San Jose, California Conflict of Interest Disclosure of Director of Corporation: A Comprehensive Guide Introduction: In San Jose, California, directors of corporations are required to adhere to strict Conflict of Interest Disclosure regulations to ensure transparency, protect shareholders' interests, and maintain ethical business practices. These regulations aim to prevent conflicts of interest that may compromise the director's ability to act objectively on behalf of the corporation. Key Concepts: 1. Conflict of Interest: A conflict of interest arises when a director's personal, financial, or relational interests conflict with their duty to act in the best interests of the corporation and its shareholders. 2. Disclosure Obligations: Directors must disclose any potential conflicts of interest or any interest they may have in transactions that could benefit them personally or entities they're affiliated with. Such disclosures must be made promptly and in writing to the corporation's board of directors. 3. Duty of Loyalty: Directors have a fiduciary duty to prioritize the corporation's interests over their personal interests, ensuring they act with undivided loyalty. Failure to fulfill this duty can lead to legal consequences. Types of Conflict of Interest Disclosures: 1. Financial Conflicts: This type of conflict arises when a director has a financial interest in a transaction, agreement, investment, or relationship that may directly or indirectly impact the corporation. 2. Competitive Conflicts: Directors must disclose any involvement or interest in a business venture that may compete with the corporation, potentially compromising their ability to impartially make decisions. 3. Family or Personal Relationships: Directors need to disclose any familial, romantic, or personal relationships that could influence their judgment or create a bias towards specific individuals or entities involved in the corporation's operations. 4. Indirect Conflicts: Directors must also disclose any conflicts of interest that arise due to their relationship with another organization or individual, such as a consultant, supplier, or customer, that may impact their judgment. Consequences of Non-Compliance: Failure to abide by the Conflict of Interest Disclosure requirements can lead to severe consequences for directors, including: 1. Legal repercussions: Violations may result in legal action, civil lawsuits, monetary penalties, or even criminal charges for fraudulent behavior. 2. Damaged reputation: Non-compliance can tarnish a director's professional reputation, affecting their future career prospects and credibility within the business community. 3. Shareholder dissatisfaction: Failure to properly disclose conflicts of interest may lead to shareholder lawsuits, loss of trust, and decreased confidence in the corporation's management. Conclusion: In San Jose, California, the Conflict of Interest Disclosure for directors of corporations is a vital component of ensuring ethical business practices and maintaining transparency. Directors must proactively identify and disclose any conflicts of interest, be they financial, competitive, or relational. Compliance with these regulations protects the corporation's interests, preserves shareholder trust, and upholds the integrity of corporate decision-making processes.

San Jose California Conflict of Interest Disclosure of Director of Corporation

Description

How to fill out San Jose California Conflict Of Interest Disclosure Of Director Of Corporation?

Laws and regulations in every sphere differ from state to state. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid high priced legal assistance when preparing the San Jose Conflict of Interest Disclosure of Director of Corporation, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal templates. It's a great solution for professionals and individuals looking for do-it-yourself templates for various life and business occasions. All the forms can be used multiple times: once you purchase a sample, it remains accessible in your profile for future use. Thus, if you have an account with a valid subscription, you can just log in and re-download the San Jose Conflict of Interest Disclosure of Director of Corporation from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the San Jose Conflict of Interest Disclosure of Director of Corporation:

