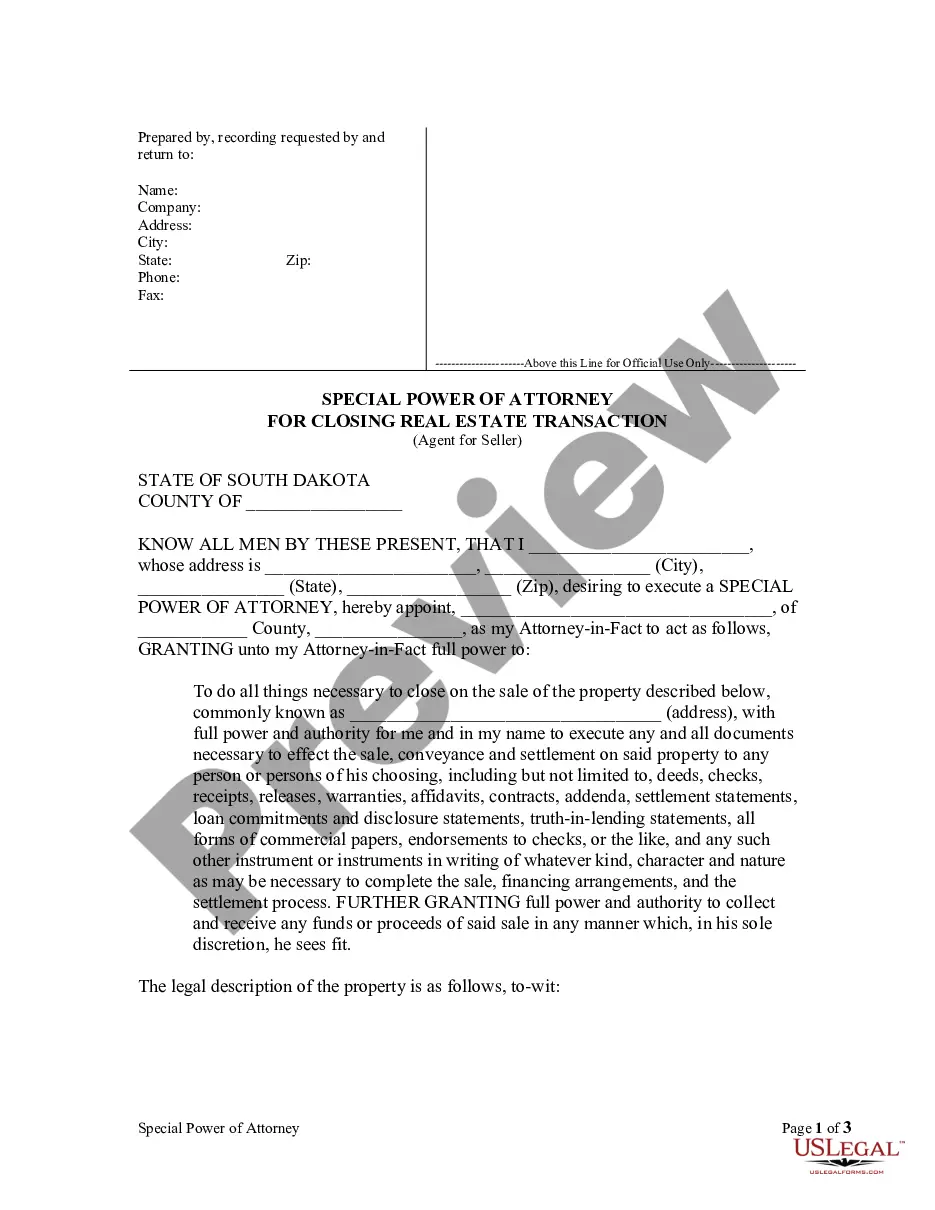

Do you need to quickly create a legally-binding Nassau Conflict of Interest Disclosure of Director of Corporation or probably any other form to take control of your personal or corporate affairs? You can go with two options: contact a legal advisor to draft a legal document for you or create it completely on your own. Luckily, there's a third option - US Legal Forms. It will help you get professionally written legal documents without paying sky-high prices for legal services.

US Legal Forms provides a huge collection of more than 85,000 state-specific form templates, including Nassau Conflict of Interest Disclosure of Director of Corporation and form packages. We provide templates for an array of life circumstances: from divorce papers to real estate document templates. We've been out there for more than 25 years and gained a rock-solid reputation among our clients. Here's how you can become one of them and obtain the needed document without extra hassles.

- First and foremost, double-check if the Nassau Conflict of Interest Disclosure of Director of Corporation is adapted to your state's or county's regulations.

- If the document has a desciption, make sure to verify what it's suitable for.

- Start the searching process over if the template isn’t what you were seeking by using the search box in the header.

- Select the plan that best suits your needs and move forward to the payment.

- Select the file format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, locate the Nassau Conflict of Interest Disclosure of Director of Corporation template, and download it. To re-download the form, simply head to the My Forms tab.

It's easy to buy and download legal forms if you use our catalog. Moreover, the templates we offer are updated by industry experts, which gives you greater confidence when dealing with legal matters. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

Situational conflict refers to where a director is under a duty to avoid a situation in which they have, or possibly may have, a conflict of interest, whereas transactional conflict refers to where conflict arises in relation to a transaction or arrangement between the director and the company.

The duty to avoid a conflict of interest is one of the fiduciary duties of directors. A director must, at all times, act in the best interests of the company, and in so doing, avoid conflicts of interest and/or adhere to all prescribed processes where a conflict arises.

A director's conflict of interest refers to a situation in which a director's personal interests or the interests of other persons to whom the director owes duties are, or may be, at odds with the duties owed by the director to his or her company.

A conflict of interest arises when a person chooses personal gain over the duties to an organization in which they are a stakeholder or exploits their position for personal gain in some way. All corporate board members have fiduciary duties and a duty of loyalty to the corporations they oversee.

How to Prevent Conflicts of Interest Ask Employees to Disclose Any Conflicts of Interest. Honesty really is the best policy.Create a Conflict of Interest Policy.Avoid Nepotism.Create a plan for managing conflicts of interest in your small business.

All directors are expected to avoid any conflicts of interest. The statutory duty insists that directors must avoid any conflictual situations.

A director's conflict of interest refers to a situation in which a director's personal interests or the interests of other persons to whom the director owes duties are, or may be, at odds with the duties owed by the director to his or her company.

Why? The need to disclose, as the court noted1, is rooted in the need to ensure transparency in the dealings by the management of the company and the moral integrity of those helming the administration of the company2.