San Antonio, Texas, is a vibrant and culturally rich city located in the southern part of the state. Known for its historic charm, diverse population, and delicious Tex-Mex cuisine, San Antonio offers residents and visitors a wide array of attractions and activities to enjoy. From exploring the iconic River Walk to visiting the historic Alamo, there is something for everyone in this bustling city. When it comes to drafting an agreement for the sale of corporate assets in San Antonio, there are several matters that need to be considered. These matters ensure that the agreement is comprehensive, legally sound, and protects the interests of all parties involved. Below is a checklist of key considerations when drafting such an agreement: 1. Identification: Clearly identify the parties involved in the sale, including the buyer and seller, by providing their legal names, addresses, and contact information. 2. Asset Description: Make a detailed list of the assets being sold, including any buildings, land, equipment, inventory, contracts, trademarks, or intellectual property. 3. Purchase Price: State the agreed-upon purchase price, including any adjustments or conditions that may affect the final amount, such as an earn-out provision or assumption of liabilities. 4. Payment Terms: Specify the payment terms for the sale, including the schedule for payment, any installment options, and whether any portion of the purchase price should be held in escrow. 5. Representations and Warranties: Outline the representations and warranties made by both the buyer and seller regarding the assets being sold, including their condition, ownership, and any applicable licenses or permits. 6. Due Diligence: Address the necessary due diligence processes that the buyer will undertake to ensure they are fully informed about the assets being sold, such as inspection, appraisal, or legal review. 7. Closing Conditions: Identify any conditions that must be satisfied before the sale can proceed, such as regulatory approvals, consents from third parties, or completion of any required documentation. 8. Allocation of Liabilities: Clearly define how liabilities, including existing debts, taxes, or obligations, are to be allocated between the buyer and seller, ensuring that both parties agree on who assumes responsibility for each. 9. Non-Competition and Confidentiality: If applicable, include non-competition and confidentiality clauses to protect the buyer's interests and prevent the seller from competing or disclosing sensitive information. 10. Governing Law and Dispute Resolution: Specify the governing law that will apply to the agreement and outline the preferred method for resolving any disputes that may arise, such as mediation, arbitration, or litigation. These considerations apply to the general agreement for the sale of corporate assets in San Antonio, Texas. However, if there are specific types of agreements within this category, they may include: — Real Estate Asset Sale Agreement: Focuses on the sale of real property, such as buildings, land, or developed spaces owned by a corporation. — Intellectual Property Asset Sale Agreement: Specifically addresses the transfer of intellectual property rights, such as patents, trademarks, copyrights, or trade secrets. — Stock or Share Purchase Agreement: Deals with the sale of corporate shares or stocks, including provisions for the transfer of control and ownership in a corporation. In conclusion, drafting an agreement for the sale of corporate assets in San Antonio, Texas, requires careful consideration of various factors. By addressing the necessary matters outlined in the checklist, parties can ensure a comprehensive and legally sound agreement that protects their interests in this culturally vibrant city.

San Antonio Texas Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets

Description

How to fill out San Antonio Texas Checklist Of Matters To Be Considered In Drafting Agreement For Sale Of Corporate Assets?

