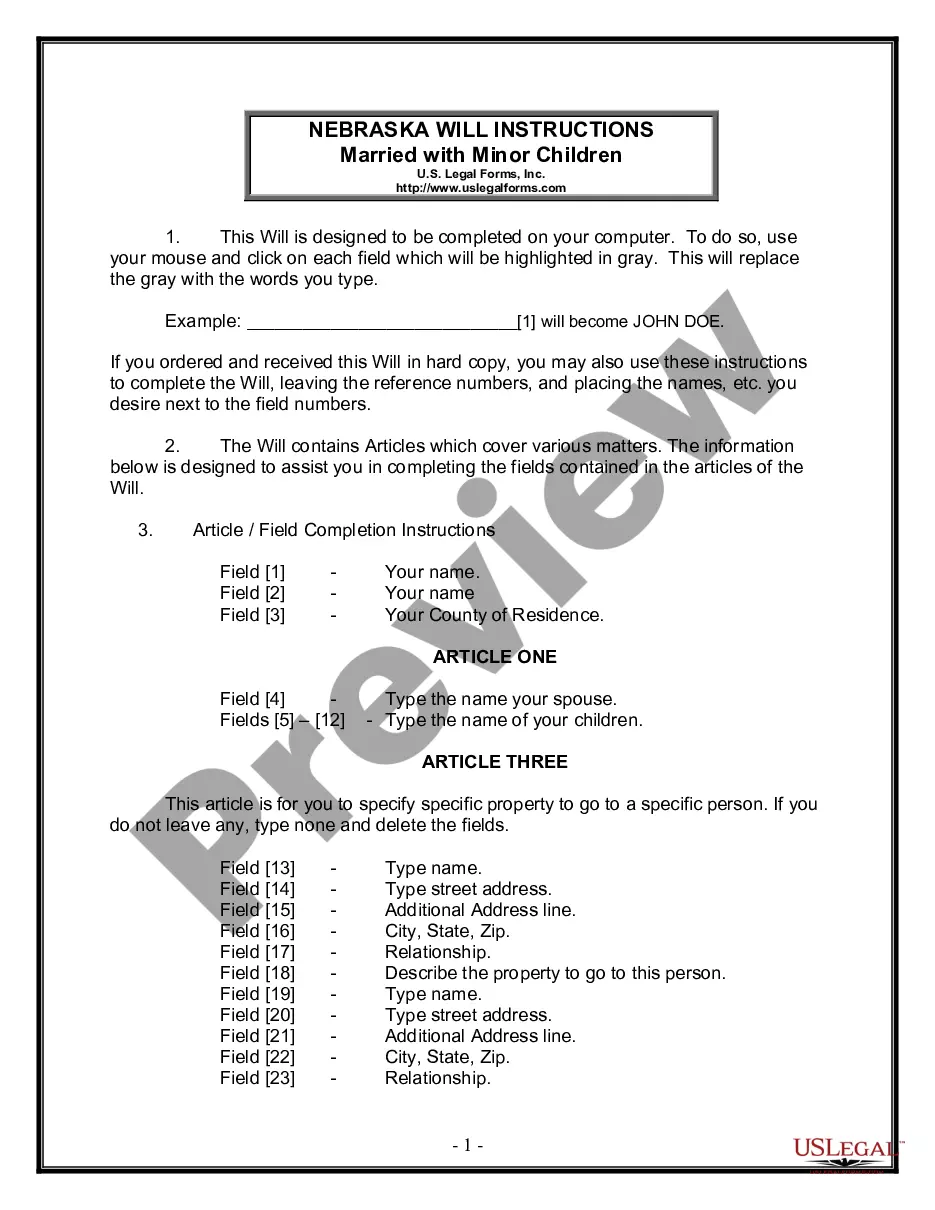

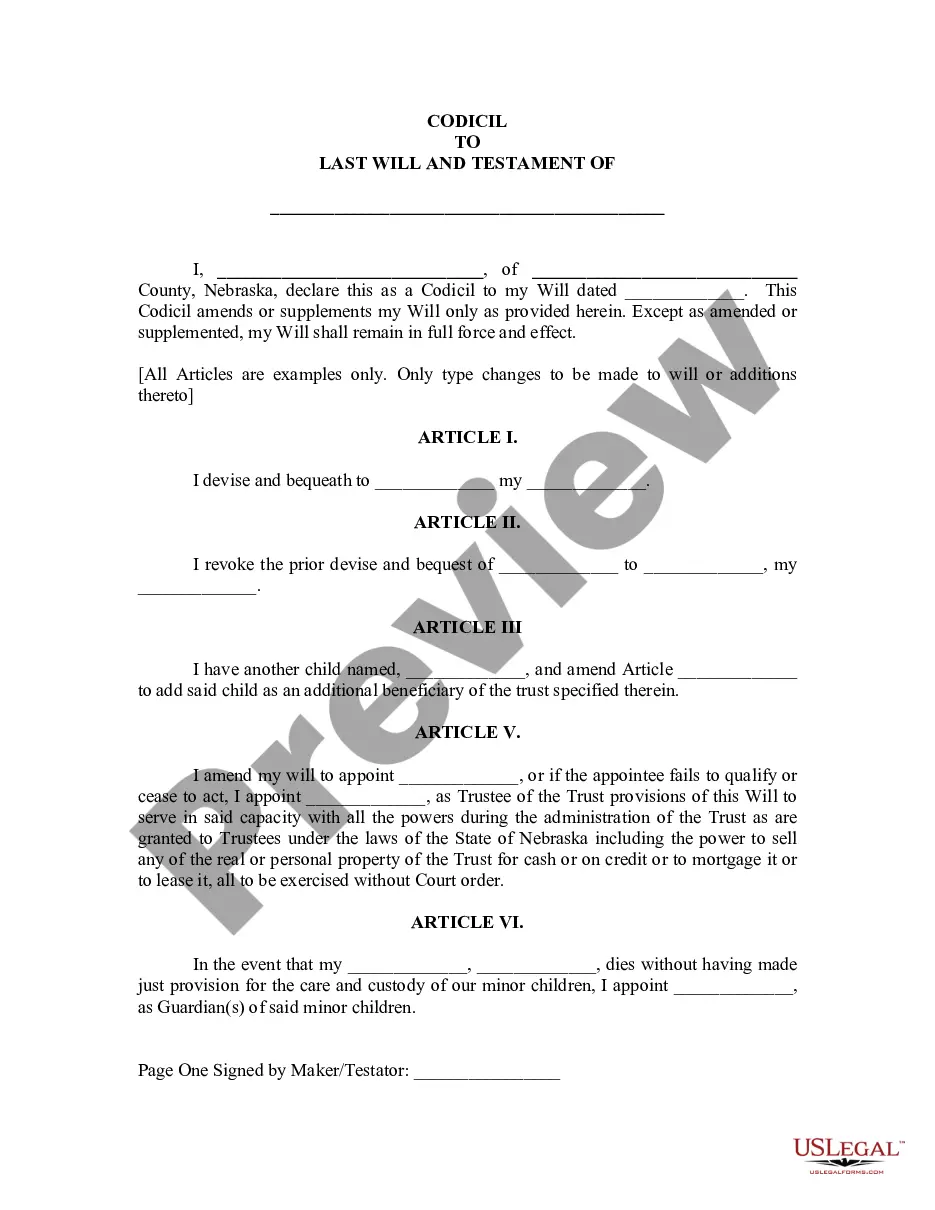

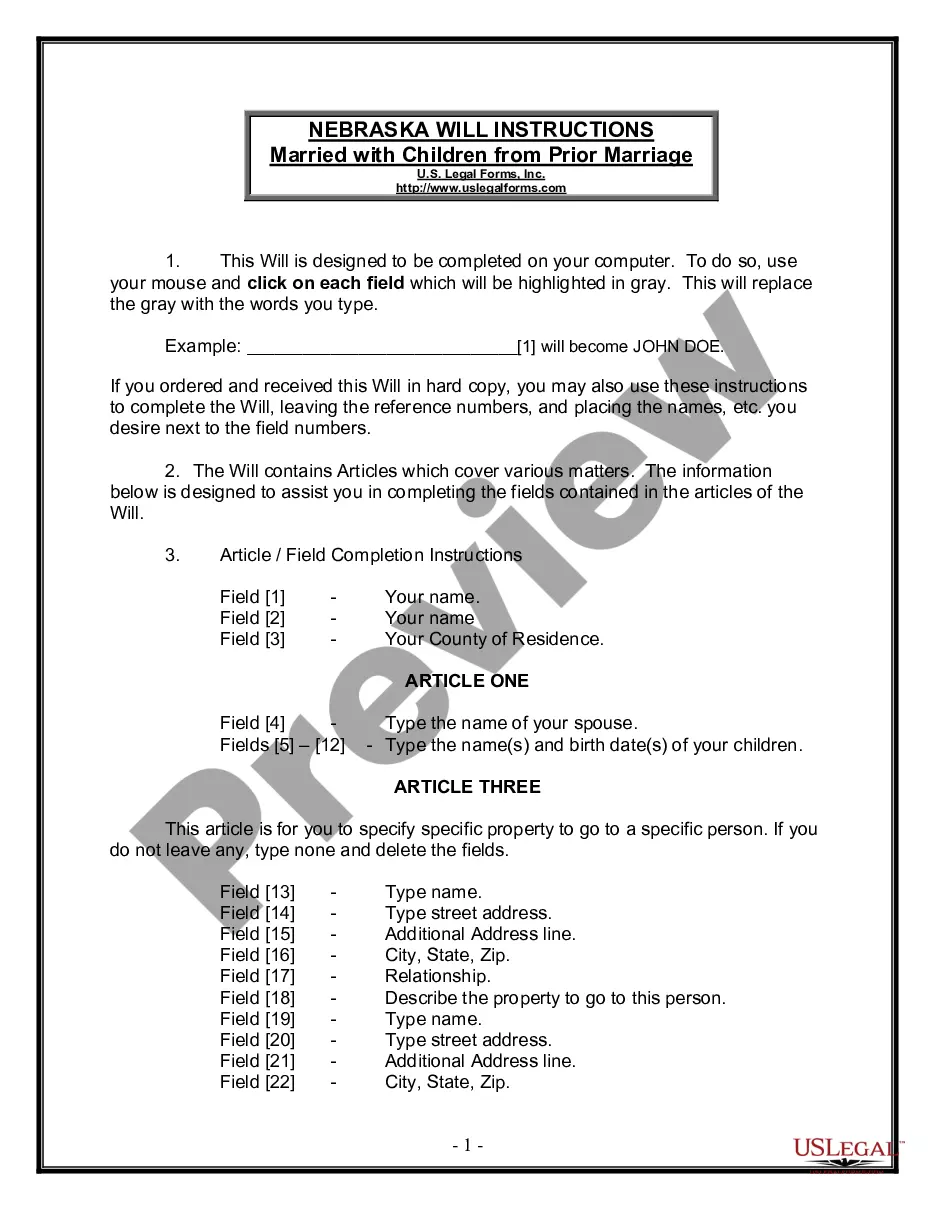

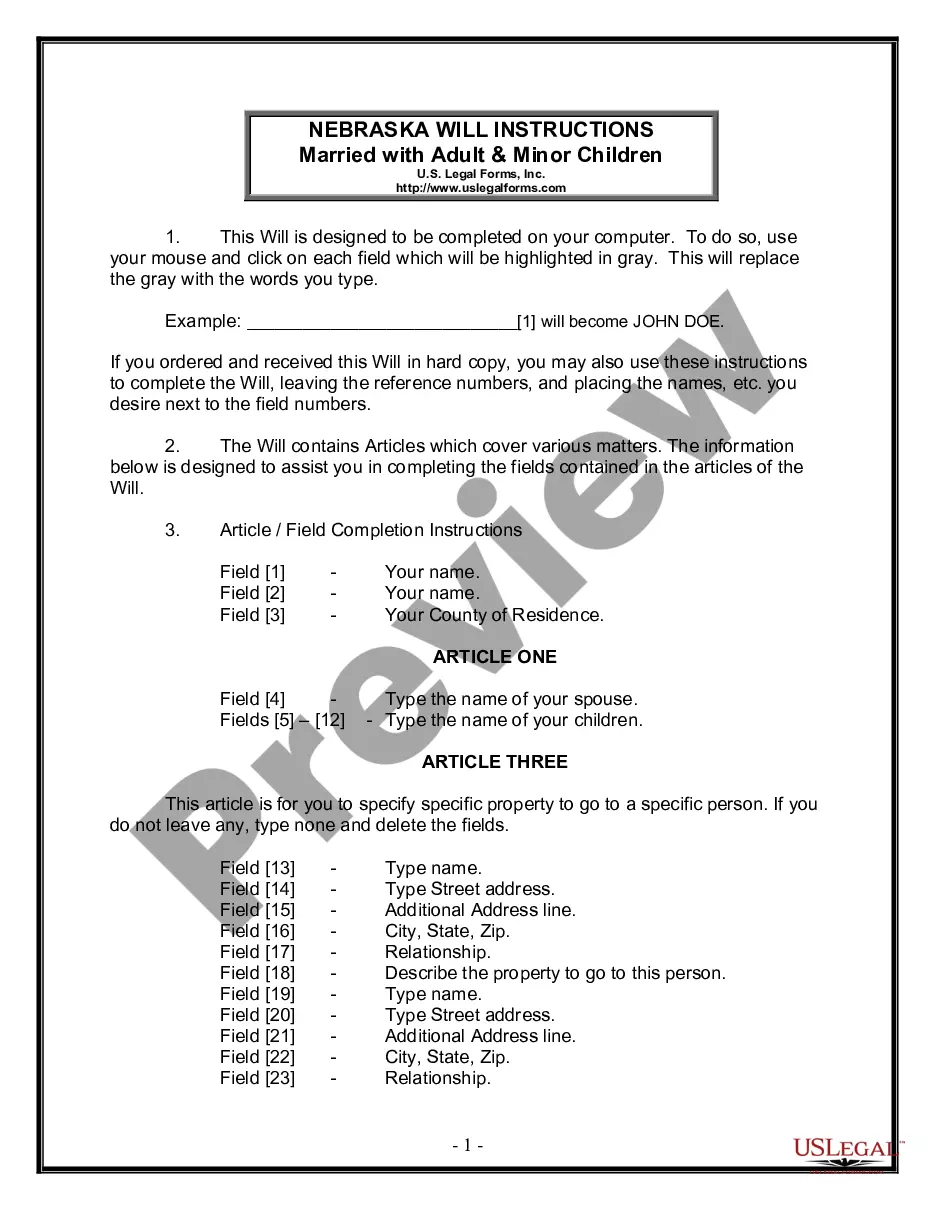

Maricopa Arizona Escrow Agreement and Instructions serve as a legally binding contract between parties involved in a real estate transaction. This agreement outlines the terms and conditions for the safe custody, transfer, and disbursement of property-related documents, funds, and other assets held by a neutral third party known as an escrow agent. The purpose of this agreement is to protect the interests of all parties by ensuring a fair and secure transaction process. The Maricopa