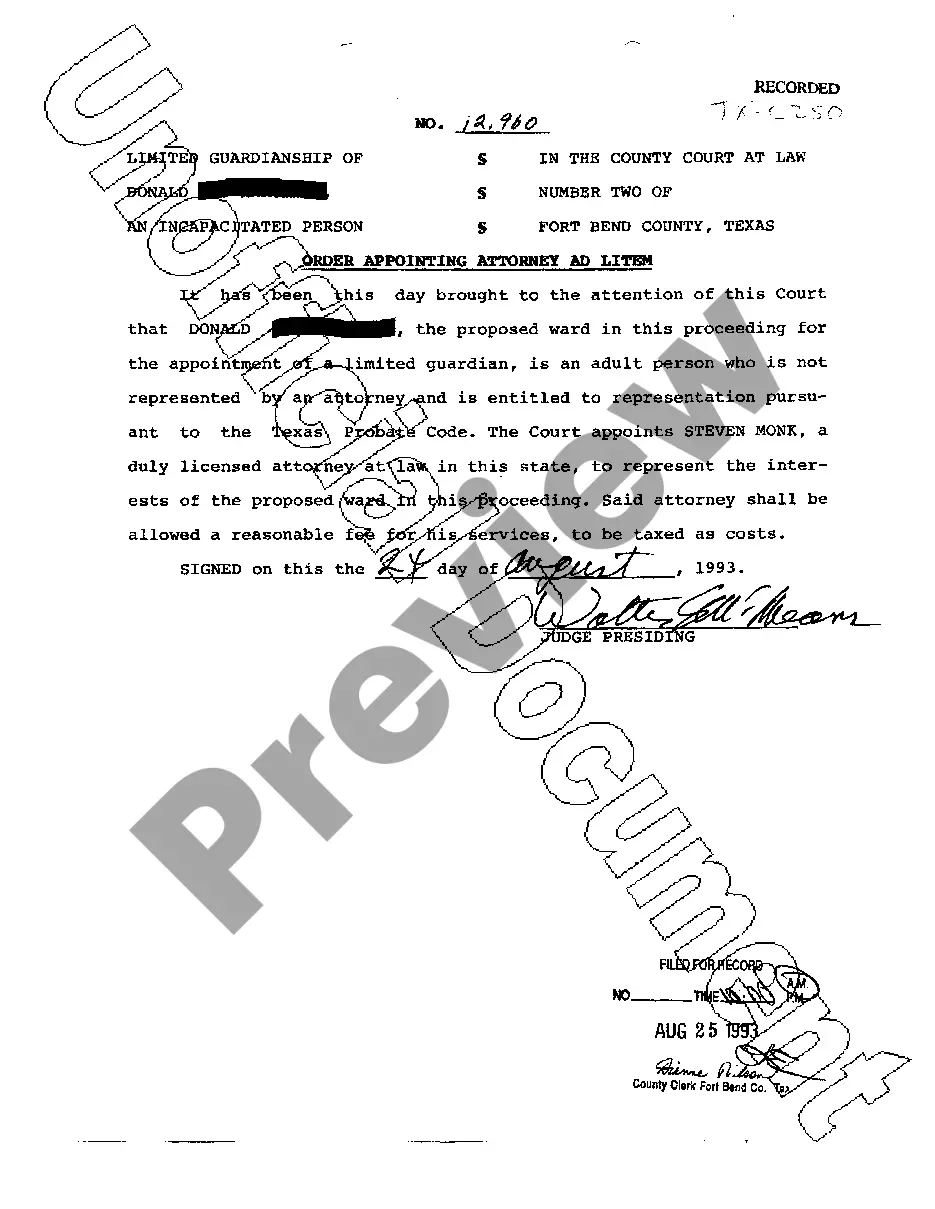

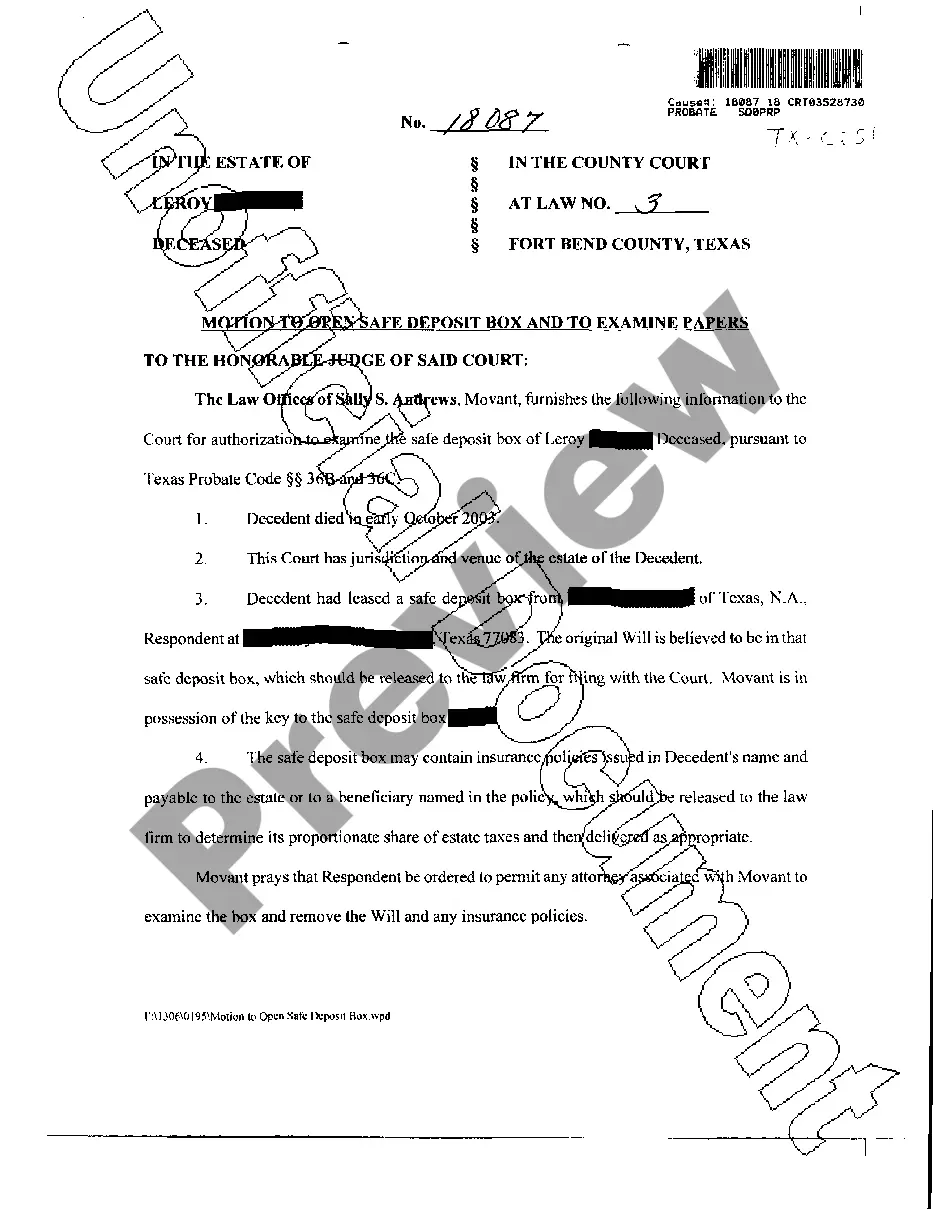

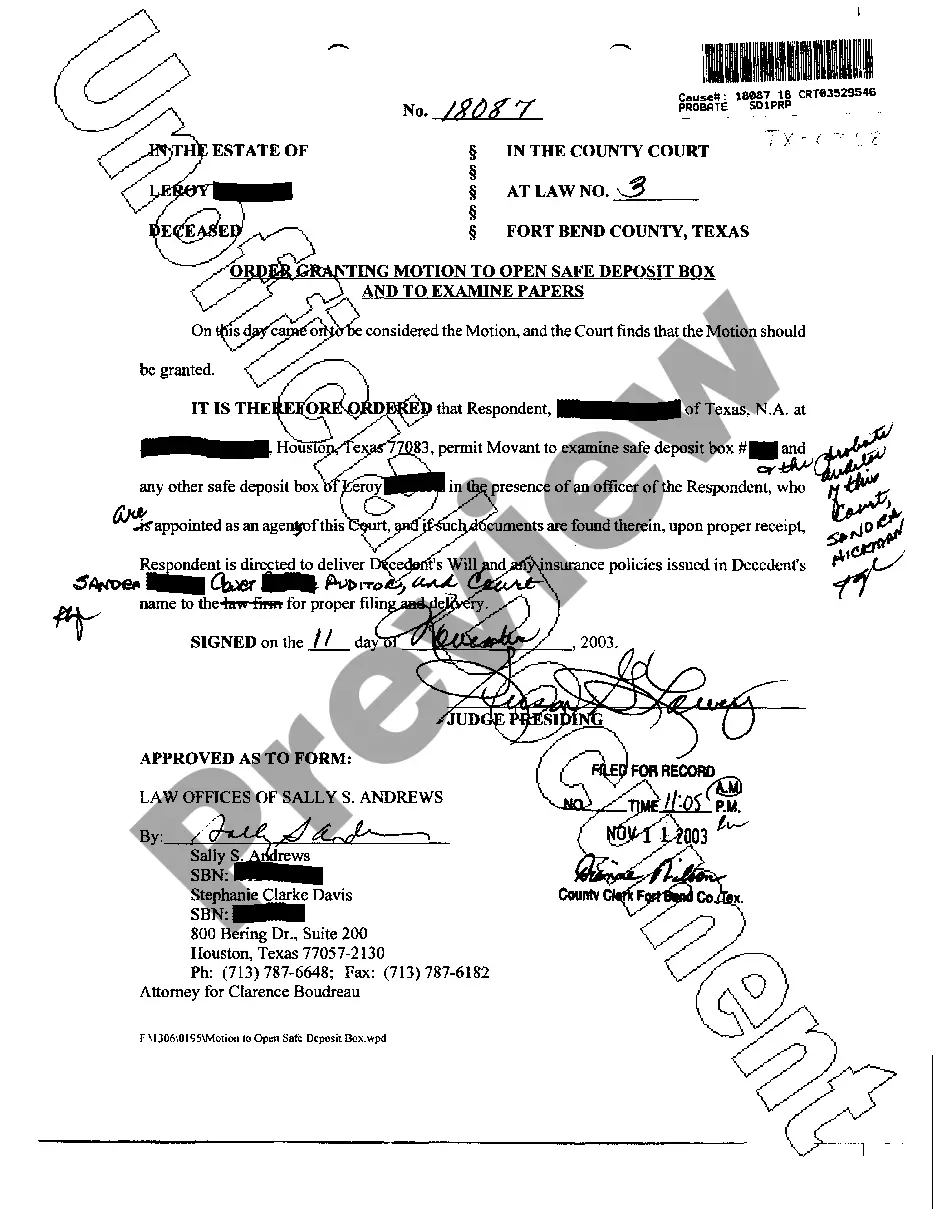

Orange California Guaranty without Pledged Collateral is a legal agreement that offers financial security and reassurance to lenders when issuing loans or credit to borrowers in Orange County, California. This type of guaranty ensures that the lender will be repaid even if the borrower defaults on their loan obligations. Orange California Guaranty without Pledged Collateral serves as a promise from a third party, known as the guarantor or cosigner, to assume responsibility for the full or partial repayment of the loan in the event the borrower cannot repay it. By providing this guarantee, the guarantor takes on the financial risk associated with the loan, reducing the lender's exposure to potential losses. This form of guaranty is particularly useful when borrowers do not have sufficient assets or collateral to pledge against the loan. Instead, the lender relies on the creditworthiness and standing of the guarantor to ensure the loan's repayment. It provides a safety net for lenders, giving them confidence in extending credit to borrowers who may otherwise not meet their strict lending criteria. However, it is important to note that Orange California Guaranty without Pledged Collateral should not be mistaken for a loan or credit facility itself. It is a supplementary agreement that accompanies the primary loan contract, allowing the lender to make a claim against the guarantor if the borrower defaults. Different types of Orange California Guaranty without Pledged