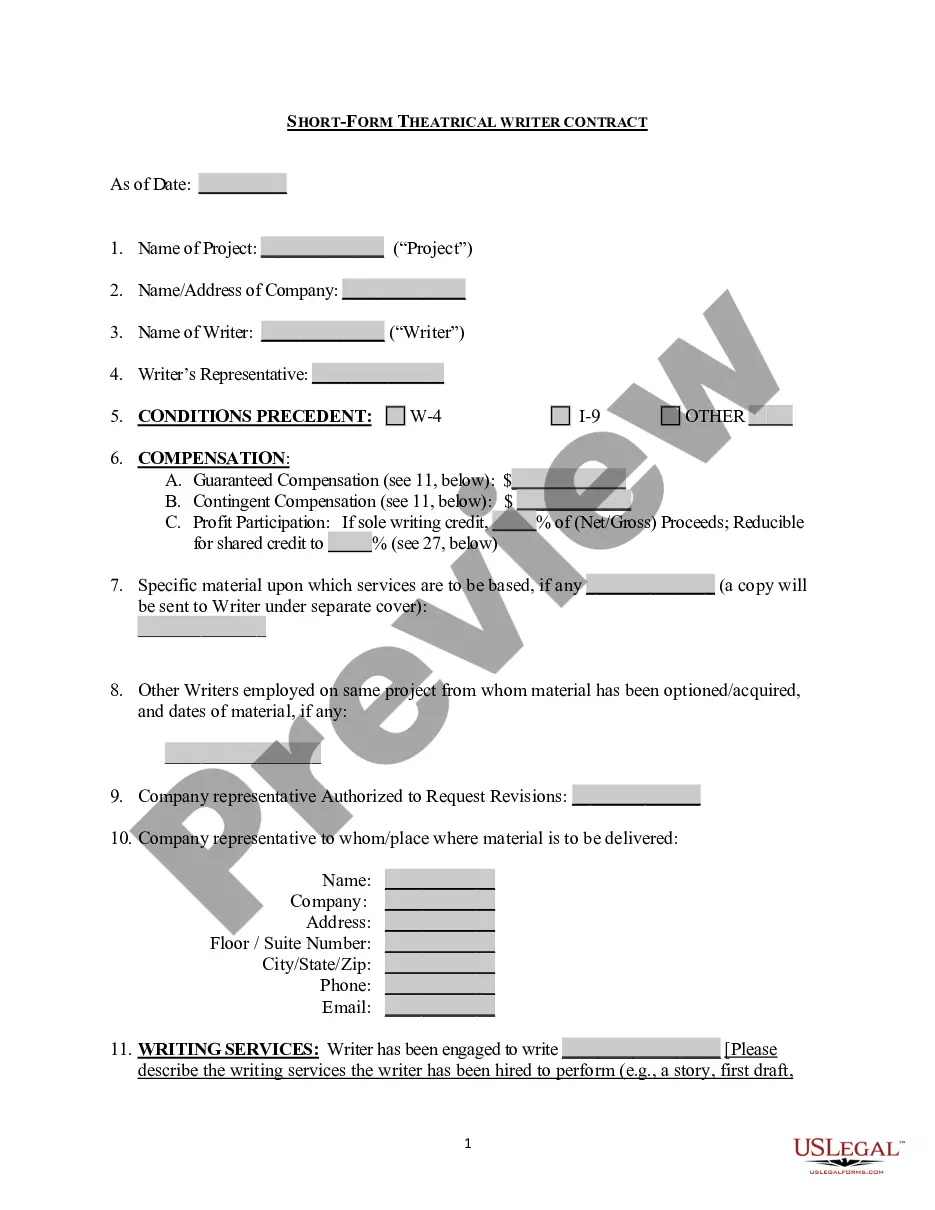

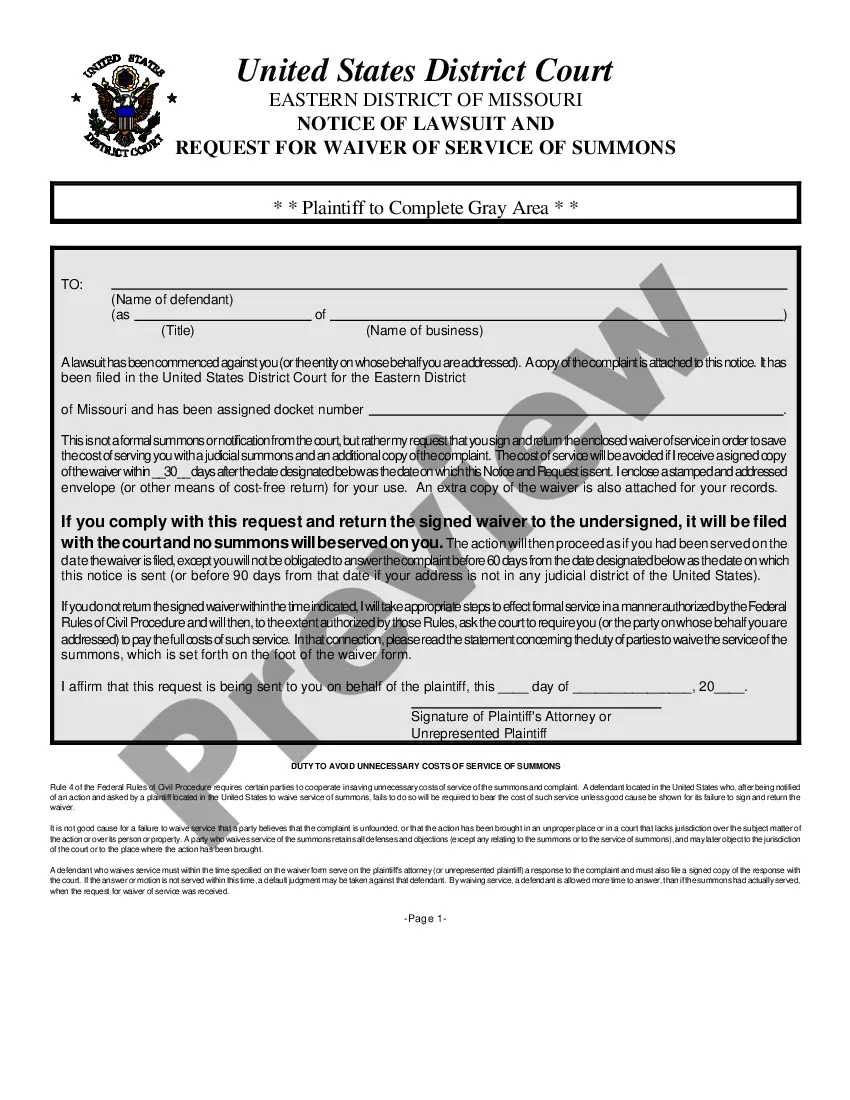

Preparing legal paperwork can be difficult. Besides, if you decide to ask a lawyer to write a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce papers, or the San Antonio Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets, it may cost you a lot of money. So what is the best way to save time and money and draw up legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is the most extensive online collection of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any scenario collected all in one place. Consequently, if you need the recent version of the San Antonio Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the San Antonio Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets:

- Look through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the right one in the header.

- Click Buy Now when you find the required sample and choose the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a payment with a credit card or through PayPal.

- Choose the document format for your San Antonio Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets and download it.

When finished, you can print it out and complete it on paper or import the samples to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the paperwork ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

5 Key Elements of a Sales Contract. The goal of any small business is to bring in income, which is usually done by making sales.The Parties to and Date of the Agreement.The Goods or Services Being Sold.The Details of Payment.Delivery Specifications.The Inspection Period.

Most commonly, the buyer's real estate agent will write up and prepare the purchase agreement. Note that agents (not being practicing attorneys themselves) cannot create their own contracts.

