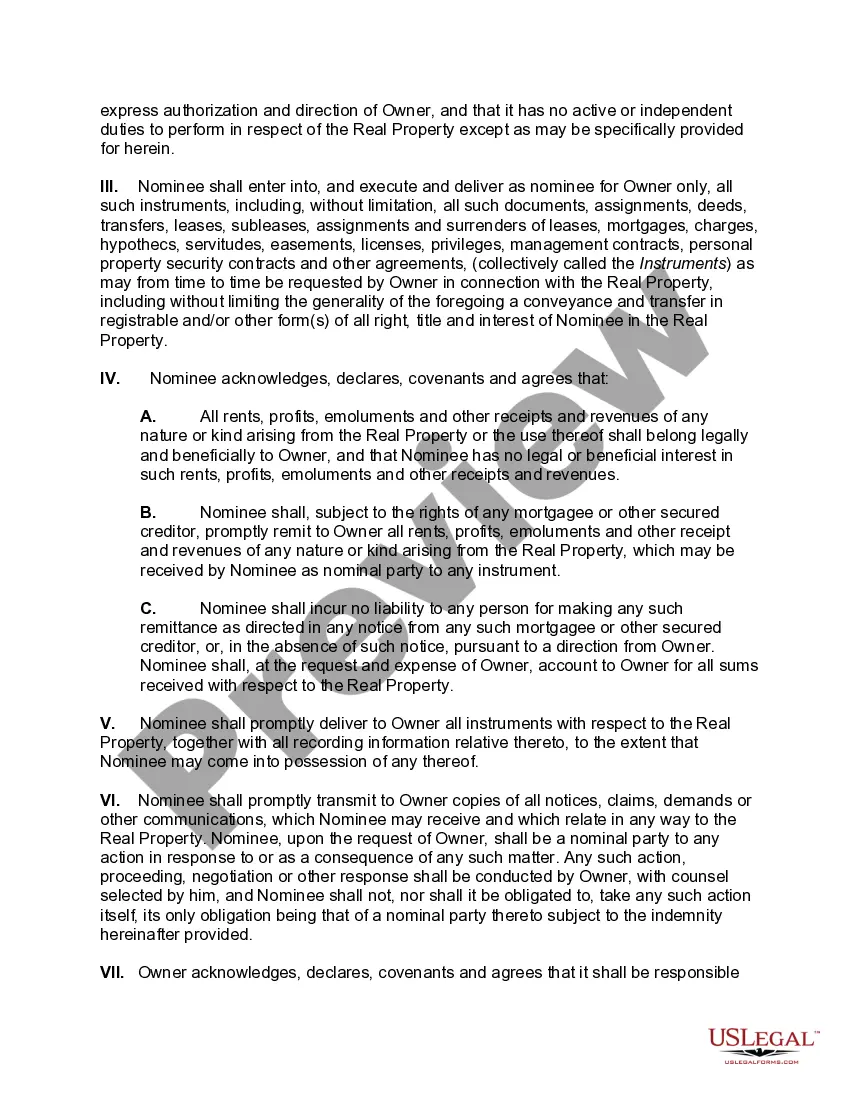

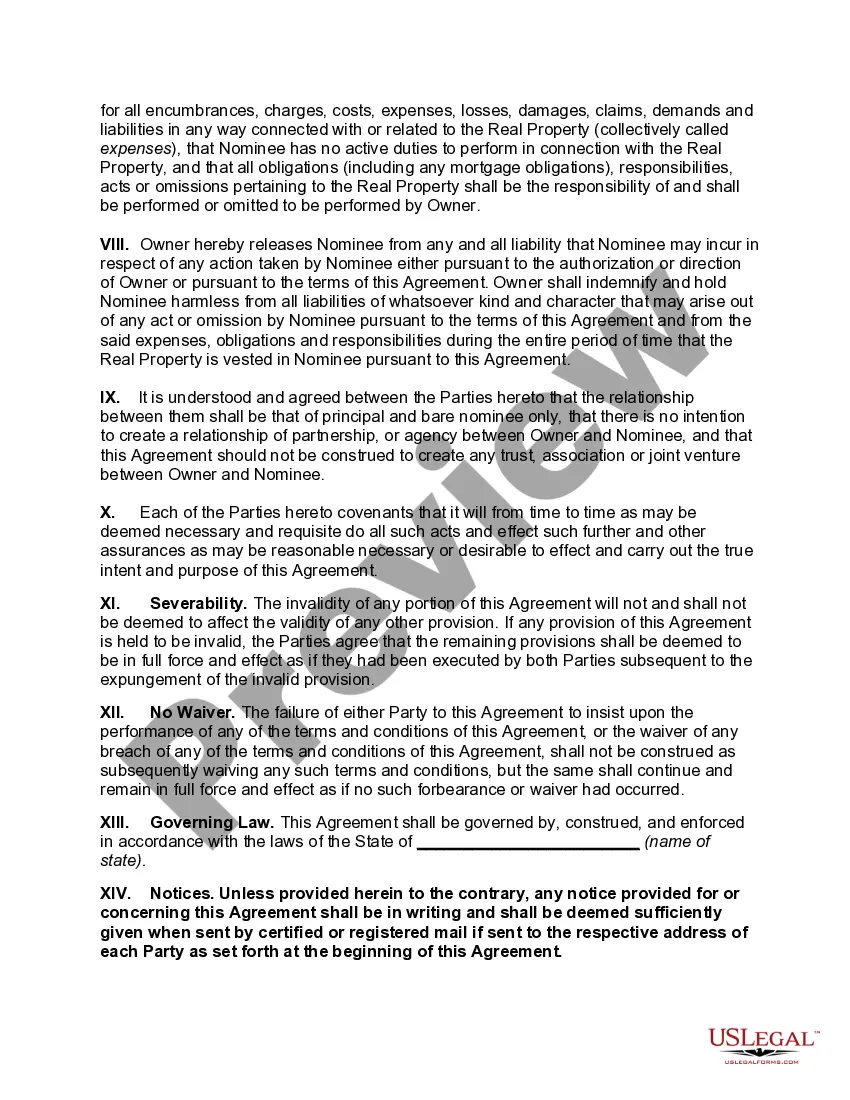

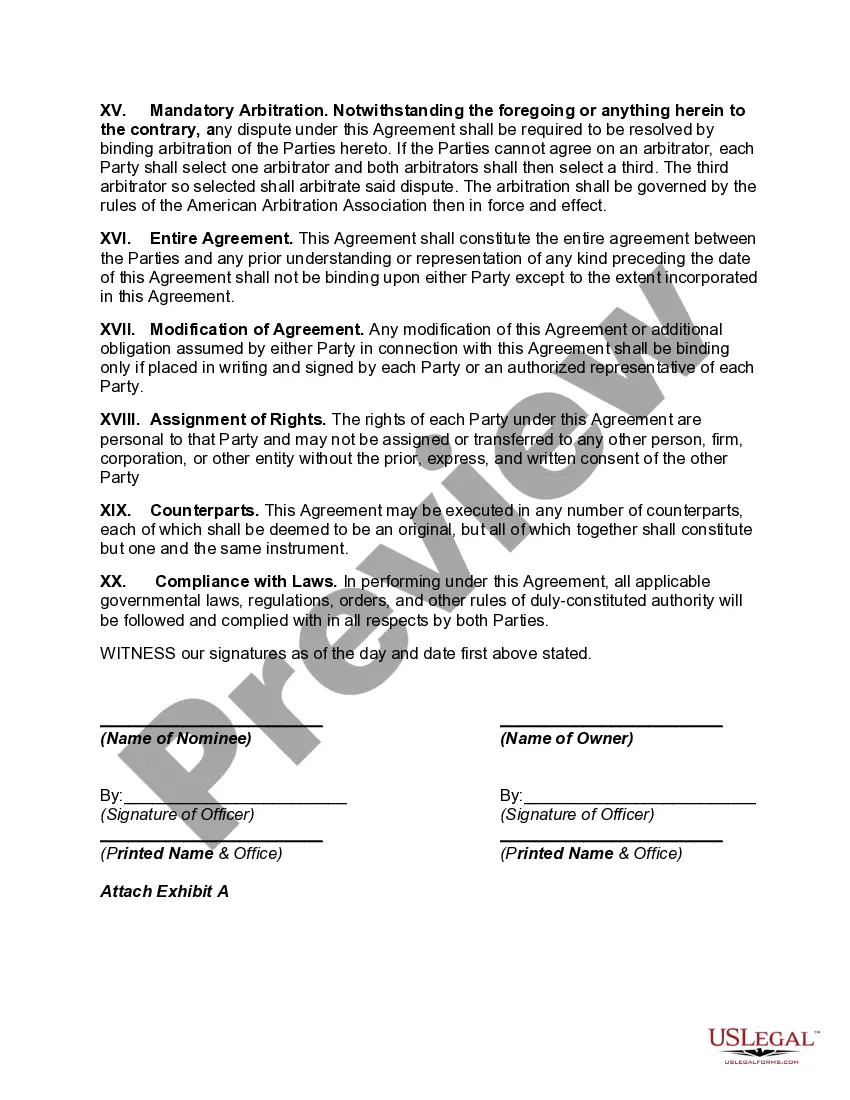

A San Diego California Nominee Agreement is a legally binding contract that outlines the roles and responsibilities of a nominee, typically an individual or entity, who agrees to hold and manage assets or investments on behalf of another party, known as the principal. This agreement is widely used in various industries, including real estate, finance, and corporate ventures, to establish a formal arrangement between the nominee and the principal. In a San Diego California Nominee Agreement, key terms and conditions are clearly defined to ensure the smooth and proper handling of the principal's assets. It typically includes details such as the identity of the nominee and the principal, a description of the assets or investments involved, and the duration of the agreement. The agreement also outlines the nominee's fiduciary duties, which include acting in the best interests of the principal and ensuring the safekeeping of the assets. One type of San Diego California Nominee Agreement is the Real Estate Nominee Agreement. This type of agreement is commonly used in the real estate industry when individuals or entities wish to purchase property but prefer to keep their ownership confidential. The nominee agrees to hold legal title to the property on behalf of the principal, maintaining privacy and protecting the principal's identity. Another type is the Corporate