Arizona Escrow Agreement generally involves the buyer, seller, lender, and escrow agent. This agreement clearly describes the responsibilities of each party and provides instructions on the steps to be followed during the escrow period, from the opening to the closing of the escrow. Various types of Maricopa Arizona Escrow Agreements and Instructions may be used depending on the specific nature of the real estate transaction. Some common types include: 1. Residential Escrow Agreement: This type of agreement is used in residential real estate transactions, such as buying or selling a house, condominium, or townhouse in Maricopa, Arizona. It outlines the terms regarding the handling of earnest money, property title searches, inspections, and the transfer of ownership. 2. Commercial Escrow Agreement: For commercial real estate transactions like buying or selling office buildings, retail spaces, or industrial properties, this type of agreement is used. It includes provisions related to due diligence, tenant agreements, lease transfers, and compliance with zoning and environmental regulations. 3. Refinance Escrow Agreement: When refinancing a property in Maricopa, Arizona, this agreement is employed. Its instructions specify the process of transferring existing liens or mortgages, disbursing funds to pay off the current loan, and opening a new loan. 4. Construction Escrow Agreement: In cases where new construction is involved, this agreement is utilized. It includes instructions for the release of funds at designated construction milestones and verification of completed work before disbursement. These Maricopa Arizona Escrow Agreements and Instructions are essential in ensuring a smooth real estate transaction process with minimal risks and disputes. By following the outlined guidelines, all parties can have confidence that their rights and obligations are protected, making the agreement a crucial aspect of Maricopa's real estate market.