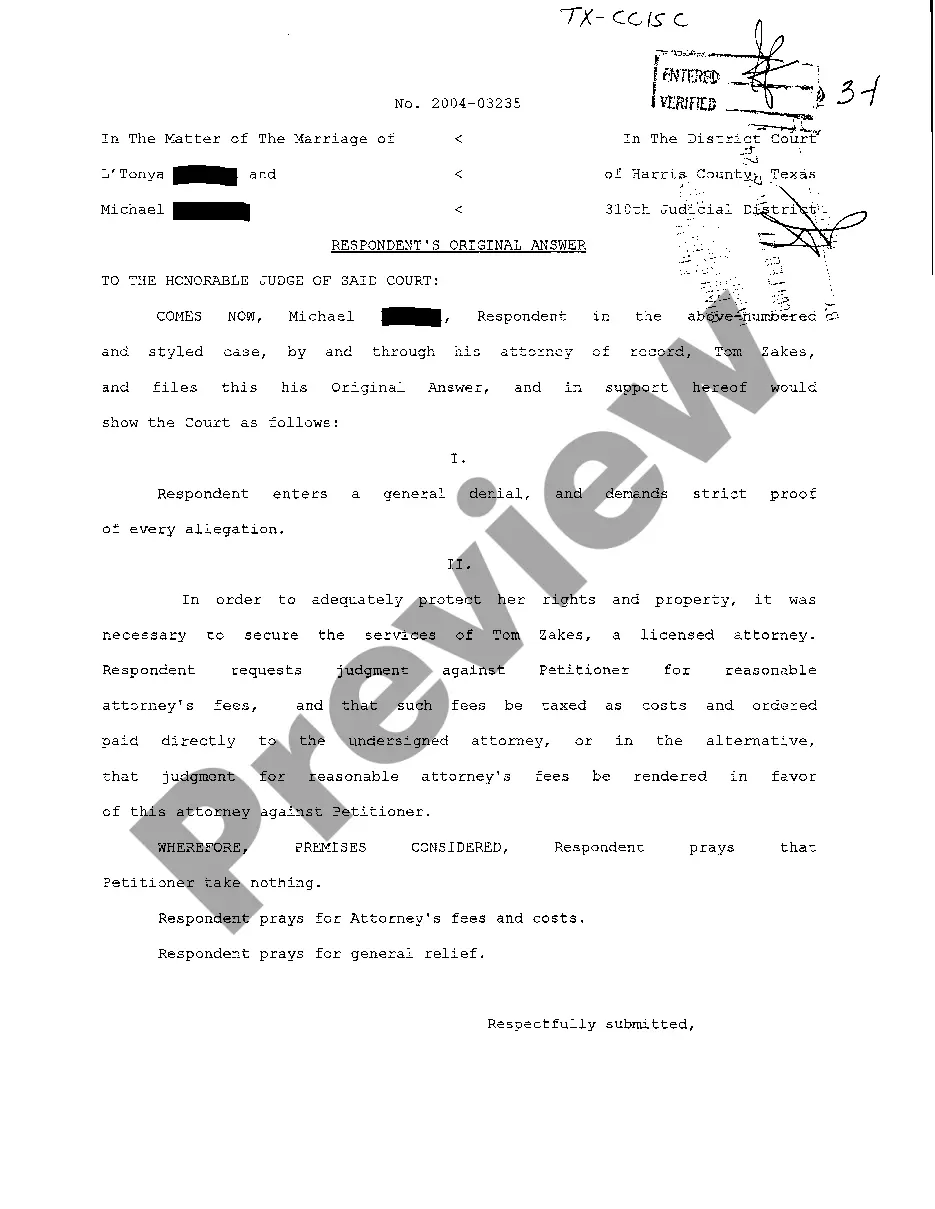

- Take a look at the page content to make sure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to get the template once you find the appropriate one.

- Opt for one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

A conflict of interest is defined as a financial transaction of such significance that it could influence the director or officer's judgment. If the director or officer would gain some financial, personal, or other benefit from a transaction, there is likely a conflict. about whether to proceed.

If you find yourself in a position of an actual, potential or a perceived conflict of interest you must declare it so that action can be taken to assess the risk and, where required, to manage or mitigate it. The University provides an on-line Declaration of Conflict of Interest form to assist you complete this task.

Declaring conflicts of interest is critical for maintaining the integrity of unbiased professional editorial assessment of the publications. When discovering potential conflicts of interest that have not been declared by the authors, this highlights a hidden manipulation or misconduct exist in the study.

Examples of financial interests that may need to be disclosed include gifts, sources of income, significant liabilities, shareholdings, trusts, directorships, real estate or involvement in self- managed superannuation funds that have the potential to generate a real or apparent conflict with official duties.

Section 75(3) provides that where a company has a sole director and that director is conflicted, any decision by that sole director must be approved by an ordinary resolution of the shareholders.

A Conflict of Interest arises when a financial or other personal interest, activity, or relationship may reasonably be expected to compromise an Employee's judgment in carrying out University responsibilities. All employees have an ongoing duty to disclose any conflict when it arises.

Avoiding hard questions and giving in to groupthink. Not knowing and understanding federal, state and local laws. Non-profit organization directors not knowing the laws for the type of non-profit organization they run. Having ex parte discussions outside the boardroom.

The duty to avoid a conflict of interest is one of the fiduciary duties of directors. A director must, at all times, act in the best interests of the company, and in so doing, avoid conflicts of interest and/or adhere to all prescribed processes where a conflict arises.

What to do when you have a conflict of interest As soon as you encounter a possible conflict of interest, notify the COM immediately.Ask that any COM or internal papers that discuss the matter not be posted to you. Avoid any informal discussions that might influence fellow COM members on the matter.

(1) A director of a company who has a material personal interest in a matter that relates to the affairs of the company must give the other directors notice of the interest unless subsection (2) says otherwise.