Houston Texas is a thriving city known for its diverse economy, vibrant culture, and business-friendly atmosphere. For corporations operating in Houston, maintaining accurate and well-documented corporate minutes is crucial to ensure legal compliance and record important business decisions. A Houston Texas Checklist for Corporate Minutes assists companies in effectively recording and discussing the proceedings of corporate meetings, thereby protecting the interests of shareholders and the long-term success of the organization. Here is a comprehensive checklist for corporate minutes in Houston Texas: 1. Opening the meeting: Begin the minutes by stating the date, time, and location of the meeting. Identify the attendees, including their names, titles, and roles within the organization. 2. Approval of previous minutes: If applicable, record the approval of the previous meeting's minutes by those present. Include any amendments or corrections made during the discussion. 3. Reports and updates: Document any reports or updates provided during the meeting by board members, executives, or committee chairs. This may encompass financial reports, progress updates, or specific departmental reports. 4. Discussion and decision-making process: Describe the key discussions that took place during the meeting, including the topics, arguments expressed, and decisions made. Note any specific resolutions or actions adapted by the board. 5. Voting and election results: Record any voting that occurred during the meeting, including the method used (show of hands, voice vote, etc.), the count of votes, and the outcome. Document the results of any board member elections or appointments. 6. Dissenting opinions or objections: Note any objections or dissenting opinions expressed by board members during discussions or voting. It is essential to maintain transparency by documenting differing viewpoints. 7. Adjournment and next meeting: Indicate when the meeting was adjourned and specify the date, time, and location of the next scheduled meeting. This information helps keep the organization's members and shareholders informed. Different types of Houston Texas Checklist for Corporate Minutes may include: 1. Annual meeting minutes checklist: Specifically designed for recording the proceedings of an organization's annual meetings. These minutes typically encompass important activities such as electing directors, ratifying financial statements, and discussing various company policies. 2. Special meeting minutes checklist: Used to record significant discussions and decisions made during special or extraordinary meetings. These meetings focus on specific topics and may be called outside the regular meeting schedule to address urgent matters. 3. Committee meeting minutes checklist: Pertaining to meetings held by committees formed within the organization, such as the audit committee or compensation committee. These minutes detail discussions relevant to the specific committee's scope and responsibilities. 4. Shareholders' meeting minutes checklist: Specifically tailored for documenting shareholder meetings, which provide shareholders with updates regarding the company's performance, financials, and future plans. These minutes include discussions related to voting on resolutions and other matters affecting shareholders. In conclusion, Houston Texas Checklist for Corporate Minutes is a vital tool for businesses to ensure compliance, transparency, and effective decision-making. Adhering to a comprehensive checklist helps organizations safeguard their interests, maintain legal compliance, and preserve accurate records of key corporate meetings. By utilizing specific types of checklists depending on the meeting's purpose, companies in Houston can enhance corporate governance, minimize legal risks, and foster long-term growth.

Houston Texas Checklist for Corporate Minutes

Description

How to fill out Houston Texas Checklist For Corporate Minutes?

Laws and regulations in every sphere differ from state to state. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documents. To avoid costly legal assistance when preparing the Houston Checklist for Corporate Minutes, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal templates. It's a great solution for specialists and individuals looking for do-it-yourself templates for various life and business scenarios. All the documents can be used many times: once you pick a sample, it remains available in your profile for subsequent use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the Houston Checklist for Corporate Minutes from the My Forms tab.

For new users, it's necessary to make a couple of more steps to get the Houston Checklist for Corporate Minutes:

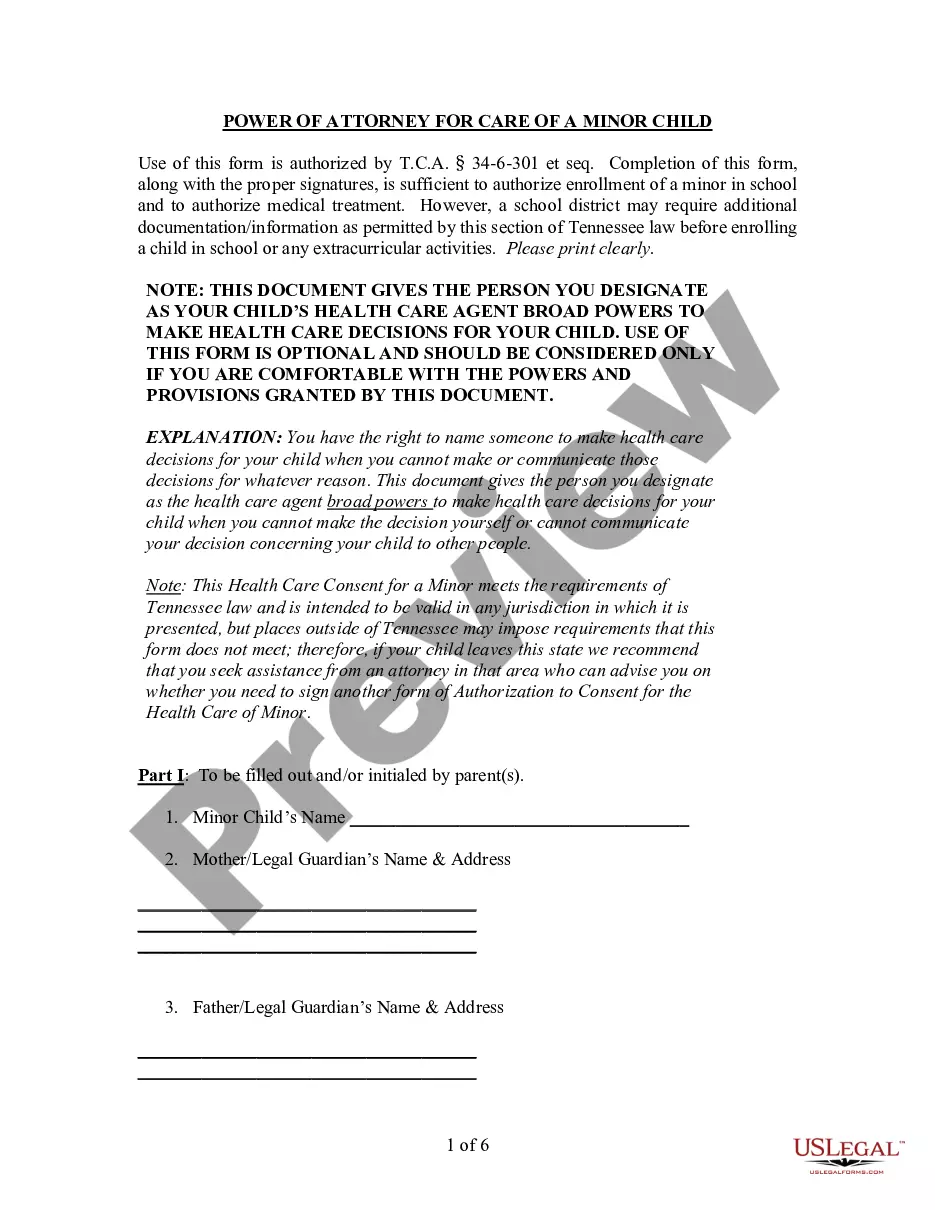

- Analyze the page content to ensure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to obtain the template once you find the proper one.

- Choose one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!