San Jose California Credit Application is a comprehensive form required by financial institutions and lending entities in San Jose, California, to assess an individual or business's creditworthiness. It captures essential information about the applicant, enabling lenders to evaluate their financial credibility and determine the risk associated with extending credit. Keywords: San Jose California, credit application, financial institutions, lending entities, creditworthiness, applicant, credit assessment, financial credibility, risk, extending credit. Types of San Jose California Credit Application: 1. Personal Credit Application: This type of credit application is designed to evaluate the creditworthiness of individuals seeking personal loans, credit cards, or other forms of personal credit. The applicant must provide personal information, including name, contact details, social security number, employment details, income, monthly expenses, current debts, assets, and liabilities. 2. Business Credit Application: This credit application is specific to businesses and is used to assess their creditworthiness when applying for business loans, lines of credit, or trade credit with suppliers. Along with general company information, the application requests details about the business's financial standing, such as tax identification number, years in operation, ownership structure, financial statements, account receivables, and payables. 3. Mortgage Credit Application: This specialized credit application is used when individuals or businesses apply for a mortgage to purchase or refinance a property in San Jose, California. In addition to the standard credit application information, applicants must provide property details, loan amount desired, employment history, income verification, and details about other owned properties or real estate holdings. 4. Auto Loan Credit Application: For individuals looking to finance a vehicle in San Jose, California, auto loan credit applications are utilized. These applications gather information about the applicant's employment, income, current debts, and desired loan amount. They may also require details about the intended vehicle, including make, model, VIN number, and purchase price. 5. Consumer Credit Card Application: This type of credit application is specific to obtaining a credit card from a financial institution or credit card company. Applicants provide personal information, income details, employment history, and information about their current financial obligations. This application also includes sections on consent, terms and conditions, and agreement with the credit card's terms. 6. Small Business Loan Credit Application: Designed for small businesses in San Jose, California, this application is used to assess creditworthiness when applying for small business loans. The application requests detailed information about the business owner, company financials, assets, liabilities, cash flow projections, and business plans. In conclusion, San Jose California Credit Application encompasses various types, including personal, business, mortgage, auto loan, consumer credit card, and small business loan applications. Each type has its own specific requirements and is tailored to assess creditworthiness based on the intended credit purpose.

San Jose California Credit Application

Description

How to fill out San Jose California Credit Application?

Whether you plan to open your business, enter into a contract, apply for your ID renewal, or resolve family-related legal issues, you must prepare specific documentation corresponding to your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and checked legal templates for any personal or business occurrence. All files are collected by state and area of use, so picking a copy like San Jose Credit Application is quick and easy.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a couple of additional steps to get the San Jose Credit Application. Follow the guide below:

- Make certain the sample meets your individual needs and state law requirements.

