Los Angeles, California is a vibrant city located on the West Coast of the United States. With its iconic landmarks, diverse population, and robust economy, Los Angeles is often referred to as the entertainment capital of the world. When drafting an agreement for the sale of corporate assets in Los Angeles, there are several important matters that need to be considered. These matters ensure that both parties involved in the agreement are protected and that the transaction is conducted smoothly. 1. Identification of Parties: Clearly identify all parties involved in the agreement, including the buyer and seller of the corporate assets. Include full legal names, addresses, and contact information. 2. Asset Description: Provide a detailed description of the corporate assets being sold, including their condition, quantity, and any relevant warranties or guarantees. 3. Purchase Price: Specify the agreed-upon purchase price for the assets, including any adjustments or installments. Outline the payment terms, including due dates and acceptable payment methods. 4. Representations and Warranties: State any representations or warranties made by the seller regarding the assets being sold. Address any limitations or disclaimers of liability related to these representations and warranties. 5. Due Diligence: Establish a timeframe for the buyer to conduct due diligence, allowing them to investigate the assets, finances, and potential risks associated with the purchase. Clearly define the rights and obligations of both parties during this period. 6. Closing and Delivery: Outline the process and timeline for closing the sale, including the transfer of ownership, delivery of assets, and any necessary regulatory approvals or consents. 7. Allocation of Liabilities: Determine how any existing liabilities and obligations of the corporation will be handled, such as outstanding debts, pending lawsuits, or ongoing contracts. Clarify which party will assume these liabilities after the sale. 8. Intellectual Property: If applicable, specify the treatment of any intellectual property rights owned by the corporation, such as trademarks, patents, or copyrights. Address any licenses or assignments of these rights. 9. Confidentiality and Non-Competition: Address any confidentiality or non-disclosure obligations that may arise from the sale. If applicable, include non-competition clauses restricting the seller from engaging in similar activities after the sale. 10. Governing Law and Dispute Resolution: Determine the jurisdiction and governing law that will apply to the agreement. Specify the procedure for resolving any disputes, such as arbitration or mediation. Different types of Los Angeles California Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets could include variations based on the specific nature of the corporate assets being sold. This could include real estate assets, intellectual property assets, or tangible assets such as machinery or vehicles. Each type may require additional considerations and provisions in the agreement based on the unique characteristics of the assets involved.

Los Angeles California Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets

Description

How to fill out Los Angeles California Checklist Of Matters To Be Considered In Drafting Agreement For Sale Of Corporate Assets?

Drafting paperwork for the business or personal demands is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's crucial to consider all federal and state laws and regulations of the particular area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it tense and time-consuming to generate Los Angeles Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets without professional assistance.

It's possible to avoid spending money on lawyers drafting your paperwork and create a legally valid Los Angeles Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets by yourself, using the US Legal Forms web library. It is the largest online catalog of state-specific legal documents that are professionally cheched, so you can be sure of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to save the necessary document.

If you still don't have a subscription, adhere to the step-by-step guideline below to get the Los Angeles Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets:

- Look through the page you've opened and verify if it has the document you require.