The buyer's solicitor will prepare and draft the sale contract, no matter whether it is an Asset Purchase Agreement or an SPA, this is because the contract will provide for a number of warranties (and possibly indemnities) but it will also govern who the purchase will be carried out, the purchase price to be paid,

An asset purchase agreement, also known as an asset sale agreement, business purchase agreement, or APA, is a written legal instrument that formalizes the purchase of a business or significant business asset. It details the structure of the deal, price, limitations, and warranties.

Important clauses in share purchase agreement that need professional attention Parties.Definitions and interpretation.Sale and purchase of shares.Price.Sale conditions.Best and reasonable endeavours.Flexible and deferred payments, and earn-out clauses.Completion.

The seller must represent its authority to sell the asset. Additionally, the seller represents that the purchase price of the asset is equal to its value, and that the seller is not in financial or legal trouble.

5 Elements of a Legally Binding Contract The Offer. Acceptance. Consideration. Mutuality of Obligation. Competency and Capacity. Other Considerations. Types of Contracts. Why Are Contracts Necessary?

5 Essential Elements of a Sales Contract The Description of Goods.Delivery Instructions.Inspection Period.Warranties and Guarantees.Payment Details.Pricing.User's Rights to Access.Service Level Agreement (SLA)

Here are parts of an asset purchase agreement that you may want to include in your document. Recitals.Definitions.Purchase Price and Allocation.Closing Terms.Warranties.Covenants.Indemnification.Governance.

The fundamental elements required to make a contract legally enforceable in the US include a valid offer and acceptance, sufficient consideration, capacity, and legality.