Riverside California Conflict of Interest Disclosure of Director of Corporation refers to the legal requirement for directors of corporations in Riverside, California to disclose any potential conflicts of interest they may have during their tenure. This disclosure is crucial in ensuring transparency, promoting ethical business practices, and protecting the interests of shareholders and stakeholders. The Conflict of Interest Disclosure is a formal document that directors must complete, which outlines any financial or personal interests they may have that could potentially influence their decision-making in their role as a director. It requires directors to disclose any relationships, investments, or financial transactions that may compromise their ability to act in the best interests of the corporation. By disclosing conflicts of interest, directors are able to maintain the integrity of their decision-making processes, avoid illegal or unethical activities, and prevent any perception of favoritism or bias. This ensures that the corporation's actions are fair, just, and in compliance with legal regulations. Different types of Riverside California Conflict of Interest Disclosure of Director of Corporation can include the following: 1. Financial conflicts of interest: This includes instances where a director may have a significant investment in a competing company, or any financial interests that could potentially bias their decision-making in favor of personal gain. 2. Family or personal conflicts of interest: Directors must disclose any relationships they may have with other board members, executives, or employees of the corporation. They should also disclose any familial or personal relationships that could result in bias or favoritism. 3. Potential conflicts arising from outside positions: Directors who hold positions in other organizations, government agencies, or boards of competing companies must disclose these positions to avoid any conflicts of interest that may impact their ability to act in the best interests of the corporation. 4. Intellectual property conflicts: If a director has any patents, trademarks, or copyrights that may overlap with the business activities of the corporation, they must disclose these potential conflicts. 5. Gifts, gratuities, or favors: Any gifts, gratuities, or favors received by a director from suppliers, customers, or competitors that could potentially influence their decision-making should be disclosed. 6. Non-financial conflicts: This category includes any non-financial interests or associations that may raise concerns about a director's ability to act in the best interests of the corporation. It is essential for directors to fully and accurately complete the Conflict of Interest Disclosure to maintain transparency and uphold the highest standards of corporate governance. Failure to disclose conflicts of interest can lead to legal consequences and damage to the reputation of the corporation and its directors.

Riverside California Conflict of Interest Disclosure of Director of Corporation

Description

How to fill out Riverside California Conflict Of Interest Disclosure Of Director Of Corporation?

If you need to find a reliable legal document provider to obtain the Riverside Conflict of Interest Disclosure of Director of Corporation, consider US Legal Forms. No matter if you need to launch your LLC business or manage your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the appropriate template.

