Title: Understanding the Salt Lake City, Utah Exchange Agreement and Brokerage Arrangement Introduction: The Salt Lake City, Utah Exchange Agreement and Brokerage Arrangement is a legal contract or agreement that facilitates the exchange of real estate properties between two or more parties within Salt Lake City. This arrangement provides a transparent and regulated system for buyers and sellers to carry out property exchanges, ensuring fair transactions and minimizing potential risks. There are different types of agreements within the Salt Lake City brokerage arrangement, each serving specific purposes. In this article, we will explore these different types and provide a detailed description of what they entail. 1. Simultaneous Exchange Agreement: A simultaneous exchange agreement, also known as a simultaneous swap, is the most traditional and straightforward type of exchange agreement. It involves the simultaneous swap of properties between two parties. In this arrangement, the exchange occurs at once, with both parties transferring their properties to the other simultaneously, using an intermediary known as an exchange accommodate or qualified intermediary to facilitate the transaction. This agreement ensures a direct property swap, without the need for any interim period or additional monetary compensation. 2. Delayed Exchange Agreement: In some cases, parties might prefer a delayed exchange agreement, which allows for more flexibility in terms of timeline. This type of agreement permits a time gap between the transfer of the relinquished property (the property being sold) and the acquisition of the replacement property (the property being purchased). This gap is commonly referred to as the "exchange period" and typically spans 180 calendar days. The intermediary holds the proceeds from the sale of the relinquished property during this period, which is then used to acquire the replacement property. 3. Reverse Exchange Agreement: A reverse exchange agreement is utilized when a buyer wishes to purchase a replacement property before selling their existing property. In this scenario, the intermediary or qualified intermediary acquires the replacement property on behalf of the buyer first, holding it temporarily. Subsequently, the buyer must sell their current property within a specific timeframe, termed the 180-day "relinquished property period." Once the relinquished property is sold, the title is transferred to the buyer, completing the reverse exchange agreement. 4. Build-to-Suit Exchange Agreement: A build-to-suit exchange agreement is a specialized arrangement that allows an investor to acquire replacement property by constructing a new property tailored to their specific needs. This agreement enables investors to utilize the exchange process to improve or upgrade their property portfolios actively. The intermediary holds the funds during the construction phase until the replacement property is completed, ensuring compliance with the exchange regulations. Conclusion: The Salt Lake City, Utah Exchange Agreement and Brokerage Arrangement offers various types of agreements to accommodate the diverse needs of real estate investors and facilitate fair property exchanges within the city. Whether it's a simultaneous, delayed, reverse, or build-to-suit exchange agreement, each type follows specific regulations and timelines to ensure a smooth and legitimate property exchange process. By understanding these different types of agreements, individuals can make informed decisions when engaging in real estate transactions in Salt Lake City, Utah.

