Orange Florida Specific Guaranty is a legally binding document that serves as a financial assurance provided by a specific guarantor to secure a particular obligation in Orange, Florida. This type of guaranty is designed to protect the rights and interests of a creditor by guaranteeing repayment of a debt or fulfilling specific contractual obligations in case the primary borrower defaults. Orange Florida Specific Guaranty acts as an additional layer of security for lenders or creditors, assuring them that in the event of non-payment or default, the guarantor will step in and fulfill the financial obligations of the borrower. This guarantee provides a level of confidence to the lender, mitigating their risk and enhancing the chances of loan approval or contract acceptance. Specific guaranties in Orange, Florida may vary depending on the nature of the obligation or the type of transaction involved. Some common variations include: 1. Loan Guaranty: This type of guaranty is commonly used in lending scenarios, where the guarantor guarantees the repayment of a specified loan amount in case the borrower fails to repay as per the agreed terms. It helps lenders reduce their risk and offers increased assurance that the loan will be repaid. 2. Performance Guaranty: This particular type of guaranty is used in contractual agreements, ensuring that the guarantor will fulfill specific contractual obligations if the primary party fails to do so. It serves to protect the interests and enforce the completion of agreed-upon tasks, such as project completion, delivery of goods or services, or meeting certain performance criteria. 3. Payment Guaranty: This guaranty focuses solely on guaranteeing payment obligations. In this arrangement, the guarantor is responsible for ensuring timely payments for specific services rendered, goods supplied, or other financial responsibilities as defined by the underlying agreement. 4. Lease Guaranty: This type of guaranty is commonly used in real estate leasing agreements. The guarantor becomes responsible for fulfilling the lease obligations, such as rental payments and property maintenance, if the tenant defaults or fails to meet their contractual commitments. 5. Debt Guaranty: Debt guaranties are typically utilized when an individual or business entity borrows funds from a lender. The guarantor guarantees the repayment of the debt, increasing the lender's confidence by providing an additional source of payment if the borrower is unable to fulfill their obligations. Overall, Orange Florida Specific Guaranty serves as a legal assurance that ensures the fulfillment of financial obligations in Orange, Florida. It provides an extra layer of protection for creditors or lenders, mitigating risk, and increasing the likelihood of successful loan approvals or contractual agreements.