Nominee Agreement. Often utilized by shareholders or beneficial owners, this agreement appoints a nominee to hold shares or interests in a company on behalf of the principal. The nominee's role may involve voting on behalf of the principal during shareholder meetings, executing agreements, or receiving dividends. A third type is the Investment Nominee Agreement, typically used by investors who prefer to remain anonymous. In this arrangement, the nominee holds and manages investment portfolios, such as stocks, bonds, or mutual funds, on behalf of the principal. The nominee is responsible for making investment decisions and handling any related administrative tasks, providing the principal with a layer of anonymity. Overall, a San Diego California Nominee Agreement is a crucial legal instrument that establishes a professional relationship between a nominee and a principal. By clearly defining the roles, obligations, and rights of both parties, this agreement helps safeguard the interests of the principal while facilitating the efficient management of their assets or investments.

San Diego California Nominee Agreement

Description

How to fill out San Diego California Nominee Agreement?

Creating legal forms is a must in today's world. Nevertheless, you don't always need to look for qualified assistance to create some of them from scratch, including San Diego Nominee Agreement, with a platform like US Legal Forms.

US Legal Forms has over 85,000 forms to select from in different categories ranging from living wills to real estate papers to divorce documents. All forms are organized based on their valid state, making the searching experience less overwhelming. You can also find information resources and tutorials on the website to make any tasks related to document completion simple.

Here's how you can find and download San Diego Nominee Agreement.

- Take a look at the document's preview and description (if provided) to get a basic idea of what you’ll get after getting the document.

- Ensure that the document of your choice is specific to your state/county/area since state laws can affect the legality of some records.

- Check the similar document templates or start the search over to locate the correct document.

- Click Buy now and register your account. If you already have an existing one, choose to log in.

- Choose the option, then a suitable payment gateway, and buy San Diego Nominee Agreement.

- Choose to save the form template in any available format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the appropriate San Diego Nominee Agreement, log in to your account, and download it. Of course, our platform can’t replace an attorney completely. If you have to deal with an extremely difficult situation, we recommend getting an attorney to examine your document before executing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to platform for various legal forms for millions of customers. Join them today and get your state-specific paperwork with ease!