Allegheny, Pennsylvania Simple Receipt to Seller from Buyer: A Comprehensive Guide Introduction: In the bustling state of Pennsylvania lies Allegheny County, a vibrant region home to several cities, including the iconic city of Pittsburgh. This detailed guide aims to provide insight into Allegheny, Pennsylvania's simple receipt to seller from buyer process. We will explore the purpose of these receipts, their various types, and the role they play in ensuring transparent transactions. By the end of this guide, readers will have a comprehensive understanding of the documentation requirements for buyers and sellers in Allegheny County. Key Points: 1. The Purpose of a Simple Receipt: A simple receipt is a legal document that acknowledges the transfer of goods, services, or payment from a buyer to a seller. In Allegheny, Pennsylvania, these receipts serve as evidence of a transaction and can be essential for taxation, tracking inventory, and record-keeping purposes. Both buyers and sellers should familiarize themselves with the importance of creating and retaining such receipts. 2. Types of Simple Receipts: Depending on the nature of the transaction, different types of simple receipts are applicable in Allegheny County. Some common variations include: a. Cash Receipt: Used when a buyer pays the seller in cash, confirming the date, amount, and purpose of the transaction. b. Sales Receipt: Generated when goods or services are sold, providing details such as quantity, price, and any discounts or taxes applied. c. Rent Receipt: Issued when a tenant makes a rental payment to a landlord, containing details like the rental period, amount paid, and property address. d. Donation Receipt: Given to individuals or organizations providing financial or in-kind donations, helping them claim tax deductions. 3. Required Information on a Simple Receipt: To ensure compliance with Allegheny County's regulations, specific details must be included on the receipt. While the exact requirements may vary for each receipt type, some common elements include: a. Date of transaction: The specific calendar date when the transaction occurred. b. Names and contact information: Full name, address, and contact details of both the buyer and seller. c. Description of goods or services: A detailed listing or explanation of the items exchanged or sold, including any relevant codes, serial numbers, or specifications. d. Total payment: The total amount paid, including any taxes, fees, or discounts applied. e. Payment method: The payment method used (e.g., cash, check, credit card) and any associated transaction details (e.g., check number, last four digits of a credit card). 4. Additional Considerations: While simple receipts primarily serve as evidence of a transaction, there are other aspects buyers and sellers in Allegheny County should bear in mind: a. Retention: Both parties involved should retain a copy of the receipt for their records. b. Timely issuance: The receipt should be prepared and given to the buyer at the time of the transaction. c. Accuracy: It is crucial to ensure that all information on the receipt is accurate to avoid discrepancies or potential legal issues. Conclusion: In Allegheny County, Pennsylvania, simple receipts play a vital role in documenting transactions between buyers and sellers. From cash receipts to sales receipts, these documents serve as evidence of a transaction and provide essential information for record-keeping, taxation, and inventory management purposes. By following the guidelines outlined in this guide, buyers and sellers can ensure that their transactions are properly documented and adhere to the regulations set forth by Allegheny County.

Allegheny Pennsylvania Simple Receipt to Seller from Buyer

Description

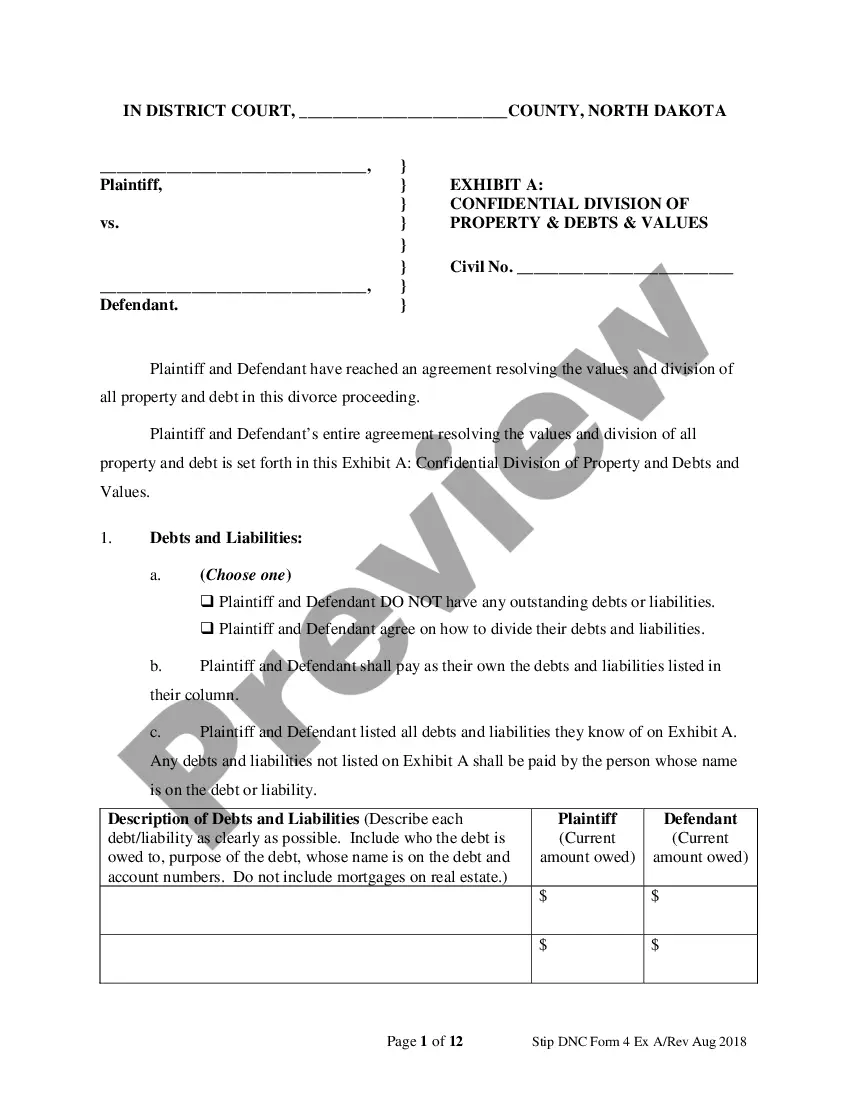

How to fill out Allegheny Pennsylvania Simple Receipt To Seller From Buyer?

How much time does it usually take you to draft a legal document? Given that every state has its laws and regulations for every life sphere, finding a Allegheny Simple Receipt to Seller from Buyer suiting all regional requirements can be stressful, and ordering it from a professional attorney is often expensive. Numerous online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive online collection of templates, grouped by states and areas of use. Aside from the Allegheny Simple Receipt to Seller from Buyer, here you can find any specific form to run your business or individual affairs, complying with your county requirements. Experts verify all samples for their actuality, so you can be certain to prepare your documentation correctly.

Using the service is remarkably simple. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required sample, and download it. You can retain the file in your profile at any moment later on. Otherwise, if you are new to the platform, there will be some extra steps to complete before you obtain your Allegheny Simple Receipt to Seller from Buyer:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another form using the related option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Choose the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Allegheny Simple Receipt to Seller from Buyer.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!