Salt Lake Utah Exchange Agreement, Brokerage Arrangement

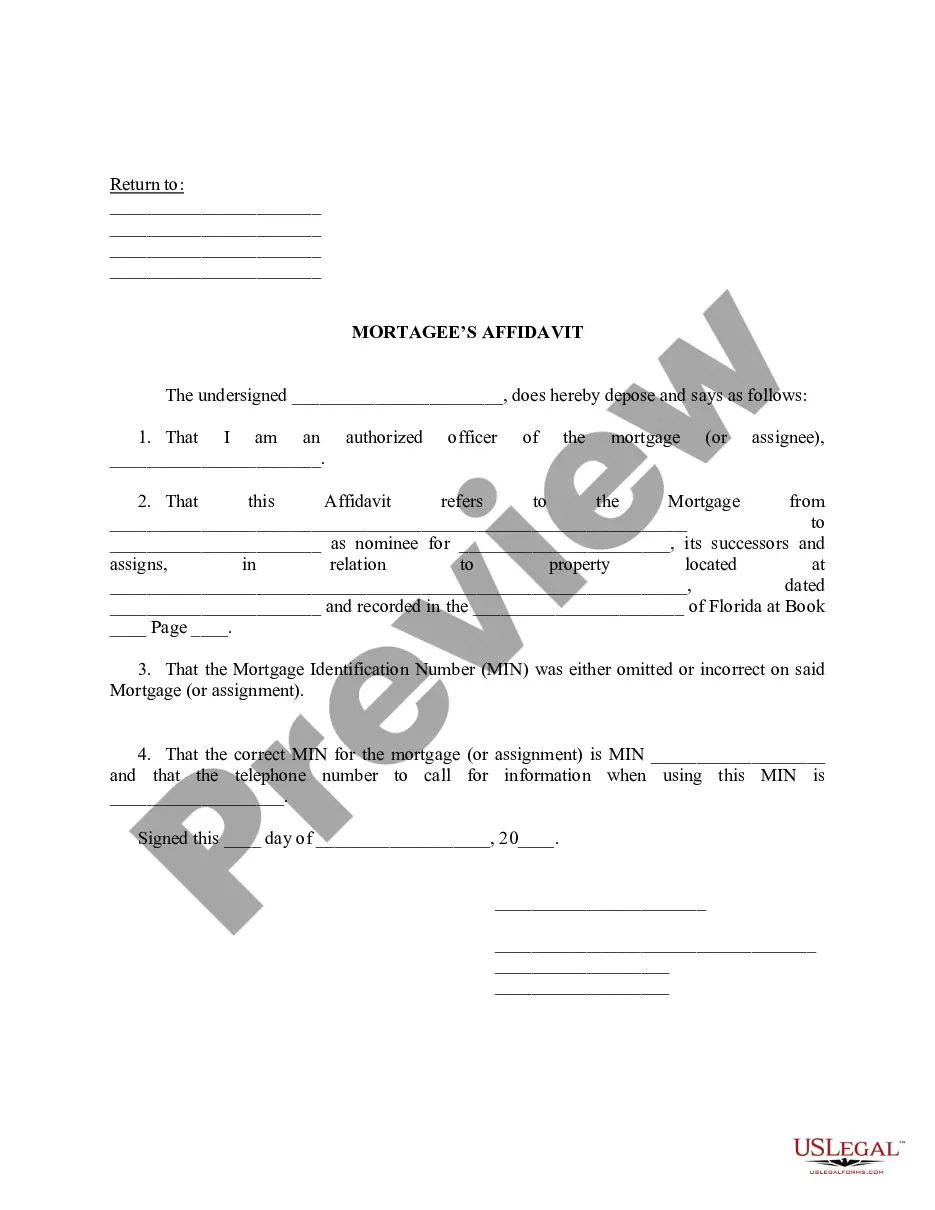

Description

How to fill out Salt Lake Utah Exchange Agreement, Brokerage Arrangement?

Draftwing documents, like Salt Lake Exchange Agreement, Brokerage Arrangement, to manage your legal affairs is a challenging and time-consumming process. Many situations require an attorney’s involvement, which also makes this task expensive. However, you can consider your legal issues into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal documents intended for a variety of scenarios and life circumstances. We ensure each document is in adherence with the laws of each state, so you don’t have to worry about potential legal issues associated with compliance.

If you're already aware of our services and have a subscription with US, you know how easy it is to get the Salt Lake Exchange Agreement, Brokerage Arrangement template. Go ahead and log in to your account, download the template, and customize it to your needs. Have you lost your document? No worries. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is fairly straightforward! Here’s what you need to do before getting Salt Lake Exchange Agreement, Brokerage Arrangement:

- Ensure that your template is specific to your state/county since the rules for writing legal documents may vary from one state another.

- Discover more information about the form by previewing it or reading a brief intro. If the Salt Lake Exchange Agreement, Brokerage Arrangement isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Sign in or register an account to start utilizing our website and download the document.

- Everything looks good on your end? Click the Buy now button and choose the subscription option.

- Pick the payment gateway and enter your payment information.

- Your form is all set. You can go ahead and download it.

It’s an easy task to locate and buy the needed document with US Legal Forms. Thousands of organizations and individuals are already benefiting from our extensive collection. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!