San Jose, California is a vibrant city located in the heart of Silicon Valley. Known for its high-tech industry and innovation, San Jose offers a dynamic blend of business opportunities, cultural experiences, and natural beauty. When drafting an agreement for the sale of corporate assets in San Jose, there are several key considerations to keep in mind. These factors encompass legal, financial, and logistical aspects of the transaction to ensure a smooth and successful sale. 1. Asset Identification: Begin by providing a comprehensive list of the assets being sold, including detailed descriptions, quantities, and any applicable identification numbers or serial numbers. 2. Purchase Price: Establish the agreed-upon purchase price for the assets, including any adjustments or contingencies based on factors such as inspections, appraisals, or market conditions. 3. Payment Terms: Outline the payment terms, including the method, timing, and installment structure of payment, along with any accompanying conditions or warranties. 4. Representations and Warranties: Include clear statements about the condition, ownership, and title of the assets being sold, to provide assurance to the buyer and protect the seller from future claims. 5. Due Diligence: Define the scope and timeline for the buyer's due diligence process, allowing them to inspect and assess the assets thoroughly before finalizing the agreement. 6. Continuing Liabilities: Determine which liabilities, if any, will remain with the seller after the sale, and clearly outline these responsibilities in the agreement. 7. Employee Transitions: Address any potential employment matters, such as the potential transfer of employees, severance agreements, or non-compete clauses, to ensure a smooth transition for both parties involved. 8. Intellectual Property: Detail any intellectual property rights associated with the assets being sold, including trademarks, copyrights, or patents, and clearly specify who will retain ownership of these rights. 9. Closing Conditions: Establish the conditions necessary for closing the agreement, such as obtaining necessary approvals, permits, or consents, and provide a timeline for completing these tasks. 10. Dispute Resolution: Include a provision on how potential disputes between the parties will be resolved, whether through arbitration, mediation, or litigation, to provide a framework for addressing conflicts. 11. Governing Law: Specify the jurisdiction and governing law that will apply to the agreement, which is typically the laws of the state of California. These considerations apply broadly to the drafting of an agreement for the sale of corporate assets in San Jose. However, specific types of assets, such as real estate, intellectual property, or manufacturing equipment, may require additional attention and tailored clauses in the agreement to address their unique characteristics and legal requirements.

San Jose California Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets

Description

How to fill out San Jose California Checklist Of Matters To Be Considered In Drafting Agreement For Sale Of Corporate Assets?

