Riverside California Credit Application is a formal document that individuals or businesses residing in Riverside, California, used to apply for credit from financial institutions or lenders. This application plays a crucial role in securing loans, credit cards, mortgages, or any other forms of credit. Keywords: Riverside California, Credit Application, loans, credit cards, mortgages, financial institutions, lenders. There are several types of credit applications commonly used in Riverside, California, tailored to various financing needs: 1. Personal Credit Application: This type of credit application is used by individuals seeking personal loans, credit cards, or other forms of unsecured credit. It requires personal information such as name, address, social security number, employment details, income, and other relevant financial information. 2. Business Credit Application: Designed specifically for businesses, this type of credit application is used to apply for business loans, lines of credit, or other business financing options offered by financial institutions. It includes information about the company's structure, financial statements, tax information, industry analysis, and future growth projections. 3. Mortgage Loan Application: This application type is specific to those looking to purchase or refinance a home in Riverside, California. It entails detailed information about the borrower's financial situation, employment history, credit score, property details, and personal identification. 4. Student Loan Application: Geared towards students pursuing higher education, this credit application is used to apply for student loans offered by federal governments or private lenders. It requires information about the student's educational institution, program of study, and financial resources. 5. Auto Loan Application: This application is used by individuals or businesses interested in purchasing a vehicle in Riverside, California. It involves providing personal and financial details, as well as estimates regarding the vehicle's make, model, and purchase price. Completing a Riverside California Credit Application accurately and honestly is essential, as the information provided will be thoroughly evaluated by lenders to determine creditworthiness and the terms and conditions of credit offers. It is important to carefully read and understand all sections of the credit application, as any discrepancies or incomplete information may affect credit approval and interest rates.

Riverside California Credit Application

Description

How to fill out Riverside California Credit Application?

Preparing documents for the business or personal needs is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's essential to consider all federal and state laws of the specific area. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it burdensome and time-consuming to draft Riverside Credit Application without expert assistance.

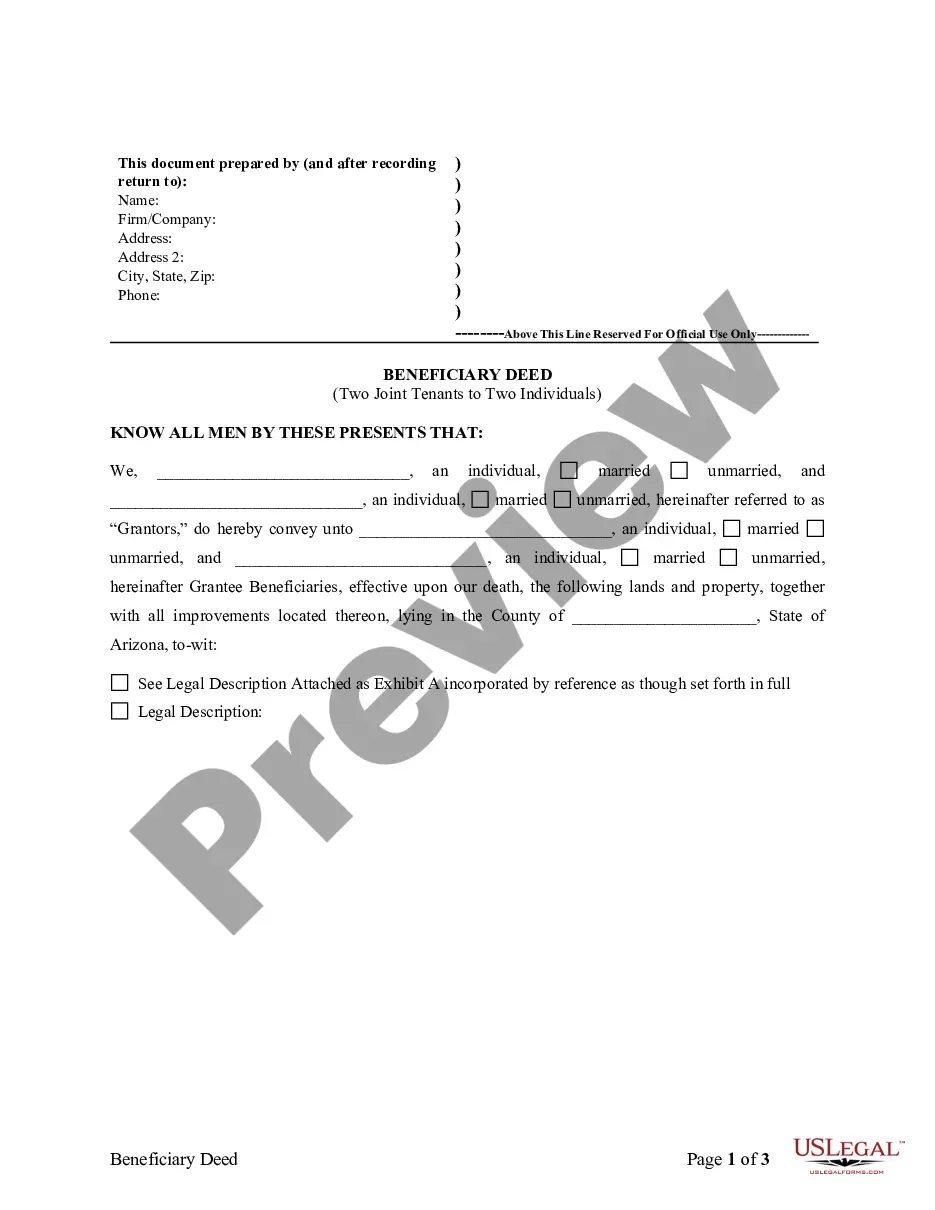

It's possible to avoid spending money on attorneys drafting your documentation and create a legally valid Riverside Credit Application on your own, using the US Legal Forms online library. It is the biggest online collection of state-specific legal documents that are professionally verified, so you can be certain of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to download the necessary form.

If you still don't have a subscription, adhere to the step-by-step guide below to obtain the Riverside Credit Application:

- Examine the page you've opened and verify if it has the sample you require.

- To achieve this, use the form description and preview if these options are available.

- To locate the one that meets your requirements, utilize the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and quickly get verified legal forms for any use case with just a couple of clicks!