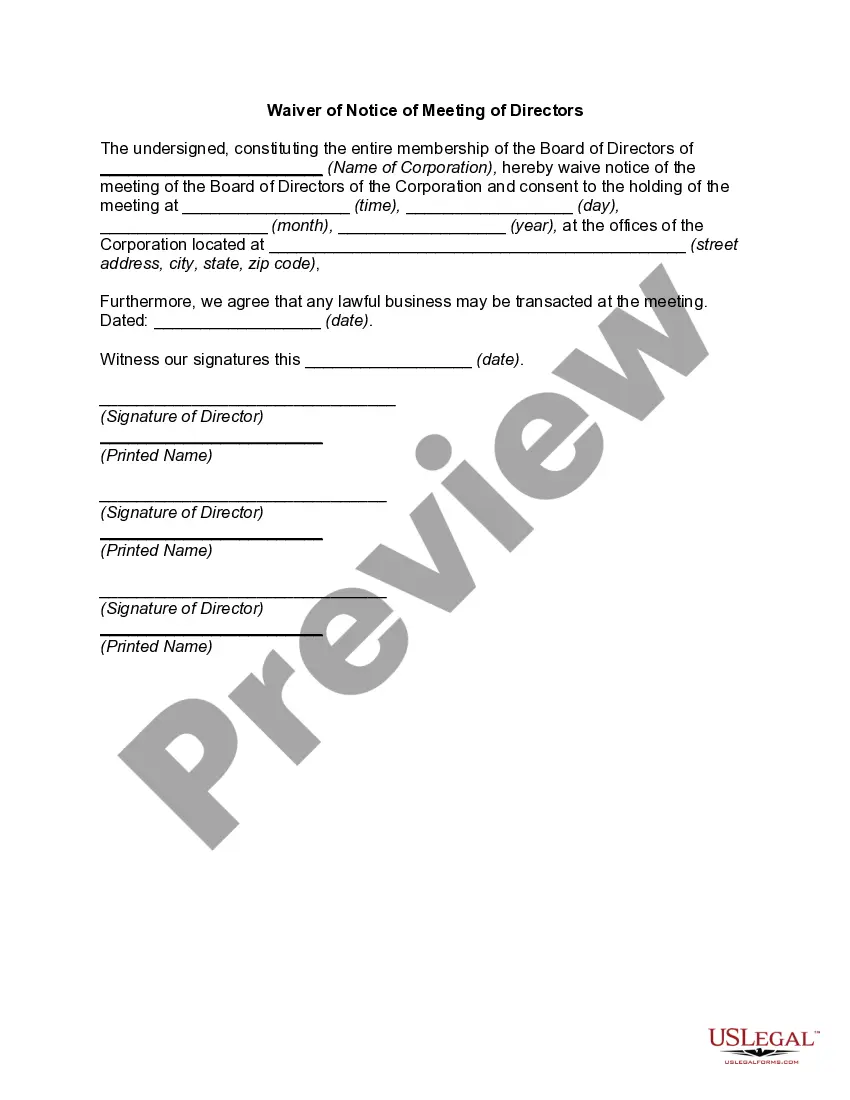

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that fits your needs, use the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Choose the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal forms for any use case with just a couple of clicks!

Form popularity

FAQ

The buyer's solicitor will prepare and draft the sale contract, no matter whether it is an Asset Purchase Agreement or an SPA, this is because the contract will provide for a number of warranties (and possibly indemnities) but it will also govern who the purchase will be carried out, the purchase price to be paid,

A contract doesn't have to be on a preprinted or standardized form: It can be written on a napkin and still be legitimate. Two parties can agree between themselves and create their own contract. Contract law, however, requires that all contracts must contain certain elements to be valid and enforceable.

The Basics of a Business Purchase Agreement Parties. This section appears at the beginning of the purchase agreement and lists the legal names of the seller and buyer, as well as their contact information. Description of Business.Sale.Covenants.Transition.Participation or Absence of Brokers.Closing.Appendices.

What to include in a business sales contract. Name the parties. Clearly state the names and locations of the buyer and seller.List the assets.Define liabilities.Set sale terms.Include other agreements.Make your sales agreement digital.

The Three Elements of an Enforceable Business Contract The Offer. The first element of a valid contract is an offer.The Acceptance. When an offer is made by one party, the offer must be accepted by the other party for the contract to be valid.Consideration.

The simple answer is YES. You can write your own contracts. There is no requirement that they must be written by a lawyer. There is no requirement that they have to be a certain form or font.

Identify the purpose: It is most fundamental to the drafting process, to ensure you have properly identified what the object of the contract is. Listen to the client carefully and verify with him to double check you know exactly what he wants.

Write the contract in six steps Start with a contract template.Open with the basic information.Describe in detail what you have agreed to.Include a description of how the contract will be ended.Write into the contract which laws apply and how disputes will be resolved.Include space for signatures.

The following assets and liabilities are normally included in the sale: Working capital. Cash (but only the amount necessary to pay expenses for a reasonable period of time) Accounts receivable. Inventory. Work in progress. Prepaid expenses. Accounts payable. Wages payable.Furniture & fixtures. Equipment. Vehicles.

Here are parts of an asset purchase agreement that you may want to include in your document. Recitals.Definitions.Purchase Price and Allocation.Closing Terms.Warranties.Covenants.Indemnification.Governance.