Maricopa Arizona Escrow Agreement and Instructions

Description

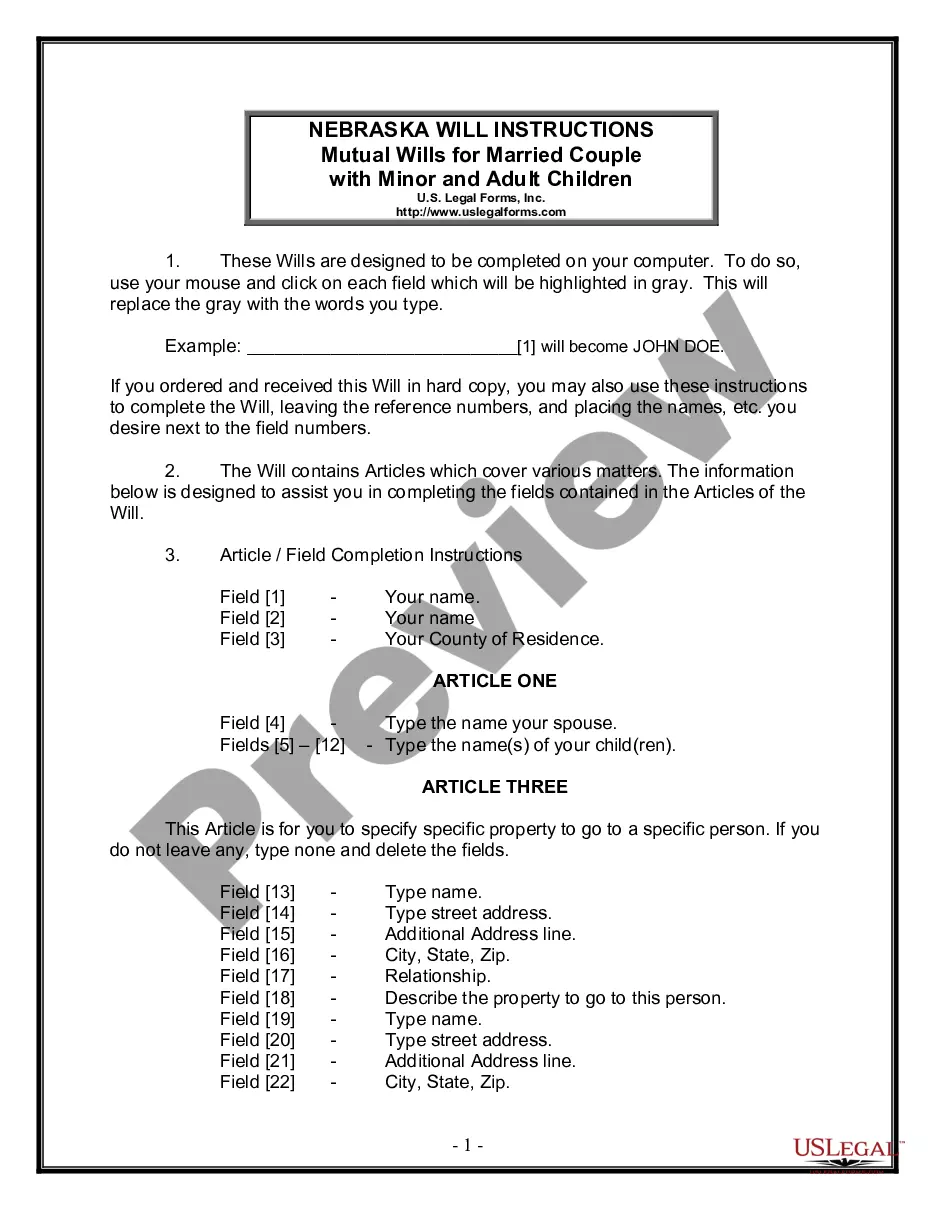

How to fill out Maricopa Arizona Escrow Agreement And Instructions?

Creating legal forms is a must in today's world. Nevertheless, you don't always need to look for professional help to create some of them from scratch, including Maricopa Escrow Agreement and Instructions, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 forms to choose from in various categories varying from living wills to real estate papers to divorce papers. All forms are organized according to their valid state, making the searching process less frustrating. You can also find information resources and guides on the website to make any tasks related to document execution simple.

Here's how you can find and download Maricopa Escrow Agreement and Instructions.

- Take a look at the document's preview and description (if available) to get a basic information on what you’ll get after getting the document.

- Ensure that the document of your choosing is specific to your state/county/area since state regulations can impact the legality of some documents.

- Check the related document templates or start the search over to locate the right document.

- Hit Buy now and register your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a suitable payment method, and buy Maricopa Escrow Agreement and Instructions.

- Select to save the form template in any available format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the appropriate Maricopa Escrow Agreement and Instructions, log in to your account, and download it. Of course, our platform can’t take the place of a lawyer completely. If you need to cope with an extremely difficult case, we advise using the services of an attorney to check your document before executing and filing it.

With over 25 years on the market, US Legal Forms proved to be a go-to platform for many different legal forms for millions of users. Join them today and get your state-compliant paperwork effortlessly!