Lima Arizona Credit Application is a formal document that individuals or businesses in need of credit must complete to apply for various financial services in Lima, Arizona. This detailed application captures relevant information about the applicant, enabling financial institutions to evaluate their creditworthiness and make informed decisions. The Lima Arizona Credit Application typically consists of several sections, each requiring specific details to be filled in accurately. These sections may include: 1. Personal Information: This section seeks personal details such as the applicant's full name, address, contact information, social security number, and date of birth. 2. Employment Information: Applicants are asked to provide details about their current and previous employment history, including the employer's name, address, job title, salary, and duration of employment. 3. Financial Information: This section encompasses the applicant's financial standing, including their income sources, assets, liabilities, existing debts, and monthly expenses. This information helps the lender assess the applicant's ability to repay the requested credit amount. 4. Credit History: Here, applicants are required to disclose their credit history, including information on existing loans, mortgages, credit cards, and any history of bankruptcy or delinquency. 5. Purpose of Credit: This section inquires about the intended use of the credit, whether it is for personal, business, or other specific purposes. 6. Collateral: If applicable, this part addresses any collateral the applicant may offer to secure the credit, such as real estate, vehicles, or other valuable assets. Types of Lima Arizona Credit Applications: 1. Personal Credit Application: Designed for individuals seeking personal loans or credit options, such as personal lines of credit, personal loans, or credit cards. 2. Business Credit Application: Geared towards businesses seeking financial assistance, such as term loans, business lines of credit, or equipment financing. 3. Mortgage Loan Application: Used specifically for applying for a mortgage loan to purchase a property or refinance an existing mortgage. 4. Auto Loan Application: Specific to those looking to finance a vehicle purchase through an auto loan. Lima Arizona Credit Applications play a crucial role in the lending process, offering a detailed snapshot of an applicant's financial health and creditworthiness. Accuracy and completeness of the information provided are of utmost importance, as they determine the likelihood of credit approval and the terms and conditions offered by the financial institution.

Pima Arizona Credit Application

Description

How to fill out Pima Arizona Credit Application?

Whether you intend to start your company, enter into an agreement, apply for your ID renewal, or resolve family-related legal concerns, you must prepare certain paperwork corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and checked legal templates for any personal or business occasion. All files are grouped by state and area of use, so picking a copy like Pima Credit Application is quick and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a couple of additional steps to get the Pima Credit Application. Adhere to the instructions below:

- Make sure the sample fulfills your personal needs and state law requirements.

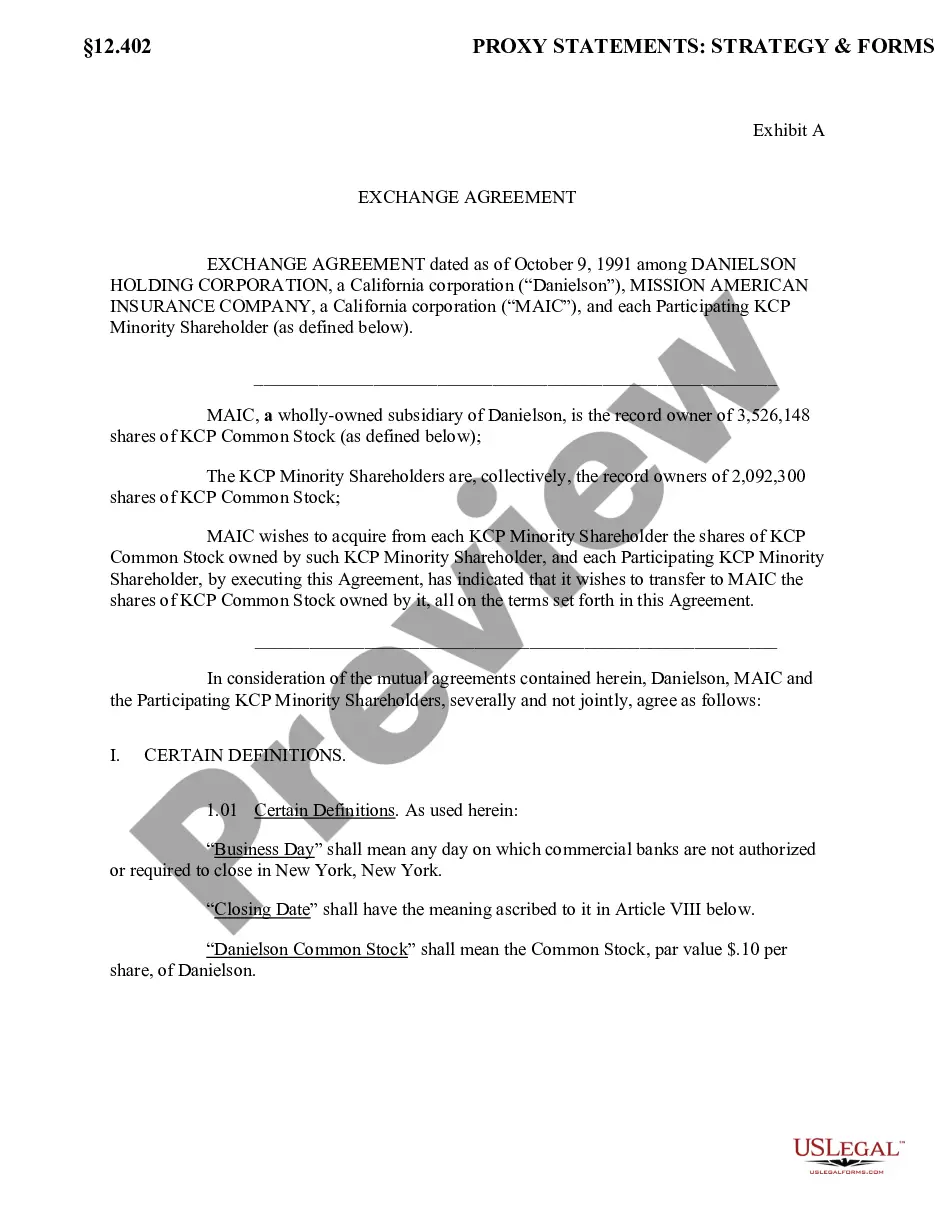

- Look through the form description and check the Preview if available on the page.

- Utilize the search tab providing your state above to find another template.

- Click Buy Now to obtain the file when you find the right one.

- Opt for the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Pima Credit Application in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are reusable. Having an active subscription, you can access all of your earlier purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!