Collateral may include: 1. Personal Guaranty: In this case, an individual assumes responsibility for the loan repayment on behalf of the borrower. The guarantor's personal creditworthiness and financial standing are assessed by the lender before granting the loan. 2. Corporate Guaranty: This type of guaranty involves a business entity acting as the guarantor. It is commonly used when a corporation is borrowing funds, and another business, such as a parent company or affiliate, provides the guarantee. 3. Limited Guaranty: A limited guaranty specifies the extent to which the guarantor is liable for repayment. It may cap the maximum amount or limit the guarantee to a specific duration, reducing the guarantor's long-term liability. 4. Unconditional Guaranty: In an unconditional guaranty, the guarantor assumes full responsibility for loan repayment without any restrictions or limitations. This type of guaranty provides the strongest level of security to the lender. Orange California Guaranty without Pledged Collateral offers an alternative solution for borrowers who lack adequate collateral to secure a loan. It also enables lenders to mitigate their risk by seeking the assurance of a third party's financial support. This arrangement facilitates access to credit for individuals and businesses in Orange County, ensuring a smoother lending process and increased financial opportunities.

Orange California Guaranty without Pledged Collateral

Description

How to fill out Orange California Guaranty Without Pledged Collateral?

If you need to get a reliable legal paperwork provider to obtain the Orange Guaranty without Pledged Collateral, look no further than US Legal Forms. No matter if you need to launch your LLC business or manage your belongings distribution, we got you covered. You don't need to be well-versed in in law to find and download the needed form.

- You can select from over 85,000 forms categorized by state/county and situation.

- The intuitive interface, number of learning materials, and dedicated support make it easy to get and complete different documents.

- US Legal Forms is a reliable service offering legal forms to millions of users since 1997.

You can simply select to search or browse Orange Guaranty without Pledged Collateral, either by a keyword or by the state/county the document is created for. After finding the needed form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply find the Orange Guaranty without Pledged Collateral template and check the form's preview and description (if available). If you're comfortable with the template’s legalese, go ahead and hit Buy now. Register an account and select a subscription plan. The template will be instantly available for download as soon as the payment is processed. Now you can complete the form.

Taking care of your legal affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our comprehensive collection of legal forms makes these tasks less pricey and more reasonably priced. Create your first business, organize your advance care planning, draft a real estate agreement, or complete the Orange Guaranty without Pledged Collateral - all from the convenience of your home.

Join US Legal Forms now!