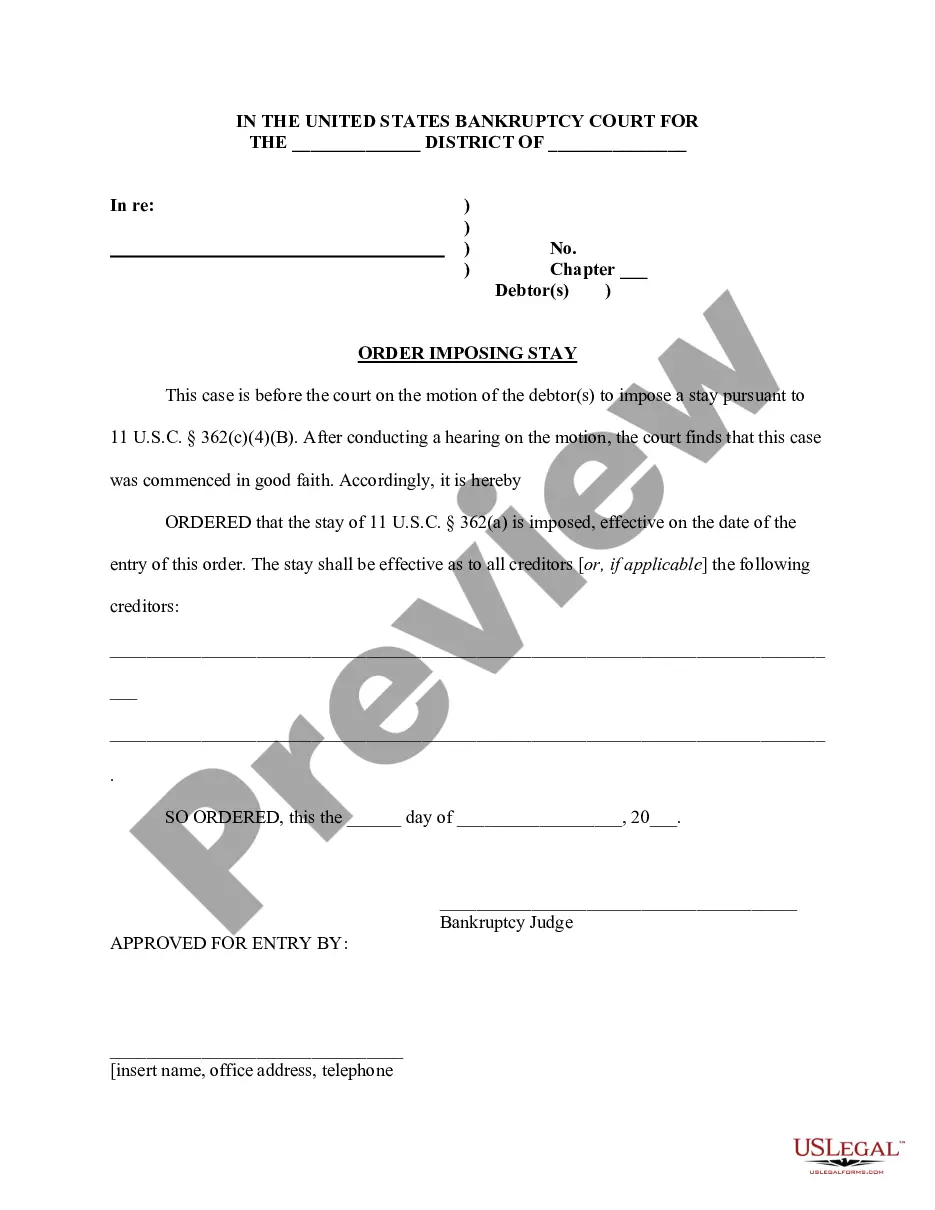

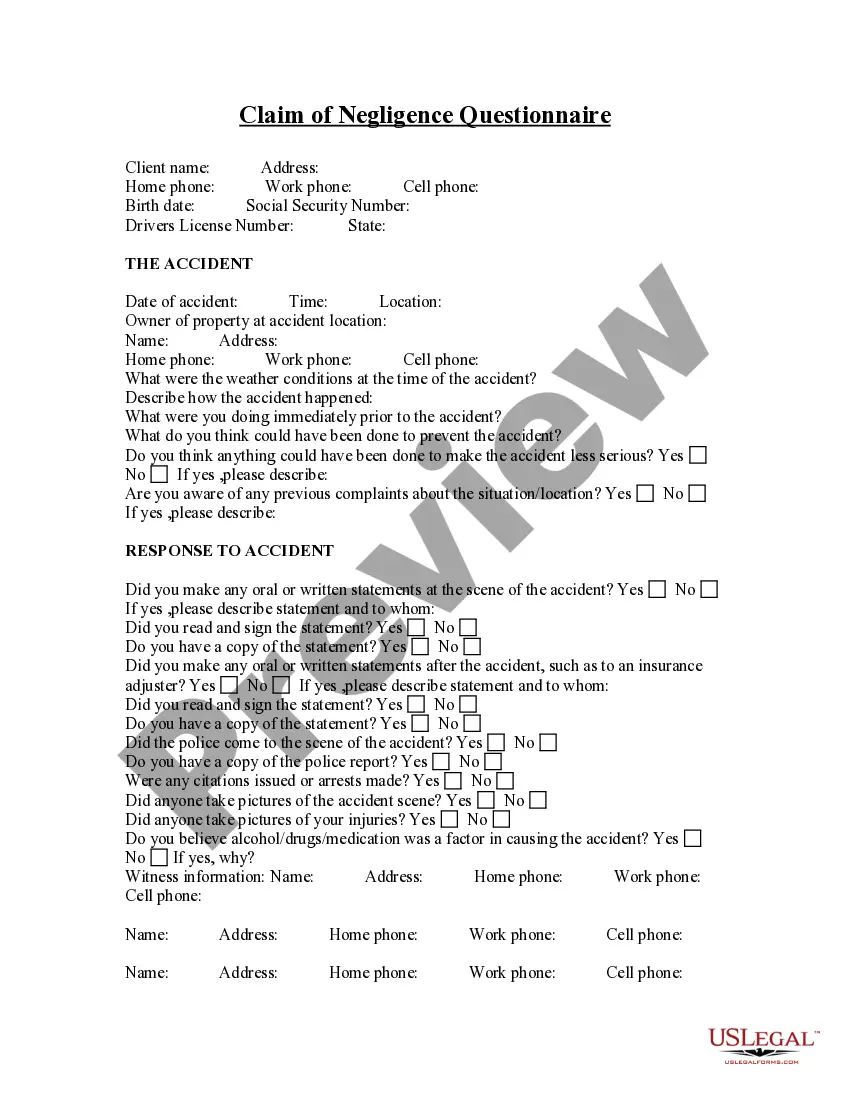

- Look through the form description and check the Preview if there’s one on the page.

- Utilize the search tab providing your state above to locate another template.

- Click Buy Now to get the sample once you find the proper one.

- Choose the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the San Jose Credit Application in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our website are multi-usable. Having an active subscription, you can access all of your earlier acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!