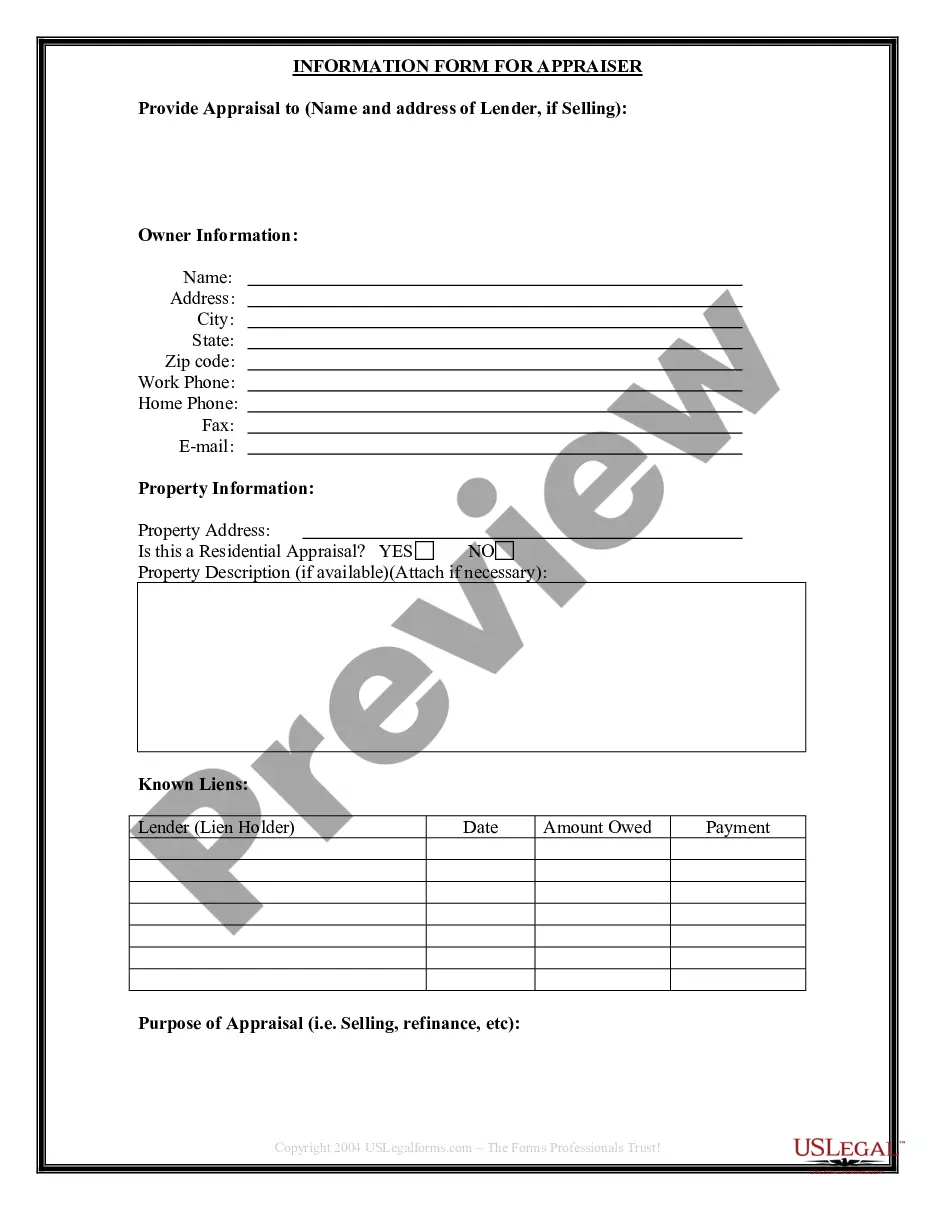

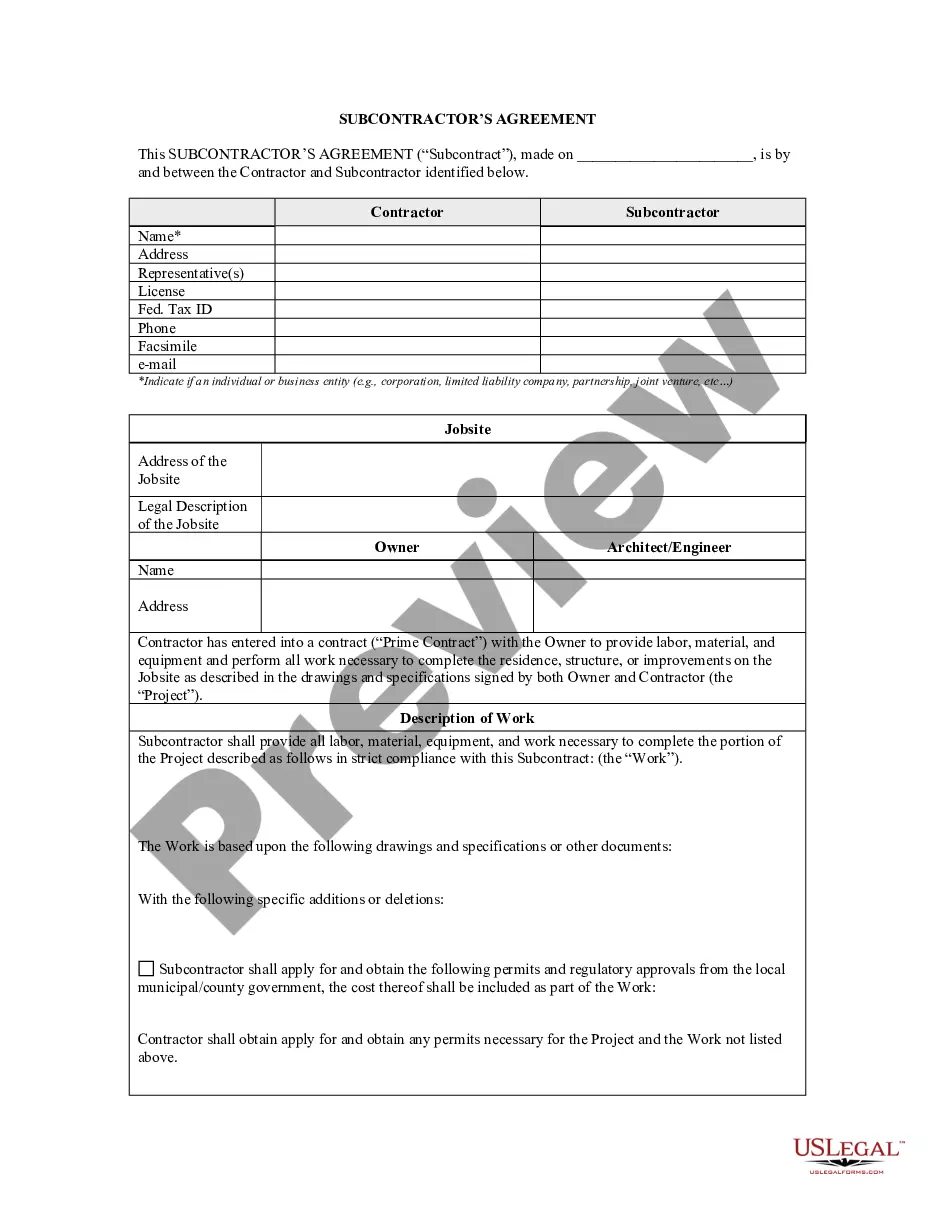

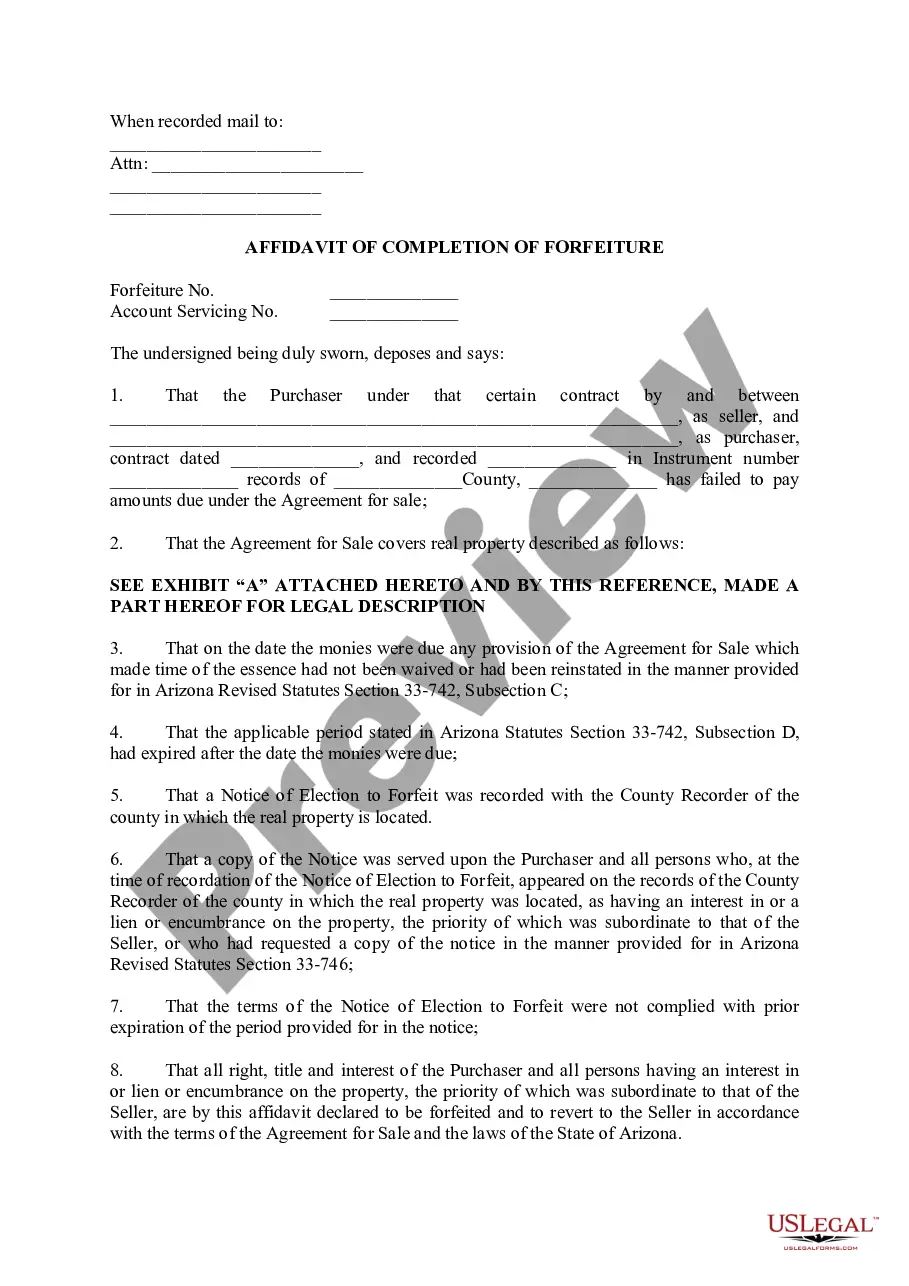

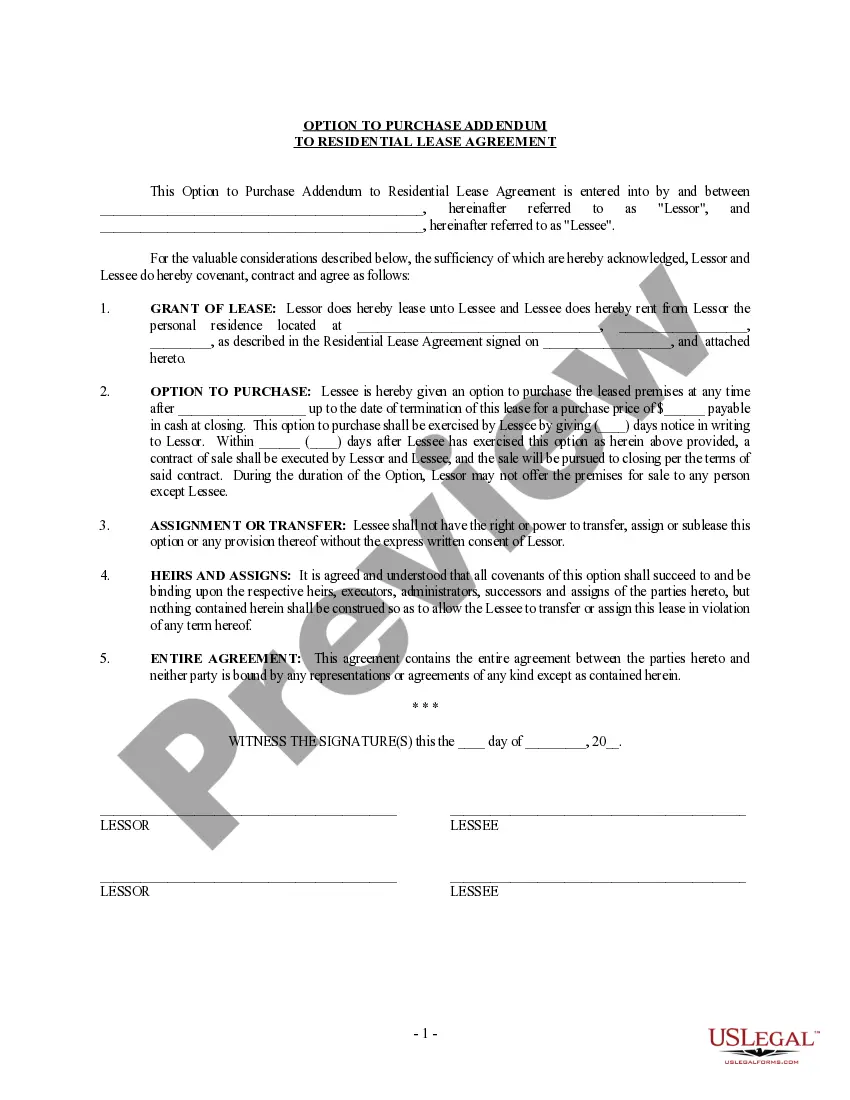

- You can select from over 85,000 forms arranged by state/county and situation.

- The intuitive interface, number of learning resources, and dedicated support make it simple to locate and execute various paperwork.

- US Legal Forms is a trusted service providing legal forms to millions of customers since 1997.

Simply select to look for or browse Riverside Conflict of Interest Disclosure of Director of Corporation, either by a keyword or by the state/county the form is intended for. After locating required template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to start! Simply find the Riverside Conflict of Interest Disclosure of Director of Corporation template and take a look at the form's preview and description (if available). If you're comfortable with the template’s terminology, go ahead and click Buy now. Create an account and select a subscription plan. The template will be instantly available for download as soon as the payment is processed. Now you can execute the form.

Handling your law-related matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our comprehensive variety of legal forms makes this experience less costly and more reasonably priced. Set up your first company, arrange your advance care planning, draft a real estate agreement, or complete the Riverside Conflict of Interest Disclosure of Director of Corporation - all from the convenience of your home.

Sign up for US Legal Forms now!