Salt Lake Utah Demand for a Shareholders Meeting is an essential aspect of corporate governance and enables shareholders to address important matters regarding the company's direction, performance, and decision-making. This detailed description will shed light on the meaning, significance, and types of Salt Lake Utah Demand for a Shareholders Meeting. Salt Lake Utah Demand for a Shareholders Meeting refers to the legal provision that allows shareholders of a company, based in Salt Lake City, Utah, to request a meeting exclusively organized for shareholders. This demand can be put forth by individual shareholders or a group of shareholders, provided they hold a certain percentage of shares (typically 10% or more) or as specified by the company's bylaws or applicable laws. By convening a Shareholders Meeting, the shareholders aim to voice their concerns, ask questions, and exercise their voting rights on critical corporate matters that directly impact their investments. The demand for such a meeting is often motivated by various factors, including: 1. Transparency and Accountability: Shareholders may request a meeting to seek transparency in the company's operations, financial statements, and decision-making processes. They can demand explanations on key issues, such as executive compensation, potential conflicts of interest, or corporate social responsibility practices. 2. Corporate Governance Issues: Shareholders concerned about the management's practices, the board of directors' composition, or the implementation of governance policies may call for a meeting to discuss and potentially rectify any perceived shortcomings. 3. Company Performance: If shareholders are dissatisfied with the company's financial performance, strategic direction, or market position, they may demand a meeting to address these concerns. They can inquire about proposed plans, growth strategies, or potential mergers and acquisitions. 4. Extraordinary Events: In cases of major corporate events like mergers, acquisitions, or significant changes in ownership structure, shareholders may require a meeting to seek clarifications, express their opinions, and evaluate potential impacts. While Salt Lake Utah Demand for a Shareholders Meeting generally refers to the overall process and purpose, there can be variations based on specific types, such as: 1. Extraordinary General Meeting (EGG): This type of meeting is called outside the regular annual general meeting to discuss urgent matters that can't wait until the next scheduled gathering. Eggs are usually requested during exceptional circumstances or when time-sensitive decisions need to be made. 2. Special Shareholders Meeting: Some companies may classify specific meetings as special shareholders meetings, where predetermined topics are exclusively discussed. For example, a special meeting might focus on electing the board of directors or approving fundamental changes to the company's bylaws. 3. Proxy Demanded Meeting: When shareholders cannot attend a meeting physically, they can issue a demand for a Proxy Meeting. In this case, shareholders can designate another person as their representative to attend, vote, and speak on their behalf. In conclusion, Salt Lake Utah Demand for a Shareholders Meeting ensures that shareholders have a platform to express their concerns, exercise their rights, and actively participate in corporate decision-making processes. These meetings contribute to transparent governance practices and foster a healthy relationship between the company's management and its stakeholders.

Salt Lake Utah Demand for a Shareholders Meeting

Description

How to fill out Salt Lake Utah Demand For A Shareholders Meeting?

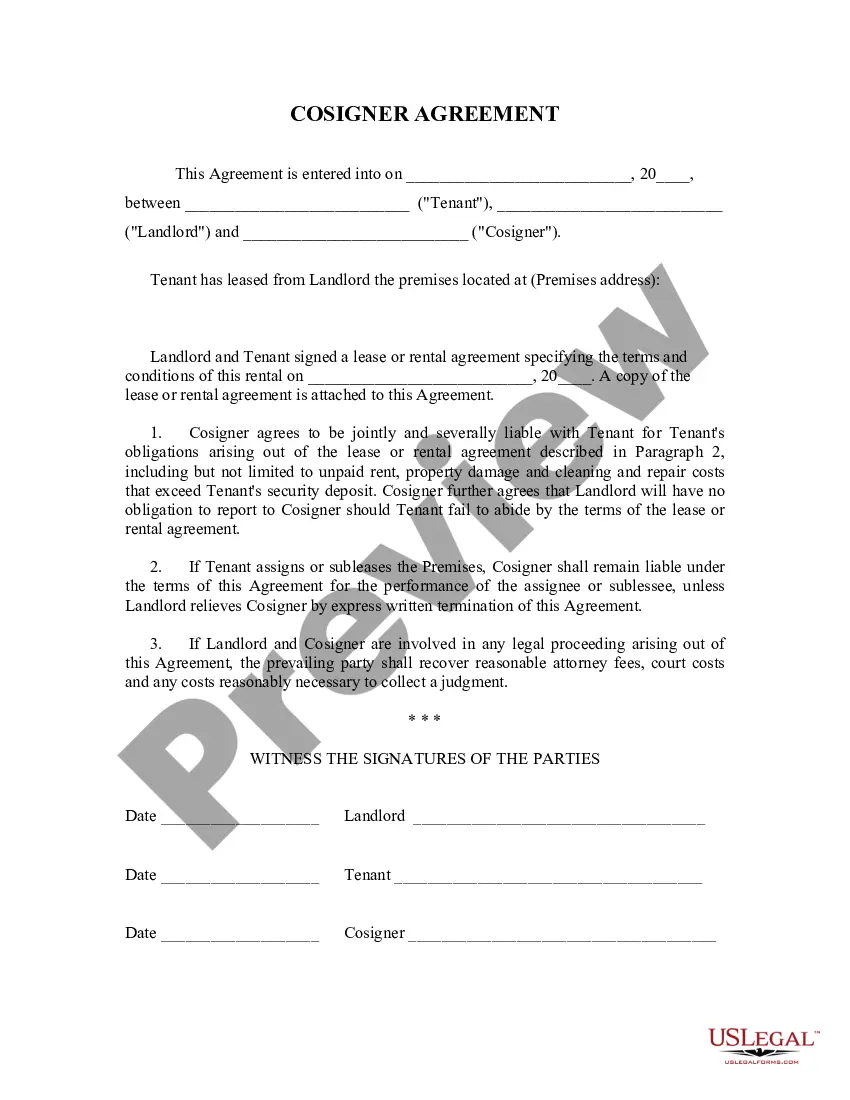

How much time does it usually take you to create a legal document? Because every state has its laws and regulations for every life sphere, finding a Salt Lake Demand for a Shareholders Meeting suiting all regional requirements can be tiring, and ordering it from a professional lawyer is often expensive. Many online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online collection of templates, grouped by states and areas of use. Apart from the Salt Lake Demand for a Shareholders Meeting, here you can find any specific form to run your business or personal deeds, complying with your regional requirements. Experts verify all samples for their validity, so you can be sure to prepare your paperwork properly.

Using the service is remarkably simple. If you already have an account on the platform and your subscription is valid, you only need to log in, select the needed sample, and download it. You can get the document in your profile anytime in the future. Otherwise, if you are new to the website, there will be a few more steps to complete before you get your Salt Lake Demand for a Shareholders Meeting:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another form utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the selected document.

- Decide on the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Salt Lake Demand for a Shareholders Meeting.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased document, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!