Maricopa, Arizona, Exchange Agreement is a legal contract between two parties that outlines the terms and conditions of the exchange of real estate properties located in Maricopa, Arizona. This agreement is commonly used in the real estate industry to facilitate the exchange of properties, allowing parties to defer capital gains taxes by reinvesting the proceeds from the sale of a property into a similar property. A Maricopa Arizona Exchange Agreement typically involves a qualified intermediary (QI) who acts as an independent third party responsible for facilitating the exchange. The QI holds the funds from the sale of the relinquished property in a segregated account until the replacement property is acquired. This intermediary ensures that the exchange transaction adheres to the rules and regulations set forth by the Internal Revenue Service (IRS). There are different types of Maricopa Arizona Exchange Agreement, Brokerage Arrangement, depending on the specific needs and goals of the parties involved. Some of these types include: 1. Simultaneous Exchange: This type of exchange occurs when the sale of the relinquished property and the acquisition of the replacement property happen concurrently. The title of the relinquished property is transferred directly to the buyer, while the replacement property is acquired simultaneously. 2. Delayed Exchange: Also known as a "Starker Exchange" or "1031 Exchange," this type of exchange occurs when the sale of the relinquished property and the acquisition of the replacement property are not simultaneous. The QI holds the funds from the sale of the relinquished property until the replacement property is identified and acquired within a specific timeframe. 3. Reverse Exchange: In a reverse exchange, the replacement property is acquired before the relinquished property is sold. This type of exchange is more complex and requires additional considerations to comply with IRS regulations. 4. Build-to-Suit Exchange: This arrangement involves the construction of a replacement property on land purchased as part of the exchange. The QI holds the funds until the construction is complete, ensuring compliance with IRS rules. 5. Improvement Exchange: Also known as a "Construction Exchange" or "Improvement-to-Suit Exchange," this type of exchange allows for the exchange of a property followed by improvements or renovations to the replacement property before it is acquired. The Maricopa Arizona Exchange Agreement, Brokerage Arrangement, plays a crucial role in facilitating tax-efficient property exchanges in Maricopa, Arizona. Whether it's a simultaneous, delayed, reverse, build-to-suit, or improvement exchange, utilizing the services of a qualified intermediary ensures compliance with IRS regulations and maximizes the benefits of a 1031 exchange.

Maricopa Arizona Exchange Agreement, Brokerage Arrangement

Description

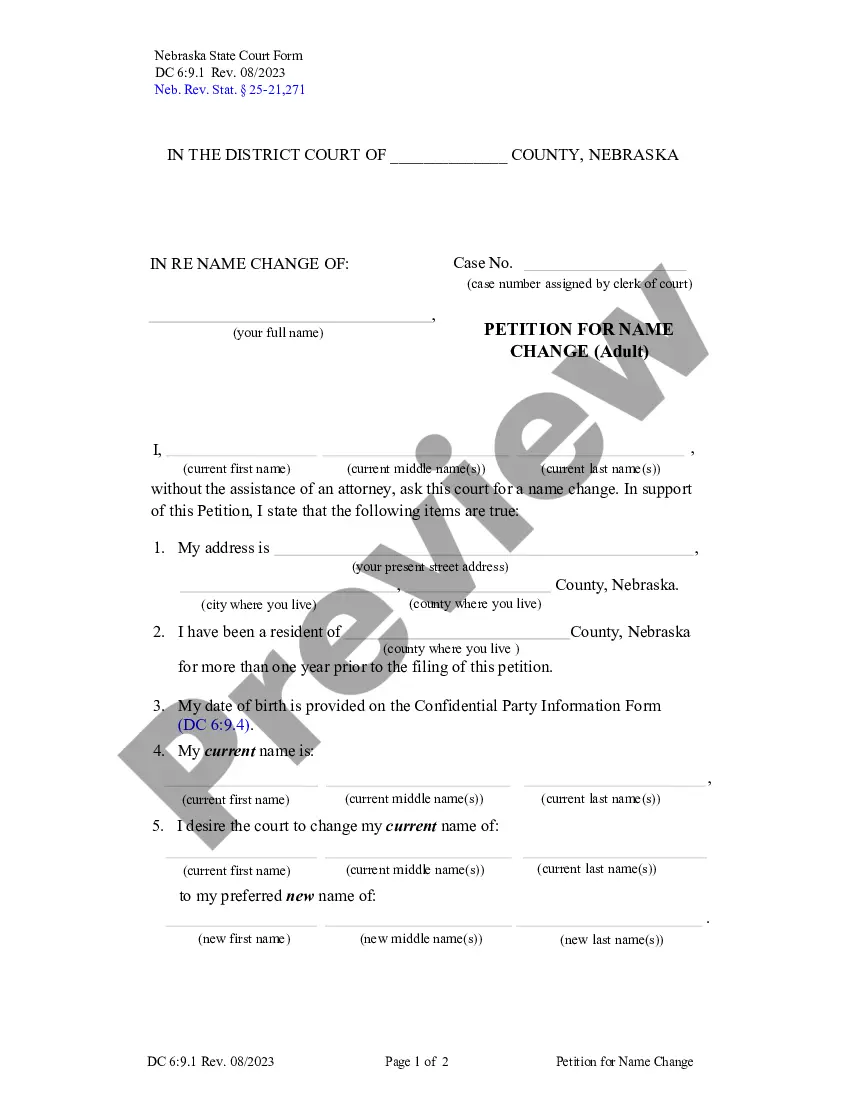

How to fill out Maricopa Arizona Exchange Agreement, Brokerage Arrangement?

Draftwing forms, like Maricopa Exchange Agreement, Brokerage Arrangement, to take care of your legal matters is a tough and time-consumming process. Many situations require an attorney’s involvement, which also makes this task not really affordable. Nevertheless, you can consider your legal affairs into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website comes with more than 85,000 legal documents intended for a variety of scenarios and life circumstances. We make sure each document is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal pitfalls associated with compliance.

If you're already aware of our services and have a subscription with US, you know how straightforward it is to get the Maricopa Exchange Agreement, Brokerage Arrangement template. Go ahead and log in to your account, download the form, and customize it to your requirements. Have you lost your document? No worries. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is just as simple! Here’s what you need to do before getting Maricopa Exchange Agreement, Brokerage Arrangement:

- Ensure that your document is specific to your state/county since the rules for creating legal paperwork may differ from one state another.

- Find out more about the form by previewing it or going through a quick description. If the Maricopa Exchange Agreement, Brokerage Arrangement isn’t something you were hoping to find, then use the header to find another one.

- Log in or register an account to start using our website and download the document.

- Everything looks good on your end? Hit the Buy now button and select the subscription option.

- Select the payment gateway and enter your payment information.

- Your form is good to go. You can try and download it.

It’s easy to locate and purchase the needed template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich library. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!