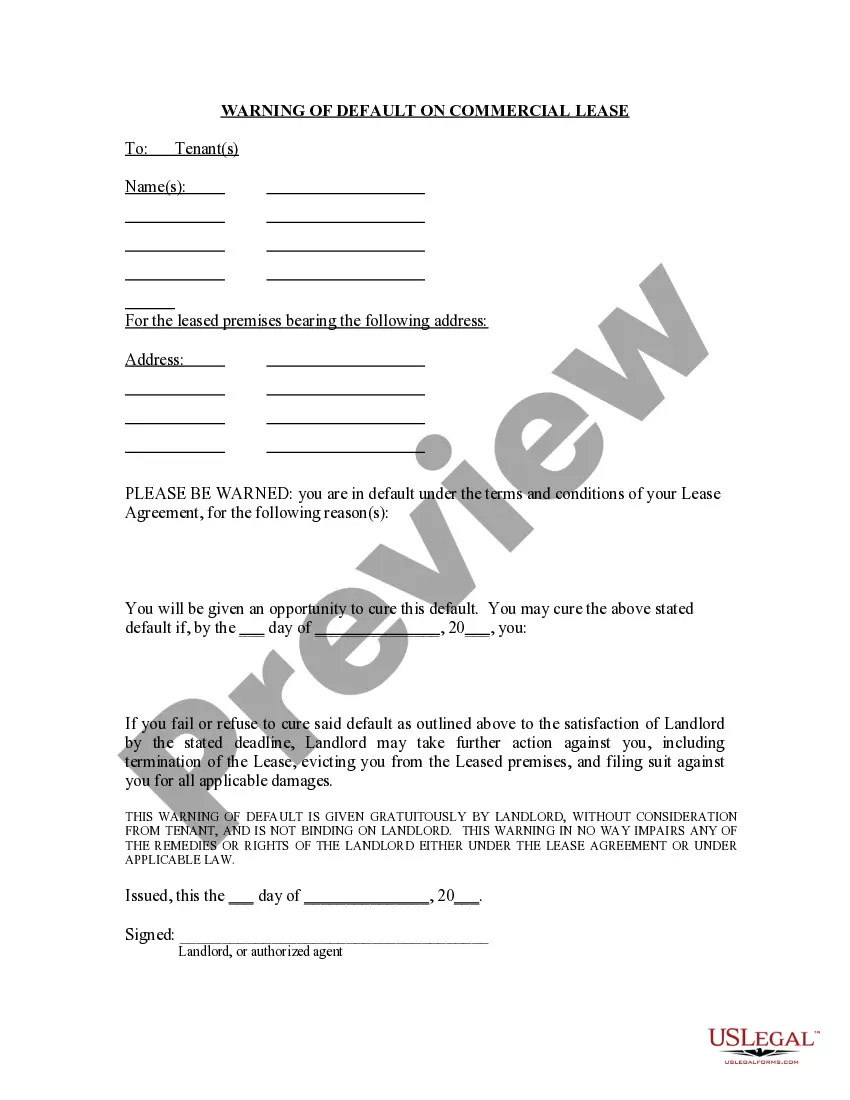

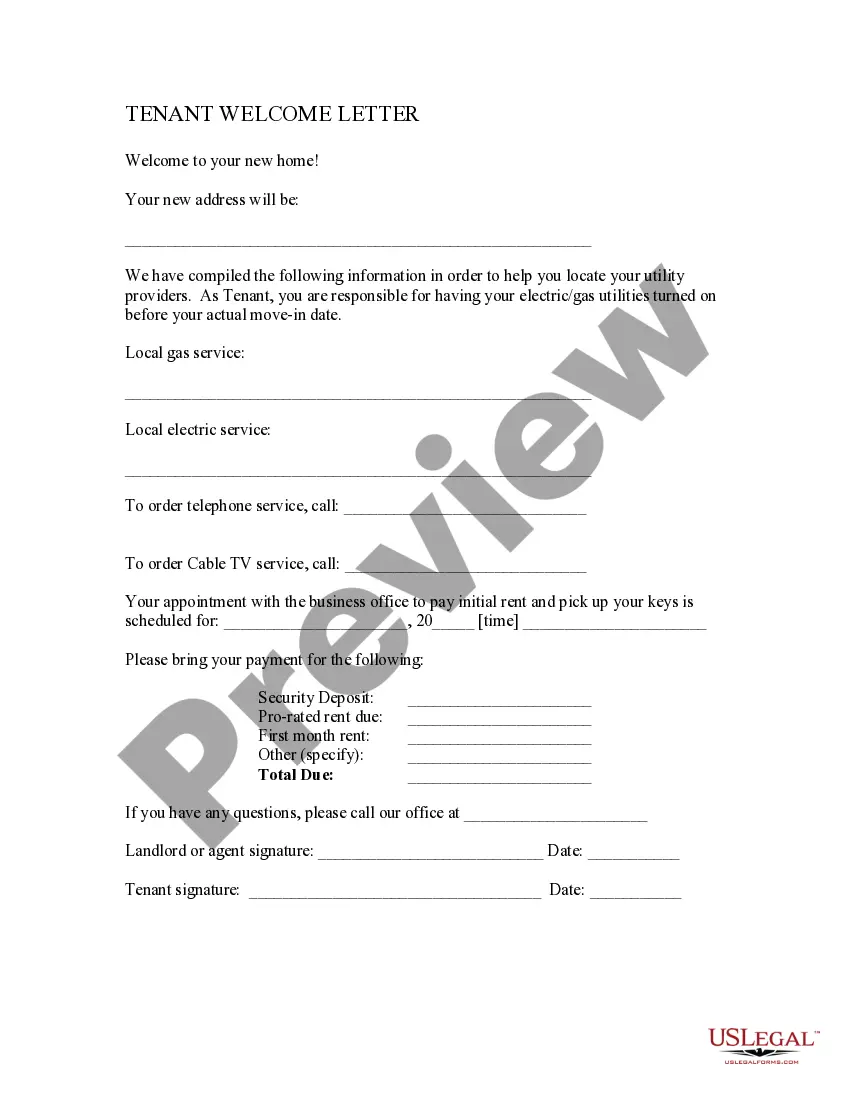

Laws and regulations in every area vary throughout the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documentation. To avoid expensive legal assistance when preparing the San Jose Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets, you need a verified template valid for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal forms. It's a perfect solution for specialists and individuals looking for do-it-yourself templates for different life and business scenarios. All the forms can be used multiple times: once you purchase a sample, it remains accessible in your profile for subsequent use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the San Jose Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets from the My Forms tab.

For new users, it's necessary to make a few more steps to get the San Jose Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets:

- Take a look at the page content to ensure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to get the template once you find the correct one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your documentation in order with the US Legal Forms!