Los Angeles, California is a vibrant city located on the West Coast of the United States. With its iconic landmarks, diverse population, and robust economy, Los Angeles is often referred to as the entertainment capital of the world. When drafting an agreement for the sale of corporate assets in Los Angeles, there are several important matters that need to be considered. These matters ensure that both parties involved in the agreement are protected and that the transaction is conducted smoothly. 1. Identification of Parties: Clearly identify all parties involved in the agreement, including the buyer and seller of the corporate assets. Include full legal names, addresses, and contact information. 2. Asset Description: Provide a detailed description of the corporate assets being sold, including their condition, quantity, and any relevant warranties or guarantees. 3. Purchase Price: Specify the agreed-upon purchase price for the assets, including any adjustments or installments. Outline the payment terms, including due dates and acceptable payment methods. 4. Representations and Warranties: State any representations or warranties made by the seller regarding the assets being sold. Address any limitations or disclaimers of liability related to these representations and warranties. 5. Due Diligence: Establish a timeframe for the buyer to conduct due diligence, allowing them to investigate the assets, finances, and potential risks associated with the purchase. Clearly define the rights and obligations of both parties during this period. 6. Closing and Delivery: Outline the process and timeline for closing the sale, including the transfer of ownership, delivery of assets, and any necessary regulatory approvals or consents. 7. Allocation of Liabilities: Determine how any existing liabilities and obligations of the corporation will be handled, such as outstanding debts, pending lawsuits, or ongoing contracts. Clarify which party will assume these liabilities after the sale. 8. Intellectual Property: If applicable, specify the treatment of any intellectual property rights owned by the corporation, such as trademarks, patents, or copyrights. Address any licenses or assignments of these rights. 9. Confidentiality and Non-Competition: Address any confidentiality or non-disclosure obligations that may arise from the sale. If applicable, include non-competition clauses restricting the seller from engaging in similar activities after the sale. 10. Governing Law and Dispute Resolution: Determine the jurisdiction and governing law that will apply to the agreement. Specify the procedure for resolving any disputes, such as arbitration or mediation. Different types of Los Angeles California Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets could include variations based on the specific nature of the corporate assets being sold. This could include real estate assets, intellectual property assets, or tangible assets such as machinery or vehicles. Each type may require additional considerations and provisions in the agreement based on the unique characteristics of the assets involved.

Los Angeles California Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets

Description

How to fill out Los Angeles California Checklist Of Matters To Be Considered In Drafting Agreement For Sale Of Corporate Assets?

Drafting paperwork for the business or personal demands is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's crucial to consider all federal and state laws and regulations of the particular area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it tense and time-consuming to generate Los Angeles Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets without professional assistance.

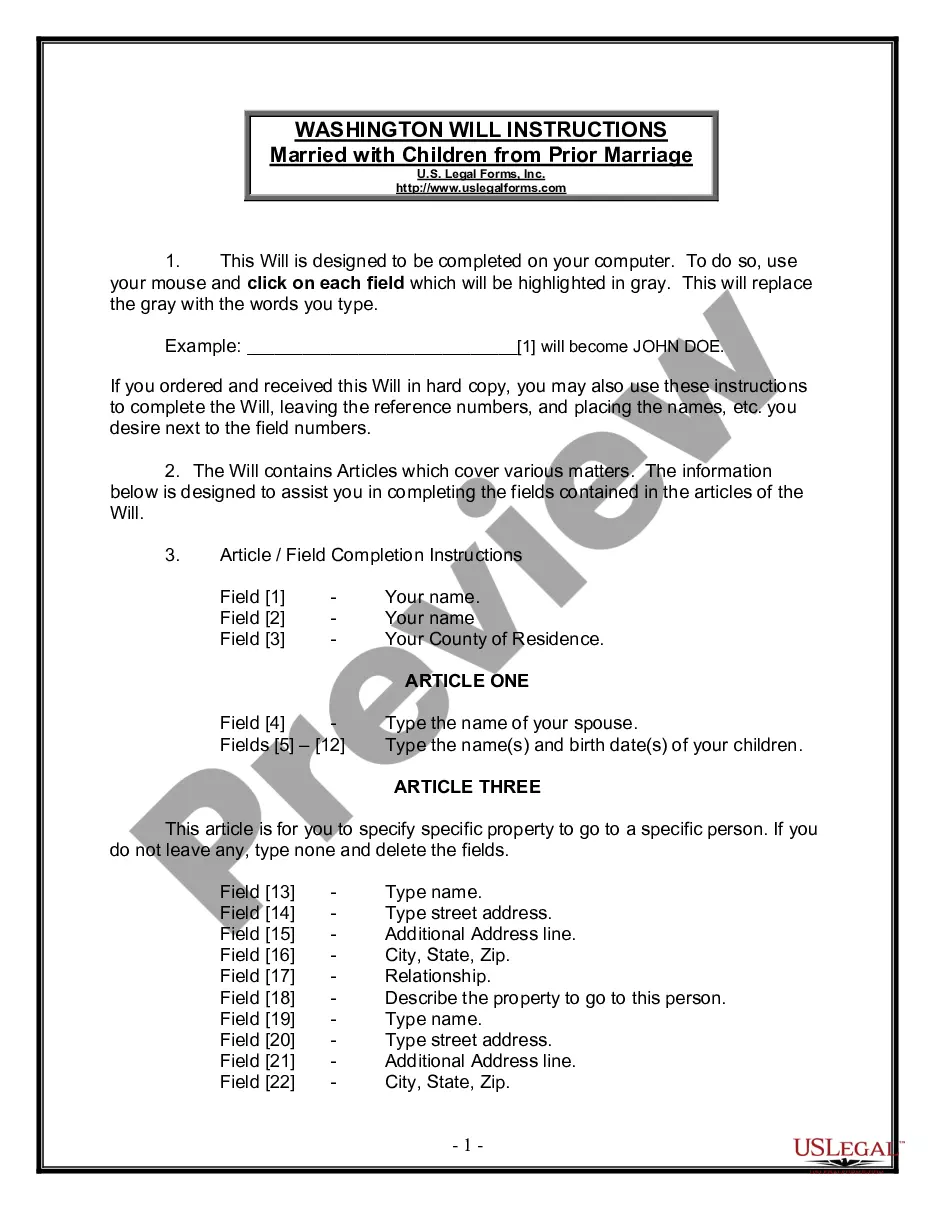

It's possible to avoid spending money on lawyers drafting your paperwork and create a legally valid Los Angeles Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets by yourself, using the US Legal Forms web library. It is the largest online catalog of state-specific legal documents that are professionally cheched, so you can be sure of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to save the necessary document.

If you still don't have a subscription, adhere to the step-by-step guideline below to get the Los Angeles Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets:

- Look through the page you've opened and verify if it has the document you require.

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that fits your needs, use the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Choose the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal forms for any use case with just a couple of clicks!