Orange Florida Specific Guaranty

Description

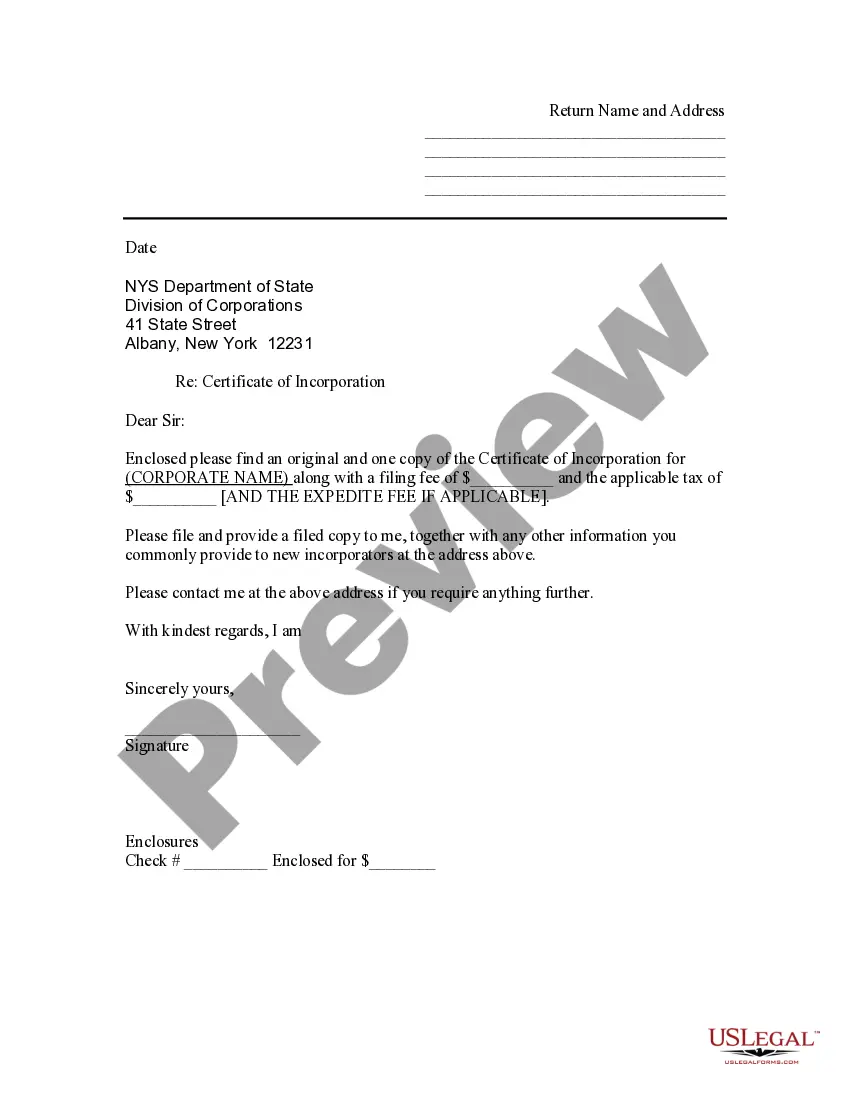

How to fill out Orange Florida Specific Guaranty?

Are you looking to quickly draft a legally-binding Orange Specific Guaranty or probably any other document to handle your personal or corporate matters? You can go with two options: hire a legal advisor to write a valid document for you or create it completely on your own. Luckily, there's another solution - US Legal Forms. It will help you get neatly written legal papers without having to pay unreasonable prices for legal services.

US Legal Forms provides a rich collection of more than 85,000 state-compliant document templates, including Orange Specific Guaranty and form packages. We provide documents for an array of life circumstances: from divorce paperwork to real estate documents. We've been on the market for over 25 years and gained a spotless reputation among our clients. Here's how you can become one of them and obtain the needed template without extra hassles.

- First and foremost, carefully verify if the Orange Specific Guaranty is adapted to your state's or county's laws.

- If the document has a desciption, make sure to verify what it's intended for.

- Start the searching process over if the form isn’t what you were hoping to find by utilizing the search box in the header.

- Choose the plan that best suits your needs and move forward to the payment.

- Choose the format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, find the Orange Specific Guaranty template, and download it. To re-download the form, simply head to the My Forms tab.

It's stressless to find and download legal forms if you use our catalog. Moreover, the paperwork we offer are updated by law professionals, which gives you greater confidence when dealing with legal affairs. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

Guarantee can refer to the agreement itself as a noun, and the act of making the agreement as a verb. Guaranty is a specific type of guarantee that is only used as a noun.

When a guarantee is given only for a specific/ particular transaction is called a specific guarantee. When a guarantee is given on a series of the transaction then it is called continuing transaction. Example. A guarantees the payment to be made by B to C, on the transfer of goods for july month.

When used as a verb, to agree to pay another person's debt or perform another person's duty, if that person fails to come through. As a noun, the written document in which this assurance is made.

4 Types Of Guarantees Personal Guarantee. If your business obtains financing, you may be required to give a personal guarantee, which means that if the business fails to repay the loan, you're on the hook.Validity Guarantee. This is a less comprehensive guarantee used by factoring companies.Warranties.Bonds.Conclusion.

Definition of guaranty (Entry 1 of 2) 1 : an undertaking to answer for the payment of a debt or the performance of a duty of another in case of the other's default or miscarriage. 2 : guarantee sense 3. 3 : guarantor. 4 : something given as security (see security sense 2) : pledge used our house as a guaranty for the

Referred to colloquially as Bad Boy Carve-outs, a list of actions or guarantees that may result in the borrower or guarantor taking on partial or full recourse liability for the loan.

A carveout guaranty is a borrower's promise to abstain from certain acts with respect to both the loan and the property.

out guarantee, also referred to as a carveout guaranty, gives a commercial lender the authority go after a borrower's personal assets if the lender forecloses on the property.

Examples of guaranty The power of the national government is limited to the enforcement of this guaranty.The second weakness of my argument concerns the durability of the guaranty clause line of argument.

In construction lending, a Carry Guaranty is a standard and typical requirement whereby a Guarantor will guaranty the payment by Borrower of all costs incurred in connection with the operation, maintenance and management of the Property (or some subset of the same) for the term of the Loan (or, if the Property is